Question

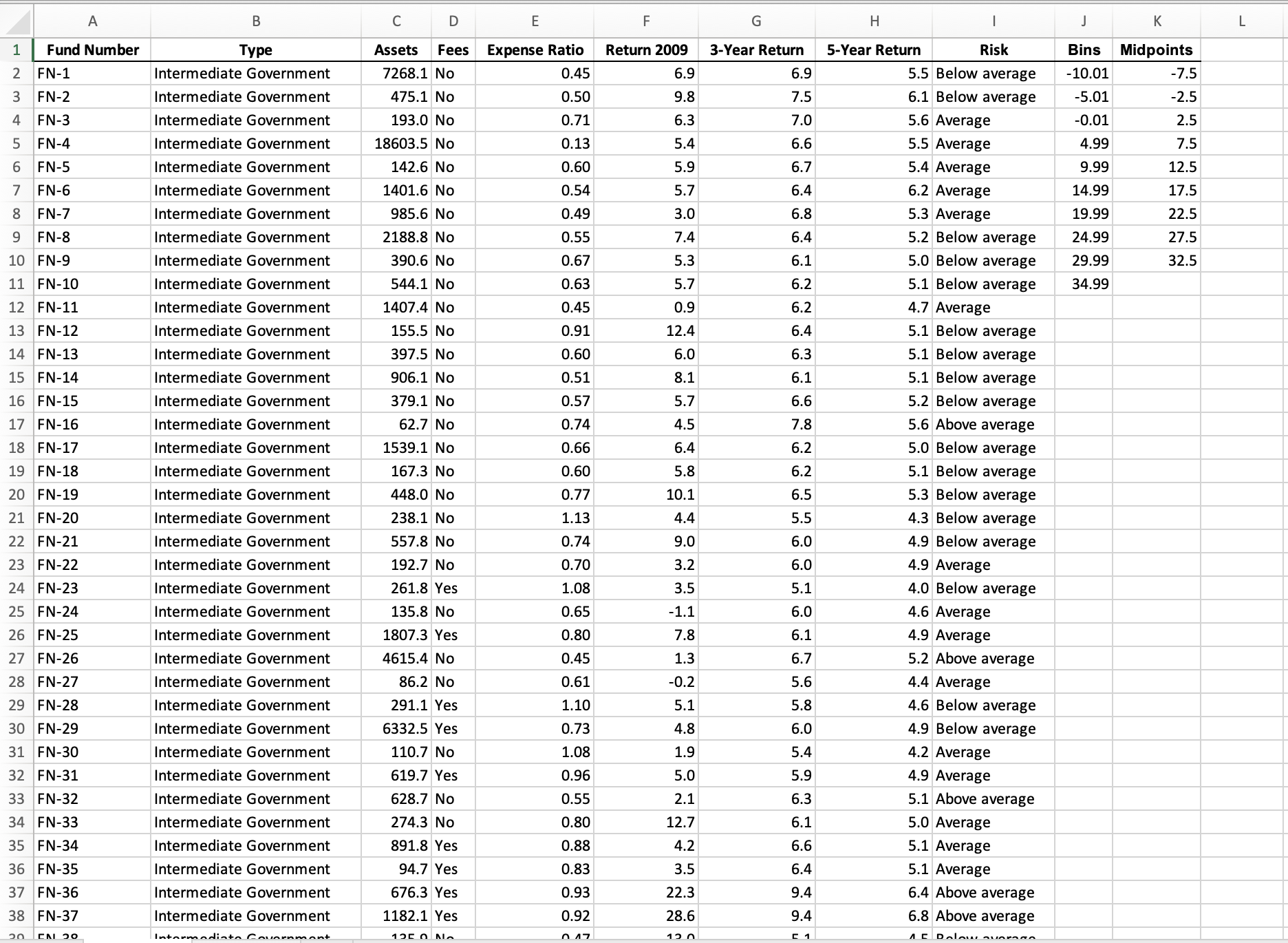

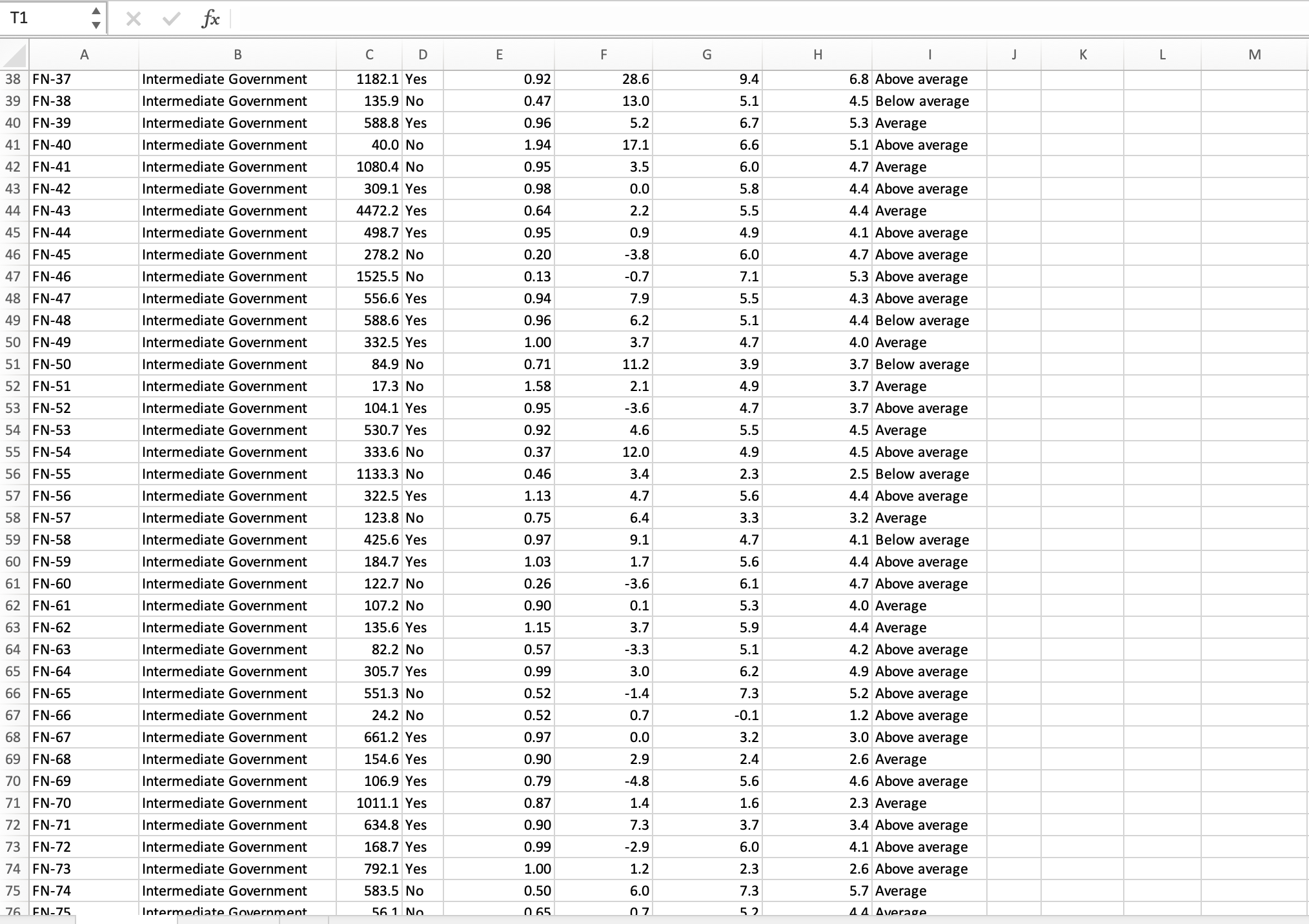

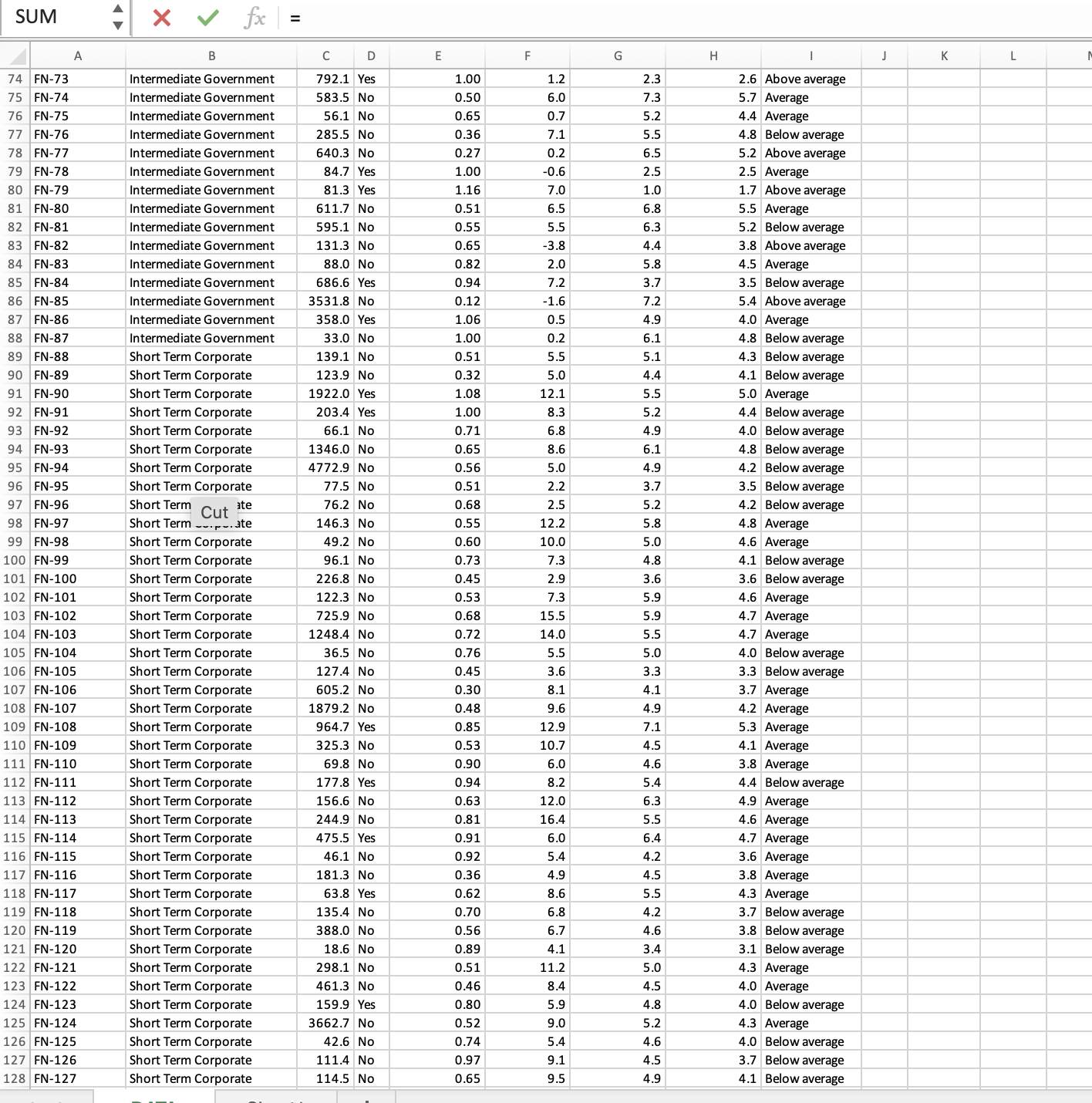

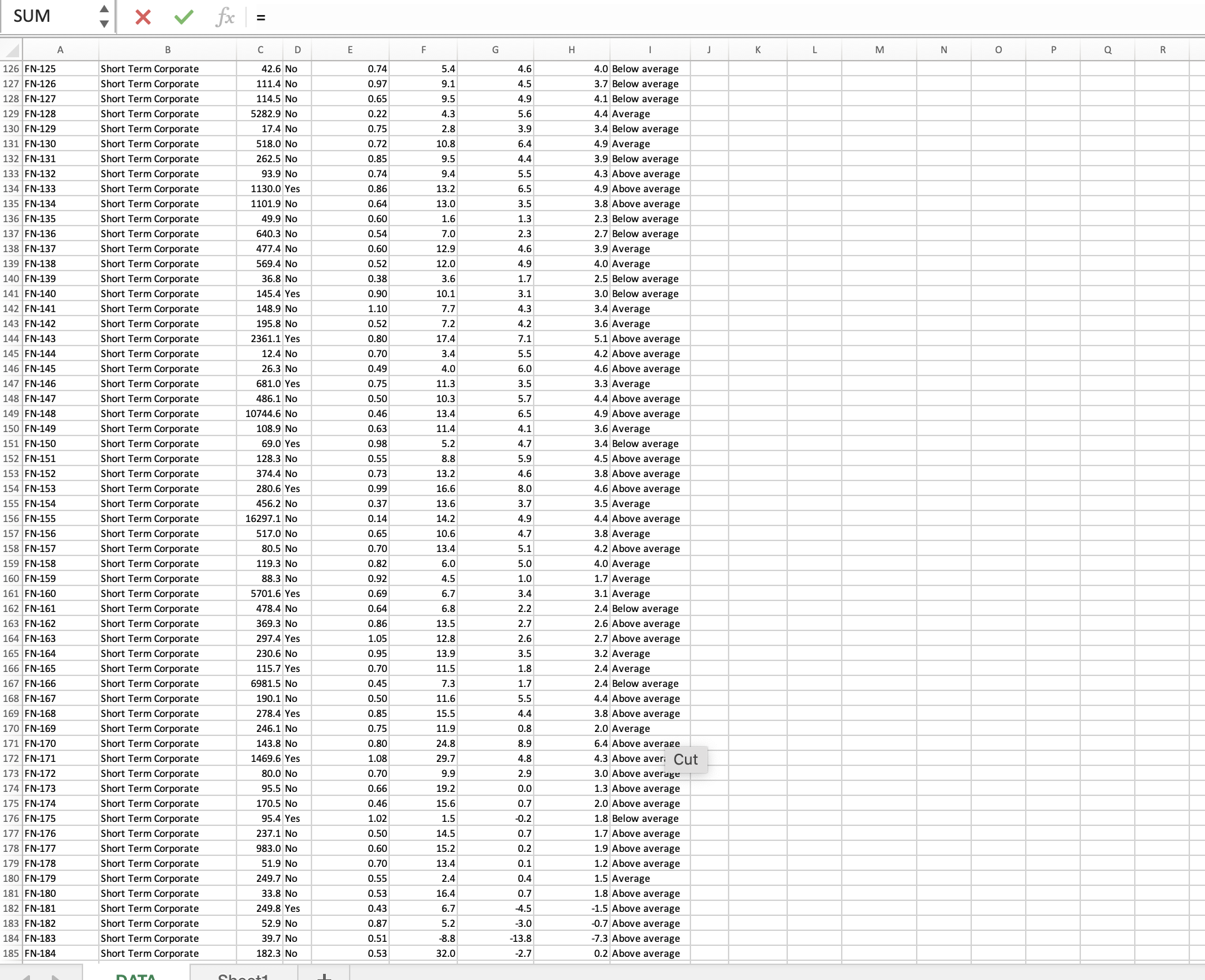

Part 4. The excel data contains information regarding nine variables from a sample of 184 mutual bond funds: Fund numberIdentification number for each bond fund

Part 4.

The excel data contains information regarding nine variables from a sample of 184 mutual bond funds: Fund numberIdentification number for each bond fund TypeBond fund type (intermediate government or short-term corporate) AssetsIn millions of dollars FeesSales charges (no or yes) Expense ratioRatio of expenses to net assets in percentage Return 2009Twelve-month return in 2009 Three-year returnAnnualized return, 20072009 Five-year returnAnnualized return, 20052009 RiskRisk-of-loss factor of the mutual fund (below average, average, or above average)

Create and analyse:

a. Summary Table of levels of risk of bond funds.

b. Contingency Tables displaying type of fund and whether a fee is charged - both based on number of funds and as a percentages of overall total, row total and column totals.

