Answered step by step

Verified Expert Solution

Question

1 Approved Answer

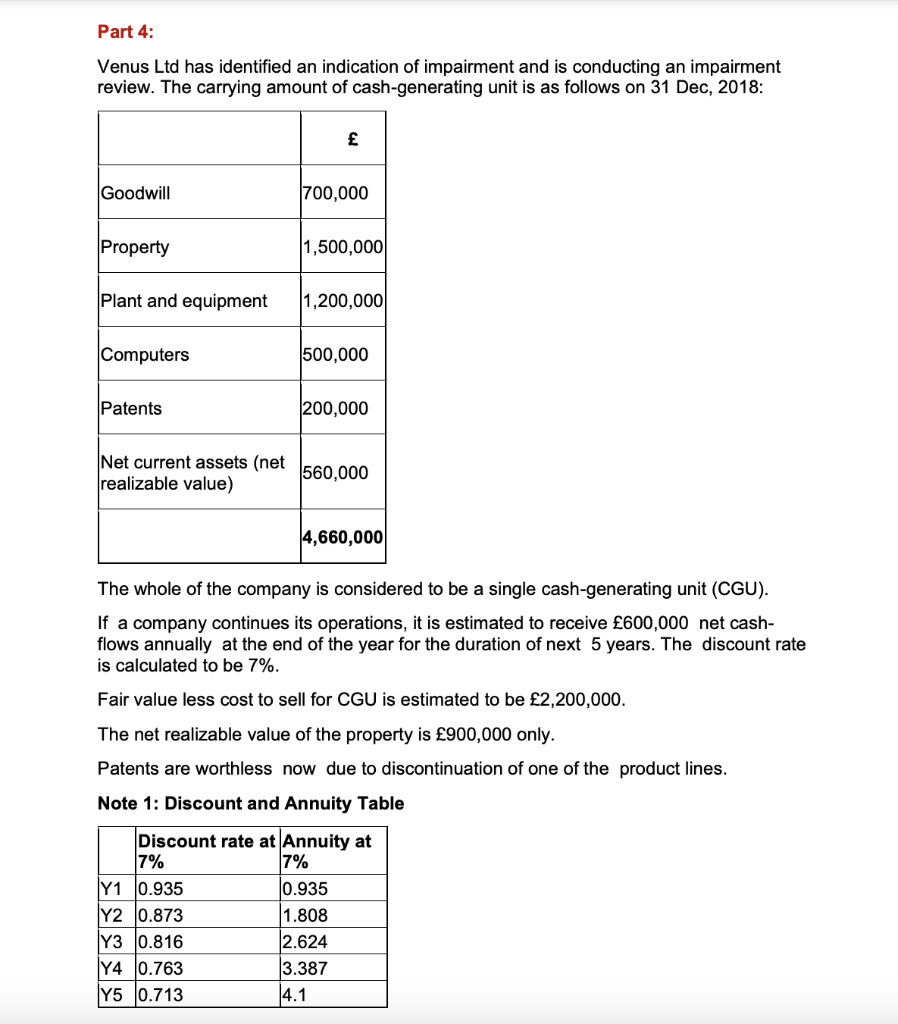

Part 4: Venus Ltd has identified an indication of impairment and is conducting an impairment review. The carrying amount of cash-generating unit is as

Part 4: Venus Ltd has identified an indication of impairment and is conducting an impairment review. The carrying amount of cash-generating unit is as follows on 31 Dec, 2018: Goodwill 700,000 Property 1,500,000 Plant and equipment 1,200,000 Computers 500,000 Patents 200,000 Net current assets (net realizable value) 560,000 4,660,000 The whole of the company is considered to be a single cash-generating unit (CGU). If a company continues its operations, it is estimated to receive 600,000 net cash- flows annually at the end of the year for the duration of next 5 years. The discount rate is calculated to be 7%. Fair value less cost to sell for CGU is estimated to be 2,200,000. The net realizable value of the property is 900,000 only. Patents are worthless now due to discontinuation of one of the product lines. Note 1: Discount and Annuity Table Discount rate at Annuity at 7% 0.935 1.808 2.624 3.387 4.1 7% Y1 0.935 Y2 0.873 Y3 0.816 Y4 0.763 Y5 0.713

Step by Step Solution

★★★★★

3.43 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Impairment loss Carrying value of CGU recoverable value of the CGU Recoverable value of the CGU high...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started