Question

PART 3 Plastitubes Limited Project-Finance Team Reflection. Both Freddy May and Peter Parker are keen to know how the companys new Project-finance team is getting

PART 3 Plastitubes Limited Project-Finance Team Reflection. Both Freddy May and Peter Parker are keen to know how the companys new Project-finance team is getting on. They have asked each member of your team to provide a brief reflection on the performance of the team. This reflection will be kept anonymous and will help senior management of Plastitubes determine the size of the performance bonus that will be awarded to team members should the investment project proceed successfully. TASK: Prepare a brief summary/reflection on the performance of your project-finance teams preparation of this assessment. This reflection should be no more than 300 words.

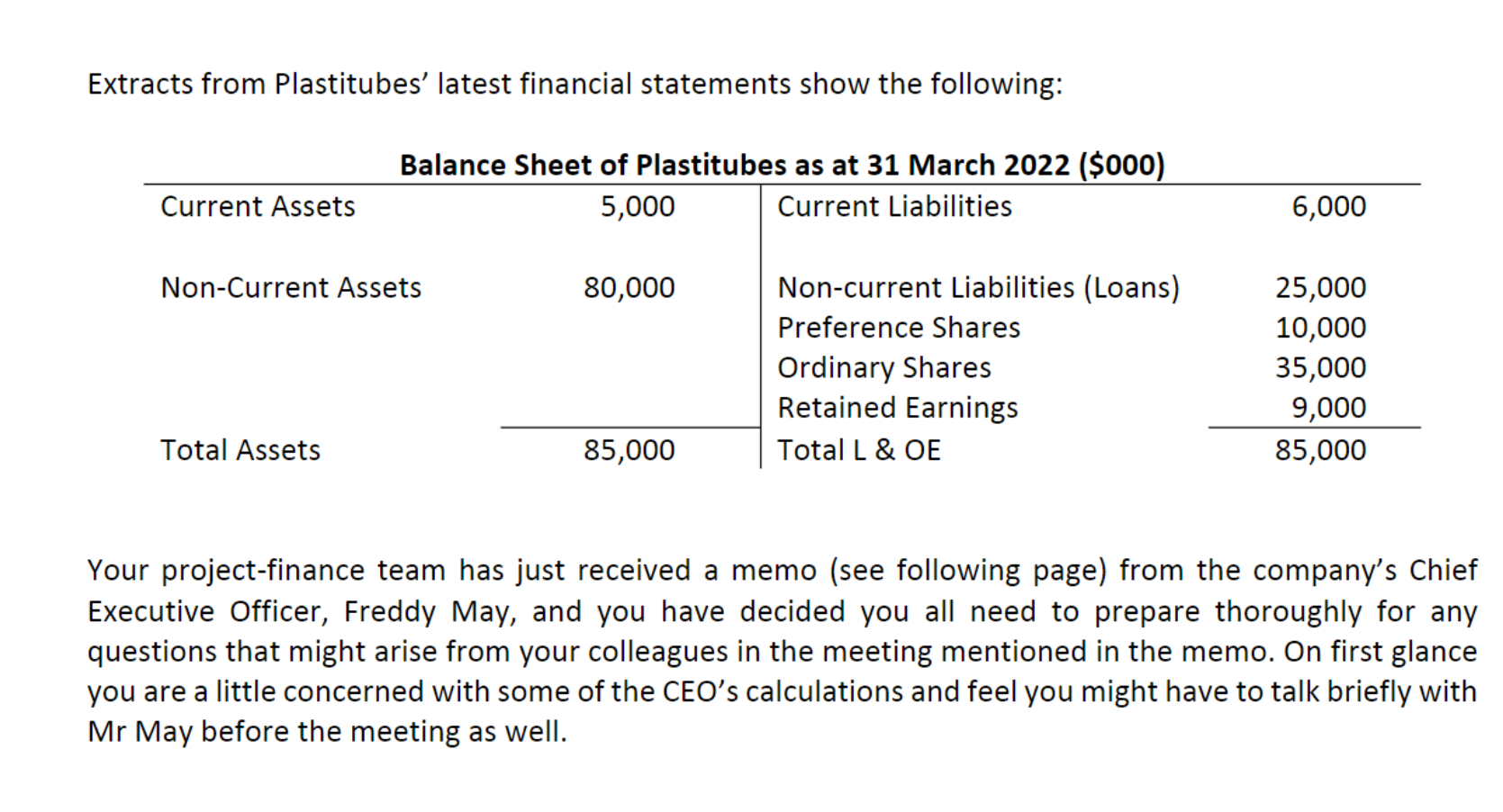

You have been employed by a company called Plastitubes Ltd., as a project-finance manager, working with a small team of project-finance experts. Plastitubes is based in Aucklands south-eastern industrial area of Penrose and manufactures a variety of Fibre Reinforced Polymer (FRP) pipes and containers used for transporting and storing corrosive liquids. Plastitubes supplies customers in New Zealand and the Pacific Islands who are mainly involved in the petrochemical and wastewater (sewage) treatment industries. Their main product, FRP pipe, has an exceptional strength to weight ratio, and weight for weight is stronger than steel. The pipes also have good shock and impact resistance and excellent flow characteristics as a smooth glass-like interior finish reduces material build-up and improves fluid transmission. Plastitubes is a medium sized company listed on the NZX and has 35 million shares on issue - the current share price is $2.50. In addition, Plastitubes issued 10 million preference shares 5 years ago. These preference shares have a $1 face value and a fixed dividend of 11%p.a. The preference shares are currently trading at $1.75 each. The company's equity beta () is 1.30, the New Zealand market risk premium is estimated at 6.0% p.a., the yield on 10-year New Zealand government bonds is 2.30% p.a., and the company tax rate is 28%. The companys long-term debt consists entirely of 25,000 10-year bonds issued exactly 4 years ago (these are listed on NZDX). Each bond has a face value of $1,000 and an annual coupon rate of 8% (paid annually). The bonds are currently trading at a yield to maturity of 6% p.a.

