Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PART 3.2 Madimetja Limited uses a job costing system to measure and trace costs for its fashion clothing. The predetermined manufacturing overhead rate has been

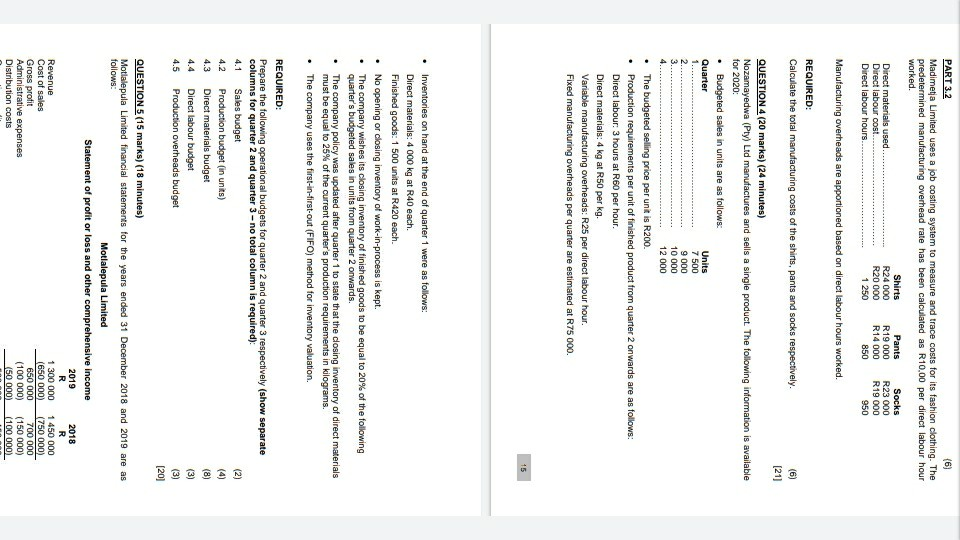

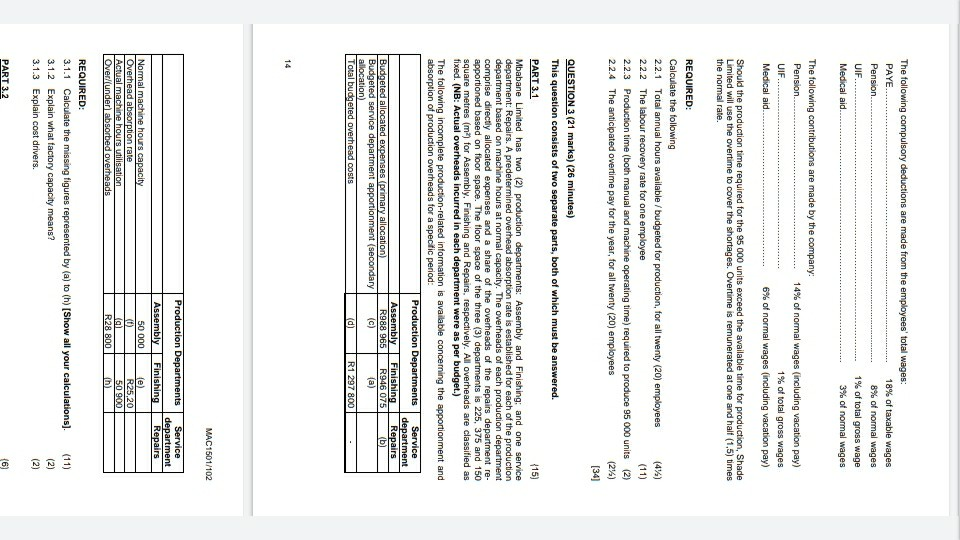

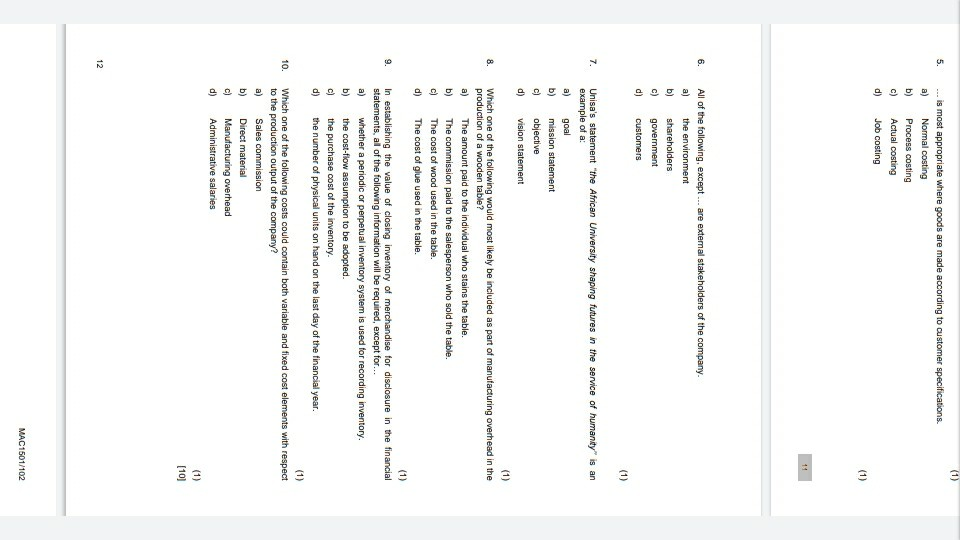

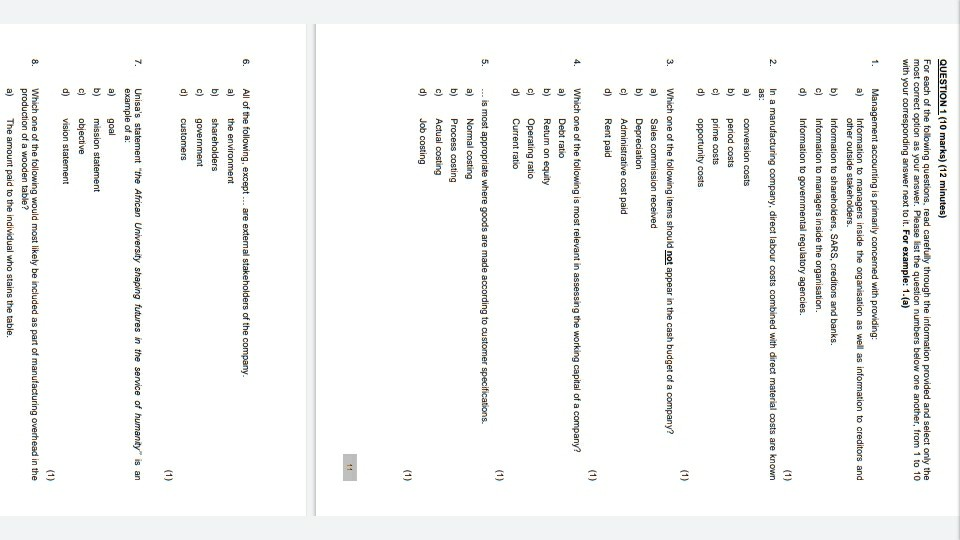

PART 3.2 Madimetja Limited uses a job costing system to measure and trace costs for its fashion clothing. The predetermined manufacturing overhead rate has been calculated as R10,00 per direct labour hour worked. Shirts Pants Socks Direct materials used. R24 000 R19 000 R23 000 Direct labour cost... R20 000 R14 000 R19 000 Direct labour hours... 1 250 850 950 Manufacturing overheads are apportioned based on direct labour hours worked. 7 500 REQUIRED: Calculate the total manufacturing costs of the shirts, pants and socks respectively. (6) (21) QUESTION 4 (20 marks) (24 minutes) Nozamayedwa (Pty) Ltd manufactures and sells a single product. The following information is available for 2020: Budgeted sales in units are as follows: Quarter Units 9 000 10 000 12 000 The budgeted selling price per unit is R200. Production requirements per unit of finished product from quarter 2 onwards are as follows: Direct labour. 3 hours at R60 per hour. Direct materials: 4 kg at R50 per kg. Variable manufacturing overheads: R25 per direct labour hour. Fixed manufacturing overheads per quarter are estimated at R75 000. Inventories on hand at the end of quarter 1 were as follows: Direct materials: 4 000 kg at R40 each. Finished goods: 1 500 units at R420 each No opening or closing inventory of work-in-process is kept. The company wishes its closing inventory of finished goods to be equal to 20% of the following quarter's budgeted sales in units from quarter 2 onwards. The company policy was updated after quarter 1 to state that the closing inventory of direct materials must be equal to 25% of the current quarter's production requirements in kilograms. The company uses the first-in-first-out (FIFO) method for inventory valuation. REQUIRED: Prepare the following operational budgets for quarter 2 and quarter 3 respectively (show separate columns for quarter 2 and quarter 3-no total column is required) 4.1 Sales budget 4.2 Production budget (in units) 4.3 Direct materials budget 4.4 Direct labour budget 4.5 Production overheads budget QUESTION 5 (15 marks) (18 minutes) Motlalepula Limited financial statements for the years ended 31 December 2018 and 2019 are as follows: Motlalepula Limited Statement of profit or loss and other comprehensive income 2019 2018 R Revenue 1 300 000 1450 000 Cost of sales (650 000) (750 000) Gross profit 650 000 700 000 Administrative expenses (100 000) (150 000) Distribution costs (50 000) (100 000) R The following compulsory deductions are made from the employees' total wages: PAYE 18% of taxable wages Pension. 8% of normal wages UIF... 1% of total gross wage Medical aid... 3% of normal wages The following contributions are made by the company: Pension.. 