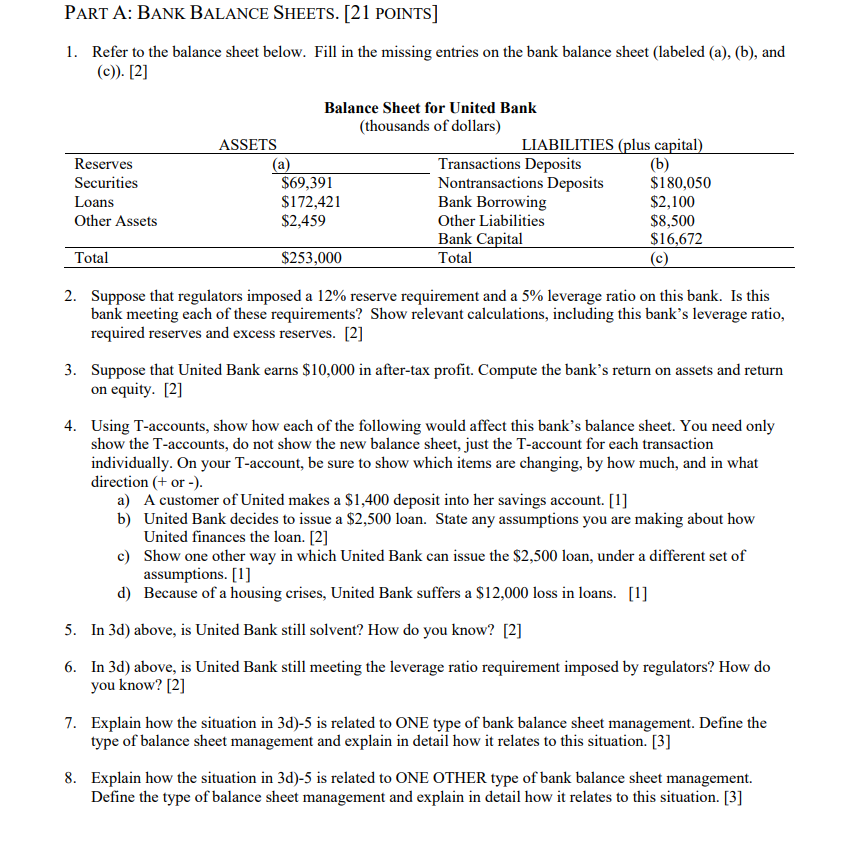

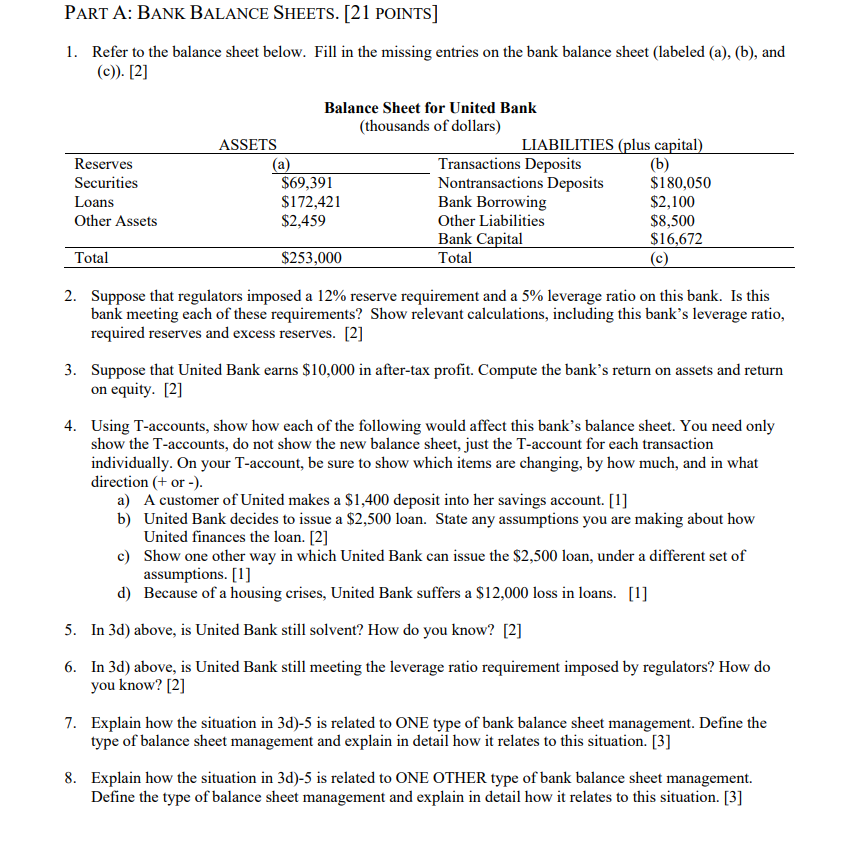

PART A: BANK BALANCE SHEETS. [21 POINTS] 1. Refer to the balance sheet below. Fill in the missing entries on the bank balance sheet (labeled (a), (b), and (c)). [2] Balance Sheet for United Bank (thousands of dollars) ASSETS LIABILITIES (plus capital) Reserves (a) Transactions Deposits (b) Securities $69,391 Nontransactions Deposits $180,050 Loans $172,421 Bank Borrowing $2,100 Other Assets $2,459 Other Liabilities $8,500 Bank Capital $16,672 Total $253,000 Total 2. Suppose that regulators imposed a 12% reserve requirement and a 5% leverage ratio on this bank. Is this bank meeting each of these requirements? Show relevant calculations, including this bank's leverage ratio, required reserves and excess reserves. [2] 3. Suppose that United Bank earns $10,000 in after-tax profit. Compute the bank's return on assets and return on equity. [2] 4. Using T-accounts, show how each of the following would affect this bank's balance sheet. You need only show the T-accounts, do not show the new balance sheet, just the T-account for each transaction individually. On your T-account, be sure to show which items are changing, by how much, and in what direction (+ or -). a) A customer of United makes a $1,400 deposit into her savings account. [1] b) United Bank decides to issue a $2,500 loan. State any assumptions you are making about how United finances the loan. [2] c) Show one other way in which United Bank can issue the $2,500 loan, under a different set of assumptions. [1] d) Because of a housing crises, United Bank suffers a $12,000 loss in loans. [1] 5. In 3d) above, is United Bank still solvent? How do you know? [2] 6. In 3d) above, is United Bank still meeting the leverage ratio requirement imposed by regulators? How do you know? [2] 7. Explain how the situation in 3d)-5 is related to ONE type of bank balance sheet management. Define the type of balance sheet management and explain in detail how it relates to this situation. [3] 8. Explain how the situation in 3d)-5 is related to ONE OTHER type of bank balance sheet management. Define the type of balance sheet management and explain in