Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 2 2 Fuso Pharmaceutical Industries develops,manufactures, and markets pharmaceutical products in Japan. Its main product is a solution used by individuals with artificial

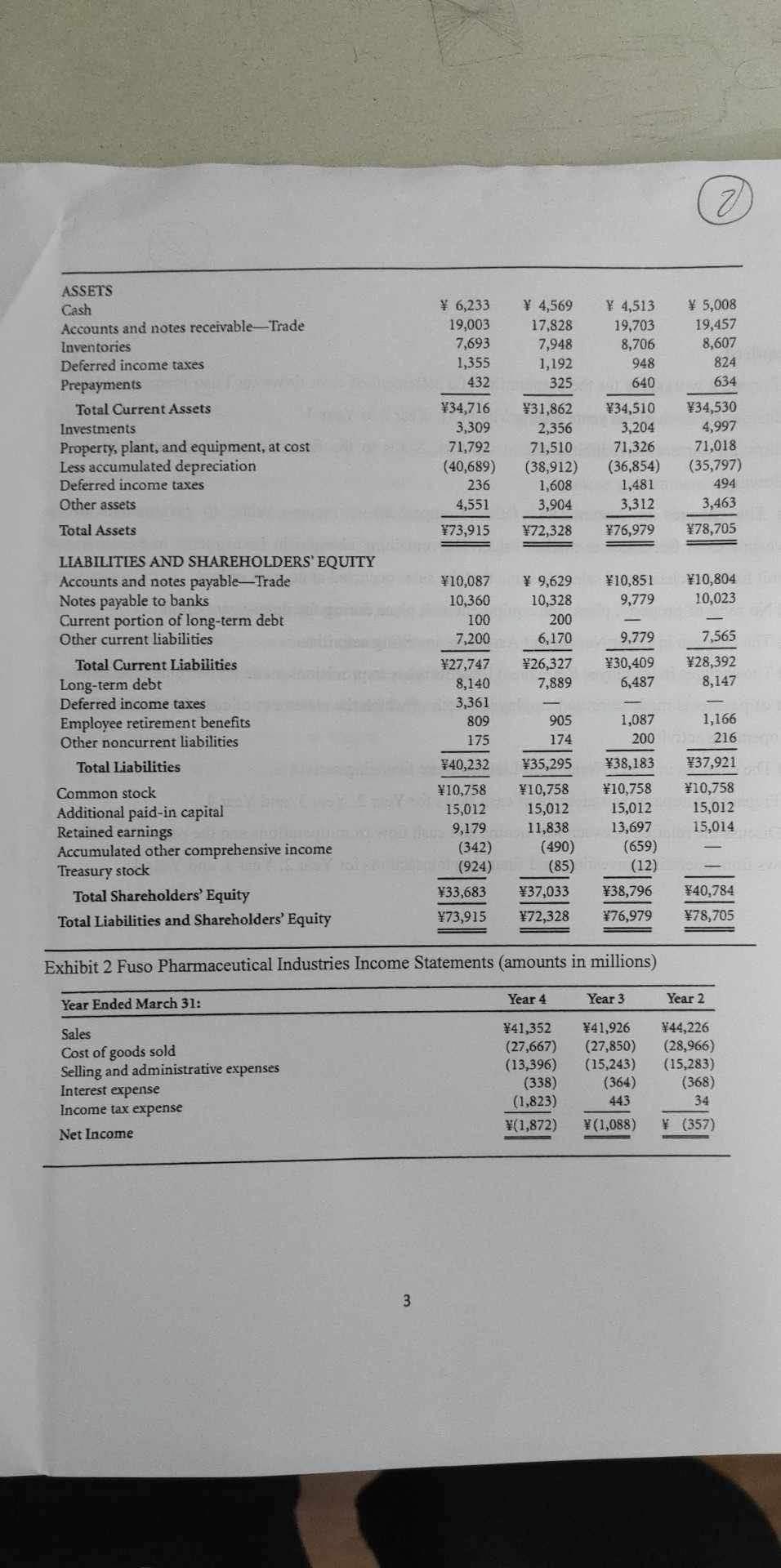

Part 2 2 Fuso Pharmaceutical Industries develops,manufactures, and markets pharmaceutical products in Japan. Its main product is a solution used by individuals with artificial kidneys. Most individuals in Japan are covered by a national health insurance system. The Japanese government sets the policies for the proportion of health care costs covered by the government versus the proportion that is the responsibility of the individual. The government also establishes the prices for prescription drugs. The Japanese economy experienced recessionary conditions in recent years. In response to these conditions, the Japanese government increased the proportion of medical costs that is the patient's responsibility and lowered the prices for prescription drugs. Exhibit 1 presents the firm's balance sheets on March 31 of Year 1 to Year 4, and Exhibit 2 presents the firm's income statements for the years ending March 31, Year 2 to Year 4. Exhibit 1 Fuso Pharmaceutical Industries Balance Sheets (amounts in millions) 2 haar lewej st Required a. Prepare a worksheet for the preparation of a statement of cash flows for Fuso Pharmaceutical Industries for each of the years ending March 31, Year 2 to Year 4. Follow the format of Exhibit 1 &2 in the text. Notes to the financial statements indicate the following: (1) The changes in Accumulated Other Comprehensive Income relate to revaluations of Investments in Securities to market value. The remaining changes in Investments in Securities result from purchases and sales. Assume that the sales occurred at no gain or loss. (2) No sales of property, plant, and equipment took place during the three-year period. (3) The changes in Other Noncurrent Assets are investing activities. (4) The changes in Employee Retirement Benefits relate to provisions made for retirement benefits net of payments made to retired employees, both of which the statement of cash flows classifies as operating activities. (5) The