Question

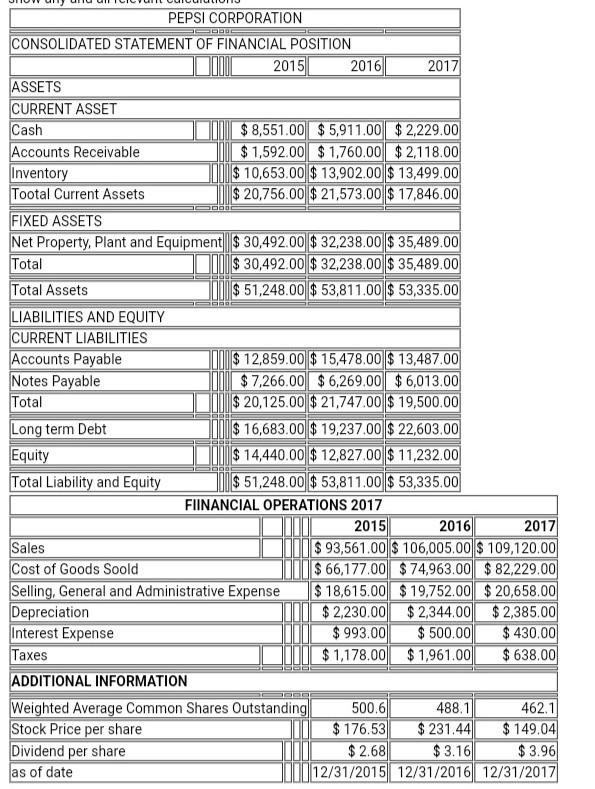

Part 3: Financial Statements and Ratios Analysis Please use use the the data in the tables below to answer the following set of questions. Please

Part 3: Financial Statements and Ratios Analysis Please use use the the data in the tables below to answer the following set of questions. Please use only the information provided and show any and all relevant calculations

1. Please show a base-year standardized income statement for 201 5/201 6/201 7 using 2015 as the base year. State why it is useful and give two observations to serve as an example. Please show all calculations an 2. If 10 year Treasury Bonds are currently priced in the market at a 3.50% Yield to Maturity, would the company's equivalent maturity debt be likely be priced to yield toE more, less or the same? Please use your knowledge derived from Chapter 7 on bond valuation to and show ali calculations 3. Please compute the Return on Equity for 2016 and 2017. Please deconstruct the 3 variables that comprise Return on on Equity using Dupont Analysis and specifically comment on the year-over-year trend with respect to to each of these three components. Please show all all. calculations 4. Please comment on the firm's profitability trend from 2020 to 2022 by examining all components of its margins (gross, operating, and net). Please show all calculations S Please calculate the following market-based ratios for 2015, 2016, and 2017. Please show all calculations Earnings per Share Price/Earnings Ratio Enterprise Value/EBITDA 6. Please comment on the trend of the firm's asset management and turnover, Please show all calculations 7 Please calculate the firm's average income, capital return, and total returns for 2016 and 2017. Please show all calculations. 8. Please calculate the firm's dividend growth rate from 201 5 to 2017. Please show allcalculations to 6 Please calculate the firm's dividend payout ratio and retained earnings for 2018. Please show all calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started