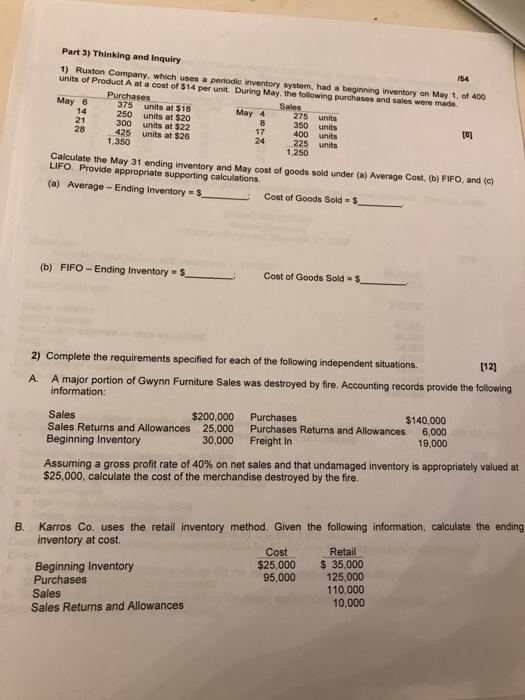

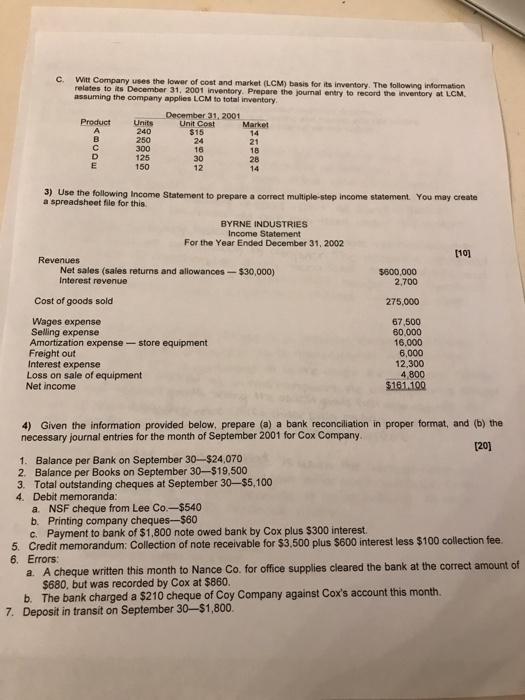

Part 3) Thinking and Inquiry 154 1) Ruxton Company, which uses a periodic inventory system had a beginning inventory on May 1 of 400 units of Product A at a cost of $14 per unit. During May, the following purchases and sales were made Purchases May 6 Sales 375 units at $18 May 4 275 units 14 250 units at $20 8 350 units 21 300 units at $22 17 400 units 28 425 units at $26 24 225 units 1.350 1.250 Calculate the May 31 ending inventory and May cost of goods sold under (a) Average Cost. (b) FIFO, and (c) LIFO. Provide appropriate supporting calculations (a) Average -Ending Inventory = $. Cost of Goods Sold (8) (b) FIFO -Ending Inventory = $ Cost of Goods Sold = $ 2) Complete the requirements specified for each of the following independent situations. [12] A. A major portion of Gwynn Furniture Sales was destroyed by fire. Accounting records provide the following information: Sales $200,000 Purchases $140,000 Sales Returns and Allowances 25,000 Purchases Returns and Allowances 6,000 Beginning Inventory 30,000 Freight in 19.000 Assuming a gross profit rate of 40% on net sales and that undamaged inventory is appropriately valued at $25,000, calculate the cost of the merchandise destroyed by the fire. B Karros Co. uses the retail inventory method. Given the following information, calculate the ending inventory at cost Cost Retail Beginning Inventory $25,000 $ 35,000 Purchases 95,000 125,000 Sales 110,000 Sales Returns and Allowances 10,000 c Wilt Company uses the lower of cost and market (LCM) basis for its inventory. The following information relates to its December 31, 2001 Inventory. Prepare the journal entry to record the inventory at LCM assuming the company applies LCM to total inventory December 31, 2001 Product Units Unit Cost Market A 240 $15 14 250 24 21 16 18 D 125 30 28 E 150 12 14 300 3) Use the following Income Statement to prepare a correct multiple-step income statement. You may create a spreadsheet file for this BYRNE INDUSTRIES Income Statement For the Year Ended December 31, 2002 [10] $600,000 2,700 275,000 Revenues Net sales (sales returns and allowances - $30,000) Interest revenue Cost of goods sold Wages expense Selling expense Amortization expense - store equipment Freight out Interest expense Loss on sale of equipment Net income 67,500 60.000 16.000 6,000 12,300 4 800 $161.100 4) Given the information provided below, prepare (a) a bank reconciliation in proper format, and (b) the necessary journal entries for the month of September 2001 for Cox Company [20] 1. Balance per Bank on September 30-$24,070 2. Balance per Books on September 30-$19,500 3. Total outstanding cheques at September 30-$5,100 4. Debit memoranda: a. NSF cheque from Lee Co.-$540 b. Printing company cheques-$60 c. Payment to bank of $1,800 note owed bank by Cox plus $300 interest 5. Credit memorandum: Collection of note receivable for $3.500 plus $600 interest less $100 collection fee. 6. Errors: a. A cheque written this month to Nance Co. for office supplies cleared the bank at the correct amount of $680, but was recorded by Cox at $860. b. The bank charged a $210 cheque of Coy Company against Cox's account this month. 