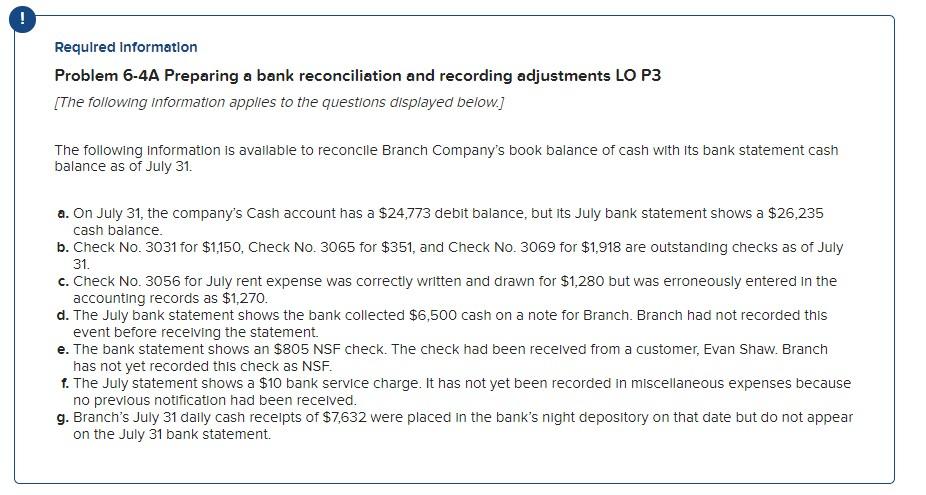

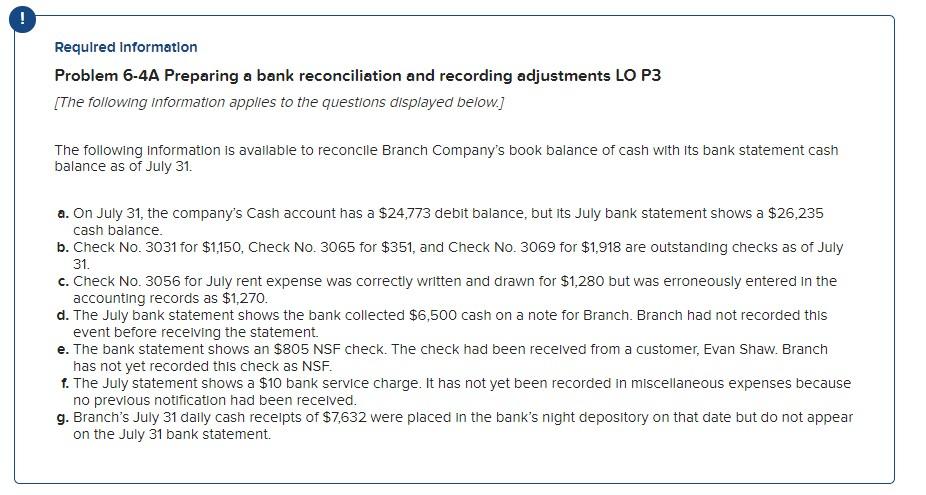

Part 2

Prepare the journal entries necessary to make the companys book balance of cash equal to the reconciled cash balance as of July 31. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

a.Record the adjusting entry required, if any, related to the July 31 cash balance.

b.Record the adjusting entry required, if any, related to the outstanding checks.

c.Record the adjusting entry required, if any, related to Check No. 3056.

d.Record the adjusting entry required, if any, for the collection of the note by bank for Branch.

e.Record the adjusting entry required, if any, related to the NSF check.

f.Record the adjusting entry required, if any, related to bank service charges.

g.Record the adjusting entry required, if any, related to the July 31 deposit.