changes in Other Noncurrent Liabilities are financing activities. b. Prepare a comparative statement of cash flows for Year 2, Year 3, and Year 4. c. Discuss the relation between net income and cash flow from operations and the pattern of cash flows from operating, investing, and financing transactions for Year 2, Year 3, and Year 4. RUMALE V exibil in proud Cinsim 2WD GAT ASSETS Cash Accounts and notes receivable-Trade Inventories Deferred income taxes Prepayments Total Current Assets Investments Property, plant, and equipment, at cost Less accumulated depreciation Deferred income taxes Other assets Total Assets LIABILITIES AND SHAREHOLDERS' EQUITY Accounts and notes payable-Trade Notes payable to banks Current portion of long-term debt Other current liabilities Total Current Liabilities Long-term debt Deferred income taxes Employee retirement benefits Other noncurrent liabilities Total Liabilities Common stock Additional paid-in capital Retained earningsenoji Accumulated other comprehensive income Treasury stock Total Shareholders' Equity Total Liabilities and Shareholders' Equity 6,233 19,003 7,693 1,355 432 3 34,716 3,309 71,792 (40,689) 236 4,551 73,915 100 7,200 10,087 9,629 10,360 10,328 27,747 8,140 3,361 809 175 40,232 10,758 15,012 19,179 (342) (924) 4,569 17,828 7,948 1,192 325 33,683 73,915 31,862 34,510 2,356 3,204 71,510 71,326 (38,912) (36,854) 1,608 1,481 3,904 3,312 72,328 76,979 200 6,170 26,327 7,889 - 905 174 35,295 10,758 15,012 11,838 (490) (85) 4,513 19,703 8,706 948 640 37,033 72,328 10,851 9,779 9,779 30,409 6,487 167 1,087 (659) (12) 38,796 76,979 Exhibit 2 Fuso Pharmaceutical Industries Income Statements (amounts in millions) Year Ended March 31: Sales Cost of goods sol Selling and administrative expenses Interest expense Income tax expense Net Income Year 4 Year 3 41,352 41,926 (27,667) (27,850) (13,396) (15,243) 5,008 19,457 8,607 824 634 1,166 200216200 38,183 37,921 10,758 10,758 15,012 15,012 13,697 15,014 (364) 443 34,530 4,997 71,018 (35,797) 494 3,463 78,705 2 10,804 10,023 7,565 28,392 8,147 40,784 78,705 Year 2 44,226 (28,966) (15,283) (338) (1,823) (1,872) (1,088) (357) (368) 34 qyt 1572

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started