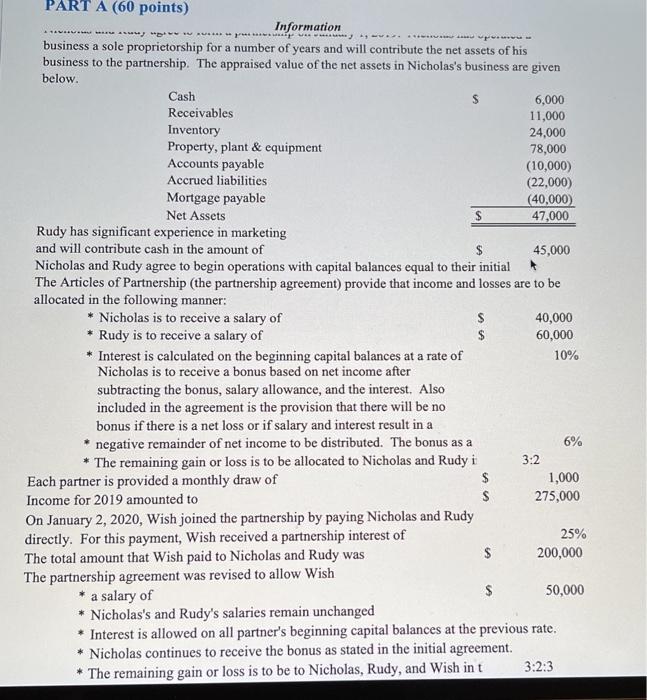

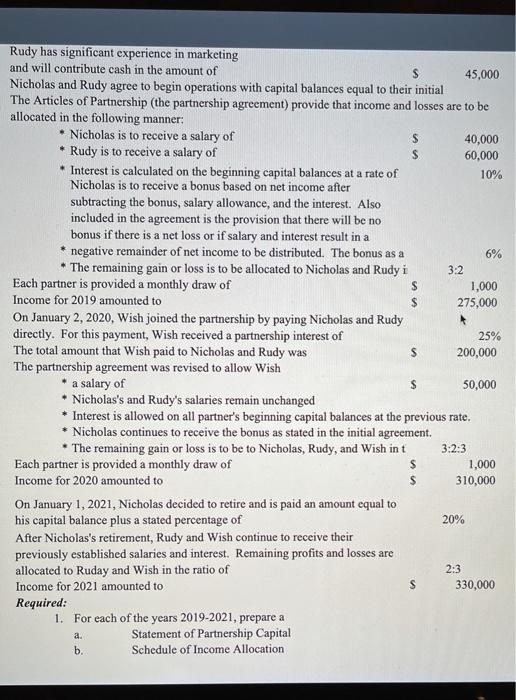

PART A (60 points) ... - * * Information business a sole proprietorship for a number of years and will contribute the net assets of his business to the partnership. The appraised value of the net assets in Nicholas's business are given below. Cash $ 6,000 Receivables 11,000 Inventory 24,000 Property, plant & equipment 78,000 Accounts payable (10,000) Accrued liabilities (22,000) Mortgage payable (40,000) Net Assets 47,000 Rudy has significant experience in marketing and will contribute cash in the amount of 45,000 Nicholas and Rudy agree to begin operations with capital balances equal to their initial The Articles of Partnership (the partnership agreement) provide that income and losses are to be allocated in the following manner: * Nicholas is to receive a salary of $ 40,000 * Rudy is to receive a salary of $ 60,000 * Interest is calculated on the beginning capital balances at a rate of 10% Nicholas is to receive a bonus based on net income after subtracting the bonus, salary allowance, and the interest. Also included in the agreement is the provision that there will be no bonus if there is a net loss or if salary and interest result in a negative remainder of net income to be distributed. The bonus as a 6% * The remaining gain or loss is to be allocated to Nicholas and Rudy i 3:2 Each partner is provided a monthly draw of $ 1,000 Income for 2019 amounted to $ 275,000 On January 2, 2020, Wish joined the partnership by paying Nicholas and Rudy directly. For this payment, Wish received a partnership interest of 25% The total amount that Wish paid to Nicholas and Rudy was 200,000 The partnership agreement was revised to allow Wish a salary of 50,000 * Nicholas's and Rudy's salaries remain unchanged * Interest is allowed on all partner's beginning capital balances at the previous rate. * Nicholas continues to receive the bonus as stated in the initial agreement. 3:2:3 * The remaining gain or loss is to be to Nicholas, Rudy, and Wish int $ + 3:2 Rudy has significant experience in marketing and will contribute cash in the amount of 45,000 Nicholas and Rudy agree to begin operations with capital balances equal to their initial The Articles of Partnership (the partnership agreement) provide that income and losses are to be allocated in the following manner: Nicholas is to receive a salary of S 40,000 Rudy is to receive a salary of S 60,000 Interest is calculated on the beginning capital balances at a rate of 10% Nicholas is to receive a bonus based on net income after subtracting the bonus, salary allowance, and the interest. Also included in the agreement is the provision that there will be no bonus if there is a net loss or if salary and interest result in a * negative remainder of net income to be distributed. The bonus as a 6% * The remaining gain or loss is to be allocated to Nicholas and Rudy i Each partner is provided a monthly draw of 1,000 Income for 2019 amounted to $ 275,000 On January 2, 2020, Wish joined the partnership by paying Nicholas and Rudy directly. For this payment, Wish received a partnership interest of 25% The total amount that Wish paid to Nicholas and Rudy was S 200,000 The partnership agreement was revised to allow Wish * a salary of $ 50,000 * Nicholas's and Rudy's salaries remain unchanged * Interest is allowed on all partner's beginning capital balances at the previous rate. * Nicholas continues to receive the bonus as stated in the initial agreement. The remaining gain or loss is to be to Nicholas, Rudy, and Wish int 3:2:3 Each partner is provided a monthly draw of $ 1,000 Income for 2020 amounted to $ 310,000 On January 1, 2021, Nicholas decided to retire and is paid an amount equal to his capital balance plus a stated percentage of 20% After Nicholas's retirement, Rudy and Wish continue to receive their previously established salaries and interest. Remaining profits and losses are allocated to Ruday and Wish in the ratio of Income for 2021 amounted to 330,000 Required: 1. For each of the years 2019-2021, prepare a Statement of Partnership Capital