An example of how the input should look for the answer is below vvv

Part 3

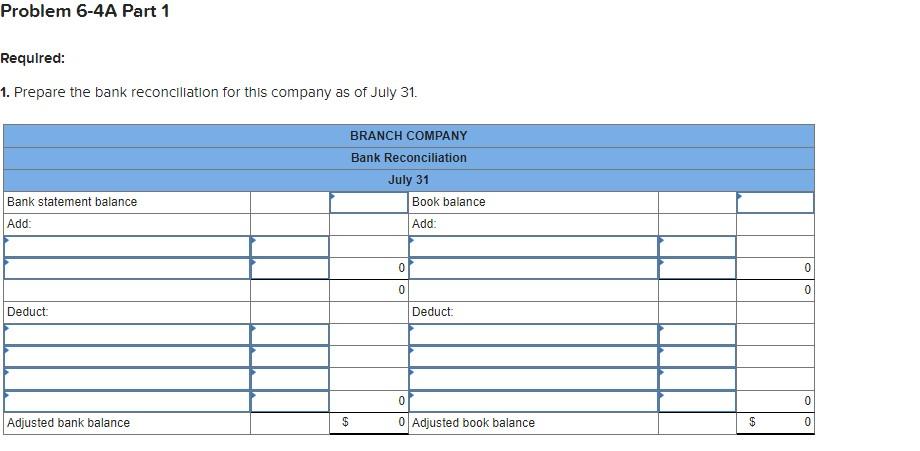

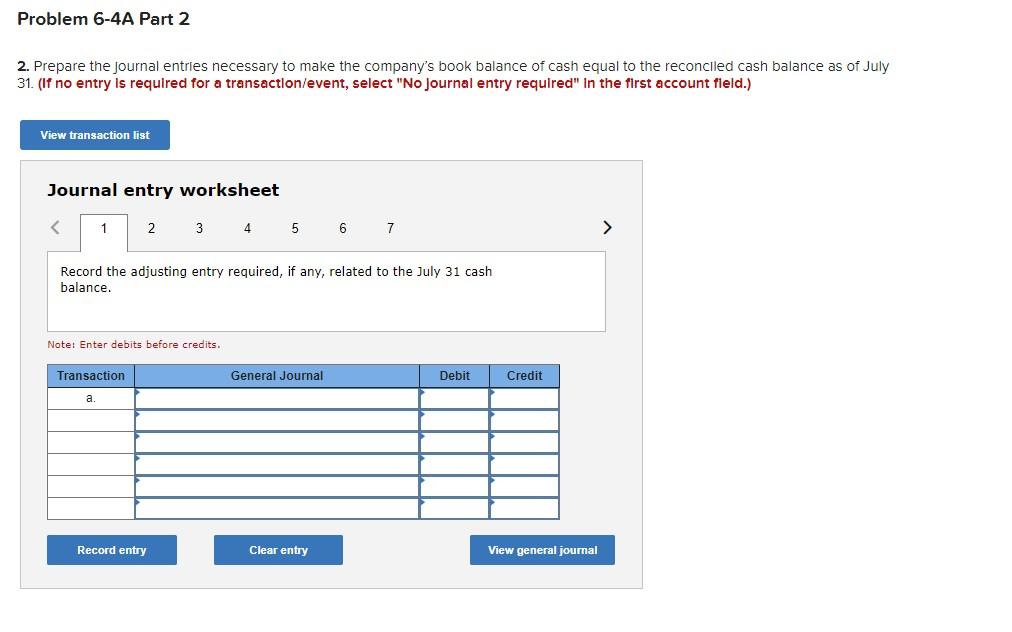

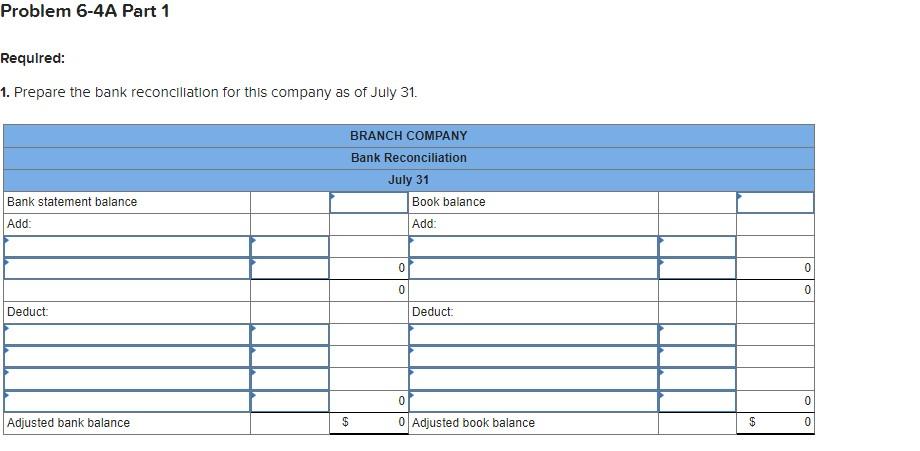

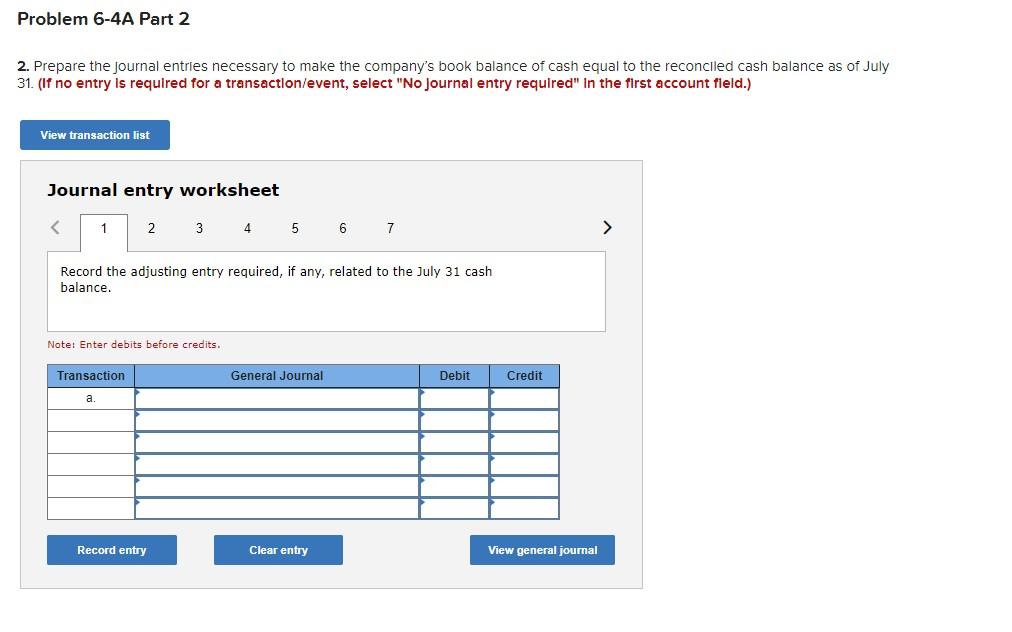

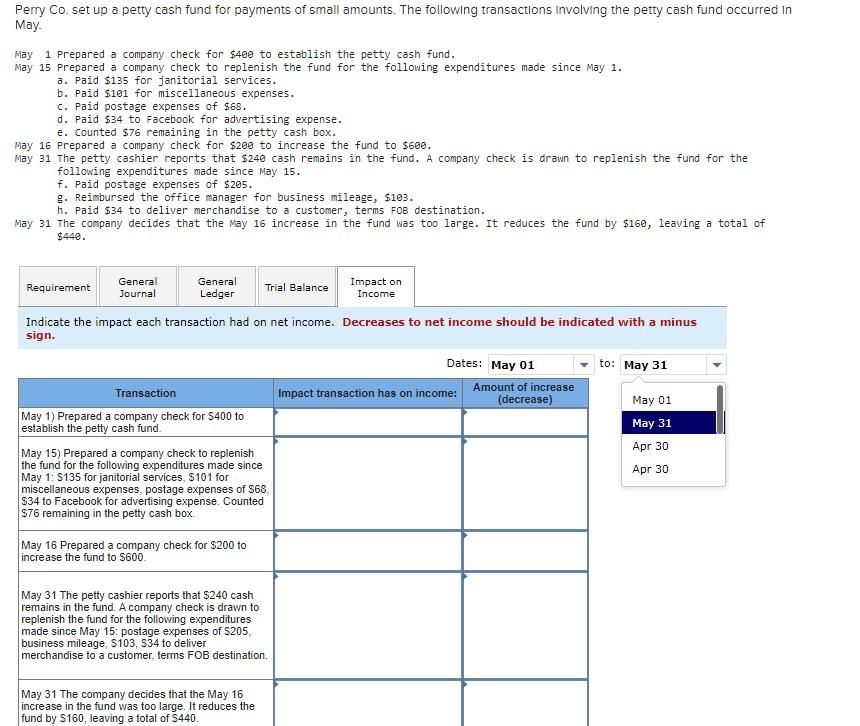

Problem 6-4A Part 1 Required: 1. Prepare the bank reconciliation for this company as of July 31. BRANCH COMPANY Bank Reconciliation July 31 Book balance Add: Bank statement balance Add: 0 0 0 0 Deduct: Deduct: 0 0 Adjusted bank balance $ 0 Adjusted book balance $ 0 Required Information Problem 6-4A Preparing a bank reconciliation and recording adjustments LO P3 [The following information applies to the questions displayed below.) The following information is available to reconcile Branch Company's book balance of cash with its bank statement cash balance as of July 31. a. On July 31, the company's Cash account has a $24,773 debit balance, but its July bank statement shows a $26,235 cash balance. b. Check No. 3031 for $1,150, Check No. 3065 for $351, and Check No. 3069 for $1.918 are outstanding checks as of July 31. C. Check No. 3056 for July rent expense was correctly written and drawn for $1,280 but was erroneously entered in the accounting records as $1,270. d. The July bank statement shows the bank collected $6,500 cash on a note for Branch. Branch had not recorded this event before receiving the statement e. The bank statement shows