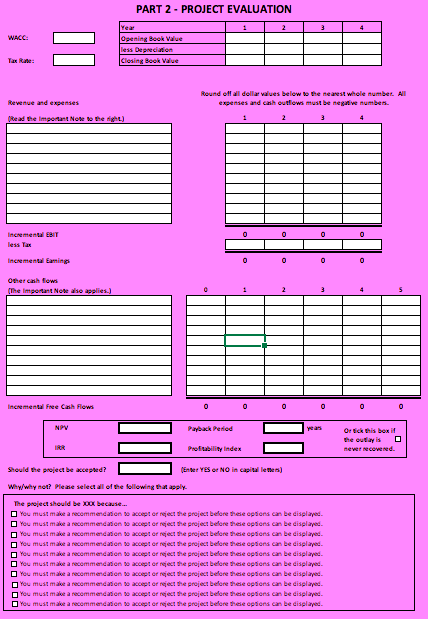

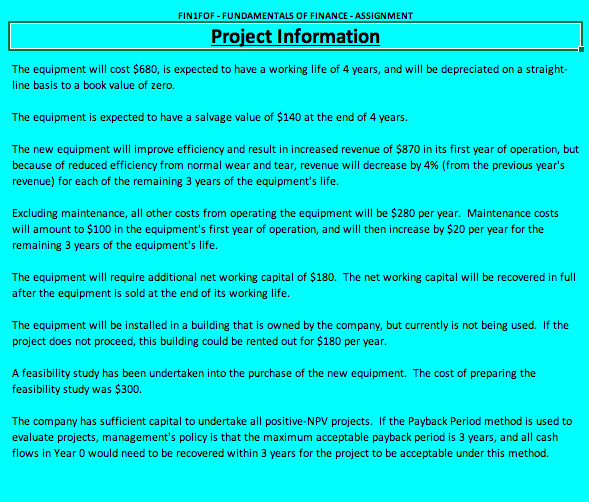

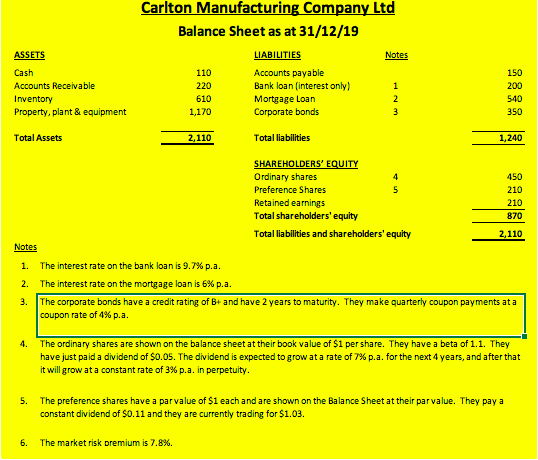

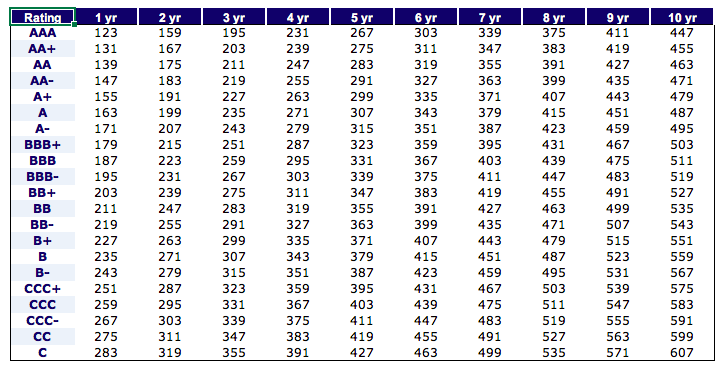

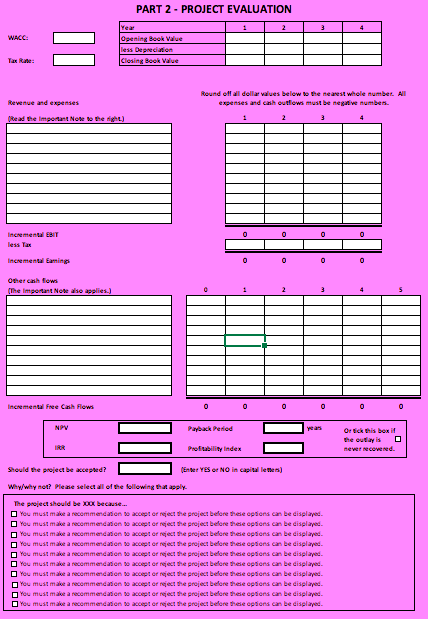

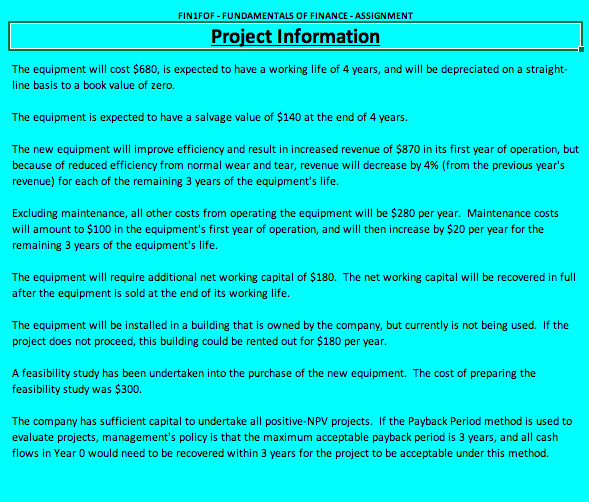

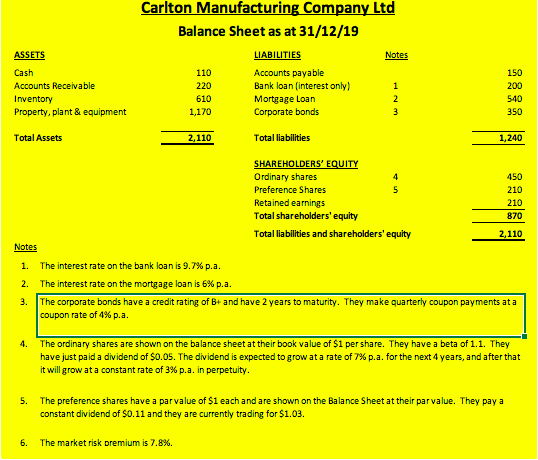

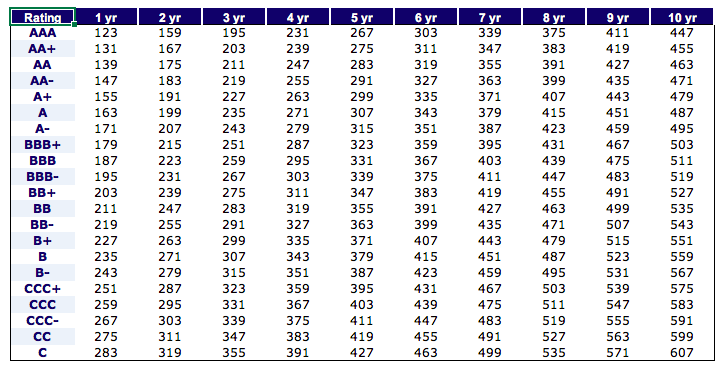

PART 2 - PROJECT EVALUATION 2 3 4 WASC = Year Opening Book Valve less Depreciation Cloring Book Value Tax Rate: Revenue and expenses Round off all dollar values below the nearest whole number. All upnds and can bewa musk megate numbn.. Read the important Not to me 0 Incremental EBIT less Tax Incremental Emine Othern Tews (The important Note also applies) Incremental Free Cash Flows 0 NPV Payback Period . Ottick this box it the outlayis never recovered Profitability index Should the project be accepted? (Enter YES or NO in capital letes) Why/Why not? Please select all of the following that apply. The project should be car because... You must make a recommendations accept or reject the project before these options can be displayed You must make a recommendation to accept or reject the project before these options can be displayed You must make a recommendations compt of reject the project before the options can be displayed You must make a recommendation to accept or reject the project before these options can be displayed You must make a recommendations accept or reject the project before these options can be displayed You must make a recommendations accept or reject the project before these options can be displayed You must make a recommendations compt of reject the project before the options can be displayed You must make a recommendations accept or reject the project before these options can be displayed You must make a recommendations accept or reject the project before the options can be displayed You must make a recommendations accept or reject the project before these