Question

Part A (25 marks) Please find attached a multi-year Income Statement (Appendix A1) and multi-year Balance Sheet (Appendix A2) for Canadian Motorbikes. This company is

Part A (25 marks)

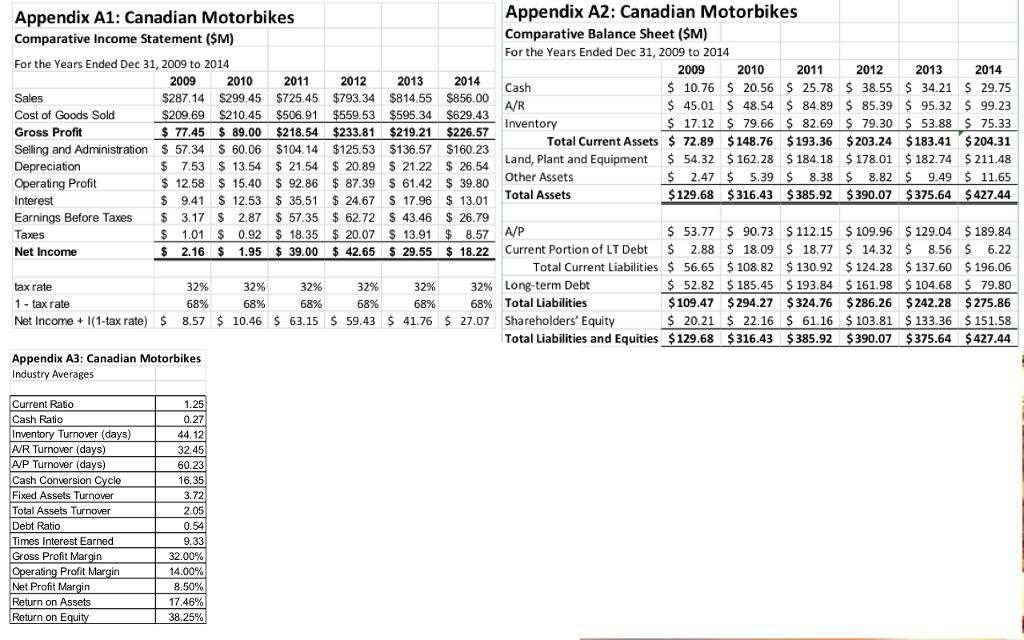

Please find attached a multi-year Income Statement (Appendix A1) and multi-year Balance Sheet (Appendix A2) for Canadian Motorbikes. This company is a (fictional) motorcycle manufacturer that brought on a new CEO in 2012. You work for an investment company that is considering investing in the motorcycle company – and, if the investment is made, whether or not to retain the CEO. You are part of a team that is evaluating the performance of the company. Your job is to calculate and interpret important financial ratios and to make comments to help make a decision on whether or not to invest. Appendix A3 contains financial ratio averages for all companies in the industry. This should be useful.

Please use the information in Appendix A1 to A3 to do the following:

Calculate the Current Ratio, Debt Ratio, Return on Assets (ROA) and Return on Equity (ROE). For the ROA and ROE, you should use the average total assets and the average total equity in your calculations. (The average is the total across two years divided by two). Calculate these values for each of 2011-2014. Interpret your calculations: what does this information mean? How is the company doing? (16 marks)

Calculate ratios related to how quickly the company pays its trade debt and how quickly it collects from its customers. These are known as Accounts Payable (AP) Turnover and Accounts Receivable (AR) Turnover. The formula for AP Turnover is: Cost of Goods Sold/average accounts payable. The formula for AR Turnover is: credit sales/average accounts receivable. Calculate the AP and AR Turnover for each of 2011-2014. Interpret your calculations: what does this information mean? How is the company doing? (9 marks)