an $805 NSF check. The check had been received from a customer, Evan Shaw. Branch has not yet recorded this check as NSF. f. The July statement shows a $10 bank service charge. It has not yet been recorded in miscellaneous expenses because no previous notification had been received. g. Branch's July 31 dally cash receipts of $7,632 were placed in the bank's night depository on that date but do not appear on the July 31 bank statement Problem 6-4A Part 2 2. Prepare the journal entries necessary to make the company's book balance of cash equal to the reconciled cash balance as of July 31. (If no entry is required for a transaction/event, select "No Journal entry required in the first account field.) View transaction list Journal entry worksheet Record the adjusting entry required, if any, related to the July 31 cash balance. Note: Enter debits before credits. Transaction General Journal Debit Credit a. Record entry Clear entry View general journal Perry Co. set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May May 1 Prepared a company check for $400 to establish the petty cash fund. May 15 Prepared a company check to replenish the fund for the following expenditures made since May 1. a. Paid $135 for janitorial services. b. Paid $101 for miscellaneous expenses. C. Paid postage expenses of $68. d. Paid $34 to Facebook for advertising expense. e. Counted $76 remaining in the petty cash box. May 16 Prepared a company check for $200 to increase the fund to $600. May 31 The petty cashier reports that $240 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. f. Paid postage expenses of $205. g. Reimbursed the office manager for business mileage, $103. h. Paid $34 to deliver merchandise to a customer, terms FOB destination. May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by $160, leaving a total of $448. Requirement General General Trial Balance Impact on Journal Ledger Income Indicate the impact each transaction had on net income. Decreases to net income should be indicated with a minus sign. Dates: May 01 to: May 31 Transaction Impact transaction has on income: Amount of increase (decrease) May 01 May 1) Prepared a company check for $400 to establish the petty cash fund. May 31 May 15) Prepared a company check to replenish Apr 30 the fund for the following expenditures made since May 1: $135 for janitorial services, S101 for Apr 30 miscellaneous expenses postage expenses of $68 $34 to Facebook for advertising expense. Counted S76 remaining in the petty cash box. May 16 Prepared a company check for $200 to increase the fund to $600. May 31 The petty cashier reports that $240 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. postage expenses of S205, business mileage, 5103, 534 to deliver merchandise to a customer, terms FOB destination. May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by S160, leaving a total of 5440