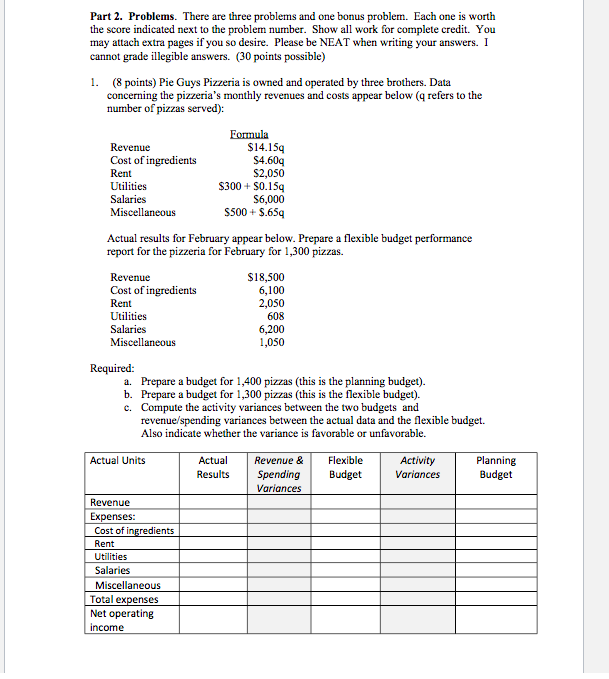

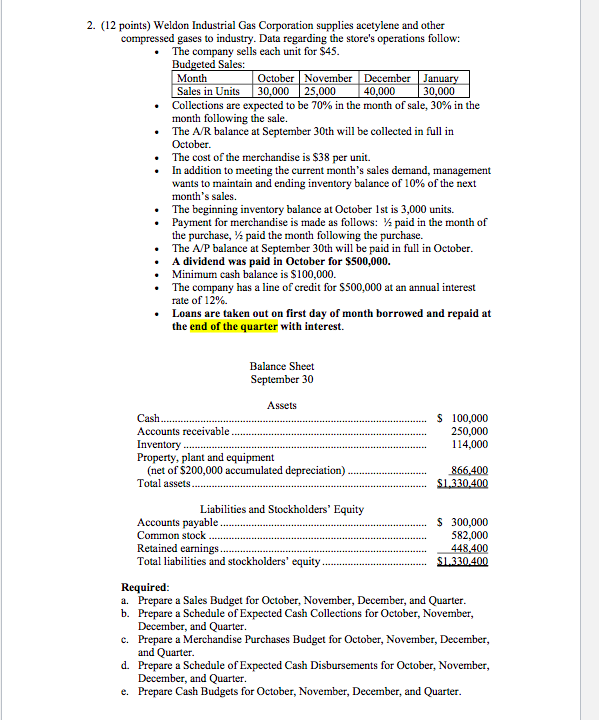

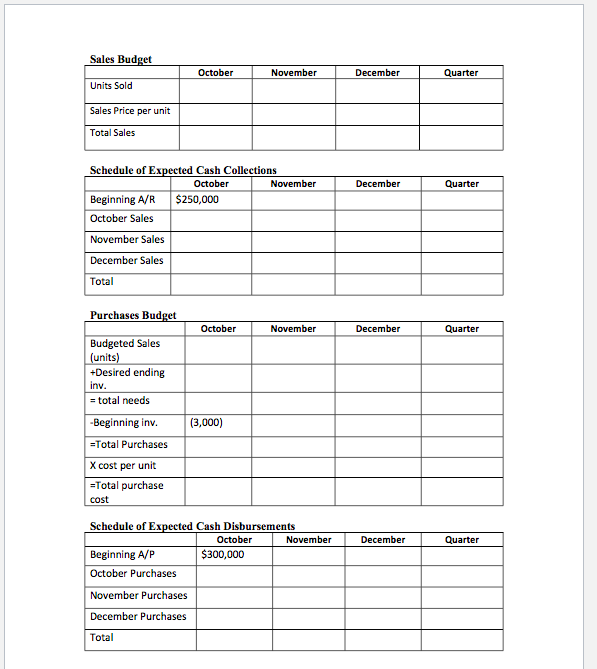

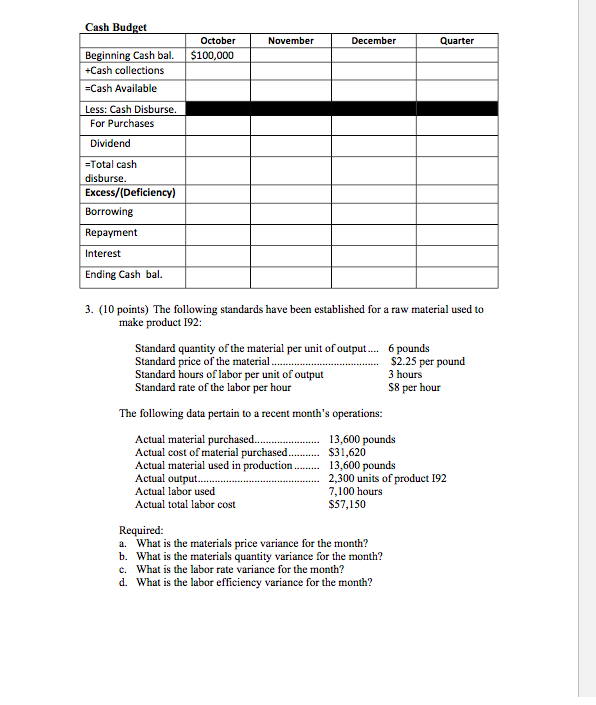

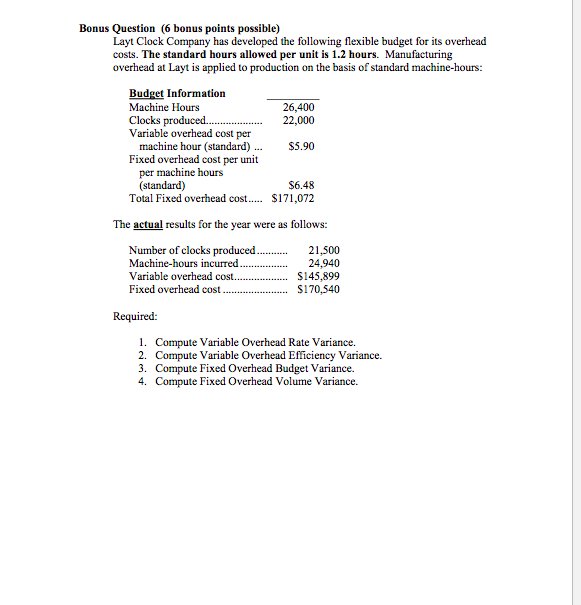

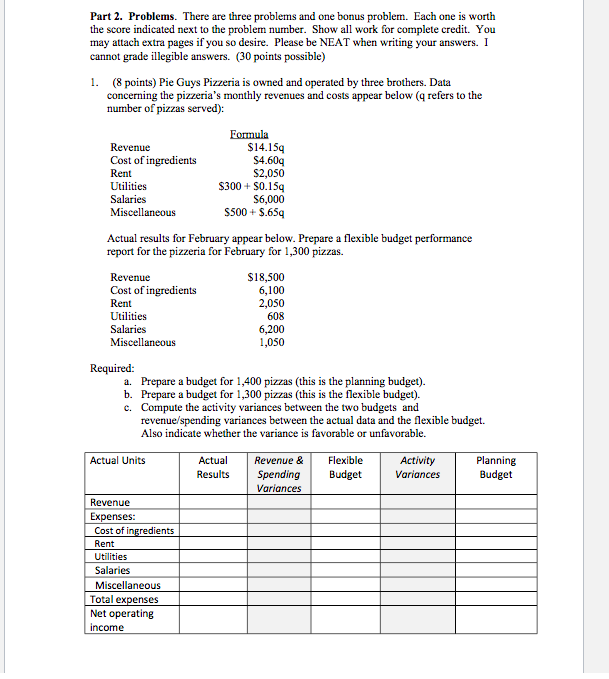

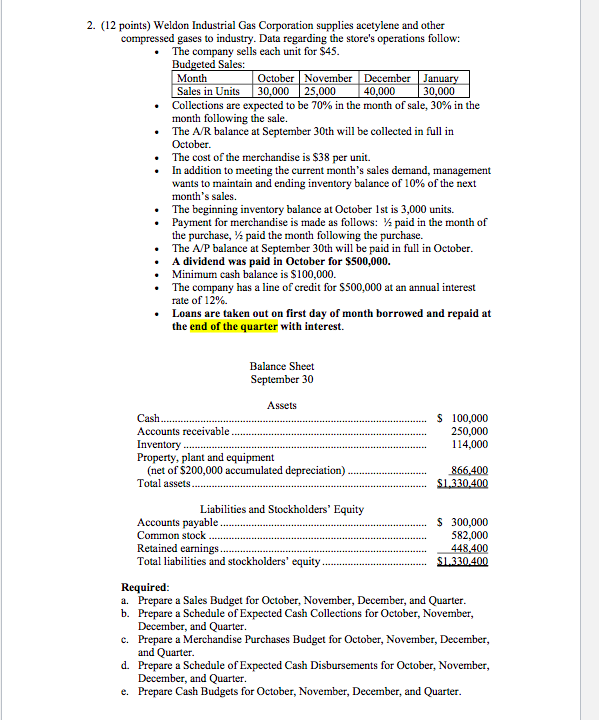

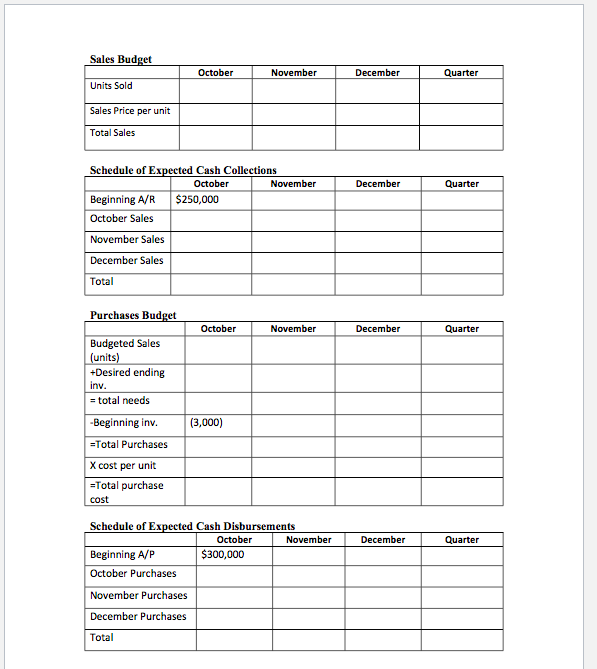

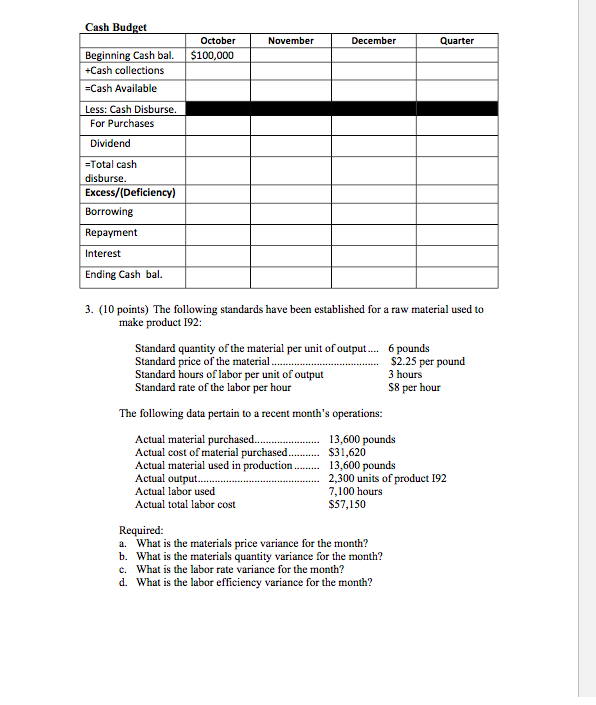

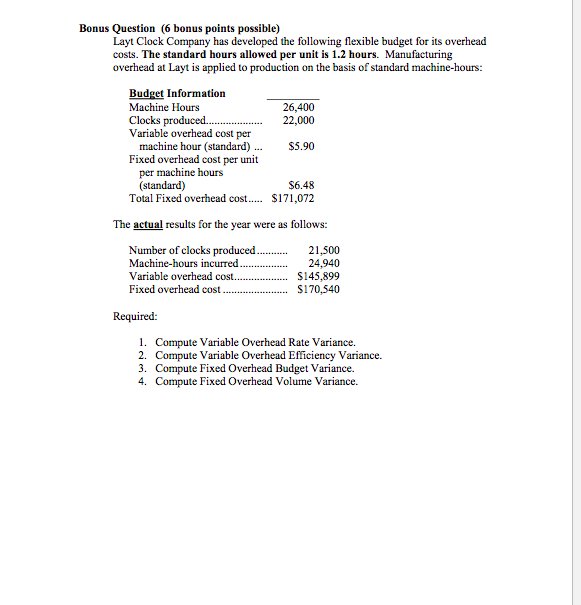

Part 2. Problems. There are three problems and one bonus problem. Each one is worth the score indicated next to the problem number. Show all work for complete credit. You may attach extra pages if you so desire. Please be NEAT when writing your answers. I cannot grade illegible answers. (30 points possible) 1. (8 points) Pie Guys Pizzeria is owned and operated by three brothers. Data concerning the pizzeria's monthly revenues and costs appear below (q refers to the number of pizzas served): Revenue Cost of ingredients Rent Utilities Salaries Miscellaneous Formula $14.159 S4.60 $2,050 $300 + S0.159 $6,000 S500+ $.654 Actual results for February appear below. Prepare a flexible budget performance report for the pizzeria for February for 1,300 pizzas. Revenue Cost of ingredients Rent Utilities Salaries Miscellaneous $18,500 6,100 2,050 608 6,200 1,050 Required: a. Prepare a budget for 1,400 pizzas (this is the planning budget). b. Prepare a budget for 1,300 pizzas (this is the flexible budget). c. Compute the activity variances between the two budgets and revenue/spending variances between the actual data and the flexible budget. Also indicate whether the variance is favorable or unfavorable. Actual