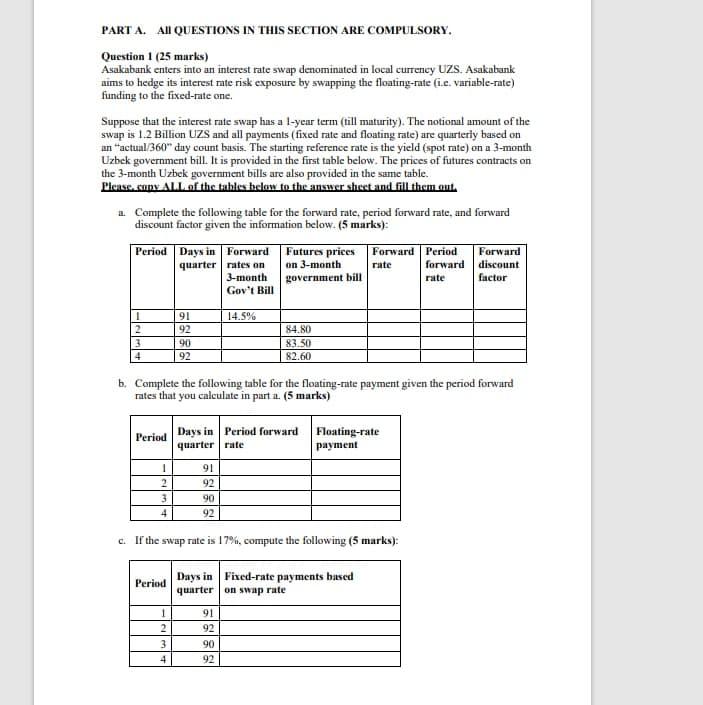

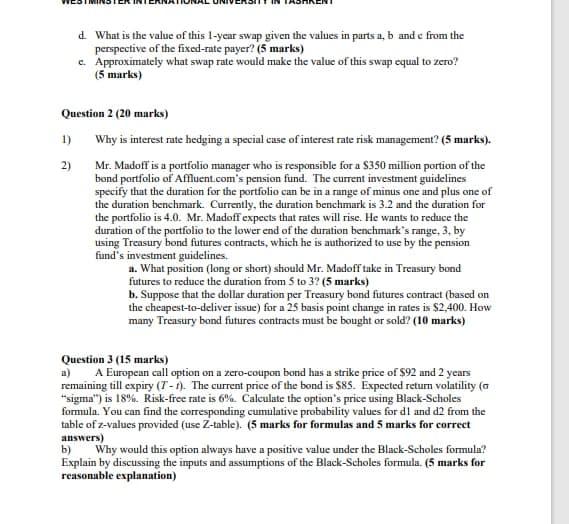

PART A. A QUESTIONS IN THIS SECTION ARE COMPULSORY. Question 1 (25 marks) Asakabank enters into an interest rate swap denominated in local currency UZS. Asakabunk aims to hedge its interest rate risk exposure by swapping the floating-rate (i.e. variable-rate) funding to the fixed-rate one Suppose that the interest rate swap has a l-year term (till maturity). The notional amount of the swap is 1.2 Billion UZS and all payments (fixed rate and floating rate) are quarterly based on an actual/360" day count basis. The starting reference rate is the yield (spot rate) on a 3-month Uzbek government hill. It is provided in the first table below. The prices of futures contracts on the 3-month Uzbek government bills are also provided in the same table. Please copy ALL of the tables below to the answer sheet and fill them out. Complete the following table for the forward rate, period forward rate, and forward discount factor given the information below. (5 marks): Period Days in Forward Futures prices Forward Period Forward quarter rates on forward 3-month government bill Gov't Bill on 3-month rate discount factor rate 14.5% 1 2 3 4 91 92 90 92 84.80 83.50 82.60 b. Complete the following table for the floating-rate payment given the period forward rates that you calculate in part 1. (5 marks) Period Days in Period forward Floating-rate payment quarter rate 1 2 3 4 91 92 90 92 c. If the swap rate is 17%, compute the following (5 marks): Period Days in Fixed-rate payments based quarter on swap rate 1 2 3 91 92 cm 90 92 What is the value of this l-year swap given the values in parts a, b and c from the perspective of the fixed-rate payer? (5 marks) c Approximately what swap rate would make the value of this swap equal to zero? (5 marks) Question 2 (20 marks) 1) Why is interest rate hedging a special case of interest rate risk management? (5 marks). 2) Mr. Madoff is a portfolio manager who is responsible for a $350 million portion of the band portfolio of Affluent.com's pension fund. The current investment guidelines specify that the duration for the portfolio can be in a range of minus one and plus one of the duration benchmark. Currently, the duration benchmark is 3.2 and the duration for the portfolio is 4.0. Mr. Madoff expects that rates will rise. He wants to reduce the duration of the portfolio to the lower end of the duration benchmark's range, 3. by using Treasury bond futures contracts, which he is authorized to use by the pension fund's investment guidelines 1. What position (long or short) should Mr. Madofftake in Treasury bond futures to reduce the duration from 5 to 3? (5 marks) b. Suppose that the dollar duration per Treasury bond futures contract (based on the cheapest-to-deliver issue) for a 25 basis point change in rates is $2,400. How many Treasury bond futures contracts must be bought or sold? (10 marks) Question 3 (15 marks) A European call option on a zero-coupon bond has a strike price of $92 and 2 years remaining till expiry (T-1). The current price of the bond is $85. Expected return volatility (a "sigma") is 18%. Risk-free rate is 6% Calculate the option's price using Black-Scholes formula. You can find the corresponding cumulative probability values for dl and d2 from the table of z-values provided (use Z-table). (5 marks for formulas and 5 marks for correct answers) b) Why would this option always have a positive value under the Black-Scholes formula? Explain by discussing the inputs and assumptions of the Black-Scholes