Question

Review the following scenario. Use the information provided to answer questions about the taxpayers 2020 return. Makayla Jennings (34) is filing as a single taxpayer.

Review the following scenario. Use the information provided to answer questions about the taxpayer’s 2020 return.

Makayla Jennings (34) is filing as a single taxpayer. During the year, she earned $53,000 in wages from her job as a high-school English teacher. Makayla has always been an avid reader, and in addition to her teaching job, she had an opportunity in early 2020 to lead a book club at a nearby community center. Makayla led the book club from early January until March 19, 2020, when the center closed due to COVID-19 restrictions. The community center paid Makayla for her work, and in early 2021, she received a Form 1099-NEC reporting $510 for nonemployee compensation in box 1.

The community center is within walking distance of Makayla’s home, so she did not have any vehicle or travel expenses. Her only business-related expense was for $50 in supplies.

Makayla had no other income during the year.

Question 13

What amount should Makayla report as profit or loss from business? You may refer to her partially completed Schedule C, Profit or Loss from Business, which is shown below, to assist you in answering this question.

Question 14

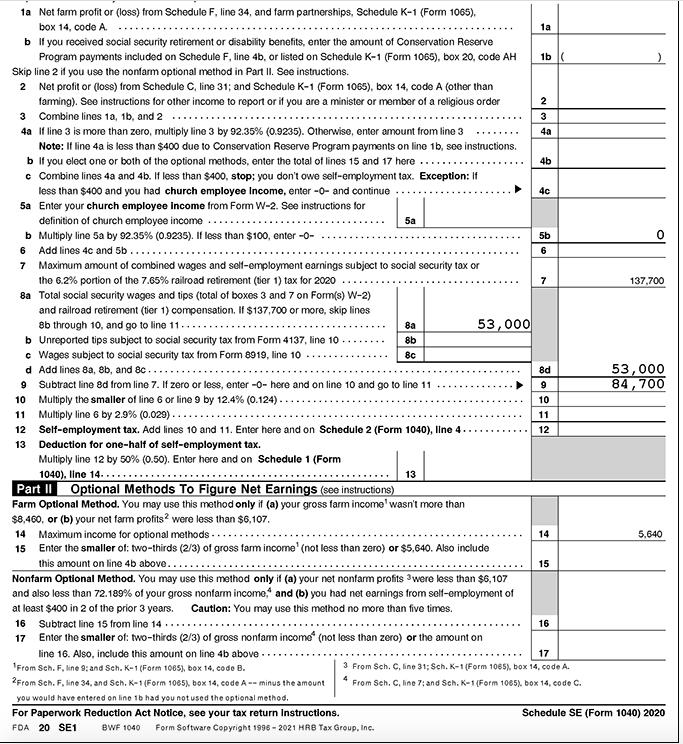

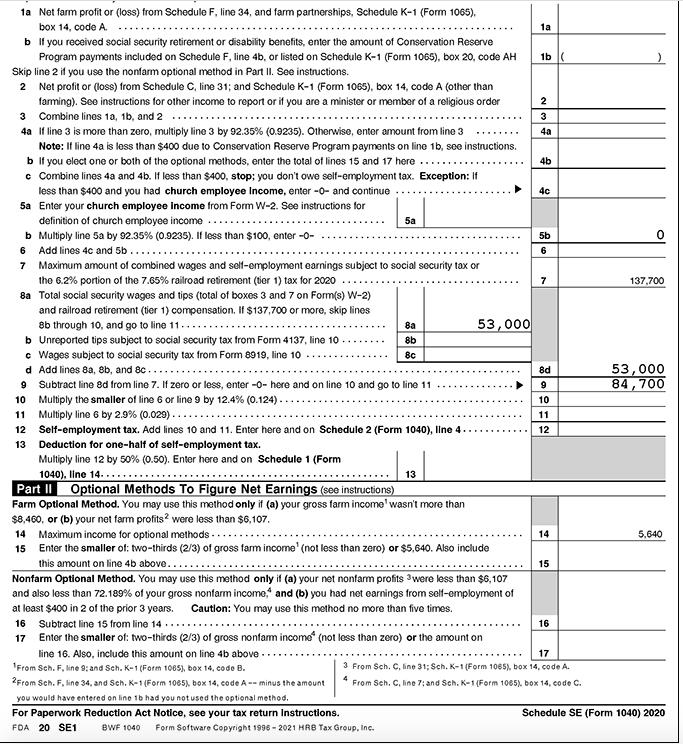

What is the amount of Makayla's self-employment tax? You may refer to her partially completed Schedule SE, Self-Employment Tax, which is shown below, to assist you in answering this question.

Part I Income Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked 2 Returns and allowances 3 Subtract line 2 from line 1 4 Cost of goods sold (from line 42) 5 Gross profit. Subtract line 4 from line 3- 6 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) 7 Gross Income. Add lines 5 and 6.. Part II Expenses. Enter expenses for business use of your home only on line 30. 8 Advertising.... 8 9 Car and truck expenses (see instructions).... 10 Commissions and fees 11 Contract labor (see instructions) 12 Depletion...... 13 Depreciation and section 179 expense deduction (not included in Part III) (see instr.)... 14 15 Insurance (other than health) 16 Interest (see instructions): Employee benefit programs (other than on line 19).. a Mortgage (paid to banks, etc.) b Other....... 9 10 11 12 13 14 15 16a 16b 17 18 Office expense (see instructions) 19 Pension & profit-sharing plans. Rent or lease (see instructions): a Vehicles, machinery, and equipment 20 b Other business property 21 Repairs and maintenance 22 Supplies (not included in Part I)... 23 Taxes and licenses 24 Travel and meals: a Travel b Deductible meals (see instructions) 25 Utilities..... 26 Wages (less employment credits)... 27 a Other expenses (from line 48).. b Reserved for future use 17 Legal and professional services 28 Total expenses before expenses for business use of home. Add lines 8 through 27a Tentative profit or (loss). Subtract line 28 from line 7........ 29 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method. See instructions. Simplified method fillers only: Enter the total square footage of (a) your home: and (b) the part of your home used for business: Method Worksheet in the instructions to figure the amount to enter on line 30 31 Net profit or (loss). Subtract line 30 from line 29. If a profit, enter on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (if you checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. Use the Simplified If a loss, you must go to line 32. 32 If you have a loss, check the box that describes your investment in this activity. See instructions. If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (If you checked the box on line 1, see the line 31 instructions). Estates and trusts, enter on Form 1041, line 3. If you checked 32b, you must attach Form 6198. Your loss may be limited. For Paperwork Reduction Act Notice, see the separate instructions. FDA 20 61 BWF 1040 Form Software Copyright 1996-2021 HRB Tax Group, Inc. 2 3 4 5 6 7 18 19 20a 20b 21 22 23 24a 24b 25 26 27a 27b 28 29 30 31 32a 32b 8 All investment is at risk. Some investment is not at risk. Schedule C (Form 1040) 2020

Step by Step Solution

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

As Makayla received an amount of 510 from community centre as ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started