Part A and B is what I need help with please.

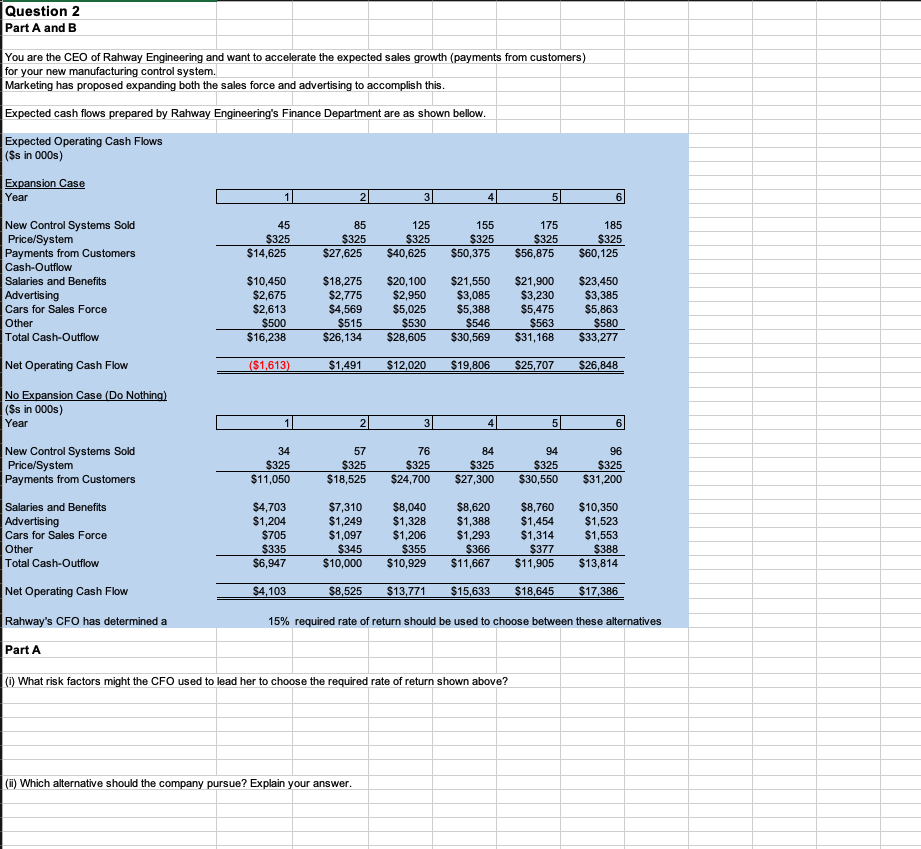

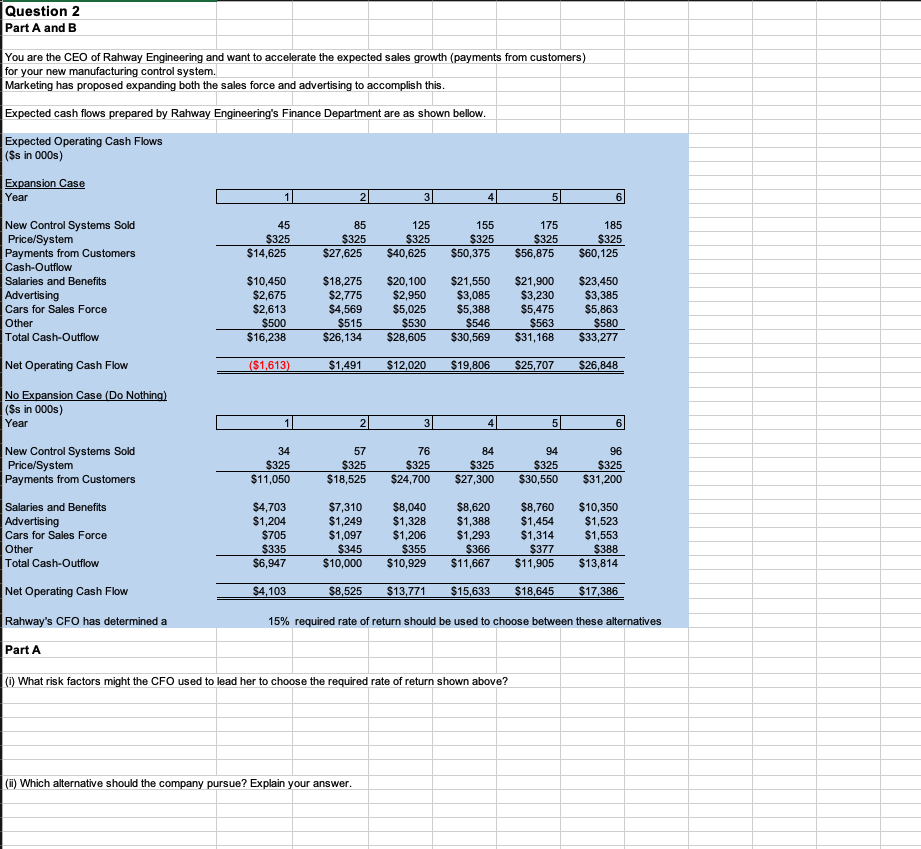

Question 2 Part A and B You are the CEO of Rahway Engineering and want to accelerate the expected sales growth (payments from customers) for your new manufacturing control system. Marketing has proposed expanding both the sales force and advertising to accomplish this. Expected cash flows prepared by Rahway Engineering's Finance Department are as shown bellow. Expected Operating Cash Flows (\$s in 000s) No Expansion Case (Do Nothing) (\$s in 000s) Rahway's CFO has determined a 15% required rate of return should be used to choose between these alternatives Part A (i) What risk factors might the CFO used to lead her to choose the required rate of return shown above? (ii) Which alternative should the company pursue? Explain your answer. Part B Rahway's Vice President of Operations, a strong proponent of expanding the sales force and advertising spending, has complained that the the CFO's choice of required rate of return over-estimates the risk. (i) What would be the decision if the required rate of return were 8% rather than the rate chosen by the CFO. The Vice President of Operations believes that the finance department has under-estimated the benefits to the new product of expanding the sales force. In addition the Vice President of Operations argues that expansion will provide a strong foundation for selling other new products that will be introduced in the next two - three years. (ii) What additional information would you want from the Vice President of Operations to determine whether to have the finance department revise its projections and recommendations? Question 2 Part A and B You are the CEO of Rahway Engineering and want to accelerate the expected sales growth (payments from customers) for your new manufacturing control system. Marketing has proposed expanding both the sales force and advertising to accomplish this. Expected cash flows prepared by Rahway Engineering's Finance Department are as shown bellow. Expected Operating Cash Flows (\$s in 000s) No Expansion Case (Do Nothing) (\$s in 000s) Rahway's CFO has determined a 15% required rate of return should be used to choose between these alternatives Part A (i) What risk factors might the CFO used to lead her to choose the required rate of return shown above? (ii) Which alternative should the company pursue? Explain your answer. Part B Rahway's Vice President of Operations, a strong proponent of expanding the sales force and advertising spending, has complained that the the CFO's choice of required rate of return over-estimates the risk. (i) What would be the decision if the required rate of return were 8% rather than the rate chosen by the CFO. The Vice President of Operations believes that the finance department has under-estimated the benefits to the new product of expanding the sales force. In addition the Vice President of Operations argues that expansion will provide a strong foundation for selling other new products that will be introduced in the next two - three years. (ii) What additional information would you want from the Vice President of Operations to determine whether to have the finance department revise its projections and recommendations