options can be displayed FIN1FOF- FUNDAMENTALS OF FINANCE - ASSIGNMENT Project Information The equipment will cost $680, is expected to have a working life of 4 years, and will be depreciated on a straight- line basis to a book value of zero. The equipment is expected to have a salvage value of $140 at the end of 4 years. The new equipment will improve efficiency and result in increased revenue of $870 in its first year of operation, but because of reduced efficiency from normal wear and tear, revenue will decrease by 4% (from the previous year's revenue) for each of the remaining 3 years of the equipment's life. Excluding maintenance, all other costs from operating the equipment will be $280 per year. Maintenance costs will amount to $100 in the equipment's first year of operation, and will then increase by $20 per year for the remaining 3 years of the equipment's life. The equipment will require additional net working capital of $180. The net working capital will be recovered in full after the equipment is sold at the end of its working life. The equipment will be installed in a building that is owned by the company, but currently is not being used. If the project does not proceed, this building could be rented out for $180 per year. A feasibility study has been undertaken into the purchase of the new equipment. The cost of preparing the feasibility study was $300. The company has sufficient capital to undertake all positive-NPV projects. If the Payback Period method is used to evaluate projects, management's policy is that the ximum acceptable payback period is 3 years, and all cash flows in Year O would need to be recovered within 3 years for the project to be acceptable under this method. Carlton Manufacturing Company Ltd Balance Sheet as at 31/12/19 ASSETS Notes 110 Cash Accounts Receivable Inventory Property, plant & equipment 220 610 1,170 LIABILITIES Accounts payable Bank loan (interest only) Mortgage Loan Corporate bonds 1 2 3 150 200 540 350 Total Assets 2,110 Total liabilities 1,240 5 SHAREHOLDERS' EQUITY Ordinary shares 4 Preference Shares Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 450 210 210 870 2,110 Notes 1. 