Part 2

Part 3

Part 4

Part 5

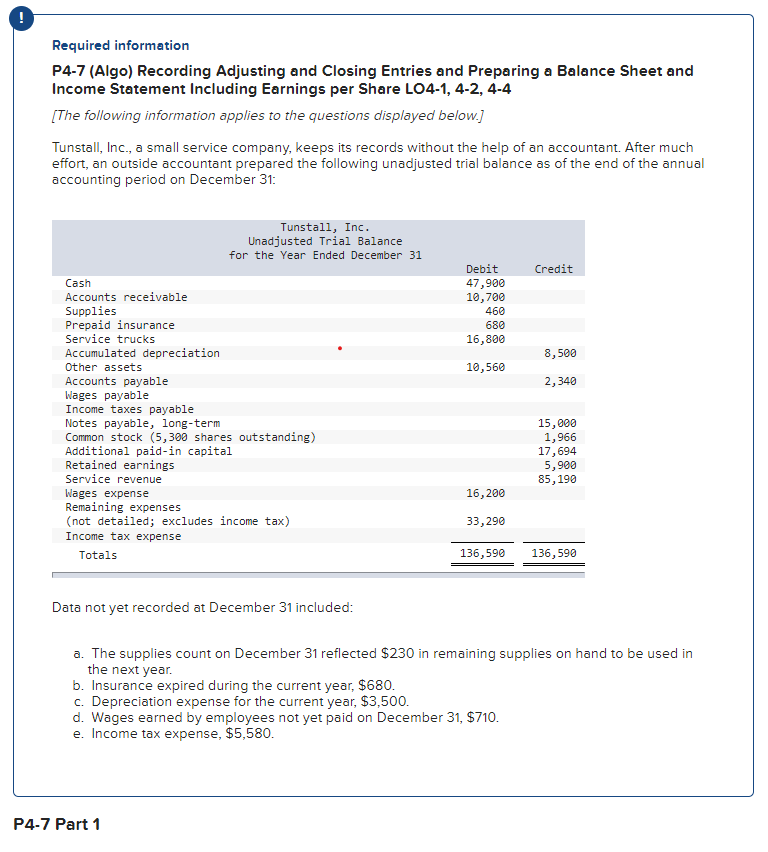

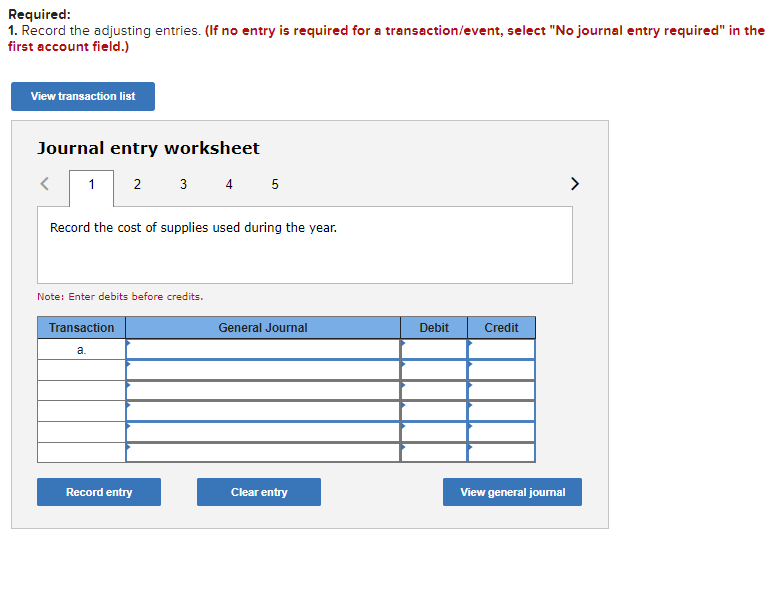

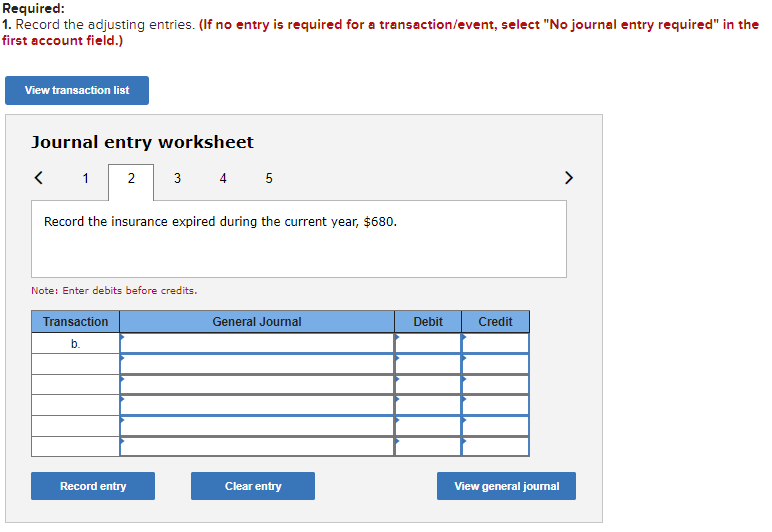

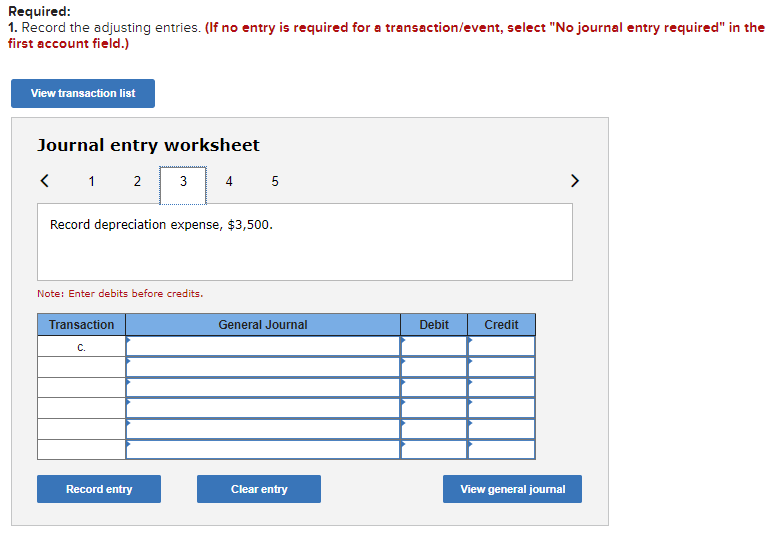

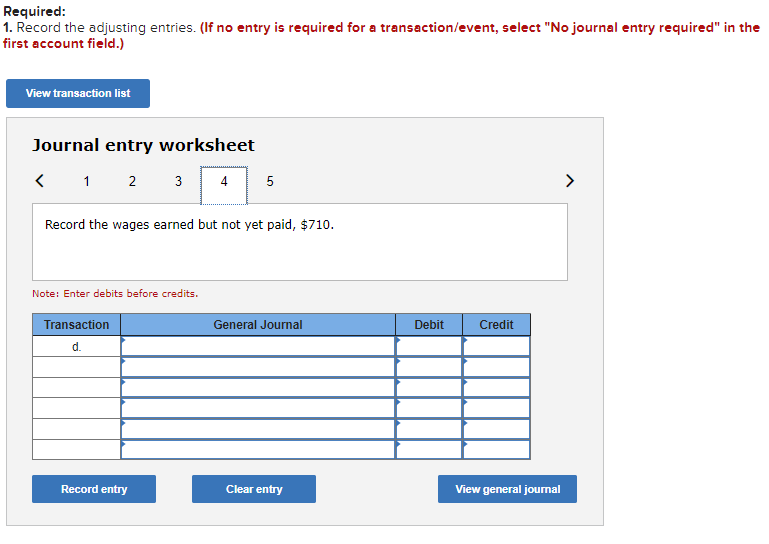

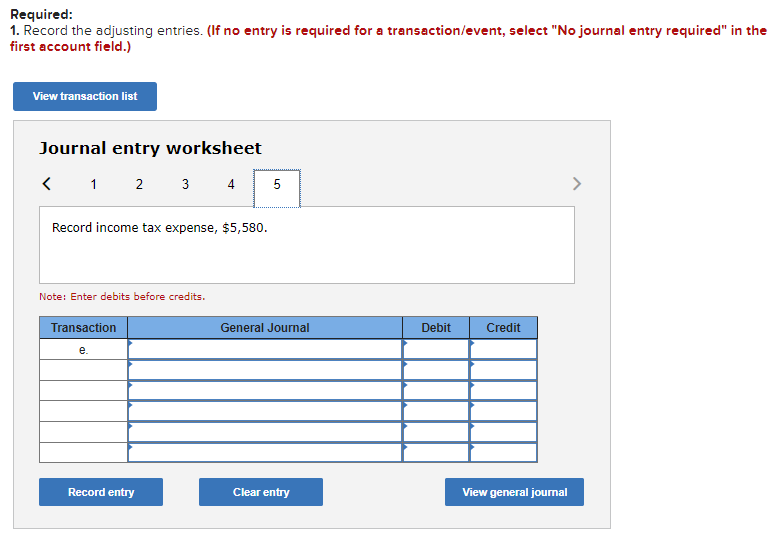

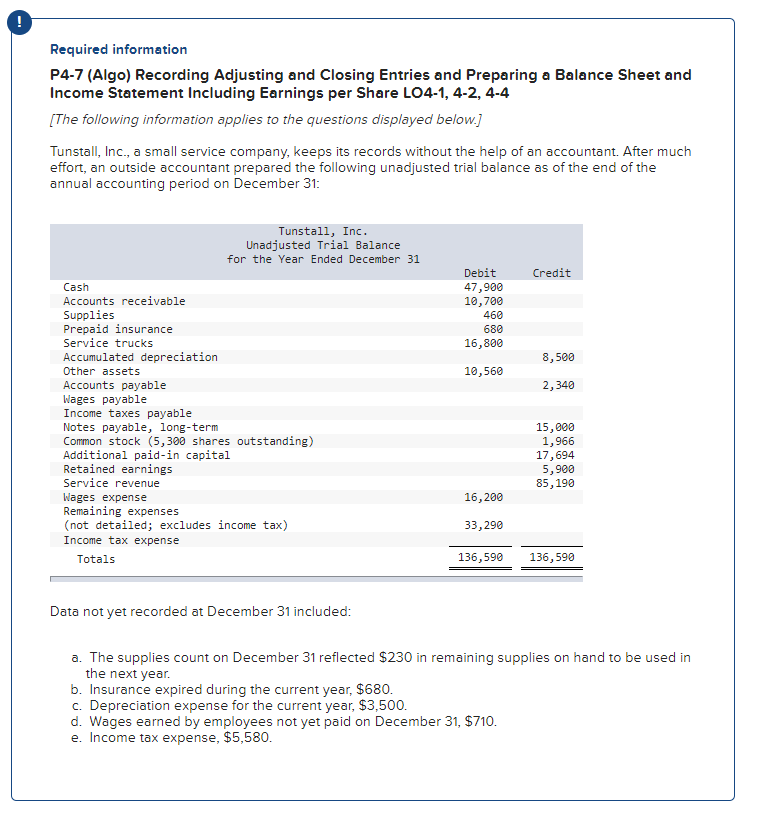

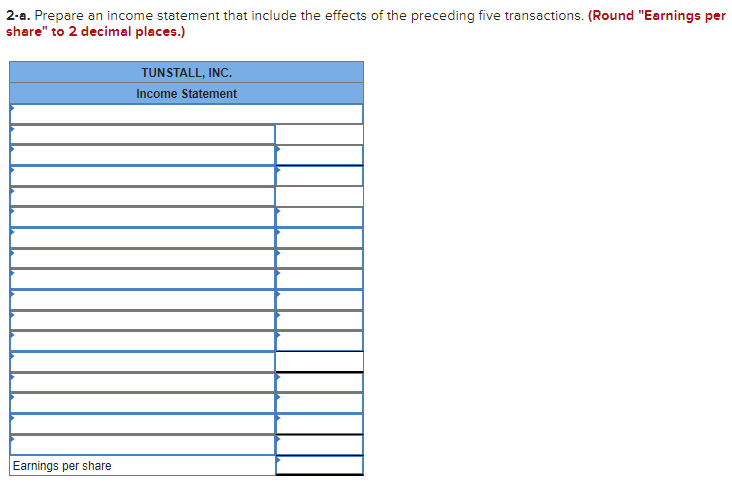

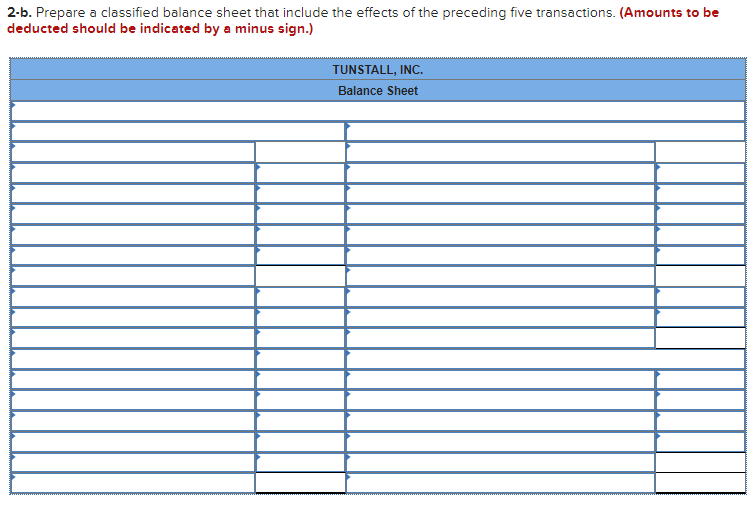

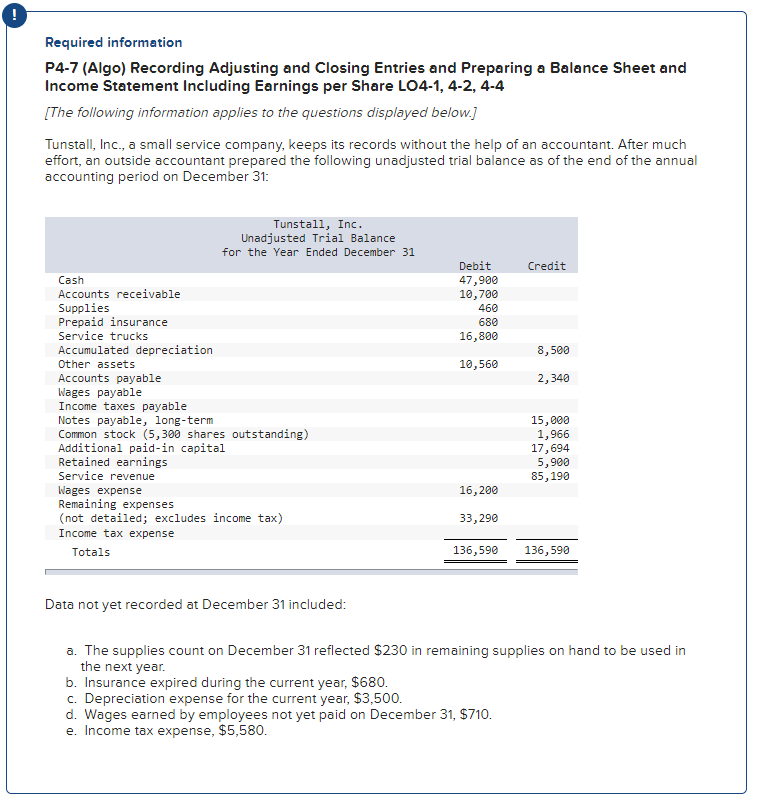

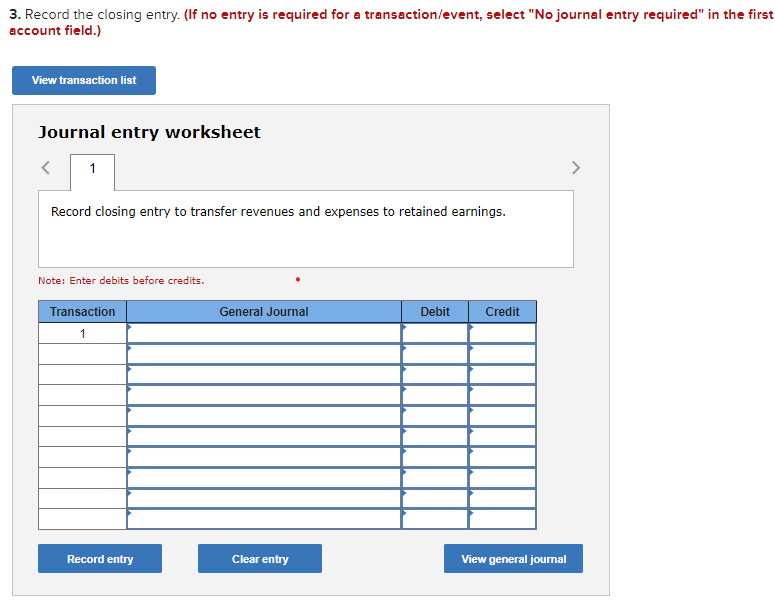

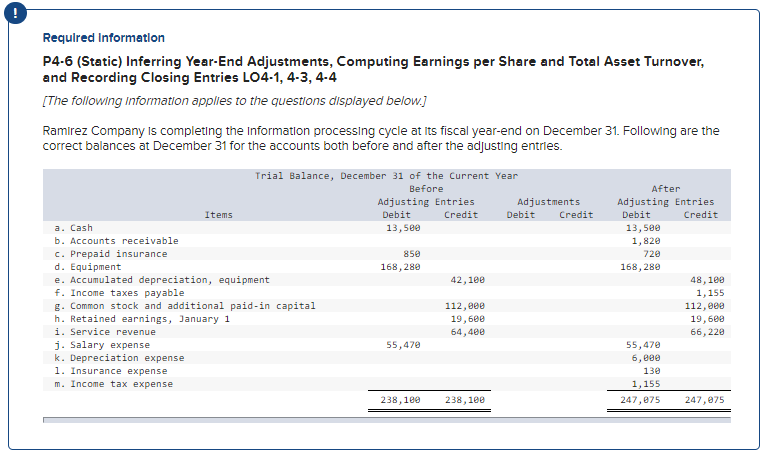

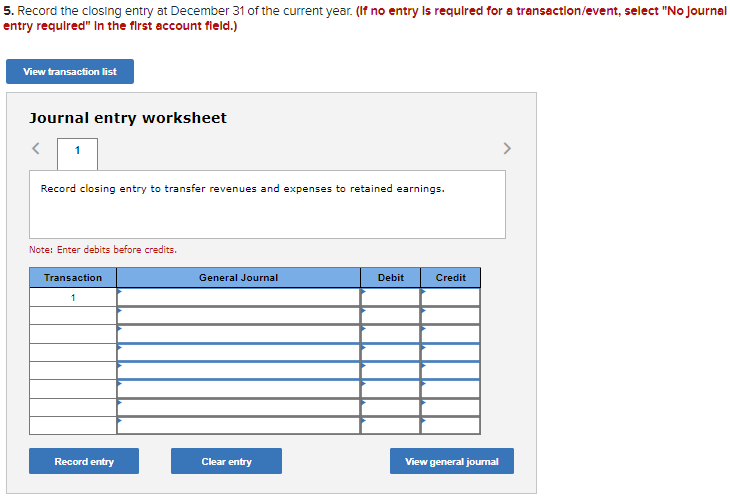

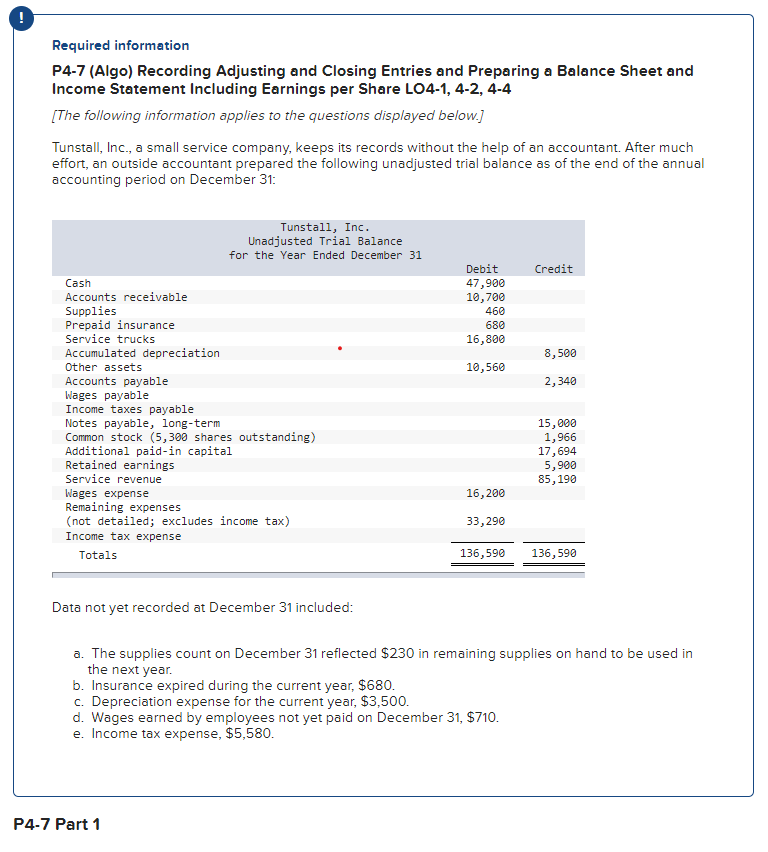

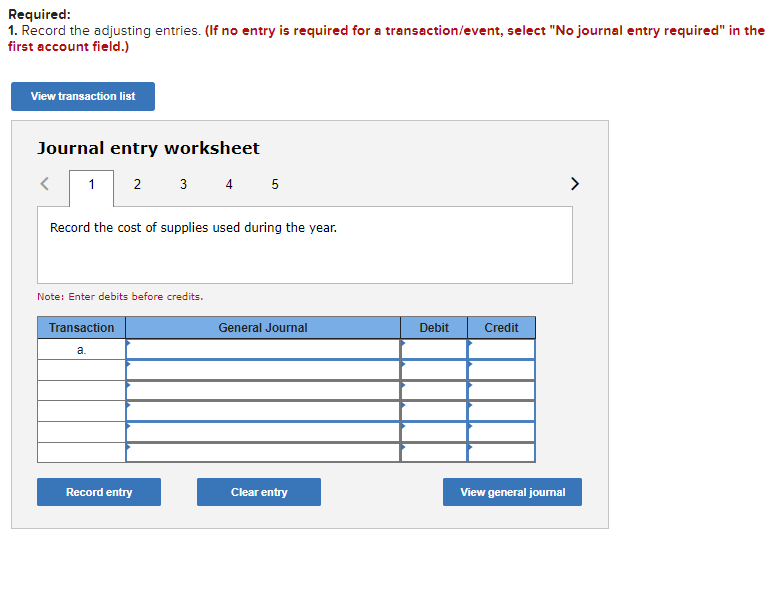

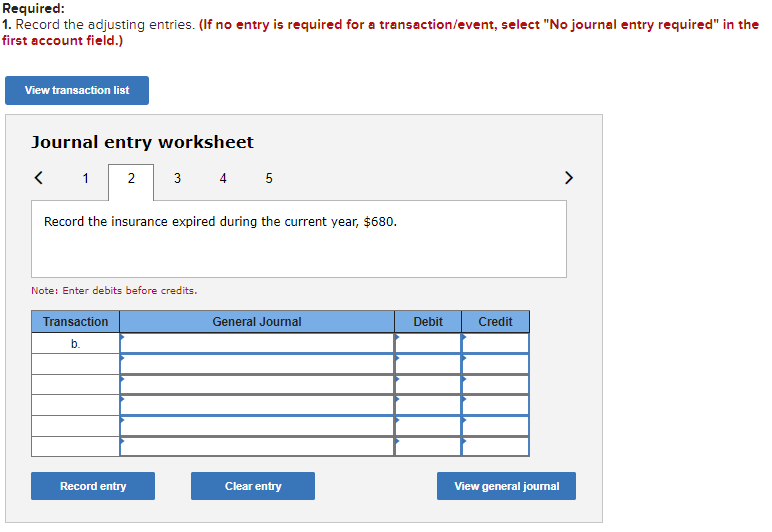

