Part 2 question 1 was done. Can someone please do 2-7 information from 1-4 is provided and last picture is the adjusted journal entries. If all questions can't be answered then please do Question 4 but if possible do 2-7 thank you. Multiple likes if done!

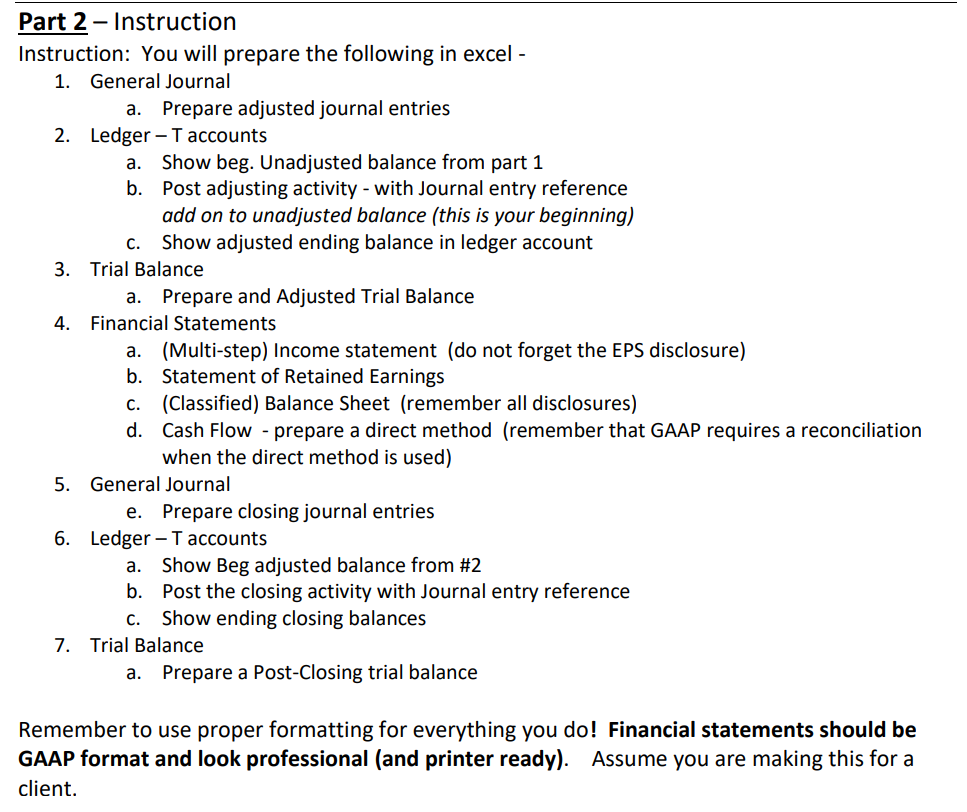

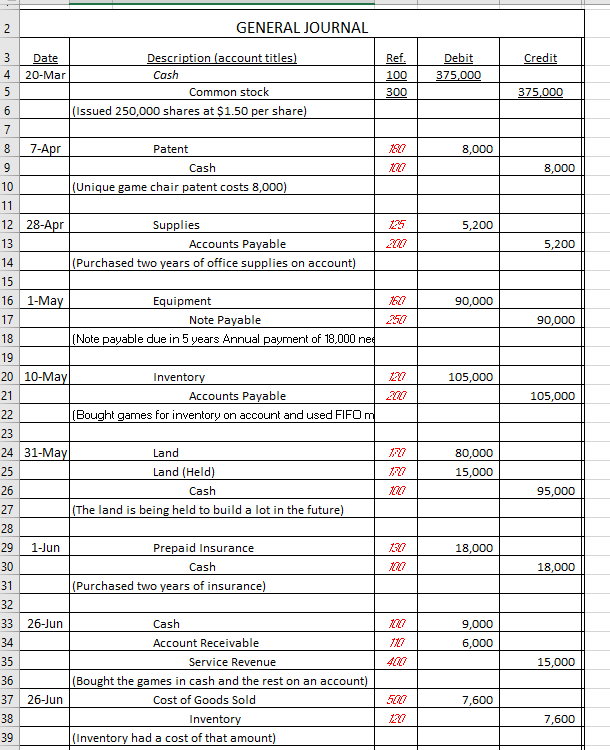

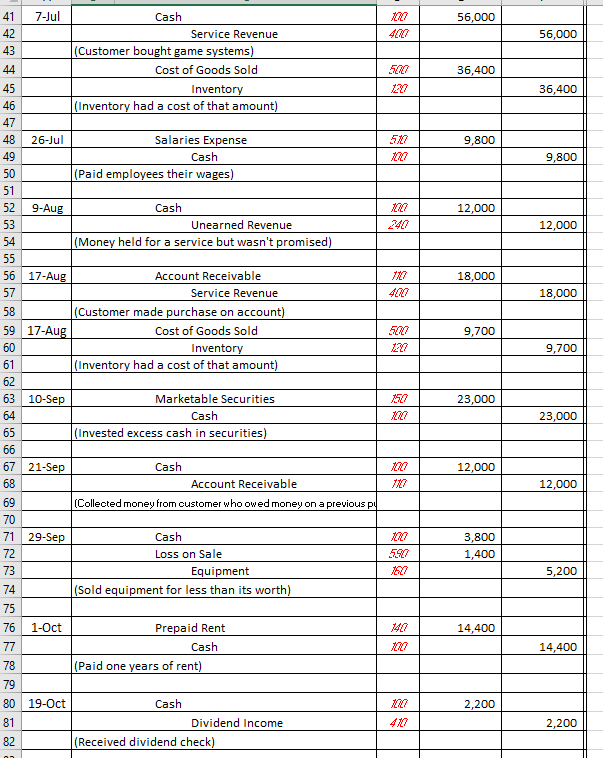

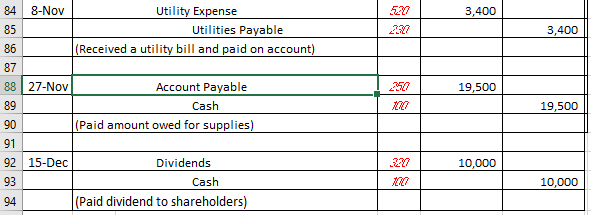

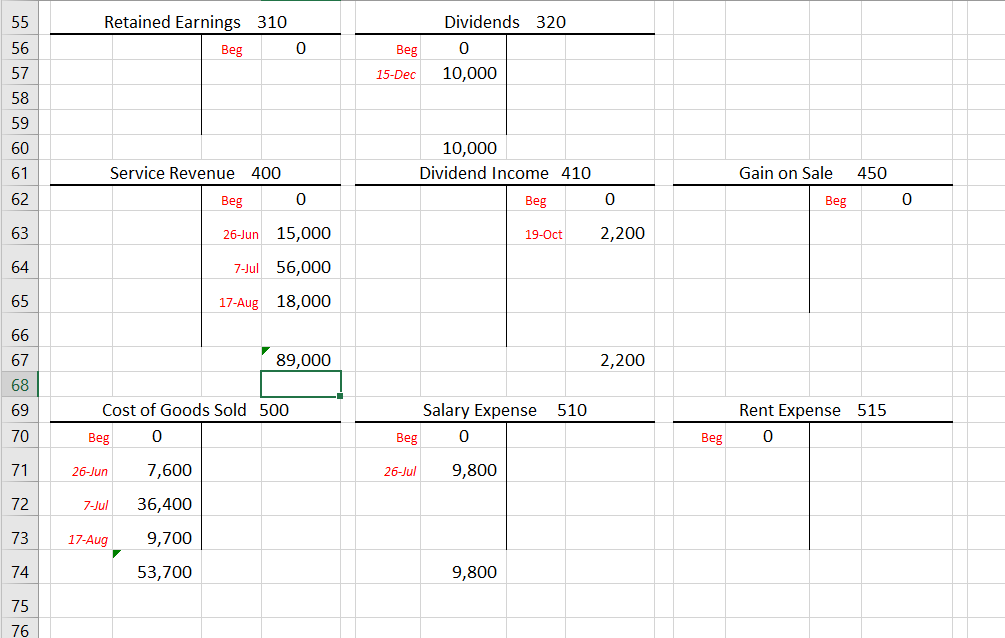

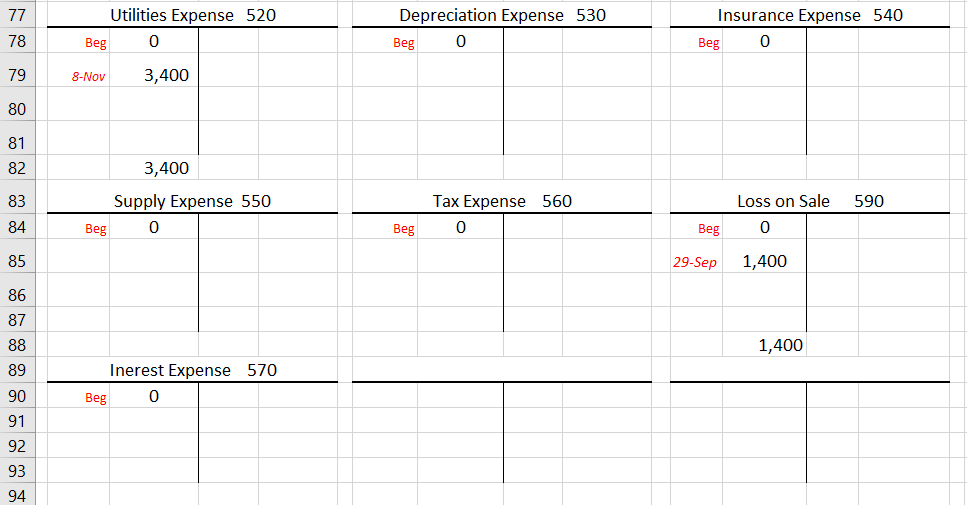

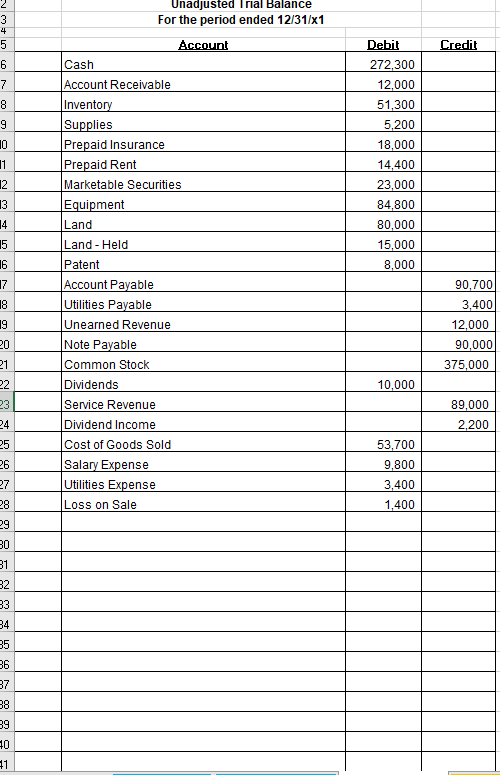

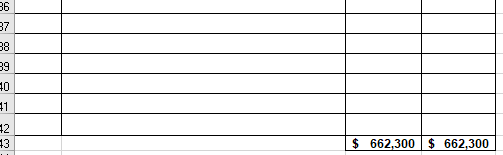

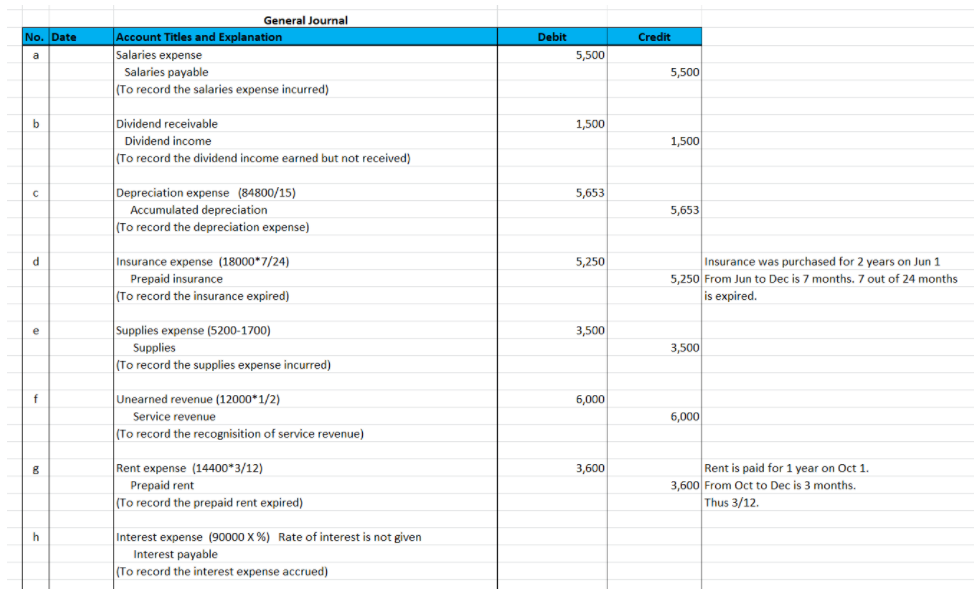

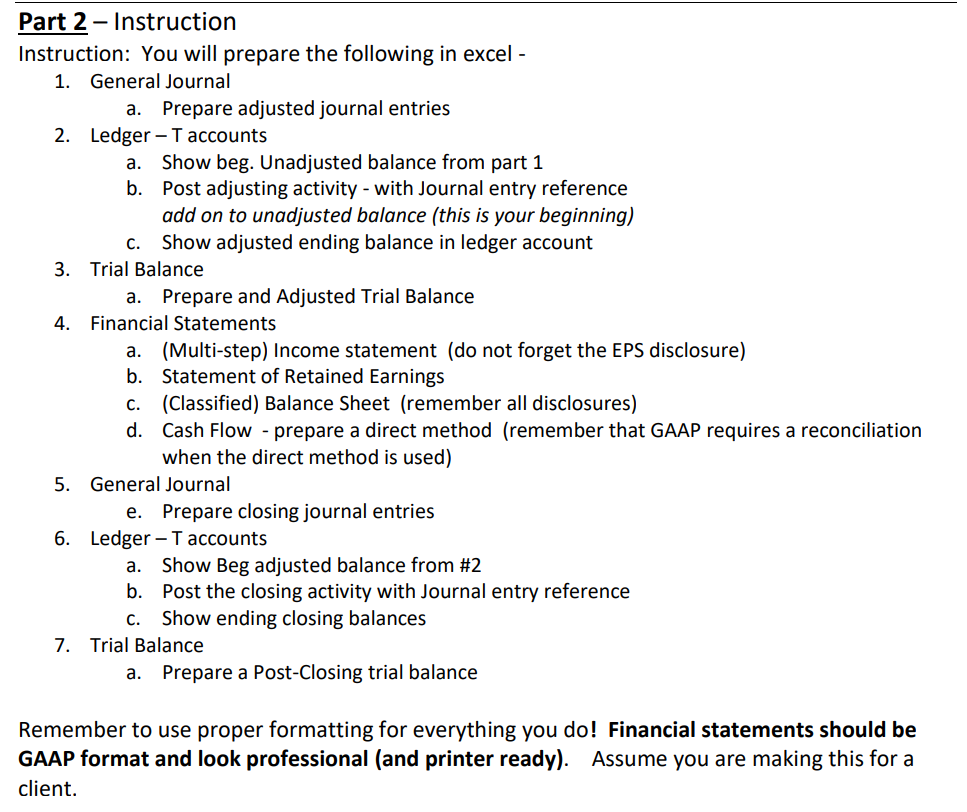

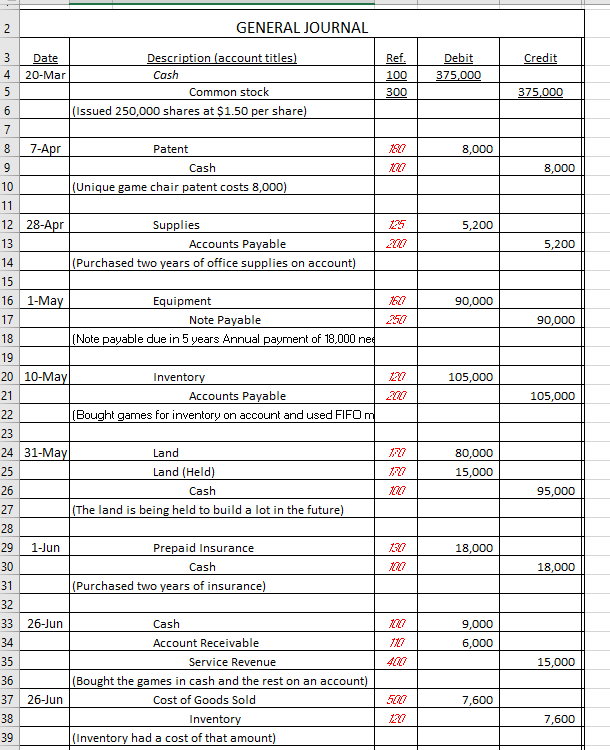

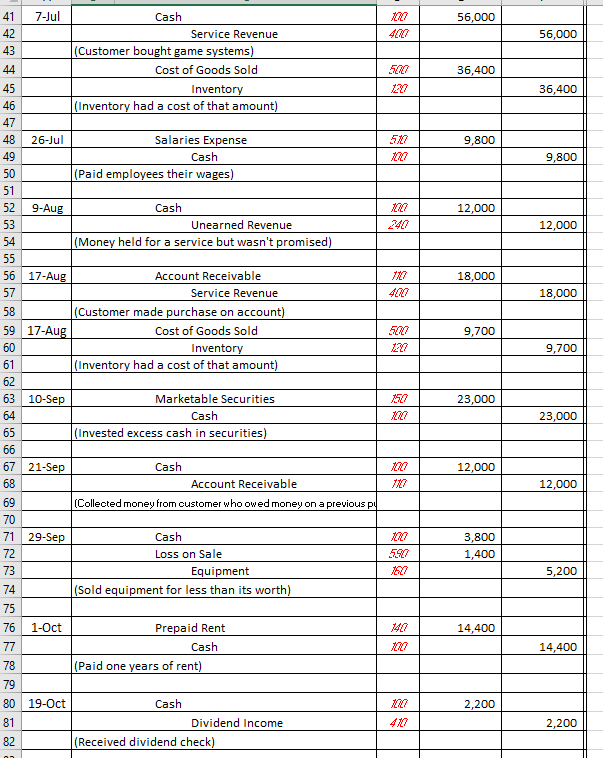

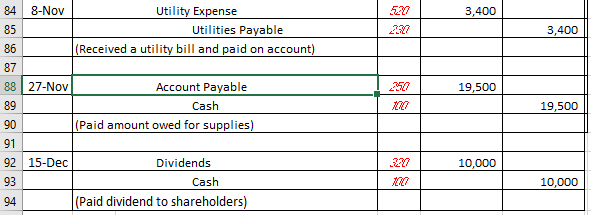

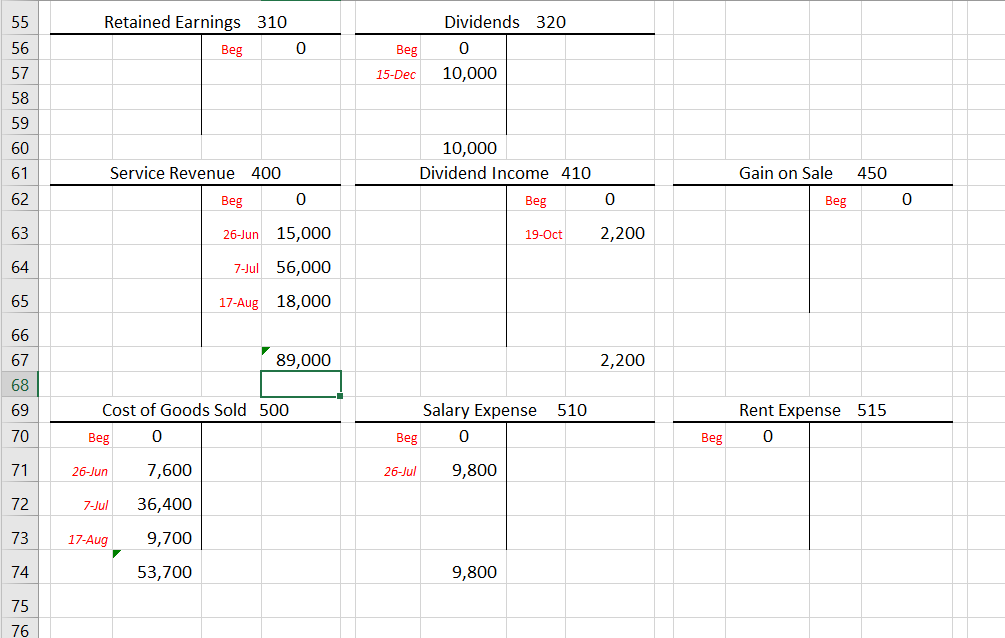

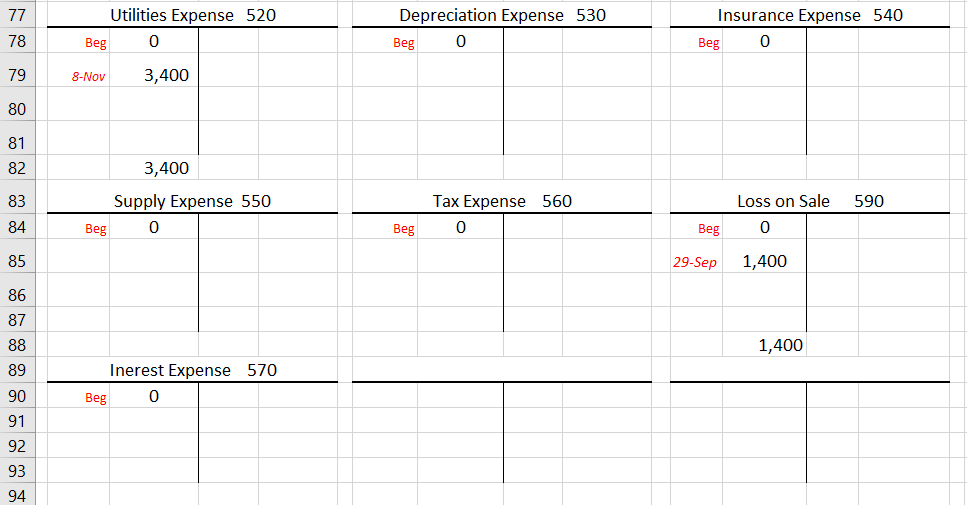

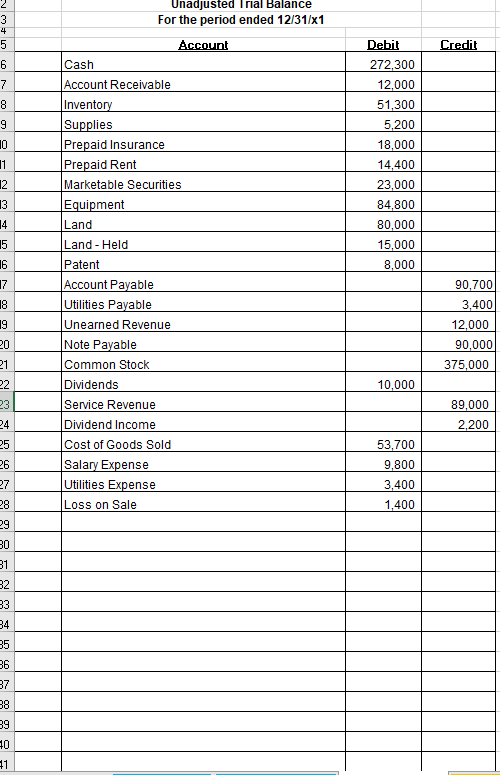

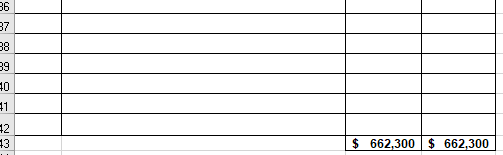

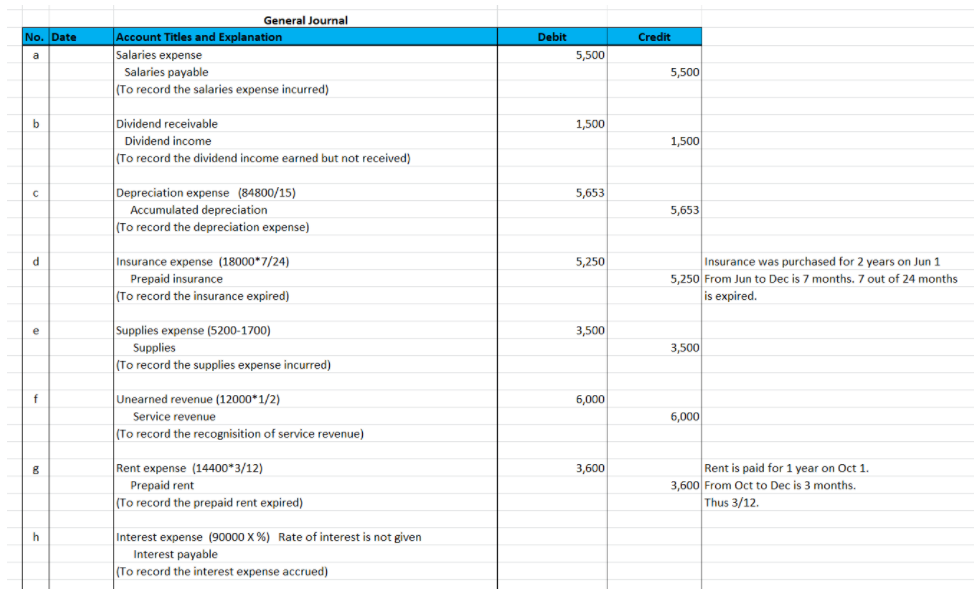

a. Part 2 - Instruction Instruction: You will prepare the following in excel - 1. General Journal Prepare adjusted journal entries 2. Ledger - Taccounts a. Show beg. Unadjusted balance from part 1 b. Post adjusting activity - with Journal entry reference add on to unadjusted balance (this is your beginning) C. Show adjusted ending balance in ledger account 3. Trial Balance a. Prepare and Adjusted Trial Balance 4. Financial Statements (Multi-step) Income statement (do not forget the EPS disclosure) b. Statement of Retained Earnings C. (Classified) Balance Sheet (remember all disclosures) d. Cash Flow - prepare a direct method (remember that GAAP requires a reconciliation when the direct method is used) 5. General Journal e. Prepare closing journal entries 6. Ledger - Taccounts Show Beg adjusted balance from #2 b. Post the closing activity with Journal entry reference Show ending closing balances 7. Trial Balance Prepare a Post-Closing trial balance a. a. C. a. Remember to use proper formatting for everything you do! Financial statements should be GAAP format and look professional (and printer ready). Assume you are making this for a client. 