14% of normal wages (including vacation pay) UIF. 1% of total gross wages Medical aid 6% of normal wages (including vacation pay) Should the production time required for the 95 000 units exceed the available time for production, Shade Limited will use the overtime to cover the shortages. Overtime is remunerated at one and half (1,5) times the normal rate. REQUIRED: Calculate the following 2.2.1 Total annual hours available /budgeted for production, for all twenty (20) employees (4%) 2.2.2 The labour recovery rate for one employee (11) 2.2.3 Production time (both manual and machine operating time) required to produce 95 000 units (2) 2.2.4 The anticipated overtime pay for the year, for all twenty (20) employees QUESTION 3 (21 marks) (26 minutes) This question consists of two separate parts, both of which must be answered. PART 3.1 (15) Mbabane Limited has two (2) production departments: Assembly and Finishing, and one service department: Repairs. A predetermined overhead absorption rate is established for each of the production department based on machine hours at normal capacity. The overheads of each production department comprise directly allocated expenses and a share of the overheads of the repairs department re- apportioned based on floor space. The floor space of the three (3) departments is 225, 375 and 150 square metres (m) for Assembly, Finishing and Repairs, respectively. All overheads are classified as fixed. (NB: Actual overheads incurred in each department were as per budget.) The following incomplete production-related information is available concerning the apportionment and absorption of production overheads for a spectic period Production Departments Service department Assembly Finishing Repairs Budgeted allocated expenses (primary allocation) R988 965 R946 075 Budgeted service department apportionment (Secondary (a) allocation) Total budgeted overhead costs (d) R1 297 800 MAC1501/102 Production Departments Service department Repairs Assembly 50 000 (1) Normal machine hours capacity Overhead absorption rate Actual machine hours utilisation Overl(under absorbed overheaos Finishing e) R25,20 50 900 h) R28 800 (11) REQUIRED: 3.1.1 Calculate the missing figures represented by (a) to (h) [Show all your calculations). 3.1.2 Explain what factory capacity means? 3.1.3 Explain cost drivers. PART 3.2 5. ... is most appropriate where goods are made according to customer specifications. a) Normal costing b) Process costing c) Actual costing d) Job costing 6. All of the following, except ... are external stakeholders of the company. a) the environment b) shareholders c) government d) customers 7. is an Unisa's statement "the African University shaping futures in the service of humanity example of a: a) goal b) mission statement c) objective d) vision statement 9. Which one of the following would most likely be included as part of manufacturing overhead in the production of a wooden table? a) The amount paid to the individual who stains the table. b) The commission paid to the salesperson who sold the table. c) The cost of wood used in the table. d) The cost of glue used in the table. (1) In establishing the value of closing inventory of merchandise for disclosure in the financial statements, all of the following information will be required, except for... a) whether a periodic or perpetual inventory system is used for recording inventory. b) the cost-flow assumption to be adopted. c) the purchase cost of the inventory. d) the number of physical units on hand on the last day of the financial year. (1) Which one of the following costs could contain both variable and fixed cost elements with respect to the production output of the company? a) Sales commission b) Direct material c) Manufacturing overhead d) Administrative salaries 10. MAC1501/102 QUESTION 1 (10 marks) (12 minutes) For each of the following questions, read carefully through the information provided and select only the most correct option as your answer. Please list the question numbers below one another, from 1 to 10 with your corresponding answer next to it. For example: 1.