Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PART 2 like? please can you be more specific? File Tools View Final Assignment BC0114 ACCOUNTING I - Word o BC0114 ACCOUNTING I Task brief

PART 2

PART 2

like? please can you be more specific?

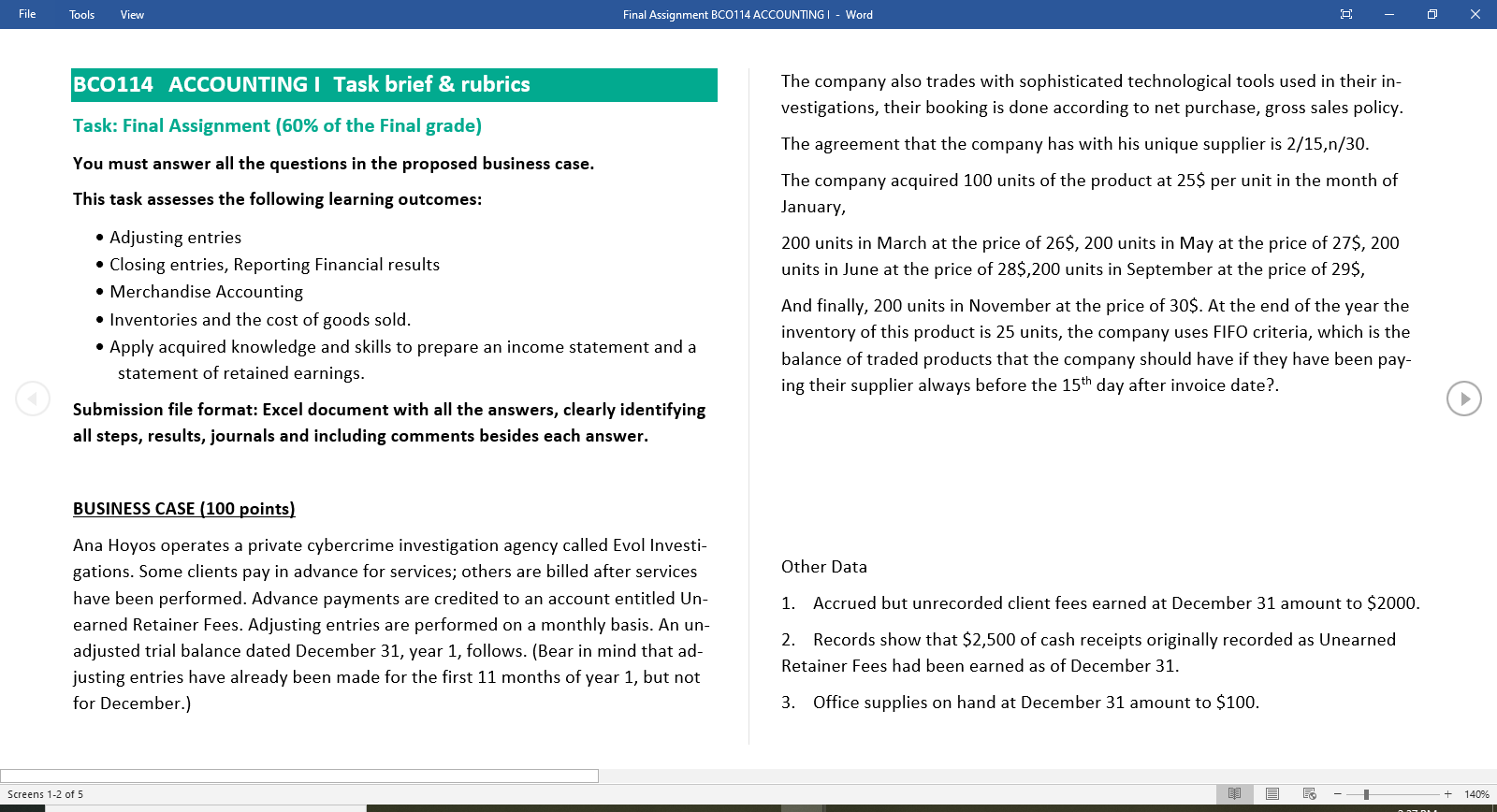

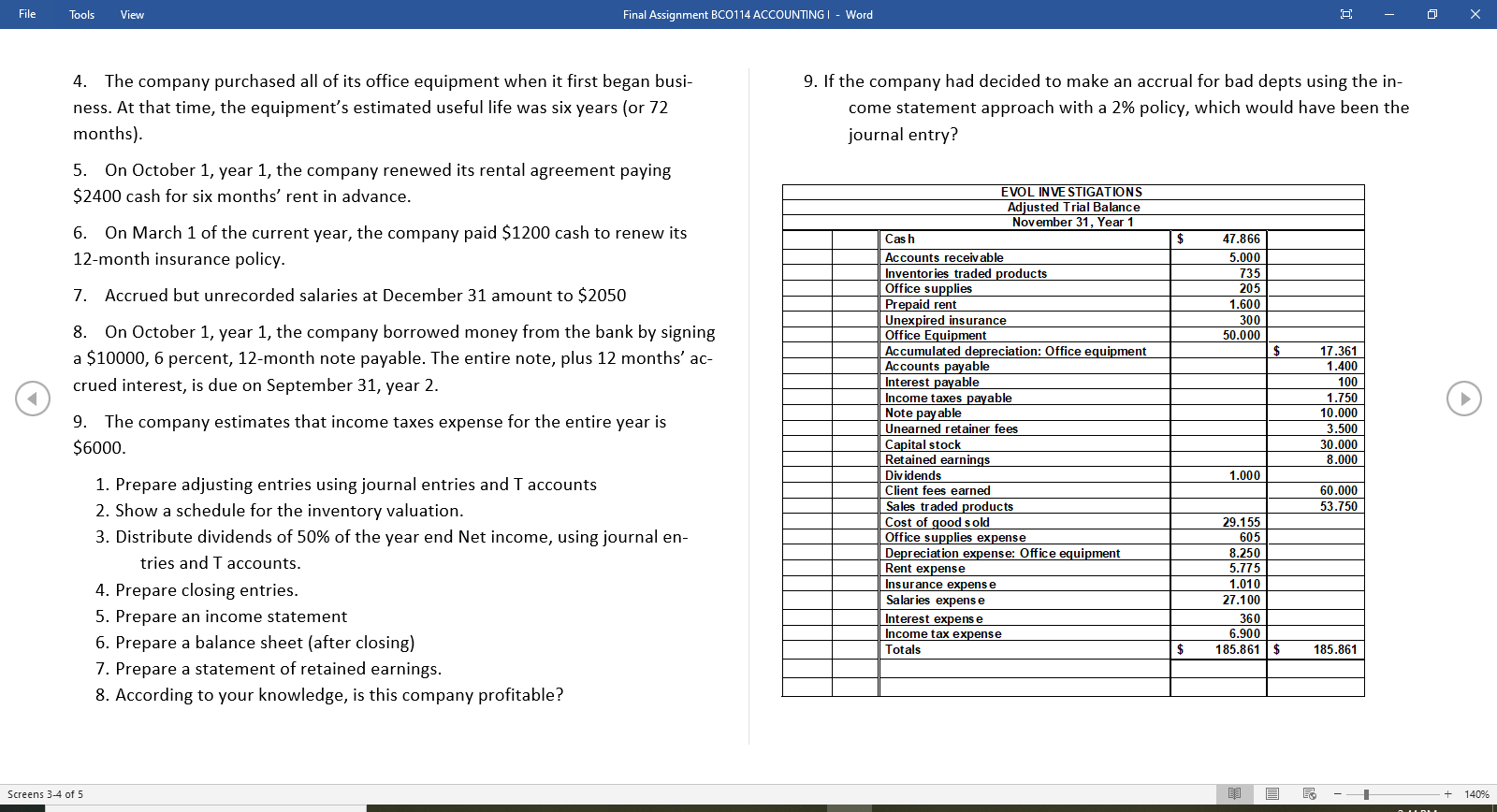

File Tools View Final Assignment BC0114 ACCOUNTING I - Word o BC0114 ACCOUNTING I Task brief & rubrics Task: Final Assignment (60% of the Final grade) You must answer all the questions in the proposed business case. This task assesses the following learning outcomes: Adjusting entries Closing entries, Reporting Financial results Merchandise Accounting Inventories and the cost of goods sold. Apply acquired knowledge and skills to prepare an income statement and a statement of retained earnings. Submission file format: Excel document with all the answers, clearly identifying all steps, results, journals and including comments besides each answer. The company also trades with sophisticated technological tools used in their in- vestigations, their booking is done according to net purchase, gross sales policy. The agreement that the company has with his unique supplier is 2/15,n/30. The company acquired 100 units of the product at 25$ per unit in the month of January, 200 units in March at the price of 26$, 200 units in May at the price of 27$, 200 units in June at the price of 28$,200 units in September at the price of 29$, And finally, 200 units in November at the price of 30$. At the end of the year the inventory of this product is 25 units, the company uses FIFO criteria, which is the balance of traded products that the company should have if they have been pay- ing their supplier always before the 15th day after invoice date?. BUSINESS CASE (100 points) Other Data 1. Accrued but unrecorded client fees earned at December 31 amount to $2000. Ana Hoyos operates a private cybercrime investigation agency called Evol Investi- gations. Some clients pay in advance for services; others are billed after services have been performed. Advance payments are credited to an account entitled Un- earned Retainer Fees. Adjusting entries are performed on a monthly basis. An un- adjusted trial balance dated December 31, year 1, follows. (Bear in mind that ad- justing entries have already been made for the first 11 months of year 1, but not for December.) 