7. Deposit in transit on September 30-$1,800 Part 3) Thinking and Inquiry 154 1) Ruxton Company, which uses a periodic inventory system had a beginning inventory on May 1 of 400 units of Product A at a cost of $14 per unit. During May, the following purchases and sales were made Purchases May 6 Sales 375 units at $18 May 4 275 units 14 250 units at $20 8 350 units 21 300 units at $22 17 400 units 28 425 units at $26 24 225 units 1.350 1.250 Calculate the May 31 ending inventory and May cost of goods sold under (a) Average Cost. (b) FIFO, and (c) LIFO. Provide appropriate supporting calculations (a) Average -Ending Inventory = $. Cost of Goods Sold (8) (b) FIFO -Ending Inventory = $ Cost of Goods Sold = $ 2) Complete the requirements specified for each of the following independent situations. [12] A. A major portion of Gwynn Furniture Sales was destroyed by fire. Accounting records provide the following information: Sales $200,000 Purchases $140,000 Sales Returns and Allowances 25,000 Purchases Returns and Allowances 6,000 Beginning Inventory 30,000 Freight in 19.000 Assuming a gross profit rate of 40% on net sales and that undamaged inventory is appropriately valued at $25,000, calculate the cost of the merchandise destroyed by the fire. B Karros Co. uses the retail inventory method. Given the following information, calculate the ending inventory at cost Cost Retail Beginning Inventory $25,000 $ 35,000 Purchases 95,000 125,000 Sales 110,000 Sales Returns and Allowances 10,000 c Wilt Company uses the lower of cost and market (LCM) basis for its inventory. The following information relates to its December 31, 2001 Inventory. Prepare the journal entry to record the inventory at LCM assuming the company applies LCM to total inventory December 31, 2001 Product Units Unit Cost Market A 240 $15 14 250 24 21 16 18 D 125 30 28 E 150 12 14 300 3) Use the following Income Statement to prepare a correct multiple-step income statement. You may create a spreadsheet file for this BYRNE INDUSTRIES Income Statement For the Year Ended December 31, 2002 [10] $600,000 2,700 275,000 Revenues Net sales (sales returns and allowances - $30,000) Interest revenue Cost of goods sold Wages expense Selling expense Amortization expense - store equipment Freight out Interest expense Loss on sale of equipment Net income 67,500 60.000 16.000 6,000 12,300 4 800 $161.100 4) Given the information provided below, prepare (a) a bank reconciliation in proper format, and (b) the necessary journal entries for the month of September 2001 for Cox Company [20] 1. Balance per Bank on September 30-$24,070 2. Balance per Books on September 30-$19,500 3. Total outstanding cheques at September 30-$5,100 4. Debit memoranda: a. NSF cheque from Lee Co.-$540 b. Printing company cheques-$60 c. Payment to bank of $1,800 note owed bank by Cox plus $300 interest 5. Credit memorandum: Collection of note receivable for $3.500 plus $600 interest less $100 collection fee. 6. Errors: a. A cheque written this month to Nance Co. for office supplies cleared the bank at the correct amount of $680, but was recorded by Cox at $860. b. The bank charged a $210 cheque of Coy Company against Cox's account this month. 7. Deposit in transit on September 30-$1,800