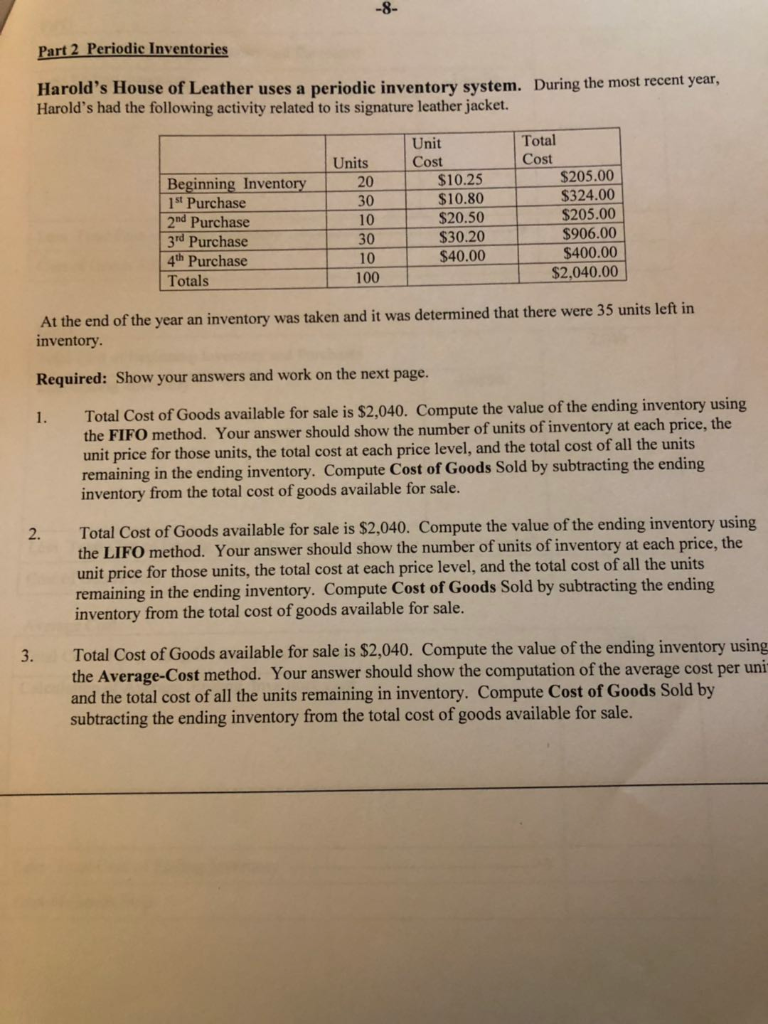

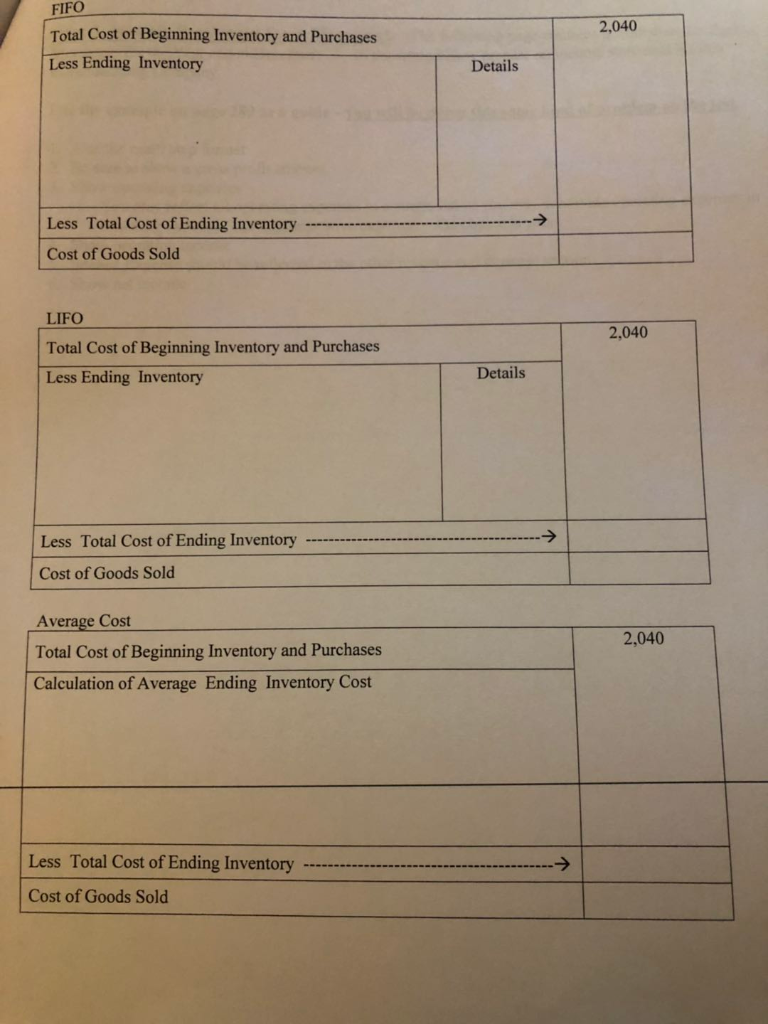

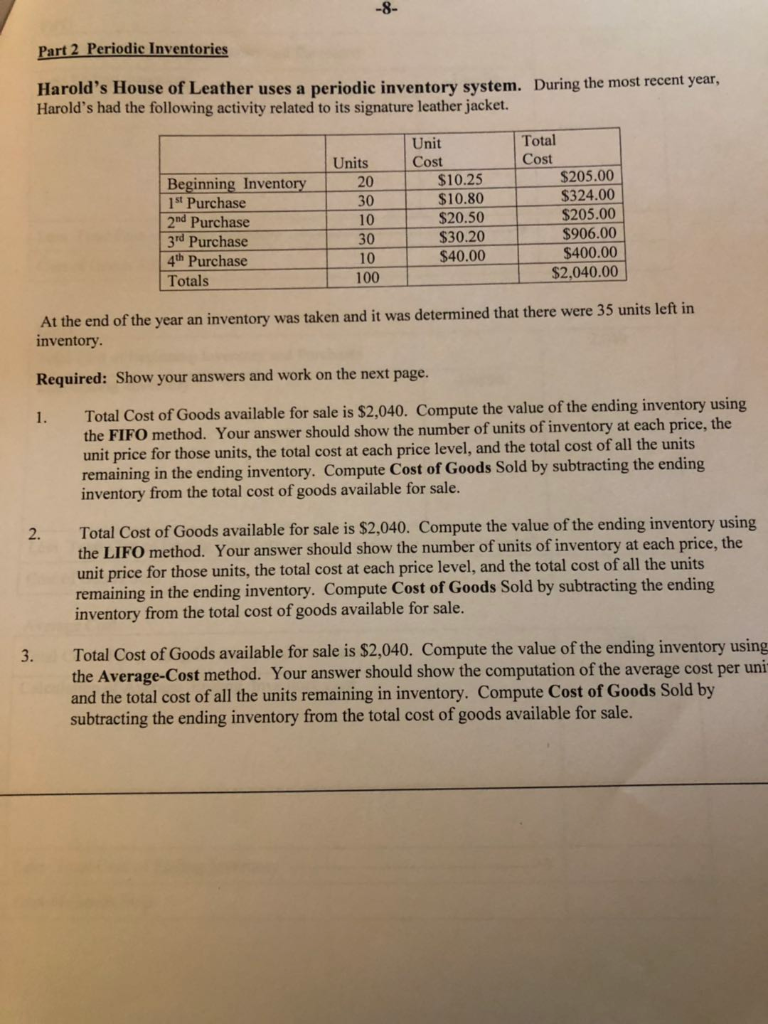

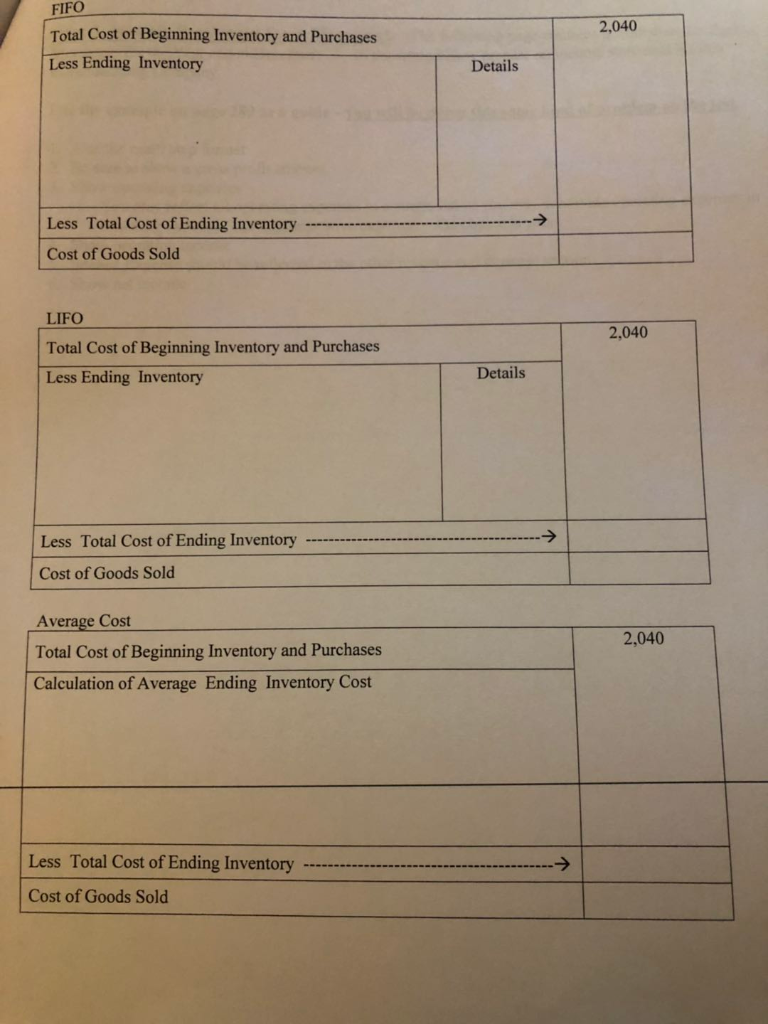

Part 2 Periodic Inventories Harold's House of Leather uses a periodic inventory system. Harold's had the following activity related to its signature leather jacket. During the most recent year, Total Cost Unit Cost Units $205.00 $324.00 $205.00 $906.00 $400.00 $2,040.00 Beginning Invento 1st Purchase 2nd Purchase 3rd Purchase 4th Purchase Totals $10.25 20 30 10 30 10 100 $20.50 $30.20 $40.00 At the end of the year an inventory was taken and it was determined that there were 35 units left in inventory Required: Show your answers and work on the next page Total Cost of Goods available for sale is $2,040. Compute the value of the ending