c. Frequency Distributions of the 2009 Return.

d. Relative Frequency Distributions and Percentage Distributions of the 2009 Return.

e. Cumulative Percentage Distributions of the 2009 Return. Pareto chart for this distribution.

f. Bar Chart and Pie Chart of Levels of Risk of Bond Funds.

g. An exploded pie chart, a doughnut chart, a cone chart, and a pyramid chart that shows the risk level of bond funds. Which graphs do you preferthe bar chart or pie chart or the exploded pie chart, doughnut chart, cone chart, or pyramid chart? Explain.

h. Side-by-side bar chart of fund type and whether a fee is charged.

i. Histograms of the 2009 Return for the Intermediate Government and Short-Term Corporate Bond Funds.

j. Percentage Polygons and Cumulative Percentage Polygons of the 2009 Return for the Intermediate Government and Short-Term Corporate Bond Funds.

Please note this problem is more about analysing and "coming up with a story" rather than just creating tables and charts.

Part 5. (Optional)

Using the other variables in the same excel data create tables and charts to gain additional insights into the mutual bond funds.

Again, please note this problem is more about analysing and "coming up with a story" rather than just creating tables and charts. Your tables and charts, for instance, can help to answer such questions as:

- Is there a difference in the returns of intermediate government bond funds and short-term corporate bond funds?

- Do intermediate government bond funds tend to be less risky investments than short-term corporate bond funds?

