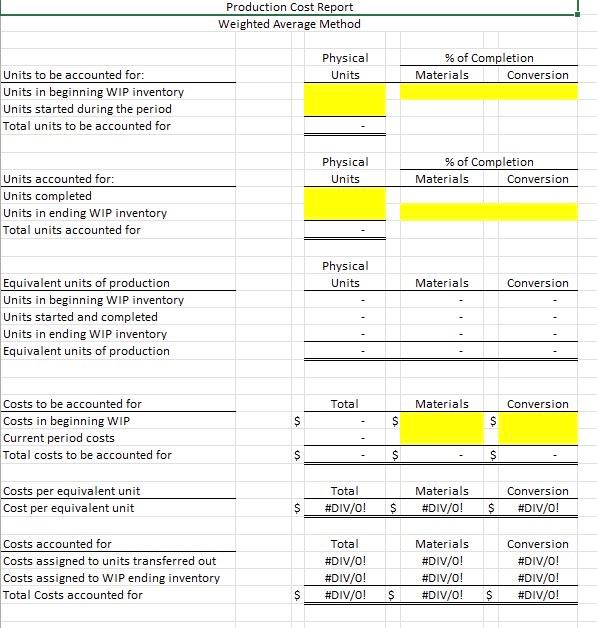

Part 1. Using the weighted average costing method

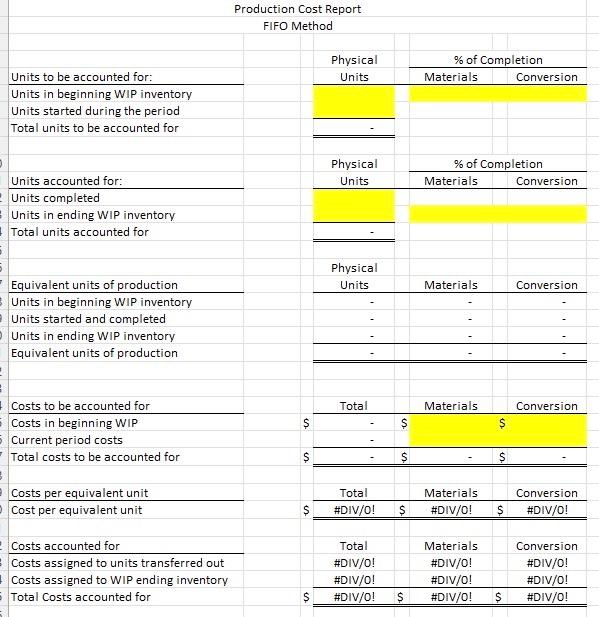

Part 2. Using the FIFO method

Acorn Furniture uses a process cost system to account for its table factory. Beginning inventory consisted of 4,500 units (100% complete as to material, 45% complete as to labor) with a cost of $138,500 materials and $107,200 conversion. 62,000 units were started into production during the month with material costs of $1,845,000 and $2,481,375 of conversion costs. The ending inventory of 5,200 chairs was 100% complete as to materials and 30% complete as to labor. Required: Part 1: Using the weighted average costing method: a. Compute the equivalent units of production for each input. b. Compute the cost per unit. c. Compute the cost transferred out to finished goods. d. Compute the ending work in process inventory balance. Part 2: Using the FIFO (first-in-first out method): a. Compute the equivalent units of production for each input. b. Compute the cost per unit. c. Compute the cost transferred out to finished goods. d. Compute the ending work in process inventory balance. Production Cost Report Weighted Average Method Physical Units % of Completion Materials Conversion Units to be accounted for: Units in beginning WIP inventory Units started during the period Total units to be accounted for Physical Units % of Completion Materials Conversion Units accounted for: Units completed Units in ending WIP inventory Total units accounted for Physical Units Materials Conversion Equivalent units of production Units in beginning WIP inventory Units started and completed Units in ending WIP inventory Equivalent units of production Total Materials Conversion S S Costs to be accounted for Costs in beginning WIP Current period costs Total costs to be accounted for $ $ S S Costs per equivalent unit Cost per equivalent unit Total #DIV/0! Materials #DIV/0! Conversion #DIV/0! $ $ $ Costs accounted for Costs assigned to units transferred out Costs assigned to WIP ending inventory Total Costs accounted for Total #DIV/0! #DIV/0! #DIV/0! Materials #DIV/0! #DIV/0! #DIV/0! Conversion #DIV/0! #DIV/0! #DIV/0! $ $ $ Production Cost Report FIFO Method Physical Units % of Completion Materials Conversion Units to be accounted for: Units in beginning WIP inventory Units started during the period Total units to be accounted for Physical Units % of Completion Materials Conversion Units accounted for: Units completed Units in ending WIP inventory Total units accounted for Physical Units Materials Conversion Equivalent units of production Units in beginning WIP inventory Units started and completed Units in ending WIP inventory Equivalent units of production Total Materials Conversion $ $ $ $ Costs to be accounted for Costs in beginning WIP Current period costs Total costs to be accounted for $ $ Costs per equivalent unit Cost per equivalent unit Total #DIV/0! Materials #DIV/0! $ $ $ Conversion #DIV/0! Costs accounted for # Costs assigned to units transferred out Costs assigned to WIP ending inventory Total Costs accounted for Total #DIV/0! #DIV/0! #DIV/0! Materials #DIV/0! #DIV/0! #DIV/0! Conversion #DIV/0! #DIV/0! #DIV/0! $ $ $