2 GENERAL JOURNAL Credit Ref. 100 300 Debit 375,000 vouw 375,000 8,000 27 8,000 5,200 2007 5,200 1927 90,000 90,000 227 105,000 Date Description (account titles) 4 20-Mar Cash 5 Common stock (Issued 250,000 shares at $1.50 per share) 7 8 7-Apr Patent Cash 10 (Unique game chair patent costs 8,000) 11 12 28-Apr Supplies 13 Accounts Payable 14 (Purchased two years of office supplies on account) 15 16 1-May Equipment 17 Note Payable 18 (Note payable due in 5 years Annual payment of 18,000 ne 19 20 10-Mayl Inventory 21 Accounts Payable 22 (Bought games for inventory on account and used FIFO m 23 24 31-Mayl Land 25 Land (Held) 26 Cash 27 (The land is being held to build a lot in the future) 28 29 1-Jun Prepaid Insurance 30 Cash 31 (Purchased two years of insurance) 32 33 26-Jun Cash 34 Account Receivable 35 Service Revenue 36 (Bought the games in cash and the rest on an account) 37 26-Jun Cost of Goods Sold 38 Inventory 39 (Inventory had a cost of that amount) 2727 105,000 80,000 15,000 27 27 95,000 27 18,000 27 18,000 27 9,000 6,000 447 15,000 5227 7,600 7,600 56,000 TO 4427 56,000 5227 36,400 36,400 9,800 5X7 X7 9,800 12,000 27 240 12,000 18,000 4427 18,000 9,700 22 9,700 41 7-Jul Cash 42 Service Revenue 43 (Customer bought game systems) 44 Cost of Goods Sold 45 Inventory 46 (Inventory had a cost of that amount) 47 48 26-Jul Salaries Expense 49 Cash 50 (Paid employees their wages) 51 52 9-Aug Cash 53 Unearned Revenue 54 (Money held for a service but wasn't promised) 55 56 17-Aug Account Receivable 57 Service Revenue 58 (Customer made purchase on account) 59 17-Aug Cost of Goods Sold 60 Inventory 61 (Inventory had a cost of that amount) 62 63 10-Sep Marketable Securities 64 Cash 65 (Invested excess cash in securities) 66 67 21-Sep