(a) 1. Management accounting is primarily concerned with providing: a) Information to managers inside the organisation as well as information to creditors and other outside stakeholders. b) Information to shareholders, SARS, creditors and banks. c) Information to managers inside the organisation. d) Information to governmental regulatory agencies. 2. In a manufacturing company, direct labour costs combined with direct material costs are known as: a) conversion costs b) period costs prime costs d) opportunity costs 3. Which one of the following items should not appear in the cash budget of a company? a) Sales commission received b) Depreciation c) Administrative cost paid d) Rent paid Which one of the following is most relevant in assessing the working capital of a company? a) Debt ratio b) Return on equity c) Operating ratio d) Current ratio 5. .. is most appropriate where goods are made according to customer specifications. a) Normal costing b) Process costing c) Actual costing d) Job costing 6. All of the following, except... are external stakeholders of the company. a) the environment b) shareholders c) government d) customers Unisa's statement "the African University shaping futures in the service of humanity" is an example of a: a) goal b) mission statement c) objective d) vision statement 8. Which one of the following would most likely be included as part of manufacturing overhead in the production of a wooden table? a) The amount paid to the individual who stains the table. PART 3.2 Madimetja Limited uses a job costing system to measure and trace costs for its fashion clothing. The predetermined manufacturing overhead rate has been calculated as R10,00 per direct labour hour worked. Shirts Pants Socks Direct materials used. R24 000 R19 000 R23 000 Direct labour cost... R20 000 R14 000 R19 000 Direct labour hours... 1 250 850 950 Manufacturing overheads are apportioned based on direct labour hours worked. 7 500 REQUIRED: Calculate the total manufacturing costs of the shirts, pants and socks respectively. (6) (21) QUESTION 4 (20 marks) (24 minutes) Nozamayedwa (Pty) Ltd manufactures and sells a single product. The following information is available for 2020: Budgeted sales in units are as follows: Quarter Units 9 000 10 000 12 000 The budgeted selling price per unit is R200. Production requirements per unit of finished product from quarter 2 onwards are as follows: Direct labour. 3 hours at R60 per hour. Direct materials: 4 kg at R50 per kg. Variable manufacturing overheads: R25 per direct labour hour. Fixed manufacturing overheads per quarter are estimated at R75 000. Inventories on hand at the end of quarter 1 were as follows: Direct materials: 4 000 kg at R40 each. Finished goods: 1 500 units at R420 each No opening or closing inventory of work-in-process is kept. The company wishes its closing inventory of finished goods to be equal to 20% of the following quarter's budgeted sales in units from quarter 2 onwards. The company policy was updated after quarter 1 to state that the closing