Units Actual Results Revenue & Spending Variances Flexible Budget Activity Variances Planning Budget Revenue Expenses: Cost of ingredients Rent Utilities Salaries Miscellaneous Total expenses Net operating income 2. (12 points) Weldon Industrial Gas Corporation supplies acetylene and other compressed gases to industry. Data regarding the store's operations follow: The company sells each unit for S45. Budgeted Sales: Month October November December January Sales in Units 30,000 25,000 40,000 30.000 Collections are expected to be 70% in the month of sale, 30% in the month following the sale. The A/R balance at September 30th will be collected in full in October The cost of the merchandise is S38 per unit. In addition to meeting the current month's sales demand, management wants to maintain and ending inventory balance of 10% of the next month's sales. The beginning inventory balance at October 1st is 3,000 units. Payment for merchandise is made as follows: % paid in the month of the purchase, paid the month following the purchase. The A/P balance at September 30th will be paid in full in October A dividend was paid in October for $500,000. Minimum cash balance is $100,000. The company has a line of credit for $500,000 at an annual interest rate of 12%. Loans are taken out on first day of month borrowed and repaid at the end of the quarter with interest. Balance Sheet September 30 $ Assets Cash......... Accounts receivable ...... Inventory ............. Property, plant and equipment (net of $200,000 accumulated depreciation). Total assets........ 