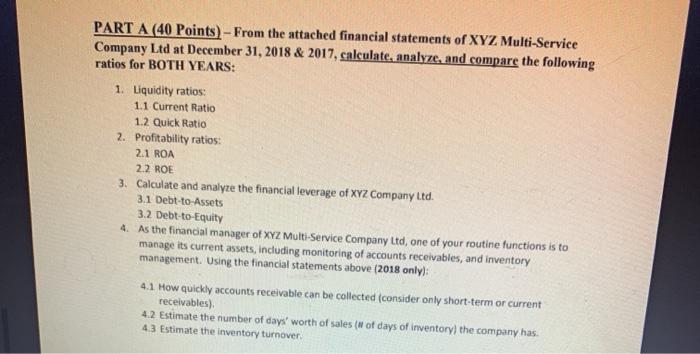

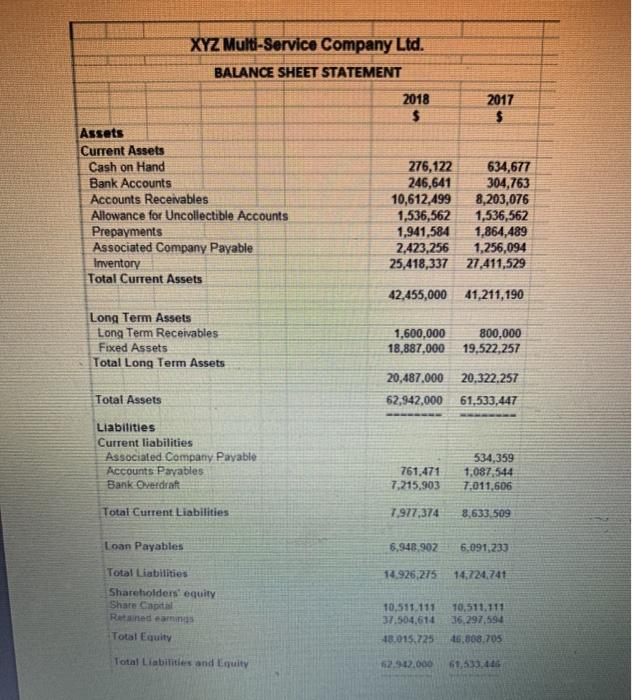

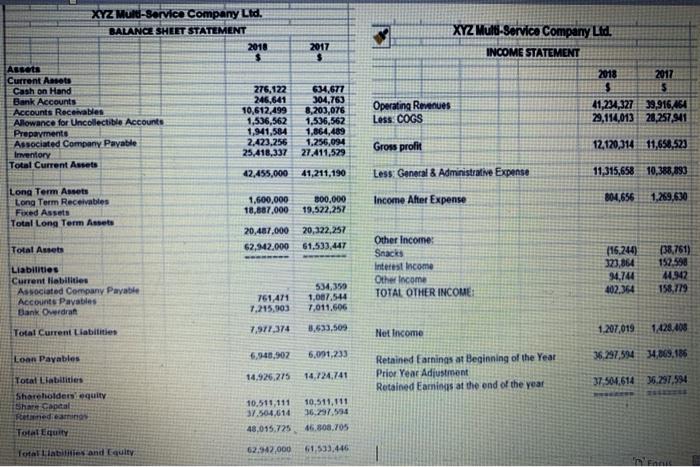

PART A (40 Points) - From the attached financial statements of XYZ Multi-Service Company Ltd at December 31, 2018 & 2017, calculate, analyze, and compare the following ratios for BOTH YEARS: 1. Liquidity ratios: 1.1 Current Ratio 1.2 Quick Ratio 2. Profitability ratios 2.1 ROA 22 ROE 3. Calculate and analyze the financial leverage of XYZ Company Ltd. 3.1 Debt-to-Assets 3.2 Debt-to-Equity 4. As the financial manager of XYZ Multi-Service Company Ltd, one of your routine functions is to manage its current assets, including monitoring of accounts receivables, and inventory management. Using the financial statements above (2018 only): 4.1 How quickly accounts receivable can be collected (consider only short-term or current receivables) 4.2 Estimate the number of days' worth of sales (# of days of inventory) the company has. 43 Estimate the inventory turnover XYZ Multi-Service Company Ltd. BALANCE SHEET STATEMENT 2018 $ 2017 $ Assets Current Assets Cash on Hand Bank Accounts Accounts Receivables Allowance for Uncollectible Accounts Prepayments Associated Company Payable Inventory Total Current Assets 276,122 634,677 246,641 304,763 10,612,499 8,203,076 1,536,562 1,536,562 1,941,584 1,864,489 2.423,256 1,256,094 25,418,337 27.411,529 42,455,000 41,211,190 Long Term Assets Long Term Receivables Fixed Assets Total Long Term Assets 1,600,000 18,887,000 800,000 19,522,257 20,487.000 20.322.257 62,942,000 61,533,447 Total Assets Liabilities Current liabilities Associated Company Pavable Accounts Payables Bank Overdraft 761.471 7,215,903 534,359 1,087,544 7,011,606 Total Current Liabilities 7.977,374 8.633 509 Loan Payables 6.948.902 6,091,233 14.926 275 14,724,741 Total Liabilities Shareholders' equity Share Capital 10,511.111 37.504.614 18.015.725 10.511.111 36,297,594 Total Equity 16.308.705 Total Liabilities and Equity 12.9 12.000 61.533. 2017 $ XYZ Multi-Service Company Lid. INCOME STATEMENT 2018 2017 $ $ Operating Revenues 41,234,327 39,916,454 Less COGS 29,114,013 28,257,941 XYZ Mull-Service Company Ltd. BALANCE SHEET STATEMENT 2010 $ Assets Current Assets Cash on Hand 276,122 Bank Accounts 246,641 Accounts Receivables 10,612,499 Allowance for Uncollectible Accounts 1,536,562 Prepayments 1,941,584 Associated Company Payable 2.423,256 Inventory 25,418,337 Total Current Assets 42,455,000 Long Term Assets Long Term Receivables 1,600,000 Fixed Assets 18.887.000 Total Long Term Assets 20,487.000 Total Assets 62.142.000 634.677 304,763 8,203,076 1,536,562 1,864,489 1.256,094 27.411,529 41,211,190 Gross profit 12,120,314 11,658,523 Less General & Administrative Expense 11,315,658 10,388,893 B04.656 Income After Expense 300.000 19,522,257 1.269,630 20,322,257 61,533.447 Liabilities Current liabilities Associated Company Payable Accounts Payables Bank Overdran Other Income: Snacks Interest Income Other come TOTAL OTHER INCOME: 116.244) 373,864 94,744 402,364 138.761) 152.598 44.942 158,779 761,471 7,215,903 534,359 1,087,544 7,011,606 7.977,374 Total Current Liabilities 3,633,503 1.207,019 1.428,408 Net Income 6.940,907 6,091,233 Loan Payables 36, 297,594 34.069,186 14.926,275 Total Liabilities Retained Earnings at Beginning of the Year Prior Year Adjustment Retained Earnings at the end of the year 14,724,741 37.504.614 36.297,594 Shareholders equity Sharr Captal Feeding Total Equity 10.511,111 37.504,614 48.015.725 10,511,111 36,297.990 46.808.705 Total liabilies and Equity 62.542.000 61,533,446 'n