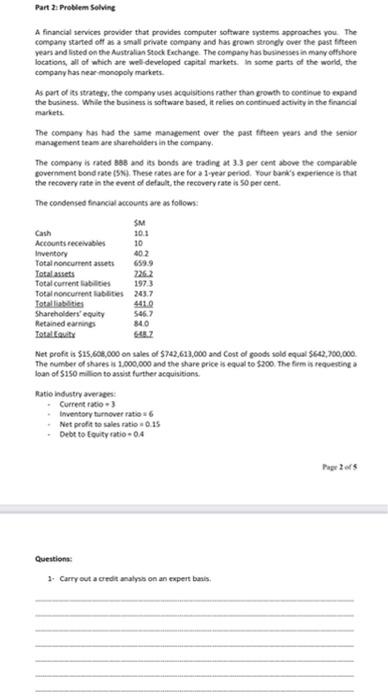

Part 2. Problem Solvine A financial services provider that provides computer software systems approaches you The company started off as a small private company and has grown strongly over the past fifteen years and listed on the Australian Stock Exchange. The company has businesses in many offshore locations all of which are well developed capital markets. In some parts of the world, the company has near monopoly markets As part of its strategy, the company uses acquisitions rather than growth to continue to expand the business. While the business is software based, it relies on continued activity in the financial markets The company has had the same management over the past three years and the senior management team are shareholders in the company The company is rated 888 and its bonds we trading # 3.3 per cent above the comparable government bond rate (5) These rates are for a 1-year period. Your bank's experience is that the recovery rate in the event of default, the recovery rate is 50 percent The condensed financial accounts are as follows: SM Cash 10.1 Accounts receivables 10 Inventory 402 Total noncurrent assets Total assets 2262 Total current 1973 Total noncurrent tables 243.7 Totallaties 4410 Shareholders equity Retained earning 840 Totalcauity Net profit is $15.60.000 on sales of $742,613,000 and Cost of goods sold equal 5642,700.000 The number of shares 1,000,000 and the share price is equal to $200. The form is requesting loan of S150 million to assist further acquisitions. Ratio Industry averages . Current ratio) Inventory turnover ratio Net profitto sales ratio 015 - Debt to Equity ratio 04 5467 Per Questions: 3. Carry out a credit analysis on an expert bis 2. Carry out a credit analysis on a market.premium basis A. Calculate the probability of repayment and probability of default (Assumingatan maturing in 1 year B. Calculate the risk premium Suppose that the company requested a loan for two years. Government bond rate for 2 years is 6% and company bond rate for 2 years 9.5%. Calculate the cumulative probability of default Pages 3. Using Altman 2 score, what is the indication of credit risk? 4- Having carried out the above analysis, carefully outline the benefits and disadvantages of lending to this company. What would be your final decision? Page 5 of 5 Part 2. Problem Solvine A financial services provider that provides computer software systems approaches you The company started off as a small private company and has grown strongly over the past fifteen years and listed on the Australian Stock Exchange. The company has businesses in many offshore locations all of which are well developed capital markets. In some parts of the world, the company has near monopoly markets As part of its strategy, the company uses acquisitions rather than growth to continue to expand the business. While the business is software based, it relies on continued activity in the financial markets The company has had the same management over the past three years and the senior management team are shareholders in the company The company is rated 888 and its bonds we trading # 3.3 per cent above the comparable government bond rate (5) These rates are for a 1-year period. Your bank's experience is that the recovery rate in the event of default, the recovery rate is 50 percent The condensed financial accounts are as follows: SM Cash 10.1 Accounts receivables 10 Inventory 402 Total noncurrent assets Total assets 2262 Total current 1973 Total noncurrent tables 243.7 Totallaties 4410 Shareholders equity Retained earning 840 Totalcauity Net profit is $15.60.000 on sales of $742,613,000 and Cost of goods sold equal 5642,700.000 The number of shares 1,000,000 and the share price is equal to $200. The form is requesting loan of S150 million to assist further acquisitions. Ratio Industry averages . Current ratio) Inventory turnover ratio Net profitto sales ratio 015 - Debt to Equity ratio 04 5467 Per Questions: 3. Carry out a credit analysis on an expert bis 2. Carry out a credit analysis on a market.premium basis A. Calculate the probability of repayment and probability of default (Assumingatan maturing in 1 year B. Calculate the risk premium Suppose that the company requested a loan for two years. Government bond rate for 2 years is 6% and company bond rate for 2 years 9.5%. Calculate the cumulative probability of default Pages 3. Using Altman 2 score, what is the indication of credit risk? 4- Having carried out the above analysis, carefully outline the benefits and disadvantages of lending to this company. What would be your final decision? Page 5 of 5