inventory using the FIFO method. Your answer should show the number of units of inventory at each price, the unit price for those units, the total cost at each price level, and the total cost of all the units remaining in the ending inventory. Compute Cost of Goods Sold by subtracting the ending inventory from the total cost of goods available for sale. 1. 2. Total Cost of Goods available for sale is $2,040. Compute the value of the ending inventory using the LIFO method. Your answer should show the number of units of inventory at each price, the unit price for those units, the total cost at each price level, and the total cost of all the units remaining in the ending inventory. Compute Cost of Goods Sold by subtracting the ending inventory from the total cost of goods available for sale. 3. Total Cost of Goods available for sale is $2,040. Compute the value of the ending inventory using the Average-Cost method. Your answer should show the computation of the average cost per uni and the total cost of all the units remaining in inventory. Compute Cost of Goods Sold by subtracting the ending inventory from the total cost of goods available for sale. FIFO Total Cost of Beginning Inventory and Purchases Less Ending Inventory 2,040 Details Less Total Cost of Ending Inventory Cost of Goods Sold LIFO Total Cost of Beginning Inventory and Purchases Less Ending Inventory 2,040- Details Less Total Cost of Ending Inventory Cost of Goods Sold Average Cost Total Cost of Beginning Inventory and Purchases Calculation of Average Ending Inventory Cost 2,040 Less Total Cost of Ending Inventory > Cost of Goods Sold