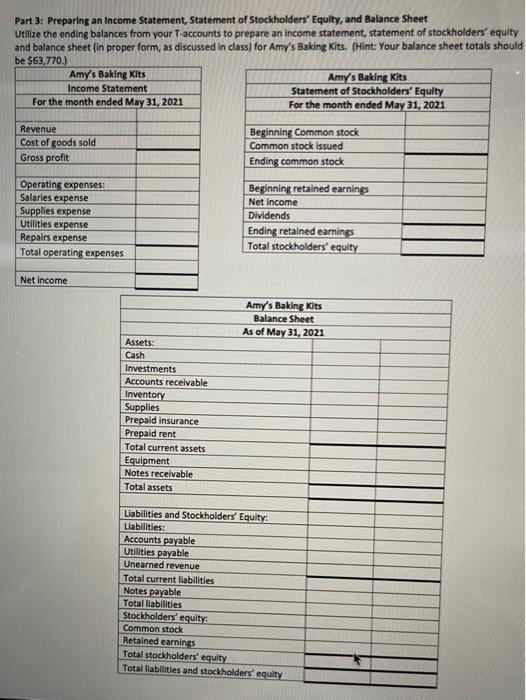

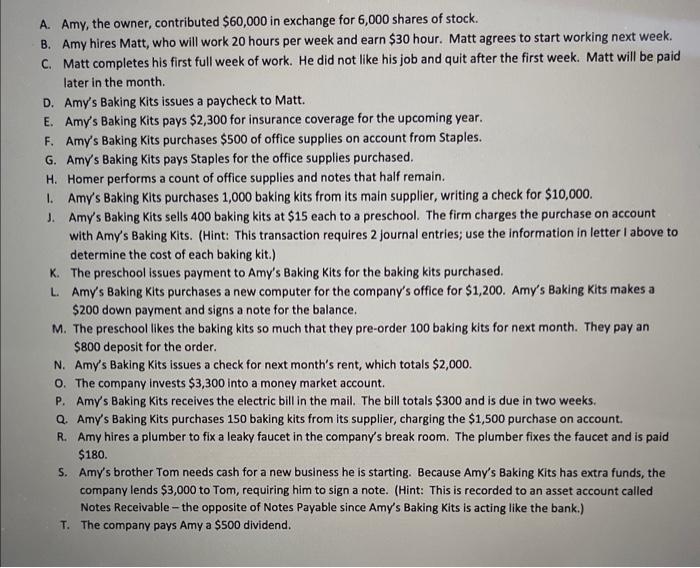

Part 3: Preparing an Income Statement, Statement of Stockholders' Equity, and Balance Sheet Utilize the ending balances from your T-accounts to prepare an income statement, statement of stocicholders' equity and balance sheet (in proper form, as discussed in class) for Amy's Baking Kits. (Hint: Your balance sheet totals should A. Amy, the owner, contributed $60,000 in exchange for 6,000 shares of stock. B. Amy hires Matt, who will work 20 hours per week and earn $30 hour. Matt agrees to start working next week. C. Matt completes his first full week of work. He did not like his job and quit after the first week. Matt will be paid later in the month. D. Amy's Baking Kits issues a paycheck to Matt. E. Amy's Baking Kits pays $2,300 for insurance coverage for the upcoming year. F. Amy's Baking Kits purchases $500 of office supplies on account from Staples. G. Amy's Baking Kits pays Staples for the office supplies purchased. H. Homer performs a count of office supplies and notes that half remain. I. Amy's Baking Kits purchases 1,000 baking kits from its main supplier, writing a check for $10,000. J. Amy's Baking Kits sells 400 baking kits at $15 each to a preschool. The firm charges the purchase on account with Amy's Baking Kits. (Hint: This transaction requires 2 journal entries; use the information in letter I above to determine the cost of each baking kit.) K. The preschool issues payment to Amy's Baking Kits for the baking kits purchased. L. Amy's Baking Kits purchases a new computer for the company's office for $1,200. Amy's Baking Kits makes a $200 down payment and signs a note for the balance. M. The preschool likes the baking kits so much that they pre-order 100 baking kits for next month. They pay an $800 deposit for the order. N. Amy's Baking Kits issues a check for next month's rent, which totals $2,000. 0. The company invests $3,300 into a money market account. P. Amy's Baking Kits receives the electric bill in the mail. The bill totals $300 and is due in two weeks. Q. Amy's Baking Kits purchases 150 baking kits from its supplier, charging the $1,500 purchase on account. R. Amy hires a plumber to fix a leaky faucet in the company's break room. The plumber fixes the faucet and is paid \$180. 5. Amy's brother Tom needs cash for a new business he is starting. Because Amy's Baking Kits has extra funds, the company lends $3,000 to Tom, requiring him to sign a note. (Hint: This is recorded to an asset account called Notes Receivable - the opposite of Notes Payable since Amy's Baking Kits is acting like the bank.) T. The company pays Amy a $500 dividend