Question

Part 2: NOTE: This is a DIFFERENT COMPANY . Using the trial balance below, complete the Multi-Step Income Statement and prepare the Statement of Retained

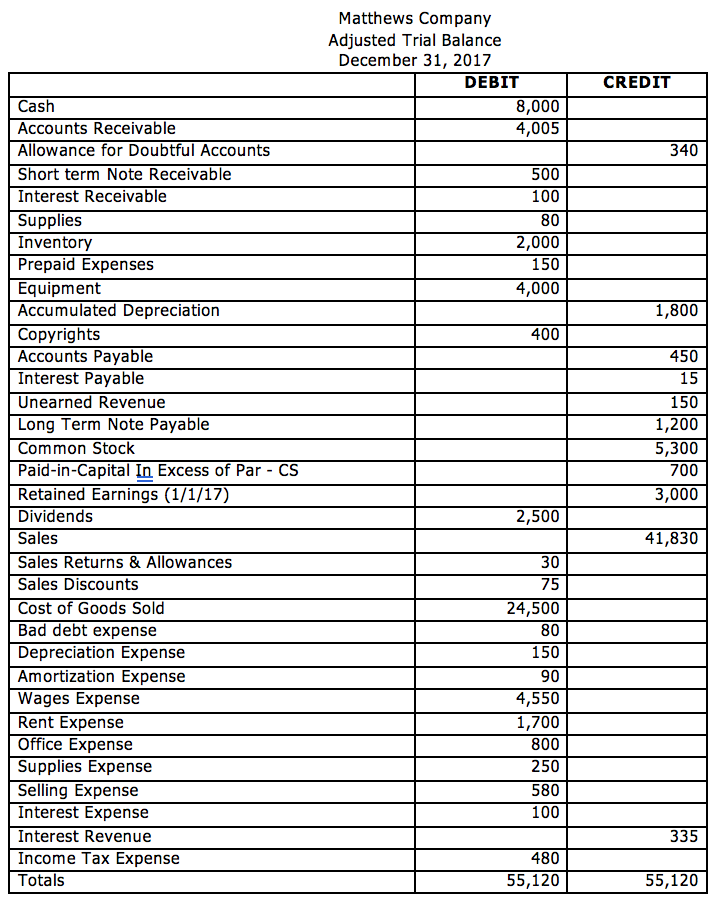

Part 2:NOTE: This is a DIFFERENT COMPANY. Using the trial balance below, complete the Multi-Step Income Statementand prepare the Statement of Retained Earningsand Classified Balance Sheeton the pages which follow. To get full credit you must include all critical subtotals.

Part 2:NOTE: This is a DIFFERENT COMPANY. Using the trial balance below, complete the Multi-Step Income Statementand prepare the Statement of Retained Earningsand Classified Balance Sheeton the pages which follow. To get full credit you must include all critical subtotals.

Part 2: Insert Second Trial Balance HERE.

Multi Step Income Statement

For the year ended December 31, 2017

(Be sure to include all the necessary headings, totals and subtotals as outlined in Chapter 5. You may not need to use all the lines provided. Note: The two columns below do not represent debit and credit balances like they do on a trial balance. On the Income Statement, use the right column for subtotals and totals.)

|

| ||

|

|

| |

|

|

| |

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

Statement of Retained Earnings

For the year ended December 31, 2017

Classified Balance Sheet

December 31, 2017

(Be sure to include all the necessary subtotals and totals as outlined in Chapter 2. You may not need to use all of the lines provided. Note: The two columns below do not represent debit and credit balances like they do on a trial balance. On the Balance Sheet, use the right column for subtotals and totals.)

|

| ||

|

| ||

|

| ||

|

| ||

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

Matthews Company Adjusted Trial Balance December 31, 2017 DEBIT CREDIT Cash Accounts Receivable Allowance for Doubtful Accounts Short term Note Receivable Interest Receivable Supplies Inventory Prepaid Expenses Equipment Accumulated Depreciation Copyrights Accounts Payable Interest Payable Unearned Revenue Long Term Note Payable Common Stock Paid-in-Capital In Excess of Par CS Retained Earnings (1/1/17) Dividends Sales Sales Returns & Allowances Sales Discounts Cost of Goods Sold Bad debt expense Depreciation Expense Amortization Expense Wages Expense Rent Expense Office Expense Supplies Expense Selling Expense Interest Expense Interest Revenue Income Tax Expense Totals 8,000 4,005 340 500 100 80 2,000 150 4,000 1,800 400 450 15 150 1,200 5,300 700 3,000 2,500 41,830 30 75 24,500 80 150 90 4,550 1,700 800 250 580 100 335 480 55,120 55,120

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started