Question

PART 3 Plastitubes Limited Project-Finance Team Reflection. Both Freddy May and Peter Parker are keen to know how the companys new Project-finance team is getting

PART 3 Plastitubes Limited Project-Finance Team Reflection. Both Freddy May and Peter Parker are keen to know how the companys new Project-finance team is getting on. They have asked each member of your team to provide a brief reflection on the performance of the team. This reflection will be kept anonymous and will help senior management of Plastitubes determine the size of the performance bonus that will be awarded to team members should the investment project proceed successfully. TASK: Prepare a brief summary/reflection on the performance of your project-finance teams preparation of this assessment. This reflection should be no more than 300 words.

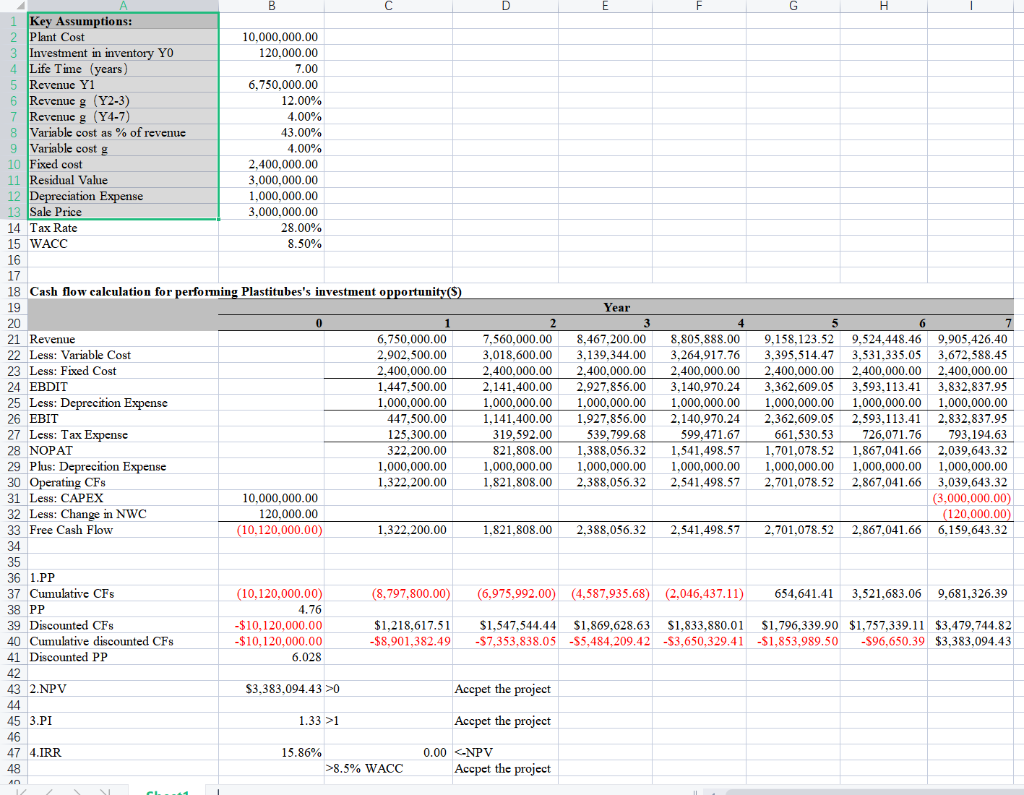

As alluded to in Mr. Mays memo from Part 1, Plastitubes is considering an investment in a new FRP Filament Winder that will improve the quality and reliability of its manufacturing processes, simultaneously eliminating a significant proportion of its variable costs. Filament winding is the process of winding resin-impregnated fibre on a mandrel surface in a precise geometric pattern. This is accomplished by rotating the mandrel while a delivery head, under computer control, precisely positions continuous strands of fibres on the mandrel surface. Compared to its existing, labour- intensive, manufacturing process this investment should improve production-efficiency however it will unfortunately significantly increase the companys operating leverage. The plant will cost $10 million plus a further $120,000 investment in inventory at the start of the project, and is expected to last for seven years before it needs replacing. Once the plant has reached the end of its useful life the additional investment in inventory will no longer be needed. The new plant is expected to generate an additional $6.75 million revenue in its first year and achieve a growth rate in revenues of 12% for the following two years, flattening out at 4% for the remaining four years of the plants life. Variable costs are projected to be 43% of sales in the first year, and will then grow at a constant rate of 4% thereafter (i.e. these costs are not 100% variable w.r.t. sales). Fixed annual operating costs (excluding depreciation) of $2.4 million are anticipated throughout the life of the plant. The new plant would be depreciated on a straight line basis over the seven years to a residual value of $3 million. At the end of its life it is expected that the plant will be sold at its book value. The companys production manager, Peter Parker, has asked your finance team to complete a financial analysis for the investment and to prepare a report about the viability of the project. He will make a recommendation to the board of directors based, in part, on your financial analysis and report.