b. Schedule of Income Allocation 2:3 s a. PART A (60 points) ... - * * Information business a sole proprietorship for a number of years and will contribute the net assets of his business to the partnership. The appraised value of the net assets in Nicholas's business are given below. Cash $ 6,000 Receivables 11,000 Inventory 24,000 Property, plant & equipment 78,000 Accounts payable (10,000) Accrued liabilities (22,000) Mortgage payable (40,000) Net Assets 47,000 Rudy has significant experience in marketing and will contribute cash in the amount of 45,000 Nicholas and Rudy agree to begin operations with capital balances equal to their initial The Articles of Partnership (the partnership agreement) provide that income and losses are to be allocated in the following manner: * Nicholas is to receive a salary of $ 40,000 * Rudy is to receive a salary of $ 60,000 * Interest is calculated on the beginning capital balances at a rate of 10% Nicholas is to receive a bonus based on net income after subtracting the bonus, salary allowance, and the interest. Also included in the agreement is the provision that there will be no bonus if there is a net loss or if salary and interest result in a negative remainder of net income to be distributed. The bonus as a 6% * The remaining gain or loss is to be allocated to Nicholas and Rudy i 3:2 Each partner is provided a monthly draw of $ 1,000 Income for 2019 amounted to $ 275,000 On January 2, 2020, Wish joined the partnership by paying Nicholas and Rudy directly. For this payment, Wish received a partnership interest of 25% The total amount that Wish paid to Nicholas and Rudy was 200,000 The partnership agreement was revised to allow Wish a salary of 50,000 * Nicholas's and Rudy's salaries remain unchanged * Interest is allowed on all partner's beginning capital balances at the previous rate. * Nicholas continues to receive the bonus as stated in the initial agreement. 3:2:3 * The remaining gain or loss is to be to Nicholas, Rudy, and Wish int $ + 3:2 Rudy has significant experience in marketing and will contribute cash in the amount of 45,000 Nicholas and Rudy agree to begin operations with capital balances equal to their initial The Articles of Partnership (the partnership agreement) provide that income and losses are to be allocated in the following manner: Nicholas is to receive a salary of S 40,000 Rudy is to receive a salary of S 60,000 Interest is calculated on the beginning capital balances at a rate of 10% Nicholas is to receive a bonus based on net income after subtracting the bonus, salary allowance, and the interest. Also included in the agreement is the provision that there will be no bonus if there is a net loss or if salary and interest result in a * negative remainder of net income to be distributed. The bonus as a 6% * The remaining gain or loss is to be allocated to Nicholas and Rudy i Each partner is provided a monthly draw of 1,000 Income for 2019 amounted to $ 275,000 On January 2, 2020, Wish joined the partnership by paying Nicholas and Rudy directly. For this payment, Wish received a partnership interest of 25% The total amount that Wish paid to Nicholas and Rudy was S 200,000 The partnership agreement was revised to allow Wish * a salary of $ 50,000 * Nicholas's and Rudy's salaries remain unchanged * Interest is allowed on all partner's beginning capital balances at the previous rate. * Nicholas continues to receive the bonus as stated in the initial agreement. The remaining gain or loss is to be to Nicholas, Rudy, and Wish int 3:2:3 Each partner is provided a monthly draw of $ 1,000 Income for 2020 amounted to $ 310,000 On January 1, 2021, Nicholas decided to retire and is paid an amount equal to his capital balance plus a stated percentage of 20% After Nicholas's retirement, Rudy and Wish continue to receive their previously established salaries and interest. Remaining profits and losses are allocated to Ruday and Wish in the ratio of Income for 2021 amounted to 330,000 Required: 1. For each of the years 2019-2021, prepare a Statement of Partnership Capital b. Schedule of Income Allocation 2:3 s a