Answered step by step

Verified Expert Solution

Question

1 Approved Answer

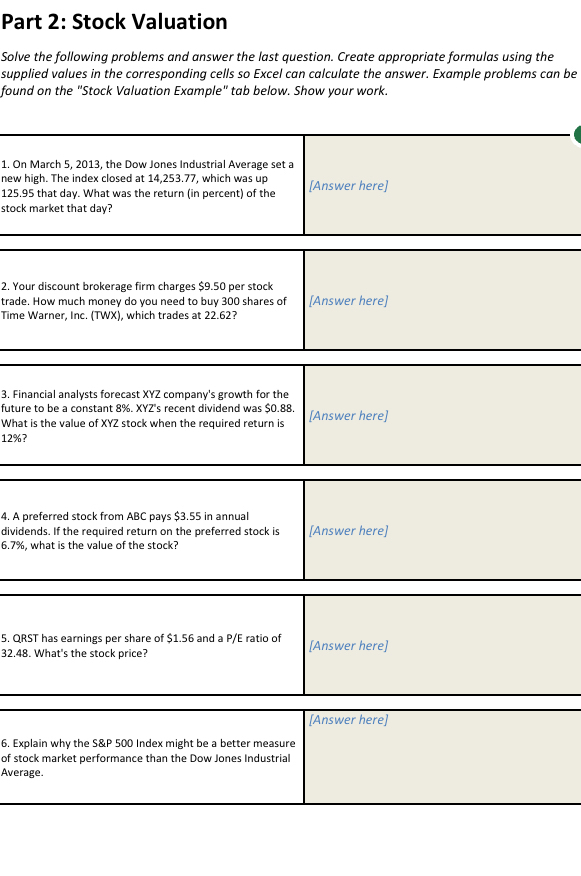

Part 2 : Stock Valuation Solve using Information provided in questions and plug into excel formulas and explain work please! Thank you! Solve the following

Part : Stock Valuation

Solve using Information provided in questions and plug into excel formulas and explain work please! Thank you!

Solve the following problems and answer the last question. Create appropriate formulas using the supplied values in the corresponding cells so Excel can calculate the answer. Example problems can be found on the "Stock Valuation Example" tab below. Show your work.

On March the Dow Jones Industrial Average set a new high. The index closed at which was up that day. What was the return in percent of the

Answer here

stock market that day?

Your discount brokerage firm charges $ per stock trade. How much money do you need to buy shares of

Answer here Time Warner, Inc. TWX which trades at

Financial analysts forecast XYZ company's growth for the future to be a constant XYZs recent dividend was $ What is the value of XYZ stock when the required return is

Answer here

A preferred stock from ABC pays $ in annual dividends. If the required return on the preferred stock is

Answer here

what is the value of the stock?

QRST has earnings per share of $ and a ratio of What's the stock price?

Answer here

Answer here

Explain why the S&P Index might be a better measure of stock market performance than the Dow Jones Industrial Average.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started