Answered step by step

Verified Expert Solution

Question

1 Approved Answer

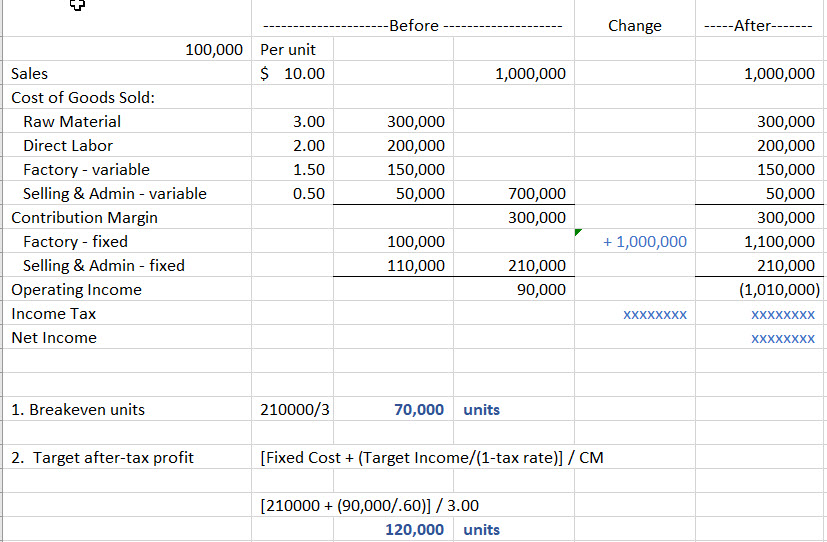

Part 2. Gayle and Joy are concerned that the estimated fixed costs are too low. They believe that theyll need additional equipment, increasing their fixed

Part 2. Gayle and Joy are concerned that the estimated fixed costs are too low. They believe that theyll need additional equipment, increasing their fixed costs by $ 31,500. Also, there has been a change in the corporate tax rate. Find the new 2018 corporate tax rate and properly cite your source (Links to an external site.). Adjust your analysis to assume an increase of $31,500 in fixed costs and the new corporate income tax rate.

- Prepare a schedule summarizing the effects of the change.

- Discuss the impacts on break even units of adding additional fixed costs.

- What would the impact on break even units be if the company increased advertising by $40,000

By "prepare a schedule," I mean a table that summarizes the changes. Here is an example of one way to do that:

-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started