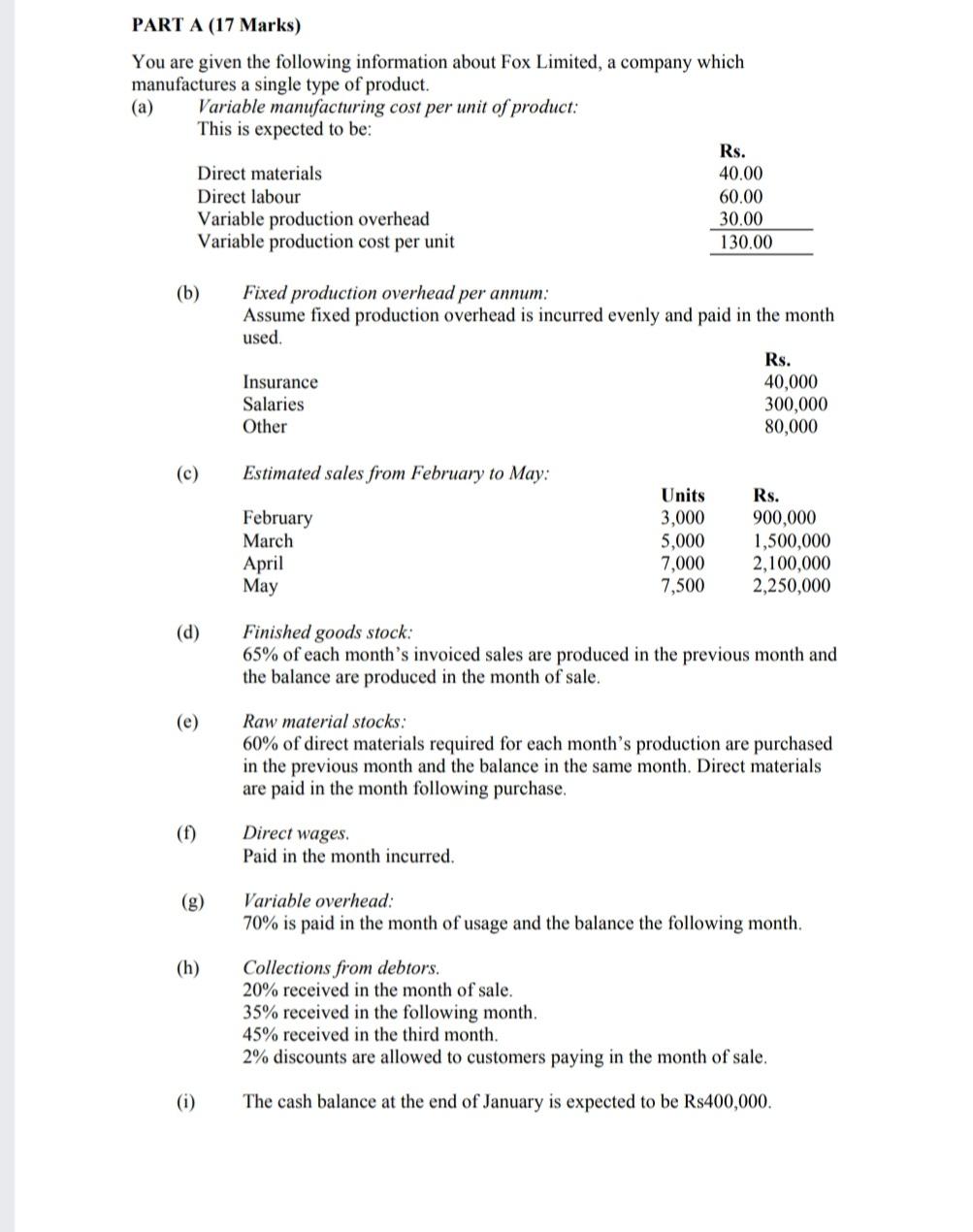

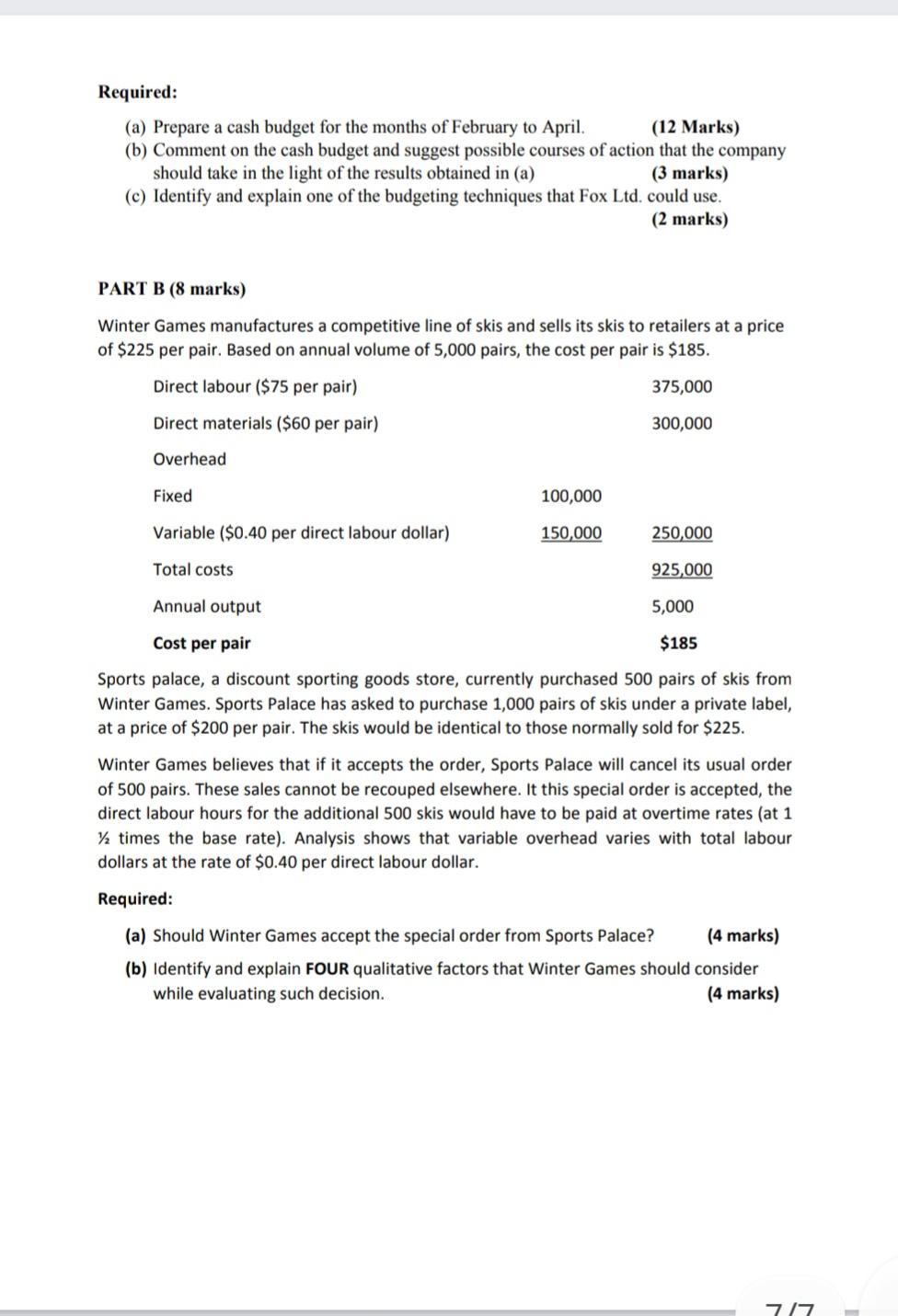

PART A (17 Marks) You are given the following information about Fox Limited, a company which manufactures a single type of product. (a) Variable manufacturing cost per unit of product: This is expected to be: Rs. Direct materials 40.00 Direct labour 60.00 Variable production overhead 30.00 Variable production cost per unit 130.00 (b) Fixed production overhead per annum: Assume fixed production overhead is incurred evenly and paid in the month used. Rs. Insurance 40,000 Salaries 300,000 Other 80,000 (c) Estimated sales from February to May: February March April May Units 3,000 5,000 7,000 7,500 Rs. 900,000 1,500,000 2,100,000 2,250,000 (d) Finished goods stock: 65% of each month's invoiced sales are produced in the previous month and the balance are produced in the month of sale. (e) Raw material stocks: 60% of direct materials required for each month's production are purchased in the previous month and the balance in the same month. Direct materials are paid in the month following purchase. (f) Direct wages. Paid in the month incurred. (g) Variable overhead: 70% is paid in the month of usage and the balance the following month. (h) Collections from debtors. 20% received in the month of sale. 35% received in the following month, 45% received in the third month. 