formula. (5 marks for reasonable explanation) PART A. A QUESTIONS IN THIS SECTION ARE COMPULSORY. Question 1 (25 marks) Asakabank enters into an interest rate swap denominated in local currency UZS. Asakabunk aims to hedge its interest rate risk exposure by swapping the floating-rate (i.e. variable-rate) funding to the fixed-rate one Suppose that the interest rate swap has a l-year term (till maturity). The notional amount of the swap is 1.2 Billion UZS and all payments (fixed rate and floating rate) are quarterly based on an actual/360" day count basis. The starting reference rate is the yield (spot rate) on a 3-month Uzbek government hill. It is provided in the first table below. The prices of futures contracts on the 3-month Uzbek government bills are also provided in the same table. Please copy ALL of the tables below to the answer sheet and fill them out. Complete the following table for the forward rate, period forward rate, and forward discount factor given the information below. (5 marks): Period Days in Forward Futures prices Forward Period Forward quarter rates on forward 3-month government bill Gov't Bill on 3-month rate discount factor rate 14.5% 1 2 3 4 91 92 90 92 84.80 83.50 82.60 b. Complete the following table for the floating-rate payment given the period forward rates that you calculate in part 1. (5 marks) Period Days in Period forward Floating-rate payment quarter rate 1 2 3 4 91 92 90 92 c. If the swap rate is 17%, compute the following (5 marks): Period Days in Fixed-rate payments based quarter on swap rate 1 2 3 91 92 cm 90 92 What is the value of this l-year swap given the values in parts a, b and c from the perspective of the fixed-rate payer? (5 marks) c Approximately what swap rate would make the value of this swap equal to zero? (5 marks) Question 2 (20 marks) 1) Why is interest rate hedging a special case of interest rate risk management? (5 marks). 2) Mr. Madoff is a portfolio manager who is responsible for a $350 million portion of the band portfolio of Affluent.com's pension fund. The current investment guidelines specify that the duration for the portfolio can be in a range of minus one and plus one of the duration benchmark. Currently, the duration benchmark is 3.2 and the duration for the portfolio is 4.0. Mr. Madoff expects that rates will rise. He wants to reduce the duration of the portfolio to the lower end of the duration benchmark's range, 3. by using Treasury bond futures contracts, which he is authorized to use by the pension fund's investment guidelines 1. What position (long or short) should Mr. Madofftake in Treasury bond futures to reduce the duration from 5 to 3? (5 marks) b. Suppose that the dollar duration per Treasury bond futures contract (based on the cheapest-to-deliver issue) for a 25 basis point change in rates is $2,400. How many Treasury bond futures contracts must be bought or sold? (10 marks) Question 3 (15 marks) A European call option on a zero-coupon bond has a strike price of $92 and 2 years remaining till expiry (T-1). The current price of the bond is $85. Expected return volatility (a "sigma") is 18%. Risk-free rate is 6% Calculate the option's price using Black-Scholes formula. You can find the corresponding cumulative probability values for dl and d2 from the table of z-values provided (use Z-table). (5 marks for formulas and 5 marks for correct answers) b) Why would this option always have a positive value under the Black-Scholes formula? Explain by discussing the inputs and assumptions of the Black-Scholes formula. (5 marks for reasonable explanation)