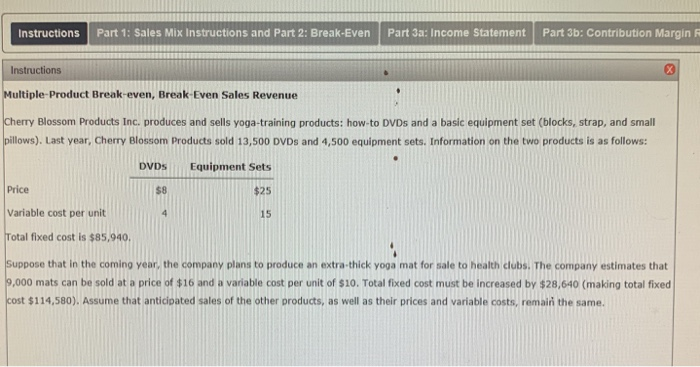

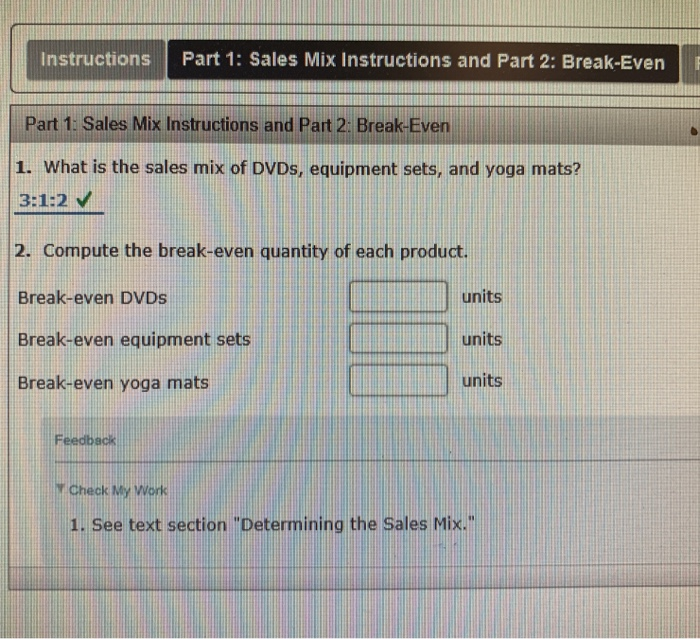

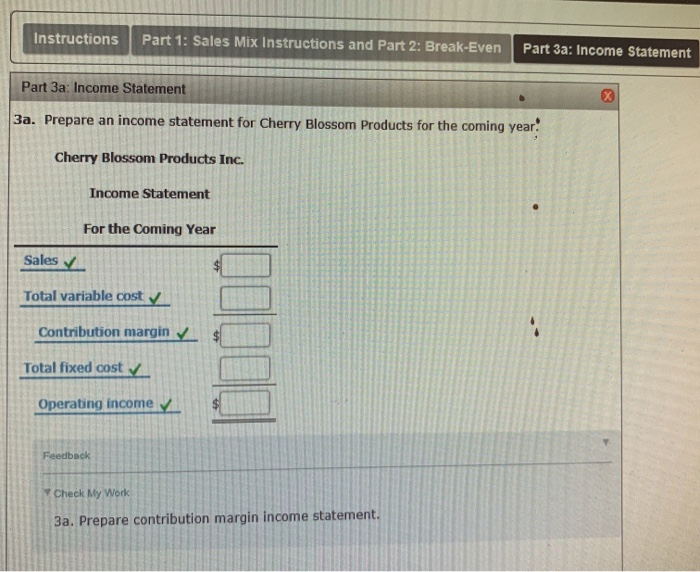

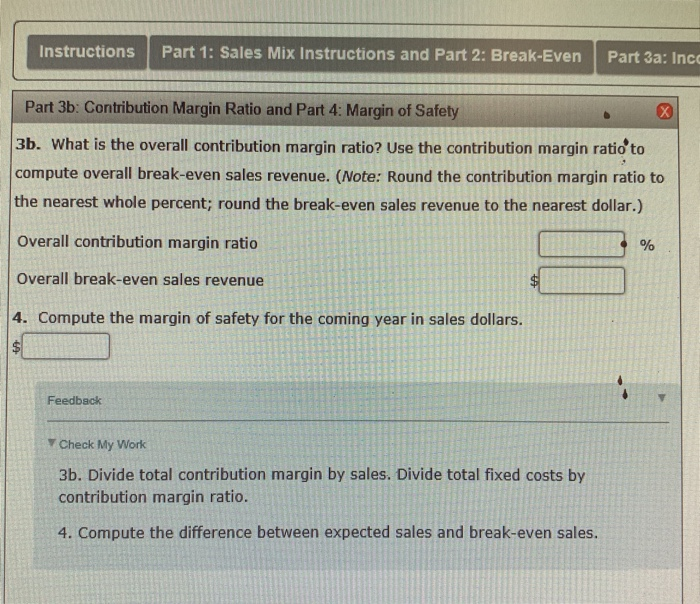

Part 3b: Contribution Margin R Part 1: Sales Mix Instructions and Part 2: Break-Even Part 3a: Income Statement Instructions Instructions Multiple-Product Break-even, Break-Even Sales Revenue Cherry Blossom Products Inc. produces and sells yoga-training products: how-to DVDS and a basic equipment set (blocks, strap, and small pillows). Last year, Cherry Blossom Products sold 13,500 DVDS and 4,500 equipment sets. Information on the two products is as follows: DVDS Equipment Sets Price $8 $25 Variable cost per unit 15 Total fixed cost is $85,940. Suppose that in the coming year, the company plans to produce an extra-thick yoga mat for sale to health clubs. The company estimates that 9,000 mats can be sold at a price of $16 and a variable cost per unit of $10. Total fixed cost must be increased by $28,640 (making total fixed cost $114,580). Assume that anticipated sales of the other products, as well as their prices and variable costs, remaii the same. Part 1: Sales Mix Instructions and Part 2: Break-Even Instructions Part 1: Sales Mix Instructions and Part 2: Break-Even 1. What is the sales mix of DVDS, equipment sets, and yoga mats? 3:1:2 2. Compute the break-even quantity of each product. units Break-even DvDs Break-even equipment sets units units Break-even yoga mats Feedback Check My Work 1. See text section "Determining the Sales Mix." Instructions Part 1: Sales Mix Instructions and Part 2: Break-Even Part 3a: Income Statement Part 3a: Income Statement X 3a. Prepare an income statement for Cherry Blossom Products for the coming year Cherry Blossom Products Inc. Income Statement For the Coming Year Sales Total variable cost Contribution margin Total fixed cost Operating income Feedback Y Check My Work 3a. Prepare contribution margin income statement. Instructions Part 1: Sales Mix Instructions and Part 2: Break-Even Part 3a: Incc Part 3b: Contribution Margin Ratio and Part 4: Margin of Safety 3b. What is the overall contribution margin ratio? Use the contribution margin ratio to compute overall break-even sales revenue. (Note: Round the contribution margin ratio to the nearest whole percent; round the break-even sales revenue to the nearest dollar.) Overall contribution margin ratio Overall break-even sales revenue 4. Compute the margin of safety for the coming year in sales dollars. Feedback Y Check My Work 3b. Divide total contribution margin by sales. Divide total fixed costs by contribution margin ratio. 4. Compute the difference between expected sales and break-even sales. TA