2% discounts are allowed to customers paying in the month of sale. The cash balance at the end of January is expected to be Rs400,000. Required: (a) Prepare a cash budget for the months of February to April. (12 Marks) (b) Comment on the cash budget and suggest possible courses of action that the company should take in the light of the results obtained in (a) (3 marks) (c) Identify and explain one of the budgeting techniques that Fox Ltd. could use. (2 marks) PART B (8 marks) Winter Games manufactures a competitive line of skis and sells its skis to retailers at a price of $225 per pair. Based on annual volume of 5,000 pairs, the cost per pair is $185. Direct labour ($75 per pair) 375,000 Direct materials ($60 per pair) 300,000 Overhead Fixed 100,000 Variable ($0.40 per direct labour dollar) 150,000 250,000 Total costs 925,000 Annual output 5,000 Cost per pair $185 Sports palace, a discount sporting goods store, currently purchased 500 pairs of skis from Winter Games. Sports Palace has asked to purchase 1,000 pairs of skis under a private label, at a price of $200 per pair. The skis would be identical to those normally sold for $225. Winter Games believes that if it accepts the order, Sports Palace will cancel its usual order of 500 pairs. These sales cannot be recouped elsewhere. It this special order is accepted, the direct labour hours for the additional 500 skis would have to be paid at overtime rates (at 1 12 times the base rate). Analysis shows that variable overhead varies with total labour dollars at the rate of $0.40 per direct labour dollar. Required: (a) Should Winter Games accept the special order from Sports Palace? (4 marks) (b) Identify and explain FOUR qualitative factors that Winter Games should consider while evaluating such decision. (4 marks) 717