Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 3 - Journal Entries The City of Tulsa engaged in the following transactions. For each of the transactions listed below, prepare the appropriate

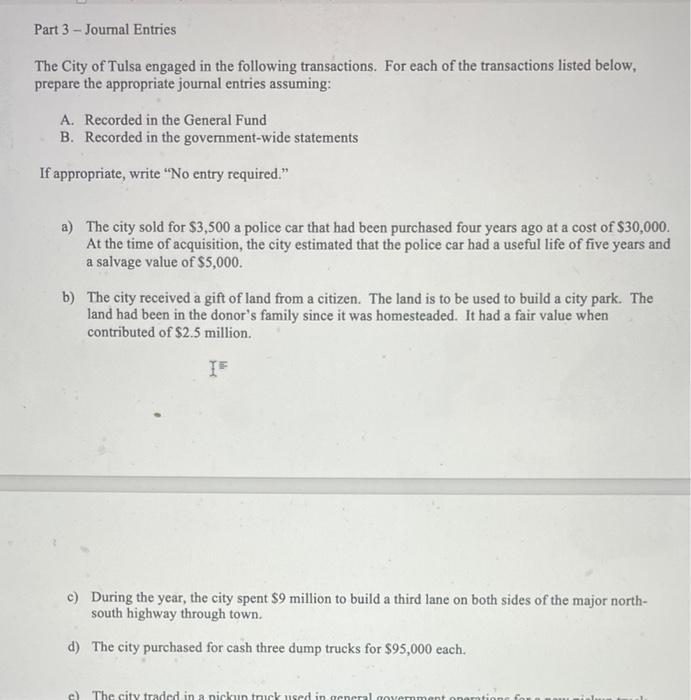

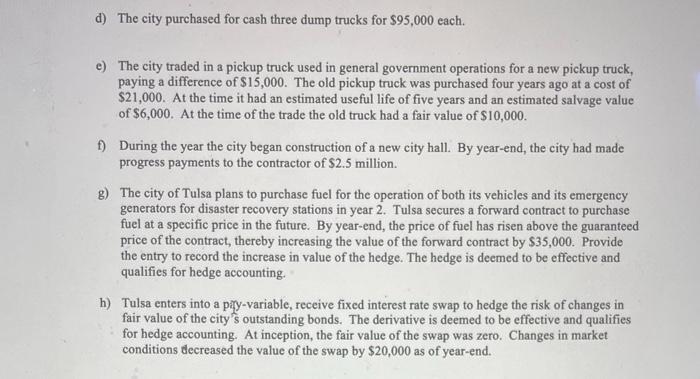

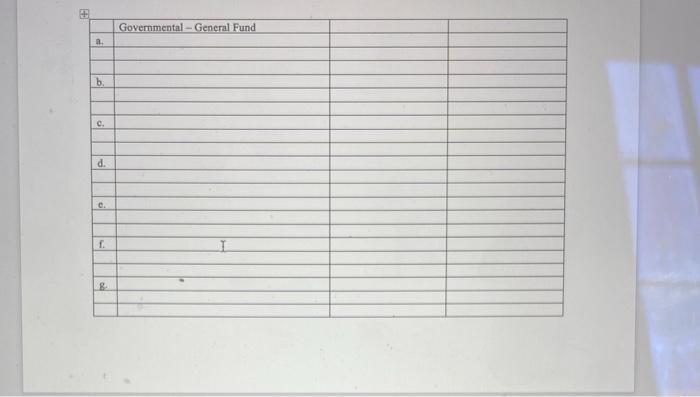

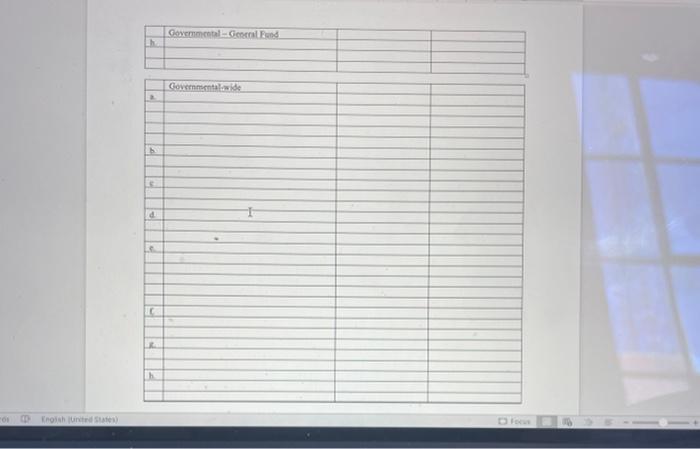

Part 3 - Journal Entries The City of Tulsa engaged in the following transactions. For each of the transactions listed below, prepare the appropriate journal entries assuming: A. Recorded in the General Fund B. Recorded in the government-wide statements If appropriate, write "No entry required." a) The city sold for $3,500 a police car that had been purchased four years ago at a cost of $30,000. At the time of acquisition, the city estimated that the police car had a useful life of five years and a salvage value of $5,000. b) The city received a gift of land from a citizen. The land is to be used to build a city park. The land had been in the donor's family since it was homesteaded. It had a fair value when contributed of $2.5 million. IF c) During the year, the city spent $9 million to build a third lane on both sides of the major north- south highway through town. d) The city purchased for cash three dump trucks for $95,000 each. c) The city traded in a pickup truck used in general government operations for d) The city purchased for cash three dump trucks for $95,000 each. e) The city traded in a pickup truck used in general government operations for a new pickup truck, paying a difference of $15,000. The old pickup truck was purchased four years ago at a cost of $21,000. At the time it had an estimated useful life of five years and an estimated salvage value of $6,000. At the time of the trade the old truck had a fair value of $10,000. f) During the year the city began construction of a new city hall. By year-end, the city had made progress payments to the contractor of $2.5 million. g) The city of Tulsa plans to purchase fuel for the operation of both its vehicles and its emergency generators for disaster recovery stations in year 2. Tulsa secures a forward contract to purchase fuel at a specific price in the future. By year-end, the price of fuel has risen above the guaranteed price of the contract, thereby increasing the value of the forward contract by $35,000. Provide the entry to record the increase in value of the hedge. The hedge is deemed to be effective and qualifies for hedge accounting. h) Tulsa enters into a pay-variable, receive fixed interest rate swap to hedge the risk of changes in fair value of the city's outstanding bonds. The derivative is deemed to be effective and qualifies for hedge accounting. At inception, the fair value of the swap was zero. Changes in market conditions decreased the value of the swap by $20,000 as of year-end. a. b. C. d. C. f. 8 Governmental - General Fund + 01 English (United States) Lh A b d Le L h Governmental-General Fund Governmental wide Focus

Step by Step Solution

★★★★★

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Govermental General Fund Debit in Credit in a Bank Ac Dr 3500 Loss on Sale of police car Ac Dr 6500 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started