Answered step by step

Verified Expert Solution

Question

1 Approved Answer

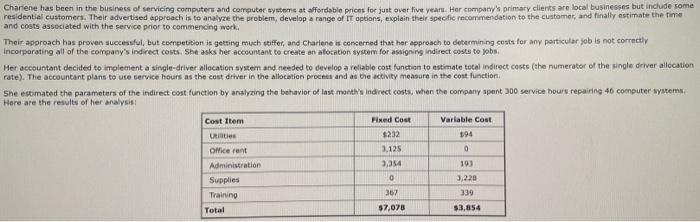

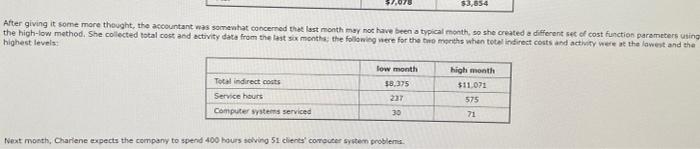

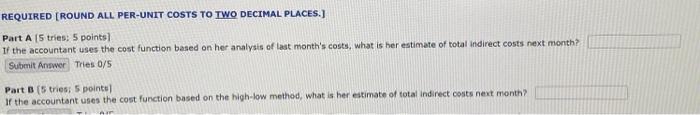

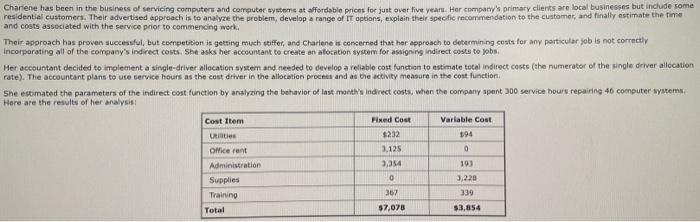

PART A and PART B PLEASE! and costs associated with the service prior to cammencing werk. incorporating all of the company's indirect costs. She asks

PART A and PART B PLEASE!

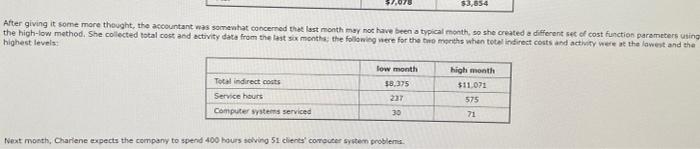

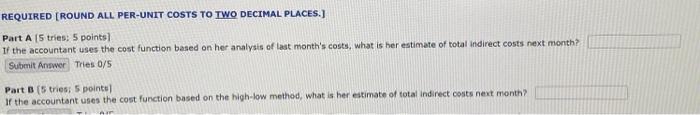

and costs associated with the service prior to cammencing werk. incorporating all of the company's indirect costs. She asks her accountant to create an atocation system for assigning indirect costs to yobs. rate). The accountant plans to use service hours as the cost diver in the allocation procest and as the activity measure in the cost function. giving it some more theught, the aceountant was somentat coocerned that last month myy noc have been a typical month, so she created a different sac of cost function parameters high-low method, She collected total cost and activity data from the last six months; the followieg nere for the thre months when totel indiroct costs and activity were at the lawent and est leveis: REQUIRED [ROUND ALL PER-UNIT COSTS TO TWO DECIMAL PLACES.] Part A 5 tries: 5 points } If the accountant uses the cost function based on her analysis of last month's costs, what is her estimate of total indirect costs next month? Tries 0/5 Part B(5 tries: 5 pointe ) If the accountant uses the cost function based on the high-low method, what is her estimate of total indirect costs next month

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started