Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 1 What is the Free Cash Flow to the Firm in 2014? What is the Free Cash Flow to the Firm in 2015? Part

Part 1

What is the Free Cash Flow to the Firm in 2014?

What is the Free Cash Flow to the Firm in 2015?

Part 2

Assume a 21% tax rate, steady state growth for 2016 forward of 3.0%, the NWC and Net Fixed Assets to sales ratios to say constant from 2015 forward, and a 9.0% cost of capital for the firm.

What is the terminal value as of FY ending 2015?

What is the Enterprise value of the firm at the end of FY 2013?

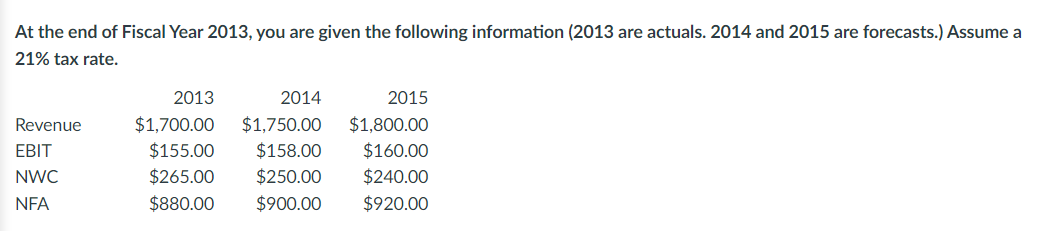

At the end of Fiscal Year 2013, you are given the following information (2013 are actuals. 2014 and 2015 are forecasts.) Assume a 21% tax rate. Revenue EBIT NWC NFA 2013 $1,700.00 $155.00 $265.00 $880.00 2014 $1,750.00 $158.00 $250.00 $900.00 2015 $1,800.00 $160.00 $240.00 $920.00 At the end of Fiscal Year 2013, you are given the following information (2013 are actuals. 2014 and 2015 are forecasts.) Assume a 21% tax rate. Revenue EBIT NWC NFA 2013 $1,700.00 $155.00 $265.00 $880.00 2014 $1,750.00 $158.00 $250.00 $900.00 2015 $1,800.00 $160.00 $240.00 $920.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started