Answered step by step

Verified Expert Solution

Question

1 Approved Answer

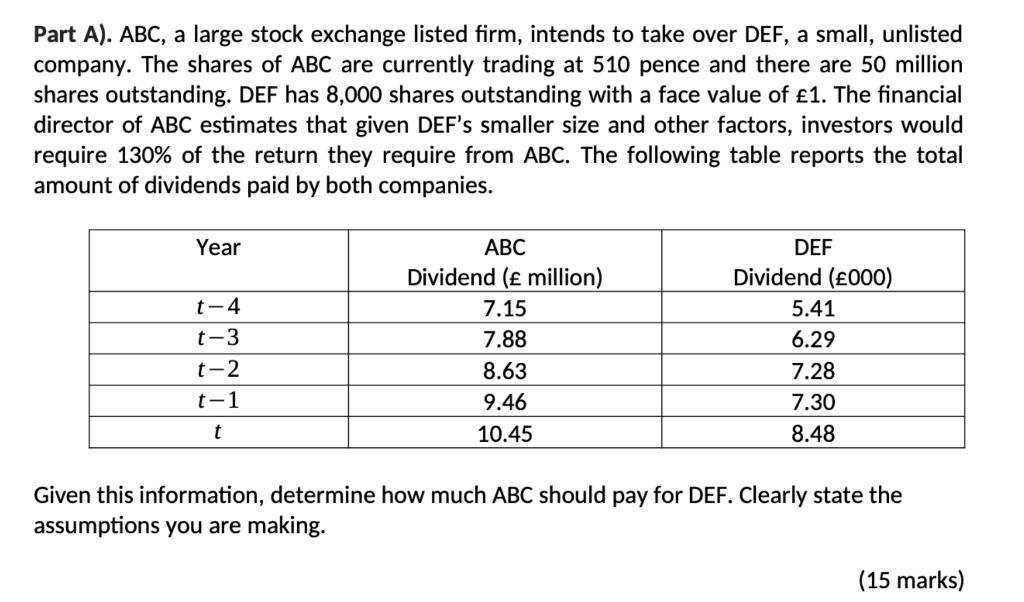

Part A). ABC, a large stock exchange listed firm, intends to take over DEF, a small, unlisted company. The shares of ABC are currently

Part A). ABC, a large stock exchange listed firm, intends to take over DEF, a small, unlisted company. The shares of ABC are currently trading at 510 pence and there are 50 million shares outstanding. DEF has 8,000 shares outstanding with a face value of 1. The financial director of ABC estimates that given DEF's smaller size and other factors, investors would require 130% of the return they require from ABC. The following table reports the total amount of dividends paid by both companies. Year t-4 t-3 t-2 t-1 t ABC Dividend ( million) 7.15 7.88 8.63 9.46 10.45 DEF Dividend (000) 5.41 6.29 7.28 7.30 8.48 Given this information, determine how much ABC should pay for DEF. Clearly state the assumptions you are making. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Answer ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started