Answered step by step

Verified Expert Solution

Question

1 Approved Answer

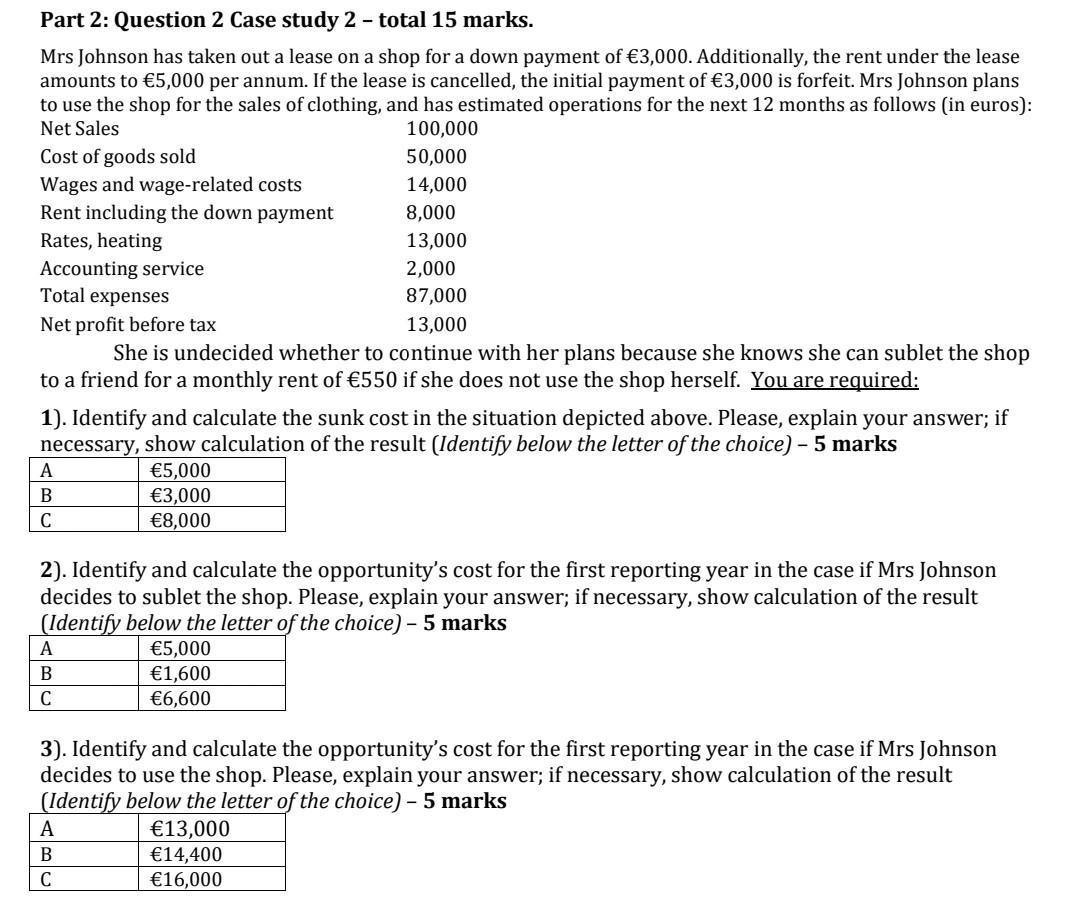

Part 2: Question 2 Case study 2 - total 15 marks. Mrs Johnson has taken out a lease on a shop for a down payment

Part 2: Question 2 Case study 2 - total 15 marks. Mrs Johnson has taken out a lease on a shop for a down payment of 3,000. Additionally, the rent under the lease amounts to 5,000 per annum. If the lease is cancelled, the initial payment of 3,000 is forfeit. Mrs Johnson plans to use the shop for the sales of clothing, and has estimated operations for the next 12 months as follows (in euros): Net Sales 100,000 Cost of goods sold 50,000 Wages and wage-related costs 14,000 Rent including the down payment 8,000 Rates, heating 13,000 Accounting service 2,000 Total expenses 87,000 Net profit before tax 13,000 She is undecided whether to continue with her plans because she knows she can sublet the shop to a friend for a monthly rent of 550 if she does not use the shop herself. You are required: 1). Identify and calculate the sunk cost in the situation depicted above. Please, explain your answer; if necessary, show calculation of the result (Identify below the letter of the choice) - 5 marks 5,000 3,000 C 8,000 A B 2). Identify and calculate the opportunity's cost for the first reporting year in the case if Mrs Johnson decides to sublet the shop. Please, explain your answer; if necessary, show calculation of the result (Identify below the letter of the choice) - 5 marks 5,000 1,600 6,600 A B 3). Identify and calculate the opportunity's cost for the first reporting year in the case if Mrs Johnson decides to use the shop. Please, explain your answer; if necessary, show calculation of the result (Identify below the letter of the choice) - 5 marks A 13,000 B 14,400 16,000 C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started