100,000 250,000 114,000 866,400 S1.330.400 .. Liabilities and Stockholders' Equity Accounts payable Common stock ........................................... Retained earnings.......... Total liabilities and stockholders' equity........ $ 300,000 582,000 448.400 S1.330.400 Required: a. Prepare a Sales Budget for October, November, December, and Quarter. b. Prepare a Schedule of Expected Cash Collections for October, November, December, and Quarter. c. Prepare a Merchandise Purchases Budget for October, November, December, and Quarter. d. Prepare a Schedule of Expected Cash Disbursements for October, November, December, and Quarter. e. Prepare Cash Budgets for October, November, December, and Quarter. Sales Budget October November December Quarter Units Sold Sales Price per unit Total Sales December Quarter Schedule of Expected Cash Collections October November Beginning A/R $250,000 October Sales November Sales December Sales Total Purchases Budget October November December Quarter Budgeted Sales (units) +Desired ending inv. total needs -Beginning inv. (3,000) 000) Total Purchases X cost per unit -Total purchase cost December Quarter Schedule of Expected Cash Disbursements October November Beginning A/P $300,000 October Purchases November Purchases December Purchases Total Cash Budget November December Quarter October $100,000 Beginning Cash bal. Cash collections Cash Available Less: Cash Disburse. For Purchases Dividend =Total cash disburse. Excess/(Deficiency) Borrowing Repayment Interest Ending Cash bal. 3. (10 points) The following standards have been established for a raw material used to make product 192: Standard quantity of the material per unit of output... 