inventory of direct materials must be equal to 25% of the current quarter's production requirements in kilograms. The company uses the first-in-first-out (FIFO) method for inventory valuation. REQUIRED: Prepare the following operational budgets for quarter 2 and quarter 3 respectively (show separate columns for quarter 2 and quarter 3-no total column is required) 4.1 Sales budget 4.2 Production budget (in units) 4.3 Direct materials budget 4.4 Direct labour budget 4.5 Production overheads budget QUESTION 5 (15 marks) (18 minutes) Motlalepula Limited financial statements for the years ended 31 December 2018 and 2019 are as follows: Motlalepula Limited Statement of profit or loss and other comprehensive income 2019 2018 R Revenue 1 300 000 1450 000 Cost of sales (650 000) (750 000) Gross profit 650 000 700 000 Administrative expenses (100 000) (150 000) Distribution costs (50 000) (100 000) R The following compulsory deductions are made from the employees' total wages: PAYE 18% of taxable wages Pension. 8% of normal wages UIF... 1% of total gross wage Medical aid... 3% of normal wages The following contributions are made by the company: Pension.. 14% of normal wages (including vacation pay) UIF. 1% of total gross wages Medical aid 6% of normal wages (including vacation pay) Should the production time required for the 95 000 units exceed the available time for production, Shade Limited will use the overtime to cover the shortages. Overtime is remunerated at one and half (1,5) times the normal rate. REQUIRED: Calculate the following 2.2.1 Total annual hours available /budgeted for production, for all twenty (20) employees (4%) 2.2.2 The labour recovery rate for one employee (11) 2.2.3 Production time (both manual and machine operating time) required to produce 95 000 units (2) 2.2.4 The anticipated overtime pay for the year, for all twenty (20) employees QUESTION 3 (21 marks) (26 minutes) This question consists of two separate parts, both of which must be answered. PART 3.1 (15) Mbabane Limited has two (2) production departments: Assembly and Finishing, and one service department: Repairs. A predetermined overhead absorption rate is established for each of the production department based on machine hours at normal capacity. The overheads of each production department comprise directly allocated expenses and a share of the overheads of the repairs department re- apportioned based on floor space. The floor space of the three (3) departments is 225, 375 and 150 square metres (m) for Assembly, Finishing and Repairs, respectively. All overheads are classified as fixed. (NB: Actual overheads incurred in each department were as per budget.) The following incomplete production-related information is available concerning the apportionment and absorption of production overheads for a spectic period Production Departments Service department Assembly Finishing Repairs Budgeted allocated expenses (primary allocation) R988 965 R946 075 Budgeted service department apportionment (Secondary (a) allocation) Total budgeted overhead costs (d) R1 297 800 MAC1501/102 Production Departments Service department Repairs Assembly 50 000 (1) Normal machine hours capacity Overhead absorption rate Actual machine hours utilisation Overl(under absorbed overheaos Finishing e) R25,20 50 900 h) R28 800 (11) REQUIRED: 3.1.1 Calculate the missing figures represented by (a) to (h) [Show all your calculations). 