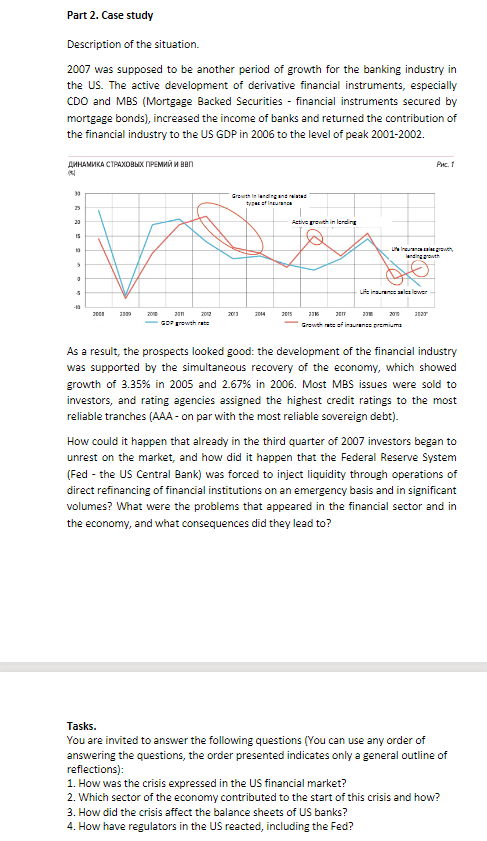

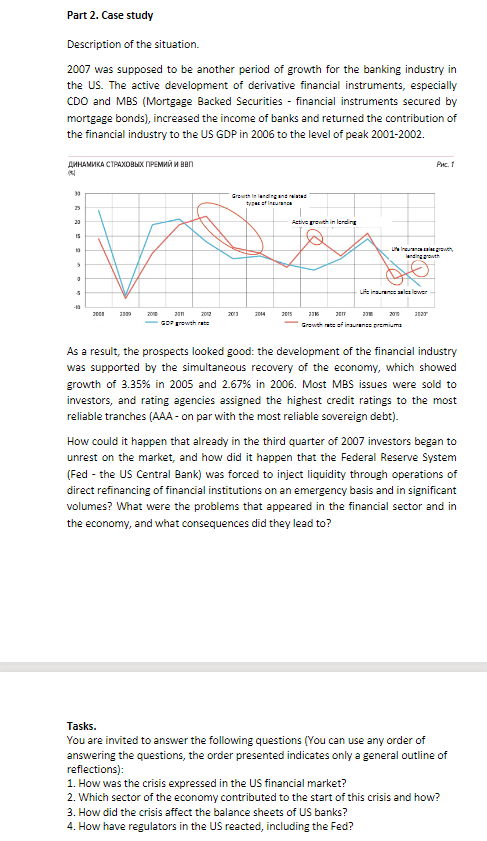

Part 2. Case study Description of the situation 2007 was supposed to be another period of growth for the banking industry in the US. The active development of derivative financial instruments, especially CDO and MBS (Mortgage Backed Securities - financial instruments secured by mortgage bonds), increased the income of banks and returned the contribution of the financial industry to the US GDP in 2006 to the level of peak 2001-2002. Act 30 Growledgang type of 20 Active prowth in lordre IS w 5 5 Lienee selenler -10 2001 2009 2010 2013 2015 2127 2011 Growth rate 2017 23 2009 Growth rate of in pemima As a result, the prospects looked good: the development of the financial industry was supported by the simultaneous recovery of the economy, which showed growth of 3.35% in 2005 and 2.67% in 2006. Most MBS issues were sold to investors, and rating agencies assigned the highest credit ratings to the most reliable tranches (AAA - on par with the most reliable sovereign debt). How could it happen that already in the third quarter of 2007 investors began to unrest on the market, and how did it happen that the Federal Reserve System (Fed - the US Central Bank) was forced to inject liquidity through operations of direct refinancing of financial institutions on an emergency basis and in significant volumes? What were the problems that appeared in the financial sector and in the economy, and what consequences did they lead to? Tasks. You are invited to answer the following questions (You can use any order of answering the questions, the order presented indicates only a general outline of reflections): 1. How was the crisis expressed in the US financial market? 2. Which sector of the economy contributed to the start of this crisis and how? 3. How did the crisis affect the balance sheets of US banks? 4. How have regulators in the US reacted, including the Fed? Part 2. Case study Description of the situation 2007 was supposed to be another period of growth for the banking industry in the US. The active development of derivative financial instruments, especially CDO and MBS (Mortgage Backed Securities - financial instruments secured by mortgage bonds), increased the income of banks and returned the contribution of the financial industry to the US GDP in 2006 to the level of peak 2001-2002. Act 30 Growledgang type of 20 Active prowth in lordre IS w 5 5 Lienee selenler -10 2001 2009 2010 2013 2015 2127 2011 Growth rate 2017 23 2009 Growth rate of in pemima As a result, the prospects looked good: the development of the financial industry was supported by the simultaneous recovery of the economy, which showed growth of 3.35% in 2005 and 2.67% in 2006. Most MBS issues were sold to investors, and rating agencies assigned the highest credit ratings to the most reliable tranches (AAA - on par with the most reliable sovereign debt). How could it happen that already in the third quarter of 2007 investors began to unrest on the market, and how did it happen that the Federal Reserve System (Fed - the US Central Bank) was forced to inject liquidity through operations of direct refinancing of financial institutions on an emergency basis and in significant volumes? What were the problems that appeared in the financial sector and in the economy, and what consequences did they lead to? Tasks. You are invited to answer the following questions (You can use any order of answering the questions, the order presented indicates only a general outline of reflections): 1. How was the crisis expressed in the US financial market? 2. Which sector of the economy contributed to the start of this crisis and how? 3. How did the crisis affect the balance sheets of US banks? 4. How have regulators in the US reacted, including the Fed