Answered step by step

Verified Expert Solution

Question

1 Approved Answer

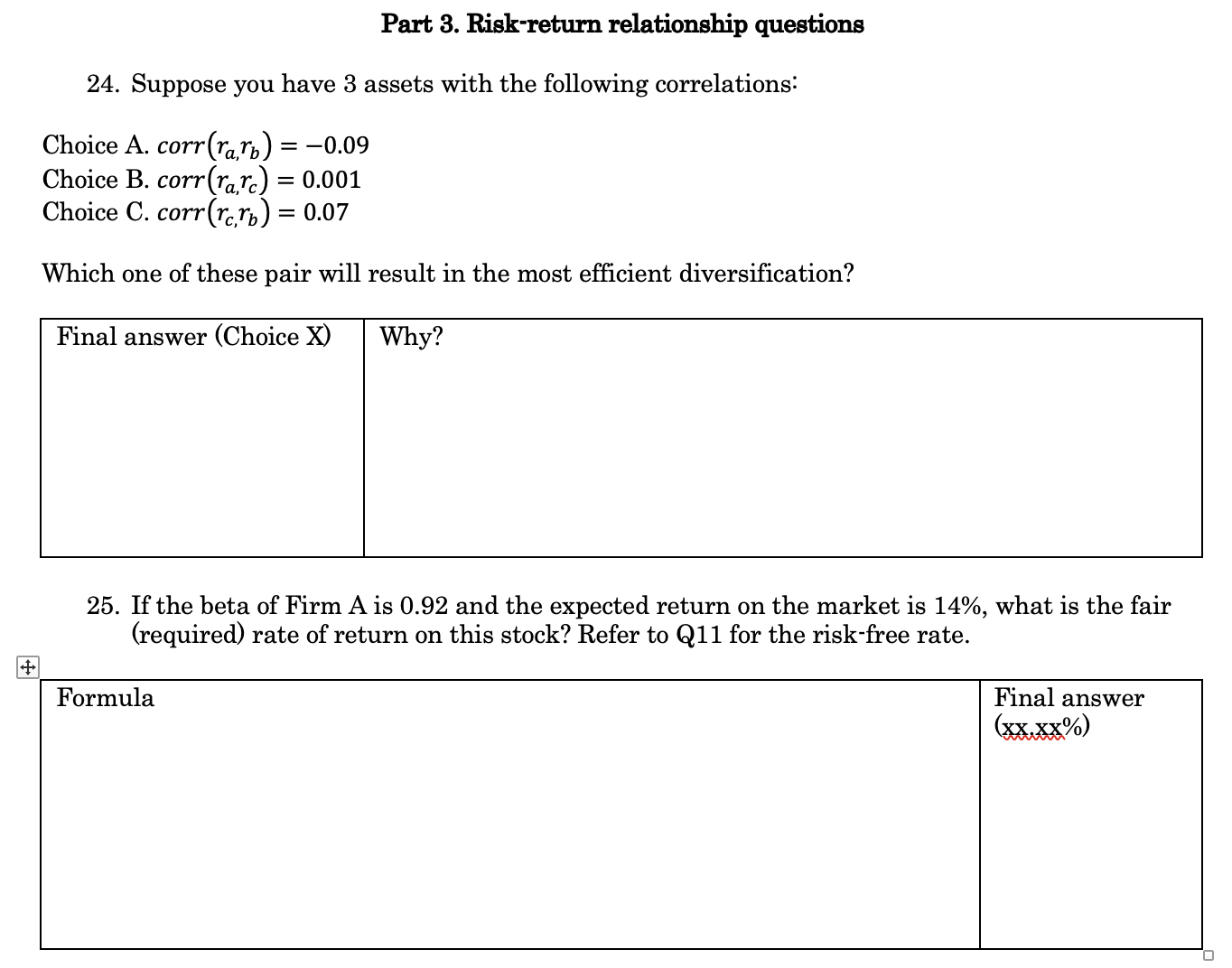

+ Part 3. Risk-return relationship questions 24. Suppose you have 3 assets with the following correlations: Choice A. corr(rarb) = -0.09 Choice B. corr(rare)

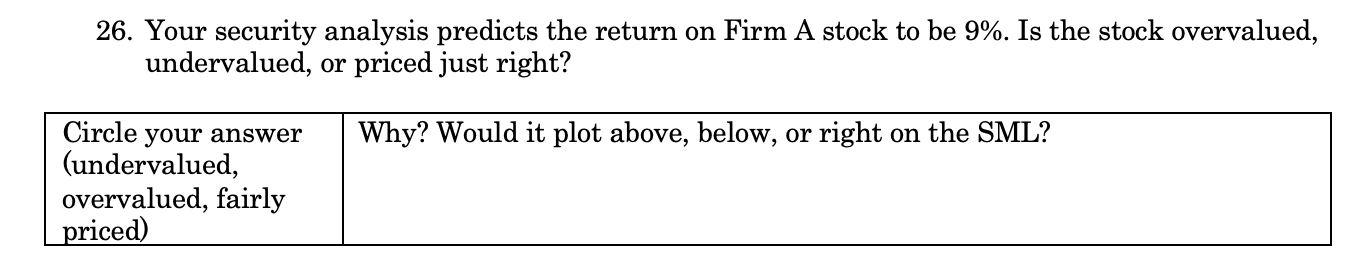

+ Part 3. Risk-return relationship questions 24. Suppose you have 3 assets with the following correlations: Choice A. corr(rarb) = -0.09 Choice B. corr(rare) = 0.001 Choice C. corr(rc.rb) = 0.07 Which one of these pair will result in the most efficient diversification? Final answer (Choice X) Why? 25. If the beta of Firm A is 0.92 and the expected return on the market is 14%, what is the fair (required) rate of return on this stock? Refer to Q11 for the risk-free rate. Formula Final answer (xx.xx%) 26. Your security analysis predicts the return on Firm A stock to be 9%. Is the stock overvalued, undervalued, or priced just right? Why? Would it plot above, below, or right on the SML? Circle your answer (undervalued, overvalued, fairly priced)

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

24 Choice B corr rare 0001 This pair has the lowest correlation cl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started