3.1.2 Explain what factory capacity means? 3.1.3 Explain cost drivers. PART 3.2 5. ... is most appropriate where goods are made according to customer specifications. a) Normal costing b) Process costing c) Actual costing d) Job costing 6. All of the following, except ... are external stakeholders of the company. a) the environment b) shareholders c) government d) customers 7. is an Unisa's statement "the African University shaping futures in the service of humanity example of a: a) goal b) mission statement c) objective d) vision statement 9. Which one of the following would most likely be included as part of manufacturing overhead in the production of a wooden table? a) The amount paid to the individual who stains the table. b) The commission paid to the salesperson who sold the table. c) The cost of wood used in the table. d) The cost of glue used in the table. (1) In establishing the value of closing inventory of merchandise for disclosure in the financial statements, all of the following information will be required, except for... a) whether a periodic or perpetual inventory system is used for recording inventory. b) the cost-flow assumption to be adopted. c) the purchase cost of the inventory. d) the number of physical units on hand on the last day of the financial year. (1) Which one of the following costs could contain both variable and fixed cost elements with respect to the production output of the company? a) Sales commission b) Direct material c) Manufacturing overhead d) Administrative salaries 10. MAC1501/102 QUESTION 1 (10 marks) (12 minutes) For each of the following questions, read carefully through the information provided and select only the most correct option as your answer. Please list the question numbers below one another, from 1 to 10 with your corresponding answer next to it. For example: 1.(a) 1. Management accounting is primarily concerned with providing: a) Information to managers inside the organisation as well as information to creditors and other outside stakeholders. b) Information to shareholders, SARS, creditors and banks. c) Information to managers inside the organisation. d) Information to governmental regulatory agencies. 2. In a manufacturing company, direct labour costs combined with direct material costs are known as: a) conversion costs b) period costs prime costs d) opportunity costs 3. Which one of the following items should not appear in the cash budget of a company? a) Sales commission received b) Depreciation c) Administrative cost paid d) Rent paid Which one of the following is most relevant in assessing the working capital of a company? a) Debt ratio b) Return on equity c) Operating ratio d) Current ratio 5. .. is most appropriate where goods are made according to customer specifications. a) Normal costing b) Process costing c) Actual costing d) Job costing 6. All of the following, except... are external stakeholders of the company. a) the environment b) shareholders c) government d) customers Unisa's statement "the African University shaping futures in the service of humanity" is an example of a: a) goal b) mission statement c) objective d) vision statement 8. Which one of the following would most likely be included as part of manufacturing overhead in the production of a wooden table? a) The amount paid to the individual who stains the table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started