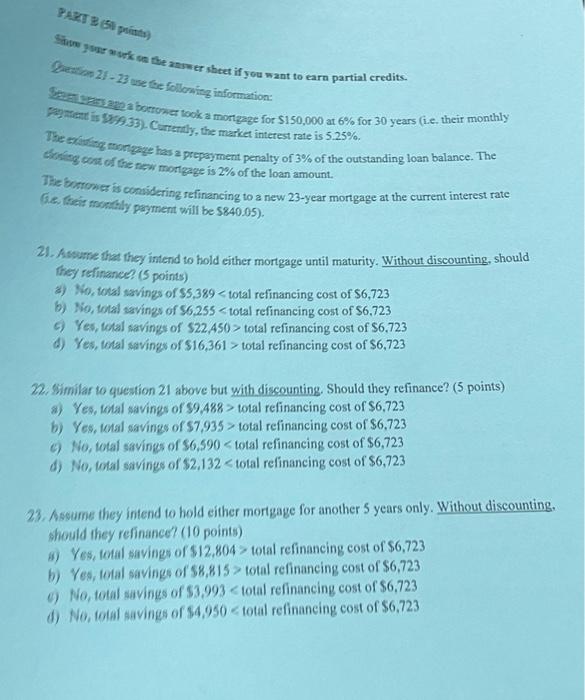

PART 3 (5 points) Skoter sheet you want to earn partial credits. E 21-23 use the following information: 252 a borrower took a mortgage for $150,000 at 6% for 30 years (i.e. their monthly 73 is 1933). Currently, the market interest rate is 5.25%. The ting mortgage has a prepayment penalty of 3% of the outstanding loan balance. The boring cost of the new morigzne is 2% of the loan amount. The borrower is considering refinancing to a new 23-year mortgage at the current interest rate Ge. facit reduly payment will be 5840.05). 21. some that they interid to hold either mortgage until maturity. Without discounting, should They refinance? (5 points) *) No total savings of $5,389

total refinancing cost of $6,723 d) Yes, wal savings of S16,361 > total refinancing cost of $6,723 n. Similar to question 21 above but with discounting, Should they refinance? (5 points) a) Yes, total savings of $9.488 > total refinancing cost of $6,723 b) Yes, total savings of $7.935 > total refinancing cost of $6,723 No, total savings of S6,590 total refinancing cost of $6,723 d) No, total savings of S2,132 total refinancing cost of $6,723 b) Yes, total savings of $8,815 > total refinancing cost of $6,723 No, total savings of $3.993 total refinancing cost of $6,723 d) No, total savings of S4,950 total refinancing cost of $6,723 PART 3 (5 points) Skoter sheet you want to earn partial credits. E 21-23 use the following information: 252 a borrower took a mortgage for $150,000 at 6% for 30 years (i.e. their monthly 73 is 1933). Currently, the market interest rate is 5.25%. The ting mortgage has a prepayment penalty of 3% of the outstanding loan balance. The boring cost of the new morigzne is 2% of the loan amount. The borrower is considering refinancing to a new 23-year mortgage at the current interest rate Ge. facit reduly payment will be 5840.05). 21. some that they interid to hold either mortgage until maturity. Without discounting, should They refinance? (5 points) *) No total savings of $5,389 total refinancing cost of $6,723 d) Yes, wal savings of S16,361 > total refinancing cost of $6,723 n. Similar to question 21 above but with discounting, Should they refinance? (5 points) a) Yes, total savings of $9.488 > total refinancing cost of $6,723 b) Yes, total savings of $7.935 > total refinancing cost of $6,723 No, total savings of S6,590 total refinancing cost of $6,723 d) No, total savings of S2,132 total refinancing cost of $6,723 b) Yes, total savings of $8,815 > total refinancing cost of $6,723 No, total savings of $3.993 total refinancing cost of $6,723 d) No, total savings of S4,950 total refinancing cost of $6,723