2. Records show that $2,500 of cash receipts originally recorded as Unearned Retainer Fees had been earned as of December 31. 3. Office supplies on hand at December 31 amount to $100. Screens 1-2 of 5 E 140% File Tools View Final Assignment BC0114 ACCOUNTING | - Word o 4. The company purchased all of its office equipment when it first began busi- ness. At that time, the equipment's estimated useful life was six years (or 72 months). 9. If the company had decided to make an accrual for bad depts using the in- come statement approach with a 2% policy, which would have been the journal entry? 5. On October 1, year 1, the company renewed its rental agreement paying $2400 cash for six months' rent in advance. $ 6. On March 1 of the current year, the company paid $1200 cash to renew its 12-month insurance policy. 7. Accrued but unrecorded salaries at December 31 amount to $2050 47.866 5.000 735 205 1.600 300 50.000 8. On October 1, year 1, the company borrowed money from the bank by signing a $10000, 6 percent, 12-month note payable. The entire note, plus 12 months' ac- crued interest, is due on September 31, year 2. EVOL INVESTIGATIONS Adjusted Trial Balance November 31, Year 1 Cash Accounts receivable Inventories traded products Office supplies Prepaid rent Unexpired insurance Office Equipment Accumulated depreciation: Office equipment Accounts payable Interest payable Income taxes payable Note payable Unearned retainer fees Capital stock Retained earnings Dividends Client fees earned Sales traded products Cost of good sold Office supplies expense Depreciation expense: Office equipment Rent expense Insurance expense Salaries expense Interest expense Income tax expense Totals 17.361 1.400 100 1.750 10.000 3.500 30.000 8.000 9. The company estimates that income taxes expense for the entire year is $6000. 1.000 60.000 53.750 1. Prepare adjusting entries using journal entries and T accounts 2. Show a schedule for the inventory valuation. 3. Distribute dividends of 50% of the year end Net income, using journal en- tries and T accounts. 4. Prepare closing entries. 5. Prepare an income statement 6. Prepare a balance sheet (after closing) 7. Prepare a statement of retained earnings. 