6 pounds Standard price of the material... $2.25 per pound Standard hours of labor per unit of output 3 hours Standard rate of the labor per hour S8 per hour The following data pertain to a recent month's operations: Actual material purchased....................... 13,600 pounds Actual cost of material purchased.......... $31,620 Actual material used in production........ 13,600 pounds Actual output. 2,300 units of product 192 Actual labor used 7,100 hours Actual total labor cost S57,150 Required: a. What is the materials price variance for the month? b. What is the materials quantity variance for the month? c. What is the labor rate variance for the month? d. What is the labor efficiency variance for the month? Bonus Question (6 bonus points possible) Layt Clock Company has developed the following flexible budget for its overhead costs. The standard hours allowed per unit is 1.2 hours. Manufacturing overhead at Layt is applied to production on the basis of standard machine-hours: Budget Information Machine Hours 26,400 Clocks produced... 22,000 Variable overhead cost per machine hour (standard) ... $5.90 Fixed overhead cost per unit per machine hours (standard) $6.48 Total Fixed overhead cost..... $171,072 The actual results for the year were as follows: Number of clocks produced........... Machine-hours incurred ............... Variable overhead cost............. Fixed overhead cost......... 21,500 24.940 $145,899 $170,540 Required: 1. Compute Variable Overhead Rate Variance. 2. Compute Variable Overhead Efficiency Variance. 3. Compute Fixed Overhead Budget Variance. 4. Compute Fixed Overhead Volume Variance