1/ B E H 1 Key Assumptions: 2 Plant Cost 10,000,000.00 Investment in inventory YO 120,000.00 Life Time (years) 7.00 5 Revenue Y1 6,750,000.00 6 Revenue g (Y2-3) 20:00 12.00% .0070 7 Revenue g (Y4-7) 4.00% Dow Variable cost as % of revenue Variable Variable cost g 43.00% torcow 9 P 4.00% wwwww 10 Fixed cost 2,400,000.00 11 Residual Value 3,000,000.00 12 Depreciation Expense 1,000,000.00 13 Sale Price 3,000,000.00 14 Tax Rate 28.00% 8.50% 15 WACC 16 17 18 Cash flow calculation for performing Plastitubes's investment opportunity($) 19 Year 20 0 3 5 21 Revenue 22 Less: Variable Cost 1 6,750,000.00 2,902,500.00 2,400,000.00 1,447,500.00 pe 23 Less: Fixed Cost 24 PPDI 2,400.000.00 2,400,000.00 2,400,000.00 2,927,856.00 3,140,970.24 24 EBDIT 2,141,400.00 of 000.00 000.000.00 25 Less: Deprecition Expense 000 00 1,000,000.00 1,000,000.00 1,000,000.00 2 6 7 7,560,000.00 8,467,200.00 8.805,888.00 9,158,123.52 9,524,448.46 9,905,426.40 3,018,600.00 3,139,344.00 3,264,917.76 3,395,514.47 3,531,335.05 3,672,588.45 2,400,000.00 2,400,000.00 2,400,000.00 27.05 3,362,609.05 3,593,113.41 3.832.837.95 1,000,000.00 1,000,000.00 1,000,000.00 2,362,609.05 2,593,113.41 2,832,837.95 661,530.53 726,071.76 793,194.63 1,701,078.52 1,867,041.66 2,039,643.32 1,000,000.00 1,000,000.00 1,000,000.00 2,701,078.52 2,867,041.66 3,039,643.32 (3,000,000.00) 1.000.000.00 447,500.00 125,300.00 26 EBIT 27 1 27 Less: Tax Expense 28 NOPAT 322,200.00 1,141,400.00 1.927,856.00 2,140.970.24 319,592.00 539,799.68 599,471.67 821,808.00 1,388,056.32 1,541,498.57 1,000,000.00 1,000,000.00 1,000,000.00 1,821,808.00 2.388.056.32 2,541,498.57 29 Plus: Deprecition Expense 1,000,000.00 30 Operating CFs 1,322,200.00 31 Less: CAPEX Less: Change in NWC (120,000.00) 33 Free Cash Flow 1,322,200.00 1,821,808.00 2.388.056.32 2,541,498.57 2,701,078.52 2,867,041.66 6,159,643.32 34 35 36 1.PP 37 Cumulative CFs (6,975,992.00) (4,587,935.68) (2,046,437.11) 30 Fr 38 PP 39 Discounted CFs (8,797,800.00) 654,641.41 3,521,683.06 9,681,326.39 $1,218,617.51 $1,547,544.44 $1,869,628.63 $1,833,880.01 $1,796,339.90 $1,757,339.11 $3,479,744.82 -$8,901,382.49 -$7,353,838.05 -$5,484,209.42 -$3,650,329.41 -$1,853,989.50 -$96,650.39 $3,383,094.43 40 Cumulative discounted CFs 41 Discounted PP 42 43 2.NPV Accpet the project 44 45 3.PI Accpet the project 46 47 4.IRR 48 Accpet the project An Chat 10,000,000.00 120,000.00 (10,120,000.00) (10,120,000.00) 4.76 -$10,120,000.00 -$10,120,000.00 6.028 $3,383,094.43 >0 1.33 >1 C 15.86% >8.5% WACC D 0.00 0 1.33 >1 C 15.86% >8.5% WACC D 0.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started