SUM \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline & A & B & C & D & E & F & G & H & I & J & K & L \\ \hline 74 & FN-73 & Intermediate Government & 792.1 & Yes & 1.00 & 1.2 & 2.3 & 2.6 & Above average & & & \\ \hline 75 & FN-74 & Intermediate Government & 583.5 & No & 0.50 & 6.0 & 7.3 & 5.7 & Average & & & \\ \hline 76 & FN-75 & Intermediate Government & 56.1 & No & 0.65 & 0.7 & 5.2 & 4.4 & Average & & & \\ \hline 77 & FN-76 & Intermediate Government & 285.5 & No & 0.36 & 7.1 & 5.5 & 4.8 & Below average & & & \\ \hline 78 & FN-77 & Intermediate Government & 640.3 & No & 0.27 & 0.2 & 6.5 & 5.2 & Above average & & & \\ \hline 79 & FN-78 & Intermediate Government & 84.7 & Yes & 1.00 & -0.6 & 2.5 & 2.5 & Average & & & \\ \hline 80 & FN-79 & Intermediate Government & 81.3 & Yes & 1.16 & 7.0 & 1.0 & 1.7 & Above average & & & \\ \hline 81 & FN80 & Intermediate Government & 611.7 & No & 0.51 & 6.5 & 6.8 & 5.5 & Average & & & \\ \hline 82 & FN81 & Intermediate Government & 595.1 & No & 0.55 & 5.5 & 6.3 & 5.2 & Below average & & & \\ \hline 83 & FN82 & Intermediate Government & 131.3 & No & 0.65 & -3.8 & 4.4 & 3.8 & Above average & & & \\ \hline 84 & FN83 & Intermediate Government & 88.0 & No & 0.82 & 2.0 & 5.8 & 4.5 & Average & & & \\ \hline 85 & FN-84 & Intermediate Government & 686.6 & Yes & 0.94 & 7.2 & 3.7 & 3.5 & Below average & & & \\ \hline 86 & FN85 & Intermediate Government & 3531.8 & No & 0.12 & -1.6 & 7.2 & 5.4 & Above average & & & \\ \hline 87 & FN-86 & Intermediate Government & 358.0 & Yes & 1.06 & 0.5 & 4.9 & 4.0 & Average & & & \\ \hline 88 & FN-87 & Intermediate Government & 33.0 & No & 1.00 & 0.2 & 6.1 & 4.8 & Below average & & & \\ \hline 89 & FN88 & Short Term Corporate & 139.1 & No & 0.51 & 5.5 & 5.1 & 4.3 & Below average & & & \\ \hline 90 & FN-89 & Short Term Corporate & 123.9 & No & 0.32 & 5.0 & 4.4 & 4.1 & Below average & & & \\ \hline 91 & FN-90 & Short Term Corporate & 1922.0 & Yes & 1.08 & 12.1 & 5.5 & 5.0 & Average & & & \\ \hline 92 & FN-91 & Short Term Corporate & 203.4 & Yes & 1.00 & 8.3 & 5.2 & 4.4 & Below average & & & \\ \hline 93 & FN92 & Short Term Corporate & 66.1 & No & 0.71 & 6.8 & 4.9 & 4.0 & Below average & & & \\ \hline 94 & FN-93 & Short Term Corporate & 1346.0 & No & 0.65 & 8.6 & 6.1 & 4.8 & Below average & & & \\ \hline 95 & FN-94 & Short Term Corporate & 4772.9 & No & 0.56 & 5.0 & 4.9 & 4.2 & Below average & & & \\ \hline 96 & FN-95 & Short Term Corporate & 77.5 & No & 0.51 & 2.2 & 3.7 & 3.5 & Below average & & & \\ \hline 97 & FN-96 & Short Term & 76.2 & No & 0.68 & 2.5 & 5.2 & 4.2 & Below average & & & \\ \hline 98 & FN-97 & Short Term _... . ate & 146.3 & No & 0.55 & 12.2 & 5.8 & 4.8 & Average & & & \\ \hline 99 & FN-98 & Short Term Corporate & 49.2 & No & 0.60 & 10.0 & 5.0 & 4.6 & Average & & & \\ \hline 100 & FN-99 & Short Term Corporate & 96.1 & No & 0.73 & 7.3 & 4.8 & 4.1 & Below average & & & \\ \hline 101 & FN-100 & Short Term Corporate & 226.8 & No & 0.45 & 2.9 & 3.6 & 3.6 & Below average & & & \\ \hline 102 & FN-101 & Short Term Corporate & 122.3 & No & 0.53 & 7.3 & 5.9 & 4.6 & Average & & & \\ \hline 103 & FN-102 & Short Term Corporate & 725.9 & No & 0.68 & 15.5 & 5.9 & 4.7 & Average & & & \\ \hline 104 & FN-103 & Short Term Corporate & 1248.4 & No & 0.72 & 14.0 & 5.5 & 4.7 & Average & & & \\ \hline 105 & FN-104 & Short Term