Cash 68 Account Receivable 69 (Collected money from customer who owed money on a previous p! 70 71 29-Sep Cash 72 Loss on Sale 73 Equipment 74 (Sold equipment for less than its worth) 75 76 1-Oct Prepaid Rent 77 Cash 78 (Paid one years of rent) 79 80 19-Oct Cash 81 Dividend Income 82 (Received dividend check) 23,000 27 23,000 R? 12,000 12,000 X27 5927 JAZ? 3,800 1,400 5,200 140 14,400 27 14,400 27 2,200 2,200 5227 3,400 227 3,400 19,500 84 8-Nov Utility Expense 85 Utilities Payable 86 (Received a utility bill and paid on account) 87 88 27-Nov Account Payable 89 Cash 90 (Paid amount owed for supplies) 91 92 15-Dec Dividends 93 Cash 94 (Paid dividend to shareholders) 277 27 19,500 227 10,000 27 10,000 1 2 120 Nm Cash 100 0 7-Apr Account Receivable 110 Beg 0 Inventory 0 3 Beg 8,000 Beg 4 20-Mar 375,000 31-May 95,000 26-Jun 6,000 21-Sep 12,000 10-May 105,000 26-Jun 7,600 5 26-Jun 17-Aug 18,000 7-Jul 36,400 6 7-Jul 17-Aug 9,700 7 51,300 8 9 8 9 9-Aug 21-Sep 29-Sep 9,000 1-Jun 18,000 56,000 26-Jul 9,800 12,000 10-Sep 23,000 12,000 1-Oct 14,400 3,800 27-Nov 19,500 2,200 15-Dec 10,000 272,300 12,000 10 19-Oct 11 12 13 14 125 140 Supplies 0 Prepaid Insurance 130 0 Prepaid Rent 0 15 Beg Beg Beg 16 28-Apr 5,200 1-Jun 18,000 1-Oct 14,400 17 18 19 20 21 5,200 Marketable Securities Beg 0 18,000 Equipment 0 14,400 Accum. Dep 150 160 165 Beg Beg 0 22 10-Sep 23,000 1-May 90,000 29-Sep 5,200 23 24 25 23,000 84,800 170 Patent 180 27 28 29 Land o 80,000 Beg Beg 31-May Land - Held 0 15,000 0 Beg 7-Apr 31-May 8,000 30 80,000 15,000 8,000 Salary Payable 220 Interest Receivable 190 Beg 0 Beg 0 Account Payable 200 Beg 0 27-Nov 19,500 28-Apr 5,200 10-May 105,000 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 90,700 Utilities Payable 230 Beg 0 8-Nov 3,400 Unearned Revenue 240 Beg 0 9-Aug 12,000 Note Payable 250 0 1-May 90,000 Beg 3,400 Tax Payable 260 Beg 12,000 Interest Payable 270 Beg 0 90,000 Common Stock 300 Beg 0 20-Mar 375,000 50 0 51 52 53 54 