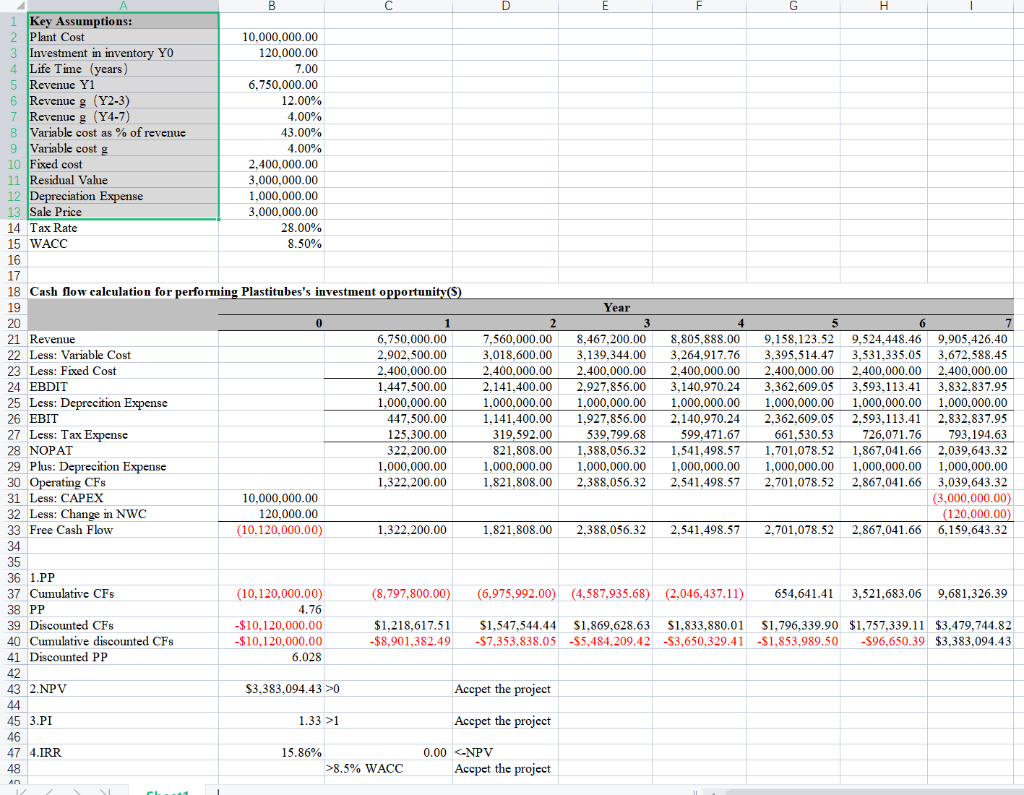

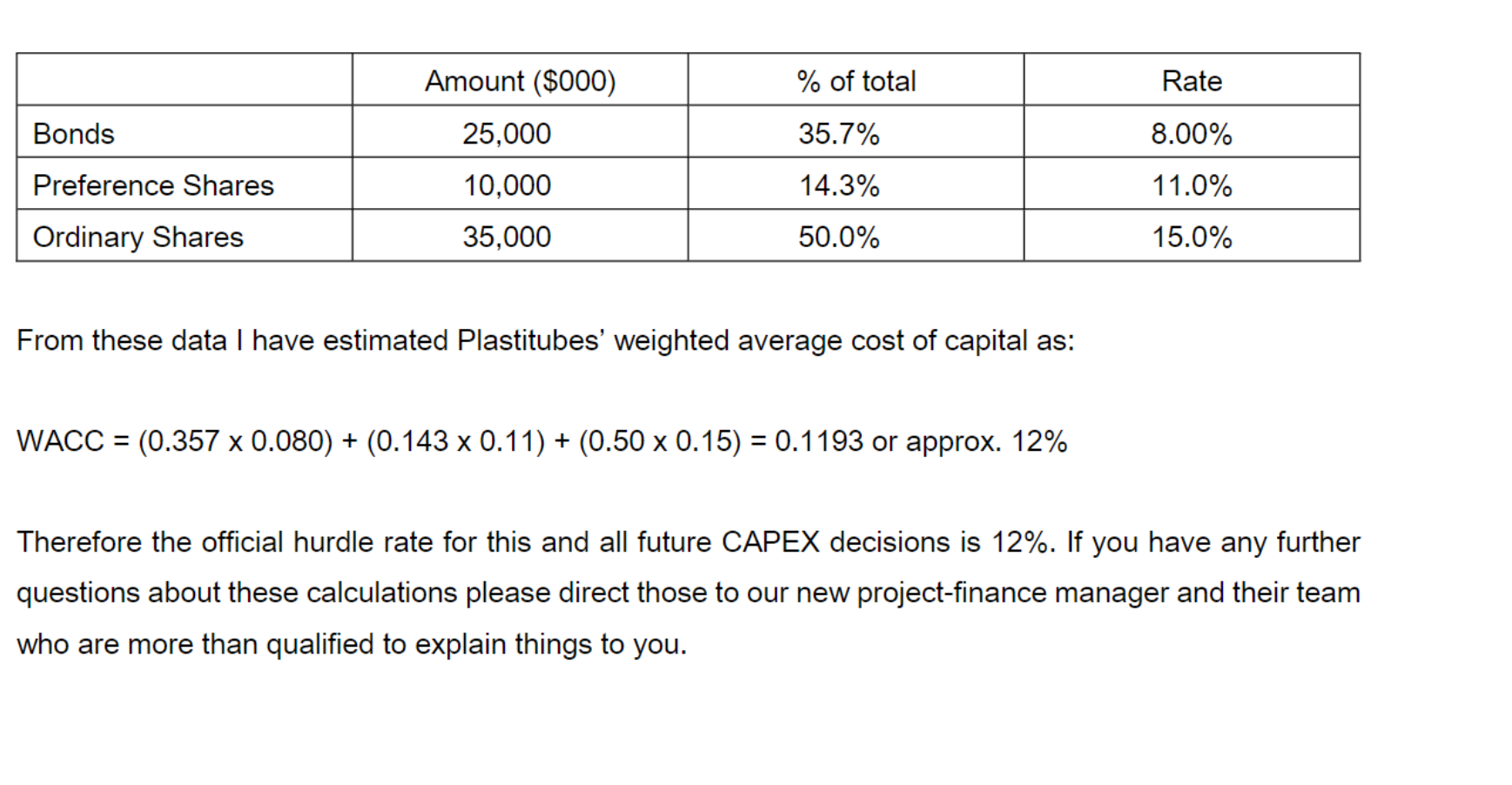

As you know, Plastitubes evaluates Capital Expenditure decisions using discounted cash-flows. The discount, or hurdle, rate is our companys weighted average cost of capital. This memo is to clarify our companys long-standing policy regarding hurdle rates for these investment decisions. Plastitubes is considering an investment in a new FRP Filament Winder that will improve the quality and reliability of our manufacturing processes, simultaneously eliminating a significant proportion of our variable costs. In case youre unaware, filament winding is the process of winding resin-impregnated fibre on a mandrel surface in a precise geometric pattern. This is accomplished by rotating the mandrel while a delivery head, under computer control, precisely positions continuous strands of fibres on the mandrel surface. Compared to our existing, labour intensive, manufacturing process this investment should provide us with significant advantages however, it does also significantly increases the companys operating leverage. Our target rate of return on equity has been 15% for many years. I realise that many new employees feel that this target is too high but I feel we need to aim for the highest profitability we can in order to keep our shareholders as happy as possible. The following table summarises the composition of Plastitubes financing: As alluded to in Mr. Mays memo from Part 1, Plastitubes is considering an investment in a new FRP Filament Winder that will improve the quality and reliability of its manufacturing processes, simultaneously eliminating a significant proportion of its variable costs. Filament winding is the process of winding resin-impregnated fibre on a mandrel surface in a precise geometric pattern. This is accomplished by rotating the mandrel while a delivery