Answered step by step

Verified Expert Solution

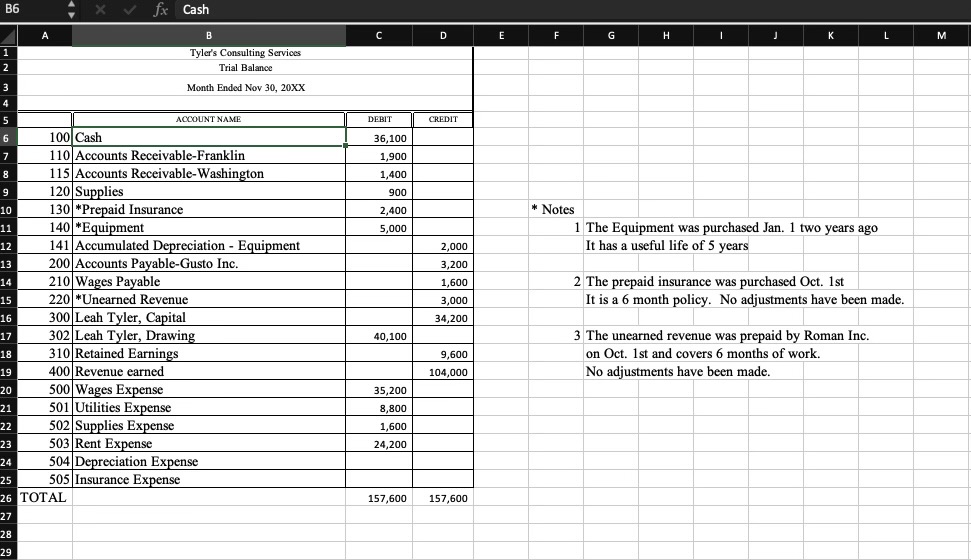

Question

1 Approved Answer

Part 2 instructions 1 . Using the feedback provided from your instructor in the gradebook comments, update any incorrect items. 2 . Prepare the Adjusted

Part instructions

Using the feedback provided from your instructor in the gradebook comments, update any incorrect items.

Prepare the Adjusted trial balance.

Prepare the Income Statement, Statement of Retained Earnings, and the Balance Sheet.

Prepare the Closing journal entries and Postclosing trial balance.

Part of Acct Project

Part of the project picks up where part left off. Use the graded feedback from part and correct any mistakes. To check your work before beginning, I will provide the journal entry answers in the following module item at the beginning of week time frame. Thus resubmissions to Part must be completed by the Module normal due date. For any items still incorrect, use these entries to correct your TAccts. To help ensure you are on the correct path, Total Assets should equal $

The same instructions from Module are recopied below. Scroll down to page for the remaining items to complete. All answers should be submitted in the same Excel template as part

Part contains the following

Adjusted trial balance

Income statement

Statement of owners equity

Balance sheet

General journal for journalizing closing entries

Postclosing trial balance

Part will have you correct any mistakes and then complete the project. The remaining parts of the project include preparing the adjusted trial balance, income statement, statement of retained earnings, balance sheet, closing entries, and postclosing trial balance.

December business transactions

Dec. st Collected $ from Franklin from a previous engagement in Oct.

Dec. nd Paid $ on Gustos Inc. invoice from a previously recorded transaction with check #

Dec rd Paid December rent of $ with check #

Dec th Completed additional work for Washington, sent invoice #YP for $ due in month.

Dec. th Paid employee from work previously expensed in Nov. with payment due Dec. th using check #

Dec. th Purchased land on a note for $ to be used for future construction of a new office building.

Land and Notes payable will have account numbers of and respectively.

Dec. th Paid $ to cover all utilities for the month of Dec using check #

Dec. th Completed $ worth of work for a repeat customer who pays cash immediately upon completion.

Dec. th Collected $ from Washington from a previous engagement in Nov.

Dec. th Our employee earned two weeks of pay amounting to $ to be paid Dec. rd

employee took vacation from Dec. thDec. st No pay will accrue

Dec. th Leah Tyler, the owner, withdrew $ for personal use using check #

Dec. th Completed a large job for Franklin for $ Sent invoice #YP due Jan. st

Dec. nd Franklin paid $ to pay off some of his balance due.

Dec. rd Paid our employee for the work expensed Dec. th

Dec thDec. st Owner took off the rest of the year.

Adjustments due with Part

The equipment was used for the third year.

Prepaid insurance was adjusted for OctDec usage.

Unearned revenue was updated to show months of work completed.

A final count of supplies showed $ remaining.

Transfer the opening trial balance amounts to the TAccts.

Journal and post to the TAccts the December and adjusting transactions.

Total each TAcct and provide the equation total at the top in the highlighted cells.

Check Figure The cash TAcct final balance should be $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started