375,000 55 56 57 Retained Earnings 310 Beg 0 Beg Dividends 320 0 10,000 15-Dec 58 59 60 10,000 Dividend Income 410 61 Service Revenue 400 450 Gain on Sale Beg 62 Beg 0 Beg 0 0 63 26-Jun 15,000 19-Oct 2,200 64 7-Jul 56,000 65 17-Aug 18,000 66 67 89,000 2,200 68 69 Cost of Goods Sold 500 510 Rent Expense 515 Salary Expense Beg 0 hen 70 Beg 0 Beg 0 71 26-Jun 7,600 26-Jul 9,800 72 7-Jul 36,400 73 17-Aug 9,700 74 53,700 9,800 75 76 77 78 Utilities Expense 520 Beg 0 Depreciation Expense 530 Beg 0 Insurance Expense 540 Beg 0 79 8-Nov 3,400 80 81 82 83 3,400 Supply Expense 550 Beg 0 Tax Expense 560 590 Loss on Sale 0 84 Beg 0 Beg 85 29-Sep 1,400 86 87 88 1,400 89 Inerest Expense 570 Beg 0 90 91 92 93 94 3 4 5 Credit 6 7 8 9 10 11 12 Unadjusted Trial Balance For the period ended 12/31/x1 Account Cash Account Receivable Inventory Supplies Prepaid Insurance Prepaid Rent Marketable Securities Equipment Land Land - Held Patent Account Payable Utilities Payable Unearned Revenue Note Payable Common Stock Dividends Service Revenue Dividend Income Cost of Goods Sold Salary Expense Utilities Expense Loss on Sale Debit 272,300 12.000 51,300 5,200 18,000 14,400 23,000 84,800 80,000 15,000 8,000 14 15 16 17 18 9 90,700 3,400 12,000 90,000 375,000 20 22 10,000 23 89,000 2200 24 53.700 9,800 3,400 1,400 25 26 27 28 29 B0 31 82 5 N Y N 99 8 NN 9 9 5 33 34 35 36 37 39 41 37 88 39 10 11 12 EE $ 662,300 $ 662,300 No. Date Debit Credit a General Journal Account Titles and Explanation Salaries expense Salaries payable () (To record the salaries expense incurred) 5,500 5,500 b 1,500 Dividend receivable Dividend income (To record the dividend income earned but not received) 1,500 5,653 Depreciation expense (84800/15) Accumulated depreciation (To record the depreciation expense) 5,653 d 5,250 Insurance expense (18000*7/24) Prepaid insurance (To record the insurance expired) Insurance was purchased for 2 years on Jun 1 5,250 From Jun to Dec is 7 months. 