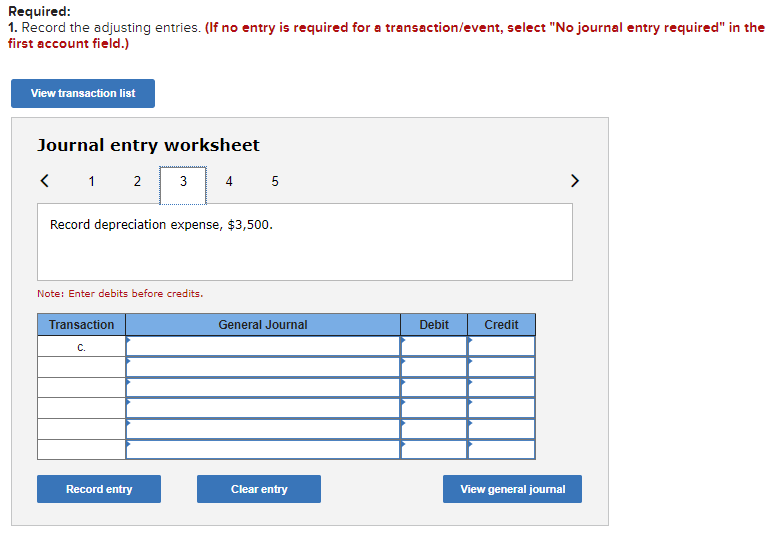

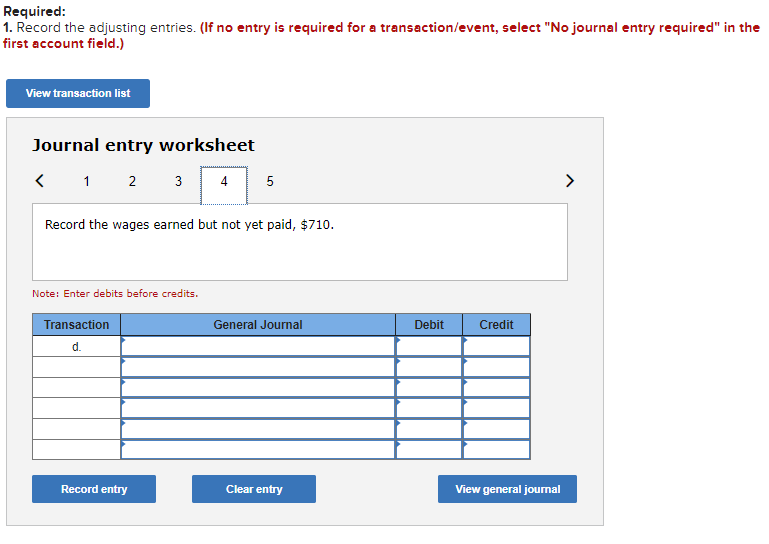

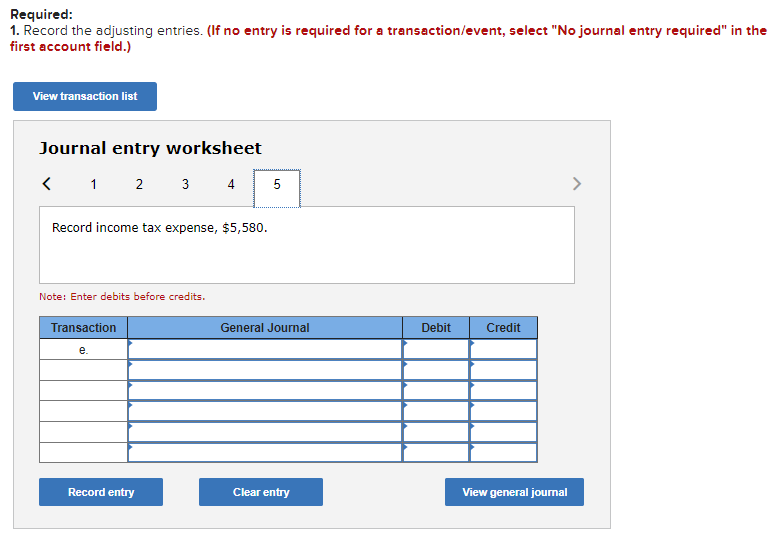

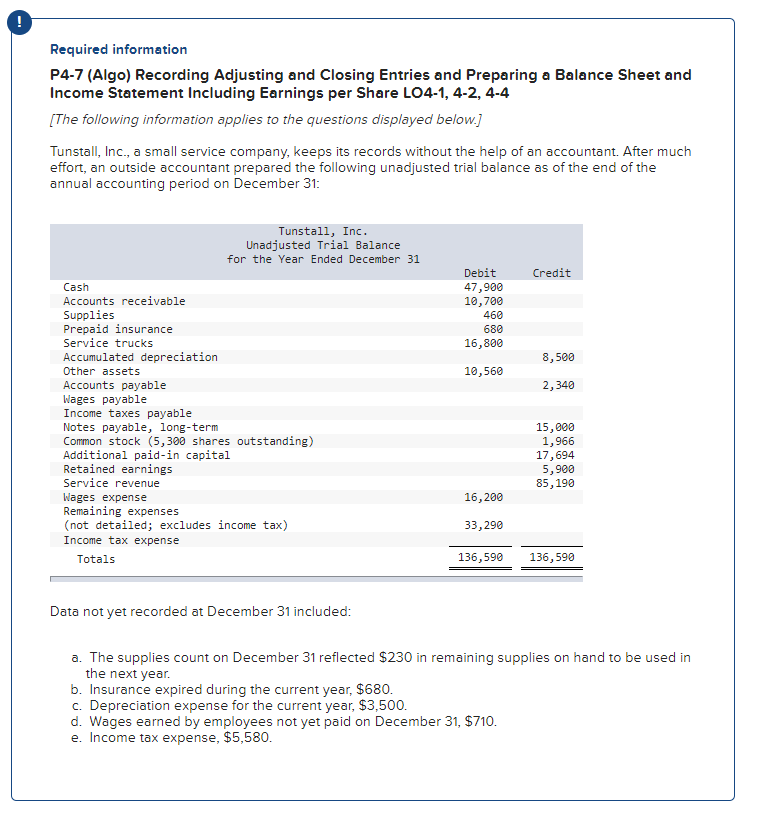

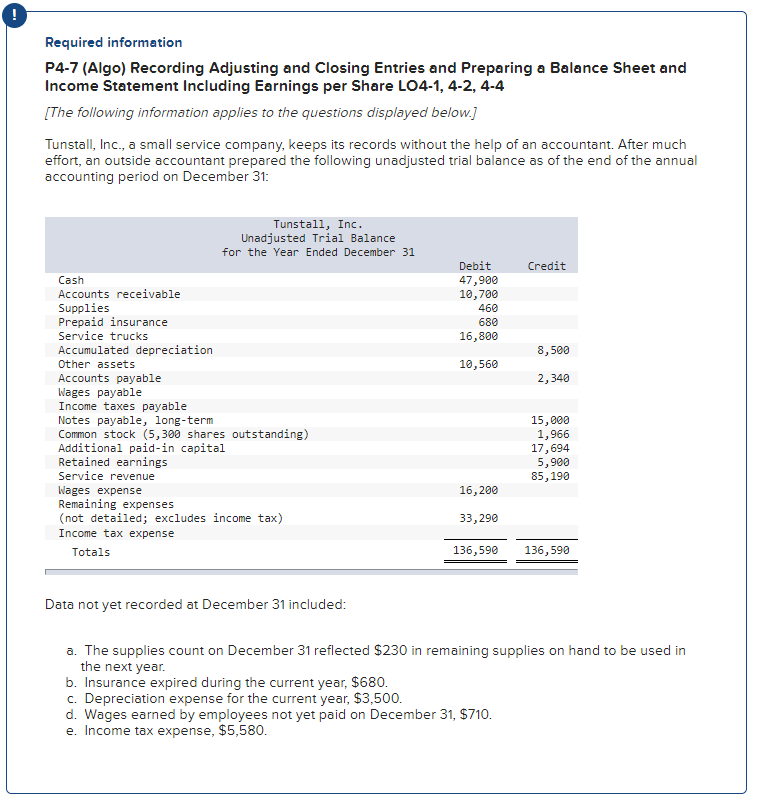

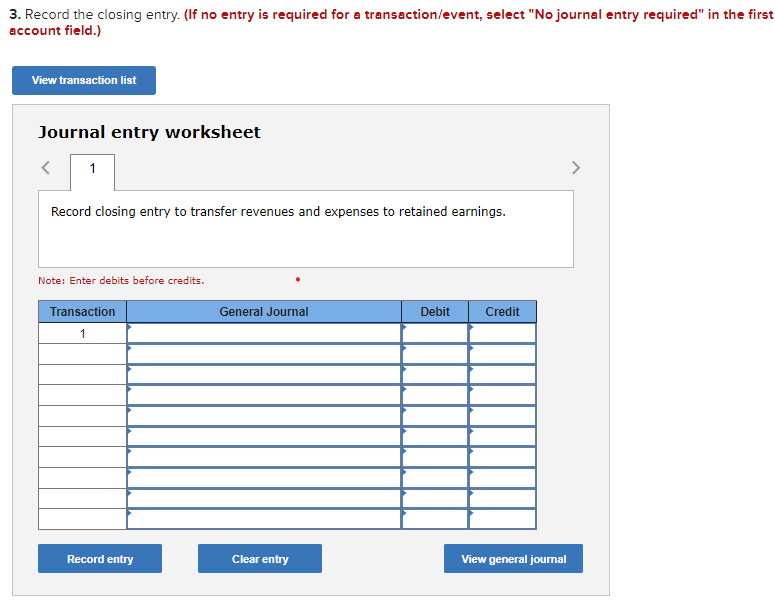

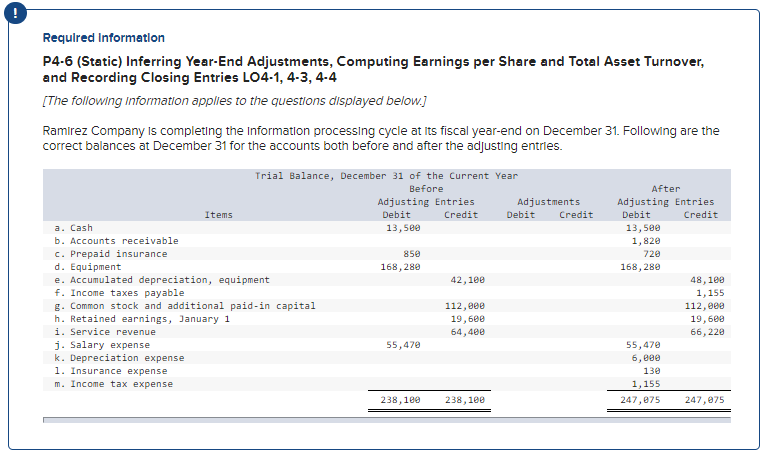

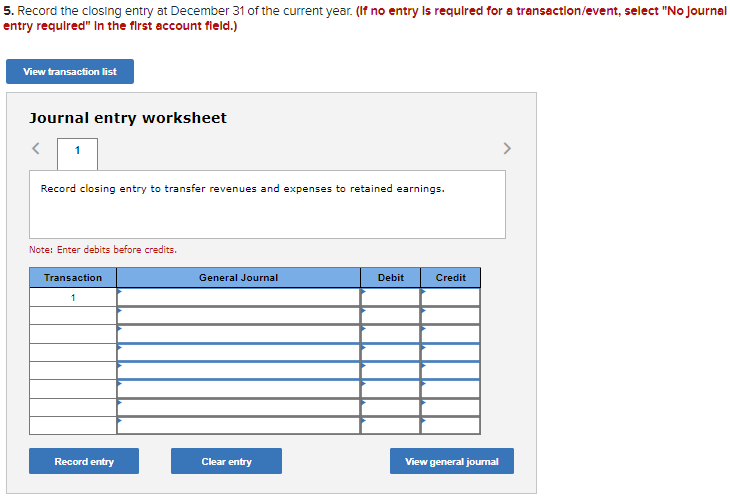

Required information P4-7 (Algo) Recording Adjusting and Closing Entries and Preparing a Balance Sheet and Income Statement Including Earnings per Share LO4-1, 4-2, 4-4 [The following information applies to the questions displayed below.] Tunstall, Inc., a small service company, keeps its records without the help of an accountant. After much effort, an outside accountant prepared the following unadjusted