8. According to your knowledge, is this company profitable? 29.155 605 8.250 5.775 1.010 27.100 360 6.900 185.861 $ $ 185.861 Screens 3-4 of 5 140% File Tools View Final Assignment BC0114 ACCOUNTING I - Word o BC0114 ACCOUNTING I Task brief & rubrics Task: Final Assignment (60% of the Final grade) You must answer all the questions in the proposed business case. This task assesses the following learning outcomes: Adjusting entries Closing entries, Reporting Financial results Merchandise Accounting Inventories and the cost of goods sold. Apply acquired knowledge and skills to prepare an income statement and a statement of retained earnings. Submission file format: Excel document with all the answers, clearly identifying all steps, results, journals and including comments besides each answer. The company also trades with sophisticated technological tools used in their in- vestigations, their booking is done according to net purchase, gross sales policy. The agreement that the company has with his unique supplier is 2/15,n/30. The company acquired 100 units of the product at 25$ per unit in the month of January, 200 units in March at the price of 26$, 200 units in May at the price of 27$, 200 units in June at the price of 28$,200 units in September at the price of 29$, And finally, 200 units in November at the price of 30$. At the end of the year the inventory of this product is 25 units, the company uses FIFO criteria, which is the balance of traded products that the company should have if they have been pay- ing their supplier always before the 15th day after invoice date?. BUSINESS CASE (100 points) Other Data 1. Accrued but unrecorded client fees earned at December 31 amount to $2000. Ana Hoyos operates a private cybercrime investigation agency called Evol Investi- gations. Some clients pay in advance for services; others are billed after services have been performed. Advance payments are credited to an account entitled Un- earned Retainer Fees. Adjusting entries are performed on a monthly basis. An un- adjusted trial balance dated December 31, year 1, follows. (Bear in mind that ad- justing entries have already been made for the first 11 months of year 1, but not for December.) 2. Records show that $2,500 of cash receipts originally recorded as Unearned Retainer Fees had been earned as of December 31. 