7 out of 24 months is expired. e 3,500 Supplies expense (5200-1700) Supplies (To record the supplies expense incurred) 3,500 f 6,000 Unearned revenue (12000*1/2) Service revenue (To record the recognisition of service revenue) 6,000 8 3,600 Rent expense (14400*3/12) Prepaid rent (To record the prepaid rent expired) Rent is paid for 1 year on Oct 1. 3,600 From Oct to Dec is 3 months. Thus 3/12. h Interest expense (90000 X %) Rate of interest is not given Interest payable (To record the interest expense accrued) a. Part 2 - Instruction Instruction: You will prepare the following in excel - 1. General Journal Prepare adjusted journal entries 2. Ledger - Taccounts a. Show beg. Unadjusted balance from part 1 b. Post adjusting activity - with Journal entry reference add on to unadjusted balance (this is your beginning) C. Show adjusted ending balance in ledger account 3. Trial Balance a. Prepare and Adjusted Trial Balance 4. Financial Statements (Multi-step) Income statement (do not forget the EPS disclosure) b. Statement of Retained Earnings C. (Classified) Balance Sheet (remember all disclosures) d. Cash Flow - prepare a direct method (remember that GAAP requires a reconciliation when the direct method is used) 5. General Journal e. Prepare closing journal entries 6. Ledger - Taccounts Show Beg adjusted balance from #2 b. Post the closing activity with Journal entry reference Show ending closing balances 7. Trial Balance Prepare a Post-Closing trial balance a. a. C. a. Remember to use proper formatting for everything you do! Financial statements should be GAAP format and look professional (and printer ready). Assume you are making this for a client. 2 GENERAL JOURNAL Credit Ref. 100 300 Debit 375,000 vouw 375,000 8,000 27 8,000 5,200 2007 5,200 1927 90,000 90,000 227 105,000 Date Description (account titles) 4 20-Mar Cash 5 Common stock (Issued 250,000 shares at $1.50 per share) 7 8 7-Apr Patent Cash 10 (Unique game chair patent costs 8,000) 