detail how it relates to this situation. [3] PART A: BANK BALANCE SHEETS. [21 POINTS] 1. Refer to the balance sheet below. Fill in the missing entries on the bank balance sheet (labeled (a), (b), and (c)). [2] Balance Sheet for United Bank (thousands of dollars) ASSETS LIABILITIES (plus capital) Reserves (a) Transactions Deposits (b) Securities $69,391 Nontransactions Deposits $180,050 Loans $172,421 Bank Borrowing $2,100 Other Assets $2,459 Other Liabilities $8,500 Bank Capital $16,672 Total $253,000 Total 2. Suppose that regulators imposed a 12% reserve requirement and a 5% leverage ratio on this bank. Is this bank meeting each of these requirements? Show relevant calculations, including this bank's leverage ratio, required reserves and excess reserves. [2] 3. Suppose that United Bank earns $10,000 in after-tax profit. Compute the bank's return on assets and return on equity. [2] 4. Using T-accounts, show how each of the following would affect this bank's balance sheet. You need only show the T-accounts, do not show the new balance sheet, just the T-account for each transaction individually. On your T-account, be sure to show which items are changing, by how much, and in what direction (+ or -). a) A customer of United makes a $1,400 deposit into her savings account. [1] b) United Bank decides to issue a $2,500 loan. State any assumptions you are making about how United finances the loan. [2] c) Show one other way in which United Bank can issue the $2,500 loan, under a different set of assumptions. [1] d) Because of a housing crises, United Bank suffers a $12,000 loss in loans. [1] 5. In 3d) above, is United Bank still solvent? How do you know? [2] 6. In 3d) above, is United Bank still meeting the leverage ratio requirement imposed by regulators? How do you know? [2] 7. Explain how the situation in 3d)-5 is related to ONE type of bank balance sheet management. Define the type of balance sheet management and explain in detail how it relates to this situation. [3] 8. Explain how the situation in 3d)-5 is related to ONE OTHER type of bank balance sheet management. Define the type of balance sheet management and explain in detail how it relates to this situation. [3]