trial balance as of the end of the annual accounting period on December 31: Data not yet recorded at December 31 included: a. The supplies count on December 31 reflected $230 in remaining supplies on hand to be used in the next year. b. Insurance expired during the current year, $680. c. Depreciation expense for the current year, $3,500. d. Wages earned by employees not yet paid on December 31,$710. e. Income tax expense, $5,580. Required: 1. Record the adjusting entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the cost of supplies used during the year. Note: Enter debits before credits. Required: 1. Record the adjusting entries. (If no entry is required for a transaction/event, select "No journal entry required" in the irst account field.) Journal entry worksheet Record the insurance expired during the current year, $680. Note: Enter debits before credits. Required: 1. Record the adjusting entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Note: Enter debits before credits. Required: 1. Record the adjusting entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the wages earned but not yet paid, $710. Note: Enter debits before credits. Required: 1. Record the adjusting entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Note: Enter debits before credits. Required information P4-7 (Algo) Recording Adjusting and Closing Entries and Preparing a Balance Sheet and Income Statement Including Earnings per Share LO4-1, 4-2, 4-4 [The following information applies to the questions displayed below.] Tunstall, Inc., a small service company, keeps its records without the help of an accountant. After much effort, an outside accountant prepared the following unadjusted trial balance as of the end of the annual accounting period on December 31 : Data not yet recorded at December 31 included: a. The supplies count on December 31 reflected $230 in remaining supplies on hand to be used in the next year. b. Insurance expired during the current year, $680. c. Depreciation expense for the current year, $3,500. d. Wages earned by employees not yet paid on December 31,$710. e. Income tax expense, $5,580. 