Answered step by step

Verified Expert Solution

Question

1 Approved Answer

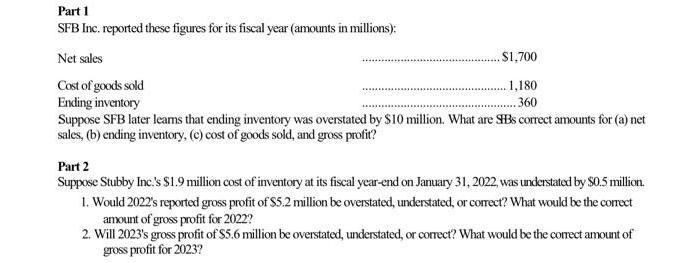

Part 1 SFB Inc. reported these figures for its fiscal year (amounts in millions): Net sales $1,700 Cost of goods sold Ending inventory Suppose

Part 1 SFB Inc. reported these figures for its fiscal year (amounts in millions): Net sales $1,700 Cost of goods sold Ending inventory Suppose SFB later leams that ending inventory was overstated by $10 million. What are SBs correct amounts for (a) net sales, (b) ending inventory, (c) cost of goods sold, and gross profit? ..1,180 360 Part 2 Suppose Stubby Inc.'s SI.9 million cost of inventory at its fiscal year-end on January 31, 2022 was understated by S0.5 million. 1. Would 2022's reported gross profit of $5.2 million be overstated, understated, or corect? What would be the corect amount of gross profit for 2022? 2. Will 2023's gross profit of S5.6 million be overstated, understated, or correct? What would be the corect amount of gross profit for 2023?

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 Q Suppose SFB later learns that ending inventory was overstated by 10 million What are SFBs correct amounts for a net sales b ending inventory ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started