3. Office supplies on hand at December 31 amount to $100. Screens 1-2 of 5 E 140% File Tools View Final Assignment BC0114 ACCOUNTING | - Word o 4. The company purchased all of its office equipment when it first began busi- ness. At that time, the equipment's estimated useful life was six years (or 72 months). 9. If the company had decided to make an accrual for bad depts using the in- come statement approach with a 2% policy, which would have been the journal entry? 5. On October 1, year 1, the company renewed its rental agreement paying $2400 cash for six months' rent in advance. $ 6. On March 1 of the current year, the company paid $1200 cash to renew its 12-month insurance policy. 7. Accrued but unrecorded salaries at December 31 amount to $2050 47.866 5.000 735 205 1.600 300 50.000 8. On October 1, year 1, the company borrowed money from the bank by signing a $10000, 6 percent, 12-month note payable. The entire note, plus 12 months' ac- crued interest, is due on September 31, year 2. EVOL INVESTIGATIONS Adjusted Trial Balance November 31, Year 1 Cash Accounts receivable Inventories traded products Office supplies Prepaid rent Unexpired insurance Office Equipment Accumulated depreciation: Office equipment Accounts payable Interest payable Income taxes payable Note payable Unearned retainer fees Capital stock Retained earnings Dividends Client fees earned Sales traded products Cost of good sold Office supplies expense Depreciation expense: Office equipment Rent expense Insurance expense Salaries expense Interest expense Income tax expense Totals 17.361 1.400 100 1.750 10.000 3.500 30.000 8.000 9. The company estimates that income taxes expense for the entire year is $6000. 1.000 60.000 53.750 1. Prepare adjusting entries using journal entries and T accounts 2. Show a schedule for the inventory valuation. 3. Distribute dividends of 50% of the year end Net income, using journal en- tries and T accounts. 4. Prepare closing entries. 5. Prepare an income statement 6. Prepare a balance sheet (after closing) 7. Prepare a statement of retained earnings. 8. According to your knowledge, is this company profitable? 29.155 605 8.250 5.775 1.010 27.100 360 6.900 185.861 $ $ 185.861 Screens 3-4 of 5 140% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started