Corporate & 36.5 & No & 0.76 & 5.5 & 5.0 & 4.0 & Below average & & & \\ \hline 106 & FN-105 & Short Term Corporate & 127.4 & No & 0.45 & 3.6 & 3.3 & 3.3 & Below average & & & \\ \hline 107 & FN-106 & Short Term Corporate & 605.2 & No & 0.30 & 8.1 & 4.1 & 3.7 & Average & & & \\ \hline 108 & FN-107 & Short Term Corporate & 1879.2 & No & 0.48 & 9.6 & 4.9 & 4.2 & Average & & & \\ \hline 109 & FN-108 & Short Term Corporate & 964.7 & Yes & 0.85 & 12.9 & 7.1 & 5.3 & Average & & & \\ \hline 110 & FN-109 & Short Term Corporate & 325.3 & No & 0.53 & 10.7 & 4.5 & 4.1 & Average & & & \\ \hline 111 & FN-110 & Short Term Corporate & 69.8 & No & 0.90 & 6.0 & 4.6 & 3.8 & Average & & & \\ \hline 112 & FN-111 & Short Term Corporate & 177.8 & Yes & 0.94 & 8.2 & 5.4 & 4.4 & Below average & & & \\ \hline 113 & FN-112 & Short Term Corporate & 156.6 & No & 0.63 & 12.0 & 6.3 & 4.9 & Average & & & \\ \hline 114 & FN-113 & Short Term Corporate & 244.9 & No & 0.81 & 16.4 & 5.5 & 4.6 & Average & & & \\ \hline 115 & FN-114 & Short Term Corporate & 475.5 & Yes & 0.91 & 6.0 & 6.4 & 4.7 & Average & & & \\ \hline 116 & FN-115 & Short Term Corporate & 46.1 & No & 0.92 & 5.4 & 4.2 & 3.6 & Average & & & \\ \hline 117 & FN-116 & Short Term Corporate & 181.3 & No & 0.36 & 4.9 & 4.5 & 3.8 & Average & & & \\ \hline 118 & FN-117 & Short Term Corporate & 63.8 & Yes & 0.62 & 8.6 & 5.5 & 4.3 & Average & & & \\ \hline 119 & FN-118 & Short Term Corporate & 135.4 & No & 0.70 & 6.8 & 4.2 & 3.7 & Below average & & & \\ \hline 120 & FN-119 & Short Term Corporate & 388.0 & No & 0.56 & 6.7 & 4.6 & 3.8 & Below average & & & \\ \hline 121 & FN-120 & Short Term Corporate & 18.6 & No & 0.89 & 4.1 & 3.4 & 3.1 & Below average & & & \\ \hline 122 & FN-121 & Short Term Corporate & 298.1 & No & 0.51 & 11.2 & 5.0 & 4.3 & Average & & & \\ \hline 123 & FN-122 & Short Term Corporate & 461.3 & No & 0.46 & 8.4 & 4.5 & 4.0 & Average & & & \\ \hline 124 & FN123 & Short Term Corporate & 159.9 & Yes & 0.80 & 5.9 & 4.8 & 4.0 & Below average & & & \\ \hline 125 & FN-124 & Short Term Corporate & 3662.7 & No & 0.52 & 9.0 & 5.2 & 4.3 & Average & & & \\ \hline 126 & FN125 & Short Term Corporate & 42.6 & No & 0.74 & 5.4 & 4.6 & 4.0 & Below average & & & \\ \hline 127 & FN-126 & Short Term Corporate & 111.4 & No & 0.97 & 9.1 & 4.5 & 3.7 & Below average & & & \\ \hline 128 & FN-127 & Short Term Corporate & 114.5 & No & 0.65 & 9.5 & 4.9 & 4.1 & Below average & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline . & A & B & C & D & E & F & G & H & 1 & J & K & L \\ \hline 1 & Fund Number & Type & Assets & Fees & Expense Ratio & Return 2009 & 3-Year Return & 5-Year Return & Risk & Bins & Midpoints & \\ \hline 2 & FN-1 & Intermediate Government & 7268.1 & No & 0.45 & 6.9 & 6.9 & 5.5 & Below average & -10.01 & -7.5 & \\ \hline 3 & FN2 & Intermediate Government & 475.1 & No & 0.50 & 9.8 & 7.5 & 6.1 & Below average & -5.01 & -2.5 & \\ \hline 4 & FN-3 & Intermediate Government & 193.0 & No & 0.71 & 6.3 & 7.0 & 5.6 & Average & -0.01 & 2.5 & \\ \hline 5 & FN-4 & Intermediate Government & 18603.5 & No & 0.13 & 5.4 & 6.6 & 5.5 & Average & 4.99 & 7.5 & \\ \hline 6 & FN-5 & Intermediate Government & 142.6 & No & 0.60 & 5.9 & 6.7 & 5.4 & Average & 9.99 & 12.5 & \\ \hline 7 & FN-6 & Intermediate Government & 1401.6 & No & 0.54 & 5.7 & 6.4 & 6.2 & Average & 14.99 & 17.5 & \\ \hline 8 & FN-7 & Intermediate Government & 985.6 & No & 0.49 & 3.0 & 6.8 & 5.3 & Average & 19.99 & 22.5 & \\ \hline 9 & FN-8 & Intermediate Government & 2188.8 & No & 0.55 & 7.4 & 6.4 & 5.2 & Below average & 24.99 & 27.5 & \\ \hline 10 & FN-9 & Intermediate Government & 390.6 & No & 0.67 & 5.3 & 6.1 & 5.0 & Below average & 29.99 & 32.5 & \\ \hline 11 & FN-10 & Intermediate Government & 544.1 & No & 0.63 & 5.7 & 6.2 & 5.1 & Below average & 34.99 & & \\ \hline 12 & FN-11 & Intermediate Government & 1407.4 & No & 0.45 & 0.9 & 6.2 & 4.7 & Average & & & \\ \hline 13 & FN-12 & Intermediate Government & 155.5 & No & 0.91 & 12.4 & 6.4 & 5.1 & Below average & & & \\ \hline 14 & FN-13 & Intermediate Government & 397.5 & No & 0.60 & 6.0 & 6.3 & 5.1 & Below average & & & \\ \hline 15 & FN-14 & Intermediate Government & 906.1 & No & 0.51 & 8.1 & 6.1 & 5.1 & Below average & & & \\ \hline 16 & FN-15 & Intermediate Government & 379.1 & No & 0.57 & 5.7 & 6.6 & 5.2 & Below average & & & \\ \hline 17 & FN-16 & Intermediate Government & 62.7 & No & 0.74 & 4.5 & 7.8 & 5.6 & Above average & & & \\ \hline 18 & FN-17 & Intermediate Government & 1539.1 & No & 0.66 & 6.4 & 6.2 & 5.0 & Below average & & & \\ \hline 19 & FN-18 & Intermediate Government & 167.3 & No & 0.60 & 5.8 & 6.2 & 5.1 & Below average & & & \\ \hline 20 & FN-19 & Intermediate Government & 448.0 & No & 0.77 & 10.1 & 6.5 & 5.3 & Below average & & & \\ \hline 21 & FN-20 & Intermediate Government & 238.1 & No & 1.13 & 4.4 & 5.5 & 4.3 & Below average & & & \\ \hline 22 & FN-21 & Intermediate Government & 557.8 & No & 0.74 & 9.0 & 6.0 & 4.9 & Below average & & & \\ \hline 23 & FN-22 & Intermediate Government & 192.7 & No & 0.70 & 3.2 & 6.0 & 4.9 & Average & & & \\ \hline 24 & FN23 & Intermediate Government & 261.8 & Yes & 1.08 & 3.5 & 5.1 & 4.0 & Below average & & & \\ \hline 25 & FN-24 & Intermediate Government & 135.8 & No & 0.65 & -1.1 & 6.0 & 4.6 & Average & & & \\ \hline 26 & FN-25 & Intermediate Government & 1807.3 & Yes & 0.80 & 7.8 & 6.1 & 4.9 & Average & & & \\ \hline 27 & FN-26 & Intermediate Government & 4615.4 & No & 0.45 & 1.3 & 6.7 & 5.2 & Above average & & & \\ \hline 28 & FN-27 & Intermediate Government & 86.2 & No & 0.61 & -0.2 & 5.6 & 4.4 & Average & & & \\ \hline 29 & FN-28 & Intermediate Government & 291.1 & Yes & 1.10 & 5.1 & 5.8 & 4.6 & Below average & & & \\ \hline 30 & FN-29 & Intermediate Government & 6332.5 & Yes & 0.73 & 4.8 & 6.0 & 4.9 & Below average & & & \\ \hline 31 & FN-30 & Intermediate Government & 110.7 & No & 1.08 & 1.9 & 5.4 & 4.2 & Average & & & \\ \hline 32 & FN-31 & Intermediate Government & 619.7 & Yes & 0.96 & 5.0 & 5.9 & 4.9 & Average & & & \\ \hline 33 & FN-32 & Intermediate Government & 628.7 & No & 0.55 & 2.1 & 6.3 & 5.1 & Above average & & & \\ \hline 34 & FN-33 & Intermediate Government & 274.3 & No & 0.80 & 12.7 & 6.1 & 5.0 & Average & & & \\ \hline 35 & FN-34 & Intermediate Government & 891.8 & Yes & 0.88 & 4.2 & 6.6 & 5.1 & Average & & & \\ \hline 36 & FN-35 & Intermediate Government & 94.7 & Yes & 0.83 & 3.5 & 6.4 & 5.1 & Average & & & \\ \hline 37 & FN-36 & Intermediate Government & 676.3 & Yes & 0.93 & 22.3 & 9.4 & 6.4 & Above average & & & \\ \hline 38 & FN-37 & Intermediate Government & 1182.1 & Yes & 0.92 & 28.6 & 9.4 & 6.8 & Above average & & & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started