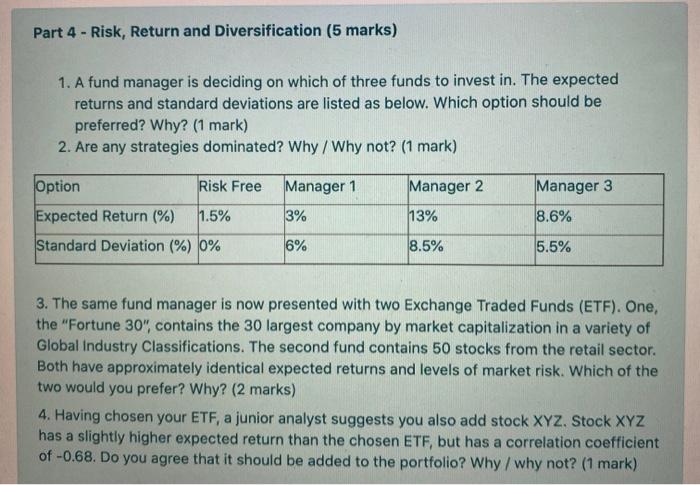

Part 4 - Risk, Return and Diversification (5 marks) 1. A fund manager is deciding on which of three funds to invest in. The expected returns and standard deviations are listed as below. Which option should be preferred? Why? (1 mark) 2. Are any strategies dominated? Why / Why not? (1 mark) Manager 1 Manager 2 Manager 3 Option Risk Free Expected Return (%) 1.5% Standard Deviation (%) 0% 3% 13% 8.6% 6% 8.5% 5.5% 3. The same fund manager is now presented with two Exchange Traded Funds (ETF). One, the "Fortune 30", contains the 30 largest company by market capitalization in a variety of Global Industry Classifications. The second fund contains 50 stocks from the retail sector. Both have approximately identical expected returns and levels of market risk. Which of the two would you prefer? Why? (2 marks) 4. Having chosen your ETF, a junior analyst suggests you also add stock XYZ. Stock XYZ has a slightly higher expected return than the chosen ETF, but has a correlation coefficient of -0.68. Do you agree that it should be added to the portfolio? Why / why not? (1 mark) Part 4 - Risk, Return and Diversification (5 marks) 1. A fund manager is deciding on which of three funds to invest in. The expected returns and standard deviations are listed as below. Which option should be preferred? Why? (1 mark) 2. Are any strategies dominated? Why / Why not? (1 mark) Manager 1 Manager 2 Manager 3 Option Risk Free Expected Return (%) 1.5% Standard Deviation (%) 0% 3% 13% 8.6% 6% 8.5% 5.5% 3. The same fund manager is now presented with two Exchange Traded Funds (ETF). One, the "Fortune 30", contains the 30 largest company by market capitalization in a variety of Global Industry Classifications. The second fund contains 50 stocks from the retail sector. Both have approximately identical expected returns and levels of market risk. Which of the two would you prefer? Why? (2 marks) 4. Having chosen your ETF, a junior analyst suggests you also add stock XYZ. Stock XYZ has a slightly higher expected return than the chosen ETF, but has a correlation coefficient of -0.68. Do you agree that it should be added to the portfolio? Why / why not? (1 mark)