head, under computer control, precisely positions continuous strands of fibres on the mandrel surface. Compared to its existing, labour- intensive, manufacturing process this investment should improve production-efficiency however it will unfortunately significantly increase the companys operating leverage. The plant will cost $10 million plus a further $120,000 investment in inventory at the start of the project, and is expected to last for seven years before it needs replacing. Once the plant has reached the end of its useful life the additional investment in inventory will no longer be needed. The new plant is expected to generate an additional $6.75 million revenue in its first year and achieve a growth rate in revenues of 12% for the following two years, flattening out at 4% for the remaining four years of the plants life. Variable costs are projected to be 43% of sales in the first year, and will then grow at a constant rate of 4% thereafter (i.e. these costs are not 100% variable w.r.t. sales). Fixed annual operating costs (excluding depreciation) of $2.4 million are anticipated throughout the life of the plant. The new plant would be depreciated on a straight line basis over the seven years to a residual value of $3 million. At the end of its life it is expected that the plant will be sold at its book value. The companys production manager, Peter Parker, has asked your finance team to complete a financial analysis for the investment and to prepare a report about the viability of the project. He will make a recommendation to the board of directors based, in part, on your financial analysis and report.

As alluded to in Mr. Mays memo from Part 1, Plastitubes is considering an investment in a new FRP Filament Winder that will improve the quality and reliability of its manufacturing processes, simultaneously eliminating a significant proportion of its variable costs. Filament winding is the process of winding resin-impregnated fibre on a mandrel surface in a precise geometric pattern. This is accomplished by rotating the mandrel while a delivery head, under computer control, precisely positions continuous strands of fibres on the mandrel surface. Compared to its existing, labour- intensive, manufacturing process this investment should improve production-efficiency however it will unfortunately significantly increase the companys operating leverage. The plant will cost $10 million plus a further $120,000 investment in inventory at the start of the project, and is expected to last for seven years before it needs replacing. Once the plant has reached the end of its useful life the additional investment in inventory will no longer be needed. The new plant is expected to generate an additional $6.75 million revenue in its first year and achieve a growth rate in revenues of 12% for the following two years, flattening out at 4% for the remaining four years of the plants life. Variable costs are projected to be 43% of sales in the first year, and will then grow at a constant rate of 4% thereafter (i.e. these costs are not 100% variable w.r.t. sales). Fixed annual operating costs (excluding depreciation) of $2.4 million are anticipated throughout the life of the plant. The new plant would be depreciated on a straight line basis over the seven years to a residual value of $3 million. At the end of its life it is expected that the plant will be sold at its book value. The companys production manager, Peter Parker, has asked your finance team to complete a financial analysis for the investment and to prepare a report about the viability of the project. He will make a recommendation to the board of directors based, in part, on your financial analysis and report.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started