Question

Far East Limited invested in three different SPPI debt securities in its portfolios in December 2020. The purposes of holding securities are held for

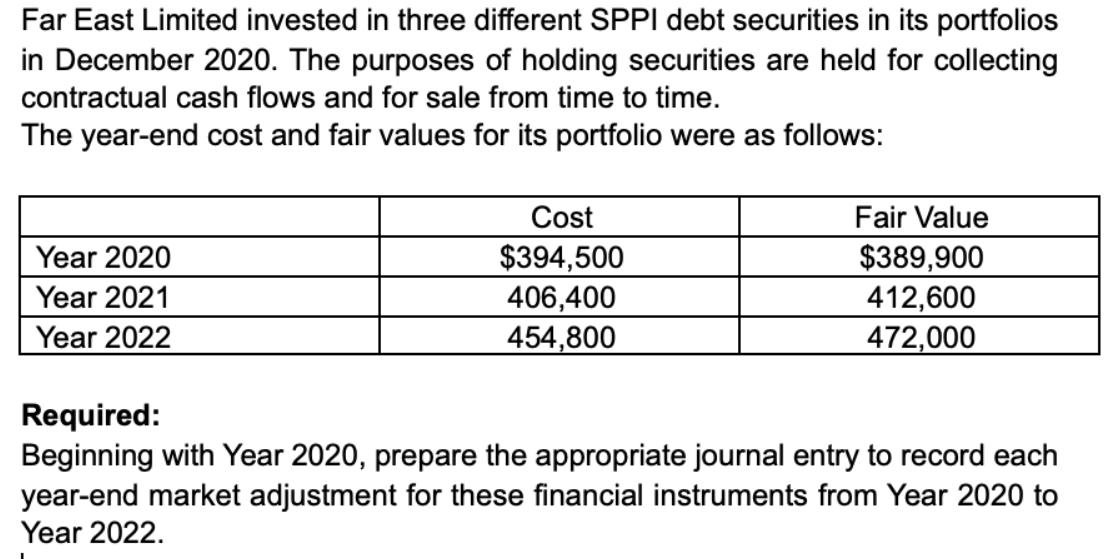

Far East Limited invested in three different SPPI debt securities in its portfolios in December 2020. The purposes of holding securities are held for collecting contractual cash flows and for sale from time to time. The year-end cost and fair values for its portfolio were as follows: Cost Fair Value $394,500 406,400 454,800 $389,900 412,600 472,000 Year 2020 Year 2021 Year 2022 Required: Beginning with Year 2020, prepare the appropriate journal entry to record each year-end market adjustment for these financial instruments from Year 2020 to Year 2022.

Step by Step Solution

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer PART A Far fast Timited Proft I lou Ale 7o gnvert ment im sec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Tools for Business Decision Making

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso, Barbara Trenholm, Wayne Irvine

7th Canadian edition

1119368456, 978-1119211587, 1119211581, 978-1119320623, 978-1119368458

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App