11 12 28-Apr Supplies 13 Accounts Payable 14 (Purchased two years of office supplies on account) 15 16 1-May Equipment 17 Note Payable 18 (Note payable due in 5 years Annual payment of 18,000 ne 19 20 10-Mayl Inventory 21 Accounts Payable 22 (Bought games for inventory on account and used FIFO m 23 24 31-Mayl Land 25 Land (Held) 26 Cash 27 (The land is being held to build a lot in the future) 28 29 1-Jun Prepaid Insurance 30 Cash 31 (Purchased two years of insurance) 32 33 26-Jun Cash 34 Account Receivable 35 Service Revenue 36 (Bought the games in cash and the rest on an account) 37 26-Jun Cost of Goods Sold 38 Inventory 39 (Inventory had a cost of that amount) 2727 105,000 80,000 15,000 27 27 95,000 27 18,000 27 18,000 27 9,000 6,000 447 15,000 5227 7,600 7,600 56,000 TO 4427 56,000 5227 36,400 36,400 9,800 5X7 X7 9,800 12,000 27 240 12,000 18,000 4427 18,000 9,700 22 9,700 41 7-Jul Cash 42 Service Revenue 43 (Customer bought game systems) 44 Cost of Goods Sold 45 Inventory 46 (Inventory had a cost of that amount) 47 48 26-Jul Salaries Expense 49 Cash 50 (Paid employees their wages) 51 52 9-Aug Cash 53 Unearned Revenue 54 (Money held for a service but wasn't promised) 55 56 17-Aug Account Receivable 57 Service Revenue 58 (Customer made purchase on account) 59 17-Aug Cost of Goods Sold 60 Inventory 61 (Inventory had a cost of that amount) 62 63 10-Sep Marketable Securities 64 Cash 65 (Invested excess cash in securities) 66 67 21-Sep Cash 68 Account Receivable 69 (Collected money from customer who owed money on a previous p! 70 71 29-Sep Cash 72 Loss on Sale 73 Equipment 74 (Sold equipment for less than its worth) 75 76 1-Oct Prepaid Rent 77 Cash 78 (Paid one years of rent) 79 80 19-Oct Cash 81 Dividend Income 82 (Received dividend check) 23,000 27 23,000 R? 12,000 12,000 X27 5927 JAZ? 3,800 1,400 5,200 140 14,400 27 14,400 27 2,200 2,200 5227 3,400 227 3,400 19,500 84 8-Nov Utility Expense 85 Utilities Payable 86 (Received a utility