Answered step by step

Verified Expert Solution

Question

1 Approved Answer

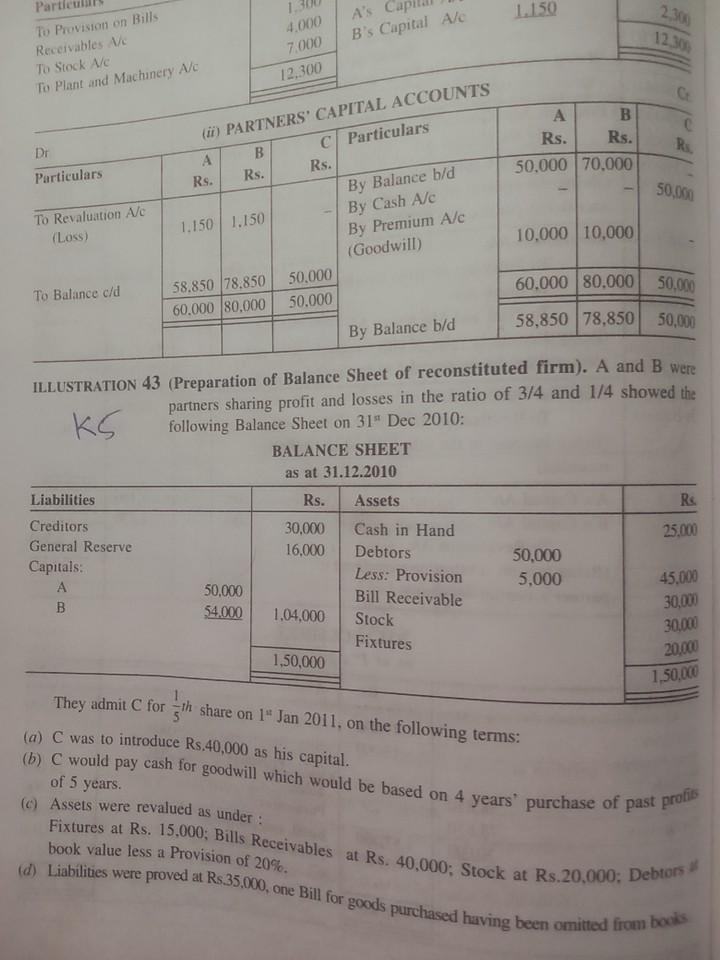

Part 1.150 1 4.000 7.000 12.300 A'S B's Capital Alc 234 12.30 To Provision on Bills Receivables to To Stock Ave To Plant and Machinery

Part 1.150 1 4.000 7.000 12.300 A'S B's Capital Alc 234 12.30 To Provision on Bills Receivables to To Stock Ave To Plant and Machinery Alc A B Rs. 50.000 70.000 Rs. Rs. Dr Particulars 50,000 To Revaluation A/C (Loss) (ii) PARTNERS' CAPITAL ACCOUNTS A B C/ Particulars Rs. Rs. Rs. By Balance bid 1.150 1.150 By Cash Ale By Premium Alc (Goodwill) 58.850 78.850 50.000 60.000 80.000 50.000 10,000 10,000 60.000 80.000 50.000 To Balance c/d 58,850 78,850 50,000 By Balance b/d ILLUSTRATION 43 (Preparation of Balance Sheet of reconstituted firm). A and B were partners sharing profit and losses in the ratio of 3/4 and 1/4 showed the KG following Balance Sheet on 31" Dec 2010: BALANCE SHEET as at 31.12.2010 Liabilities Rs. Assets Re Creditors 30,000 Cash in Hand 25.000 General Reserve 16.000 Debtors 50,000 Capitals: Less: Provision 5.000 50.000 Bill Receivable B 54,000 1.04,000 Stock Fixtures 45.000 30,000 30,000 20,000 1,50,000 1,50,000 They admit C for share on 19 Jan 2011, on the following terms: (a) C was to introduce Rs.40,000 as his capital. (b) C would pay cash for goodwill which would be based on 4 years purchase of past profils of 5 years. (c) Assets were revalued as under: Fixtures at Rs. 15,000; Bills Receivables at Rs. 40.000; Stock at Rs.20,000: Debtors (d) Liabilities were proved at Rs.35,000, one Bill for goods purchased having been omitted from books book value less a Provision of 20%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started