Question

Part A. An investor predicts that the price of XYZ stock will exhibit unusually low volatility in the coming month. Which of the following is

Part A. An investor predicts that the price of XYZ stock will exhibit unusually low volatility in the coming month. Which of the following is the best strategy for the investor to profit from this prediction? a. Write a covered call b. Establish a long straddle c. Write a straddle d. Write a time spread

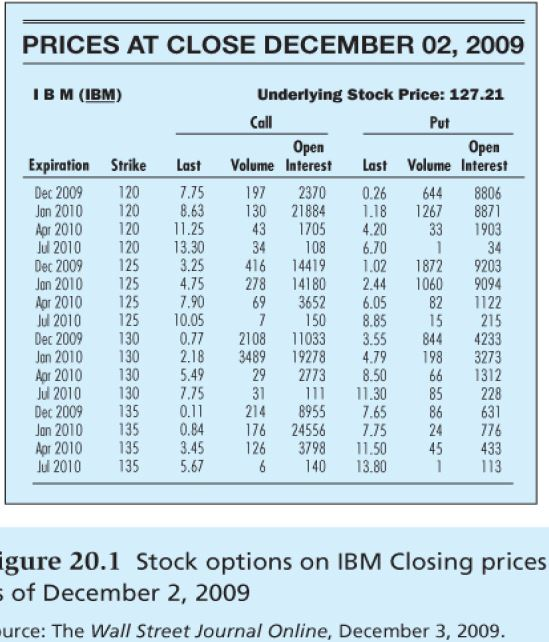

Part B. Turn back to figure 20.1, which lists prices of various IMB options. Use the data in the figure to calculate the payoff and profits for investments in each of the following January maturity options, assuming that the stock price on the maturity date is $125

a. Call option, X = 120 b. Put option, X = 120 c. Call option, X = 125 d. Put option, X = 125 e. Call option, X = 130 f. Put option, X = 130

PRICES AT CLOSE DECEMBER 02, 2009 IB M (IBM) Underlying Stock Price: 127.21 Call Put Open Expiration Strike Last Volume Interes Las Volume Interest Dec 2009 20 7.75 97 2370 0.26 644 8806 Jon 2010 120 8.6 130 21884 1.18 1267 8871 43 1705 4.20 33 1903 34 Dec 2009 25 3.25 416 14419 .02 1872 9203 Jon 2010 5 4.75 278 14180 244 060 9094 82 1122 15 215 Dec 2009 130 077 2108 11033 3.55 844 4233 Jan 2010 130 2.18 3489 19278 4.79 198 3273 29 2773 8.50 66 1312 85 228 214 8955 7.65 86 631 Jan 2010 135 0.84 176 24556 7.75 24 776 Apr 2010 135 3.45 126 3798 0 45 433 1 113 Apr 2010 120 1.25 Jul 2010 120 13.30 34 108 6.70 Apr 2010 25 7.90 ul 2010 5 10.05 69 3652 6.05 7 150 8.85 Apr 2010 130 5.49 Ju 2010 130 7.75 Dec 2009 135 0.11 lul 2010 135 5.67 6 140 13.80 igure 20.1 Stock options on IBM Closing prices of December 2, 2009 urce: The Wall Street Journal Online, December 3, 2009Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started