bill and paid on account) 87 88 27-Nov Account Payable 89 Cash 90 (Paid amount owed for supplies) 91 92 15-Dec Dividends 93 Cash 94 (Paid dividend to shareholders) 277 27 19,500 227 10,000 27 10,000 1 2 120 Nm Cash 100 0 7-Apr Account Receivable 110 Beg 0 Inventory 0 3 Beg 8,000 Beg 4 20-Mar 375,000 31-May 95,000 26-Jun 6,000 21-Sep 12,000 10-May 105,000 26-Jun 7,600 5 26-Jun 17-Aug 18,000 7-Jul 36,400 6 7-Jul 17-Aug 9,700 7 51,300 8 9 8 9 9-Aug 21-Sep 29-Sep 9,000 1-Jun 18,000 56,000 26-Jul 9,800 12,000 10-Sep 23,000 12,000 1-Oct 14,400 3,800 27-Nov 19,500 2,200 15-Dec 10,000 272,300 12,000 10 19-Oct 11 12 13 14 125 140 Supplies 0 Prepaid Insurance 130 0 Prepaid Rent 0 15 Beg Beg Beg 16 28-Apr 5,200 1-Jun 18,000 1-Oct 14,400 17 18 19 20 21 5,200 Marketable Securities Beg 0 18,000 Equipment 0 14,400 Accum. Dep 150 160 165 Beg Beg 0 22 10-Sep 23,000 1-May 90,000 29-Sep 5,200 23 24 25 23,000 84,800 170 Patent 180 27 28 29 Land o 80,000 Beg Beg 31-May Land - Held 0 15,000 0 Beg 7-Apr 31-May 8,000 30 80,000 15,000 8,000 Salary Payable 220 Interest Receivable 190 Beg 0 Beg 0 Account Payable 200 Beg 0 27-Nov 19,500 28-Apr 5,200 10-May 105,000 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 90,700 Utilities Payable 230 Beg 0 8-Nov 3,400 Unearned Revenue 240 Beg 0 9-Aug 12,000 Note Payable 250 0 1-May 90,000 Beg 3,400 Tax Payable 260 Beg 12,000 Interest Payable 270 Beg 0 90,000 Common Stock 300 Beg 0 20-Mar 375,000 50 0 51 52 53 54 375,000 55 56 57 Retained Earnings 310 Beg 0 Beg Dividends 320 0 10,000 15-Dec 58 59 60 10,000 Dividend Income 410 61 Service Revenue 400 450 Gain on Sale Beg 62 Beg 0 Beg 0 0 63 26-Jun 15,000 19-Oct 2,200 64 7-Jul 56,000 65 17-Aug 18,000 66 67 89,000 2,200 68 69 Cost of Goods Sold 500 510 Rent Expense 515 Salary Expense Beg 0 hen 70 Beg 0 Beg 0 71 26-Jun 7,600 26-Jul 9,800 72 7-Jul 36,400 73 17-Aug 9,700 74 53,700 9,800 75 76 77 78 Utilities Expense 520 Beg 0 Depreciation Expense 530 Beg 0 Insurance