Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 4: Capital Budgeting 8. Worldwide Widget Manufacturing, Inc., is preparing to launch a new manufacturing facility in a new location. The company has a

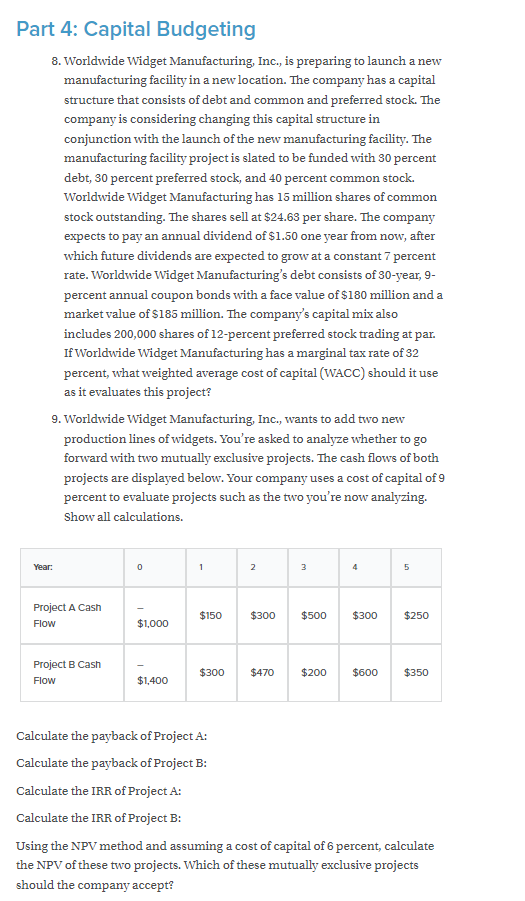

Part 4: Capital Budgeting 8. Worldwide Widget Manufacturing, Inc., is preparing to launch a new manufacturing facility in a new location. The company has a capital structure that consists of debt and common and preferred stock. The company is considering changing this capital structure in conjunction with the launch of the new manufacturing facility. The manufacturing facility project is slated to be funded with 30 percent debt, 30 percent preferred stock, and 40 percent common stock. Worldwide Widget Manufacturing has 15 million shares of common stock outstanding. The shares sell at $24.63 per share. The company expects to pay an annual dividend of $1.50 one year from now, after which future dividends are expected to grow at a constant 7 percent rate. Worldwide Widget Manufacturing's debt consists of 30-year, 9percent annual coupon bonds with a face value of $180 million and a market value of $185 million. The company's capital mix also includes 200,000 shares of 12-percent preferred stock trading at par. If Worldwide Widget Manufacturing has a marginal tax rate of 32 percent, what weighted average cost of capital (WACC) should it use as it evaluates this project? 9. Worldwide Widget Manufacturing, Inc., wants to add two new production lines of widgets. You're asked to analyze whether to go forward with two mutually exclusive projects. The cash flows of both projects are displayed below. Your company uses a cost of capital of 9 percent to evaluate projects such as the two you're now analyzing. Show all calculations. Calculate the payback of Project A: Calculate the payback of Project B: Calculate the IRR of Project A: Calculate the IRR of Project B: Using the NPV method and assuming a cost of capital of 6 percent, calculate the NPV of these two projects. Which of these mutually exclusive projects should the company accept

Part 4: Capital Budgeting 8. Worldwide Widget Manufacturing, Inc., is preparing to launch a new manufacturing facility in a new location. The company has a capital structure that consists of debt and common and preferred stock. The company is considering changing this capital structure in conjunction with the launch of the new manufacturing facility. The manufacturing facility project is slated to be funded with 30 percent debt, 30 percent preferred stock, and 40 percent common stock. Worldwide Widget Manufacturing has 15 million shares of common stock outstanding. The shares sell at $24.63 per share. The company expects to pay an annual dividend of $1.50 one year from now, after which future dividends are expected to grow at a constant 7 percent rate. Worldwide Widget Manufacturing's debt consists of 30-year, 9percent annual coupon bonds with a face value of $180 million and a market value of $185 million. The company's capital mix also includes 200,000 shares of 12-percent preferred stock trading at par. If Worldwide Widget Manufacturing has a marginal tax rate of 32 percent, what weighted average cost of capital (WACC) should it use as it evaluates this project? 9. Worldwide Widget Manufacturing, Inc., wants to add two new production lines of widgets. You're asked to analyze whether to go forward with two mutually exclusive projects. The cash flows of both projects are displayed below. Your company uses a cost of capital of 9 percent to evaluate projects such as the two you're now analyzing. Show all calculations. Calculate the payback of Project A: Calculate the payback of Project B: Calculate the IRR of Project A: Calculate the IRR of Project B: Using the NPV method and assuming a cost of capital of 6 percent, calculate the NPV of these two projects. Which of these mutually exclusive projects should the company accept Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started