2-a. Prepare an income statement that include the effects of the preceding five transactions. (Round "Earnings per share" to 2 decimal places.) 2-b. Prepare a classified balance sheet that include the effects of the preceding five transactions. (Amounts to be deducted should be indicated by a minus sign.) Required information P4-7 (Algo) Recording Adjusting and Closing Entries and Preparing a Balance Sheet and Income Statement Including Earnings per Share LO4-1, 4-2, 4-4 [The following information applies to the questions displayed below.] Tunstall, Inc., a small service company, keeps its records without the help of an accountant. After much effort, an outside accountant prepared the following unadjusted trial balance as of the end of the annual accounting period on December 31 : Data not yet recorded at December 31 included: a. The supplies count on December 31 reflected $230 in remaining supplies on hand to be used in the next year. b. Insurance expired during the current year, $680. c. Depreciation expense for the current year, $3,500. d. Wages earned by employees not yet paid on December 31,$710. e. Income tax expense, \$5,580. 3. Record the closing entry. (If no entry is required for a transaction/event, select "No journal entry required" in the firs account field.) Journal entry worksheet Record closing entry to transfer revenues and expenses to retained earnings. Note: Enter debits before credits. Requlred Information P4-6 (Static) Inferring Year-End Adjustments, Computing Earnings per Share and Total Asset Turnover, and Recording Closing Entries LO4-1, 4-3, 4-4 [The following information applies to the questions displayed below.] Ramirez Company is completing the Information processing cycle at its fiscal year-end on December 31 . Following are the correct balances at December 31 for the accounts both before and after the adjusting entrles. 5. Record the closing entry at December 31 of the current year. (If no entry is requlred for a transaction/event, select "No Journal entry requlred" In the flrst account fleld.) Journal entry worksheet Record closing entry to transfer revenues and expenses to retained earnings. Note: Enter debits before credits