Expense 540 Beg 0 79 8-Nov 3,400 80 81 82 83 3,400 Supply Expense 550 Beg 0 Tax Expense 560 590 Loss on Sale 0 84 Beg 0 Beg 85 29-Sep 1,400 86 87 88 1,400 89 Inerest Expense 570 Beg 0 90 91 92 93 94 3 4 5 Credit 6 7 8 9 10 11 12 Unadjusted Trial Balance For the period ended 12/31/x1 Account Cash Account Receivable Inventory Supplies Prepaid Insurance Prepaid Rent Marketable Securities Equipment Land Land - Held Patent Account Payable Utilities Payable Unearned Revenue Note Payable Common Stock Dividends Service Revenue Dividend Income Cost of Goods Sold Salary Expense Utilities Expense Loss on Sale Debit 272,300 12.000 51,300 5,200 18,000 14,400 23,000 84,800 80,000 15,000 8,000 14 15 16 17 18 9 90,700 3,400 12,000 90,000 375,000 20 22 10,000 23 89,000 2200 24 53.700 9,800 3,400 1,400 25 26 27 28 29 B0 31 82 5 N Y N 99 8 NN 9 9 5 33 34 35 36 37 39 41 37 88 39 10 11 12 EE $ 662,300 $ 662,300 No. Date Debit Credit a General Journal Account Titles and Explanation Salaries expense Salaries payable () (To record the salaries expense incurred) 5,500 5,500 b 1,500 Dividend receivable Dividend income (To record the dividend income earned but not received) 1,500 5,653 Depreciation expense (84800/15) Accumulated depreciation (To record the depreciation expense) 5,653 d 5,250 Insurance expense (18000*7/24) Prepaid insurance (To record the insurance expired) Insurance was purchased for 2 years on Jun 1 5,250 From Jun to Dec is 7 months. 7 out of 24 months is expired. e 3,500 Supplies expense (5200-1700) Supplies (To record the supplies expense incurred) 3,500 f 6,000 Unearned revenue (12000*1/2) Service revenue (To record the recognisition of service revenue) 6,000 8 3,600 Rent expense (14400*3/12) Prepaid rent (To record the prepaid rent expired) Rent is paid for 1 year on Oct 1. 3,600 From Oct to Dec is 3 months. Thus 3/12. h Interest expense (90000 X %) Rate of interest is not given Interest payable (To record the interest expense accrued)