Appendix A1: Canadian Motorbikes Appendix A2: Canadian Motorbikes Comparative Balance Sheet ($M) For the Years Ended Dec 31, 2009 to 2014 Comparative Income Statement (SM) For the Years Ended Dec 31, 2009 to 2014 2009 2009 2010 2011 2012 2013 2014 2010 2011 2012 2013 2014 $ 10.76 $ 20.56 $ 25.78 $ 38.55 $ 34.21 $ 29.75 $ 45.01 $ 48.54 $ 84.89 $ 85.39 $ 95.32 $ 99.23 $ 17.12 $ 79.66 $ 82.69 $ 79.30 $ 53.88 $ 75.33 Cash Sales $287.14 $299.45 $725.45 $793.34 $814.55 $856.00 A/R R Cost of Goods Sold $209.69 $210.45 $506.91 $559.53 $595.34 $629.43 Inventory Gross Profit $ 77.45 $ 89.00 $218.54 $233.81 $219.21 $226.57 Total Current Assets $ 72.89 $ 148.76 $193.36 $203.24 $183.41 $ 204.31 Selling and Administration $ 57.34 $ 60.06 Depreciation Operating Profit $104.14 $125.53 $136.57 $160.23 $ 20.89 S 21.22 $ 26 54 Land, Plant and Equipment $ 54.32 $ 162.28 $ 184.18 $ 178.01 $ 182.74 $ 211.48 $ 2.47 $ 5.39 $ 8.38 $ 8.82 $ 9.49 $ 11.65 $ 7.53 $ 13.54 $ 21.54 $ 12.58 $ 15.40 $ 92.86 $ 87.39 $ 61.42 $ 39.80 Other Assets $ 9.41 $ 12.53 $ 35.51 $ 24.67 $ 17,96 $ 13.01 Total Assets $ 3.17 $ 2.87 $ 57.35 $ 62.72 $ 43.46 $ 26.79 $ 1.01 $ 0.92 $ 18.35 $ 20.07 $ 13.91 $ 8.57 A/P $ 2.16 $ $129.68 $316.43 $385.92 $390.07 $375.64 $427.44 Interest Earnings Before Taxes $ 53.77 $ 90.73 $ 112.15 $ 109.96 $ 129.04 $ 189.84 1.95 $ 39.00 $ 42.65 $ 29.55 $ 18.22 Current Portion of LT Debt $ 2.88 $ 18.09 $ 18.77 $ 14.32 $ 8.56 $ 6.22 Total Current Liabilities $ 56.65 $ 108.82 $ 130.92 $ 124.28 $ 137.60 $ 196.06 $ 52.82 $ 185.45 $ 193.84 $ 161.98 $ 104.68 $ 79.80 Taxes Net Income 32% Long-term Debt 68% Total Liabilities tax rate 32% 32% 32% 32% 32% 1- tax rate Net Income + 1(1-tax rate) $ 8.57 $ 10.46 $ 63.15 $ 59.43 $ 41.76 $ 27.07 Shareholders' Equity $109.47 $ 294.27 $324.76 $286.26 $242.28 $275.86 $ 20.21 $ 22.16 $ 61.16 $ 103.81 $ 133.36 $ 151.58 68% 68% 68% 68% 68% Total Liabilities and Equities $129.68 $316.43 $ 385.92 $390.07 $375.64 $427.44 Appendix A3: Canadian Motorbikes Industry Averages Current Ratio Cash Ratio Inventory Turnover (days) A/R Turnover (days) A/P Turnover (days) Cash Conversion Cycle Fixed Assets Turnover Total Assets Turnover Debt Ratio Times Interest Earned Gross Profit Margin 1.25 0.27 44. 12 32.45 60.23 16.35 3.72 2.05 0.54 9.33 32.00% Operating Profit Margin Net Profit Margin Return on Assets 14.00% 8.50% 17.46% 38.25% Return on Equity

Step by Step Solution

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

All amount are calculated as Dollars Current Ratio Current Assets Current liabilities 2011 1933613092 1481 2012 2032412428 1641 2013 1834113760 1331 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6365c1c4bb4d6_240522.pdf

180 KBs PDF File

6365c1c4bb4d6_240522.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started