Question

Part #4 Conclusions: Complete using MS Word (You can create in Google docs and then save as an MS Word doc to submit.) Each question

Part #4 Conclusions: Complete using MS Word (You can create in Google docs and then save as an MS Word doc to submit.) Each question is worth 10 points. Think about this as you answer each one! Be sure to type the question (and number1, 2, etc.), skip a line, and type your response. Answer the questions using complete sentences. Bullet statements, outlines, and so forth are not acceptable and will result in zero points. Be sure that you use good grammar, sentence structure, etc. Also make sure that your writing is businesslike and professional. Your answers should be clear, concise, and complete. Lastly, make sure that your answers are your own.

FYI: I choose 2020 Intel Company.

Please send to me email if works finished. Thanks :)

Email: patrickjun321 @ google mail com

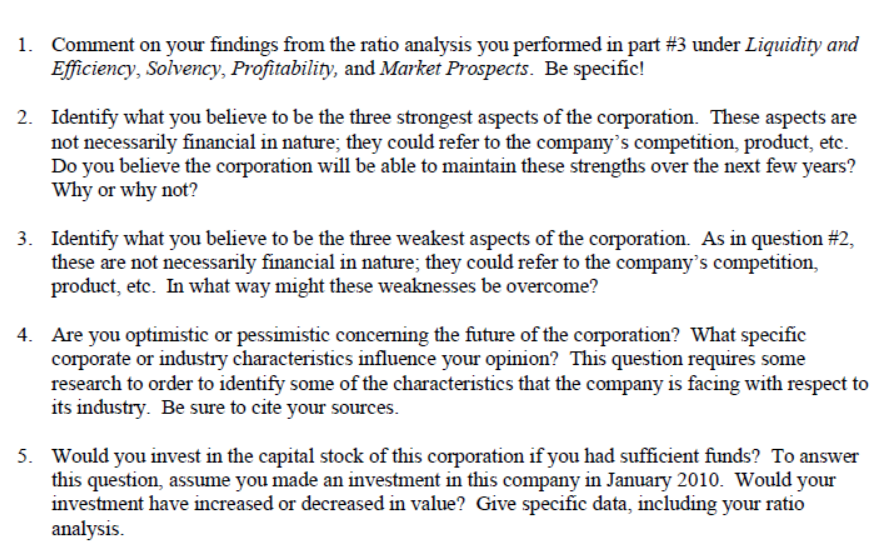

1. Comment on your findings from the ratio analysis you performed in part #3 under Liquidity and Efficiency, Solvency, Profitability, and Market Prospects. Be specific! 2. Identify what you believe to be the three strongest aspects of the corporation. These aspects are not necessarily financial in nature; they could refer to the company's competition, product, etc. Do you believe the corporation will be able to maintain these strengths over the next few years? Why or why not? 3. Identify what you believe to be the three weakest aspects of the corporation. As in question #2, these are not necessarily financial in nature; they could refer to the company's competition, product, etc. In what way might these weaknesses be overcome? 4. Are you optimistic or pessimistic concerning the future of the corporation? What specific corporate or industry characteristics influence your opinion? This question requires some research to order to identify some of the characteristics that the company is facing with respect to its industry. Be sure to cite your sources. 5. Would you invest in the capital stock of this corporation if you had sufficient funds? To answer this question, assume you made an investment in this company in January 2010. Would your investment have increased or decreased in value? Give specific data, including your ratio analysis. 1. Comment on your findings from the ratio analysis you performed in part #3 under Liquidity and Efficiency, Solvency, Profitability, and Market Prospects. Be specific! 2. Identify what you believe to be the three strongest aspects of the corporation. These aspects are not necessarily financial in nature; they could refer to the company's competition, product, etc. Do you believe the corporation will be able to maintain these strengths over the next few years? Why or why not? 3. Identify what you believe to be the three weakest aspects of the corporation. As in question #2, these are not necessarily financial in nature; they could refer to the company's competition, product, etc. In what way might these weaknesses be overcome? 4. Are you optimistic or pessimistic concerning the future of the corporation? What specific corporate or industry characteristics influence your opinion? This question requires some research to order to identify some of the characteristics that the company is facing with respect to its industry. Be sure to cite your sources. 5. Would you invest in the capital stock of this corporation if you had sufficient funds? To answer this question, assume you made an investment in this company in January 2010. Would your investment have increased or decreased in value? Give specific data, including your ratio analysisStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started