2. The interest rate on the bank loan is 9.7% p.a. The interest rate on the mortgage loan is 6% p.a. The corporate bonds have a credit rating of B+ and have 2 years to maturity. They make quarterly coupon payments at a coupon rate of 4% p.a. 3. 4. The ordinary shares are shown on the balance sheet at their book value of $1 per share. They have a beta of 1.1. They have just paid a dividend of $0.05. The dividend is expected to grow at a rate of 7% p.a. for the next 4 years, and after that it will grow at a constant rate of 3% p.a. in perpetuity. 5. The preference shares have a par value of $1 each and are shown on the Balance Sheet at their par value. They pay a constant dividend of $0.11 and they are currently trading for $1.03. 6. The market risk premium is 7.8%. 1 yr 4 7 yr 10 Rating AAA AA+ AA- A+ - BBB+ BBB- BB+ 123 131 139 147 155 163 171 179 187 195 203 211 219 227 235 243 251 259 267 275 283 2 yr 159 167 175 183 191 199 207 215 223 231 239 247 255 263 271 279 287 295 303 311 319 195 203 211 219 227 235 243 251 259 267 275 283 291 299 307 315 323 331 339 347 355 231 239 247 255 263 271 279 287 295 303 311 319 327 335 343 351 359 367 375 383 391 5 yr 267 275 283 291 299 307 315 323 331 339 347 355 363 371 379 387 395 403 411 419 427 6 yr 303 311 319 327 335 343 351 359 367 375 383 391 399 407 415 423 431 439 447 455 463 8 yr 9 yr 339 375 411 347 383 419 355 391 427 363 399 435 371 407 443 379 415 451 387 423 459 395 431 467 403 439 475 411 447 483 419 455 491 427 463 499 435 471 507 443 479 515 451 487 523 459 495 531 467 503 539 475 511 547 483 519 555 491 527 563 499 535 571 447 455 463 471 479 487 495 503 511 519 527 535 543 551 559 567 575 583 591 599 607 BB- + B - CCC+ -