Answered step by step

Verified Expert Solution

Question

1 Approved Answer

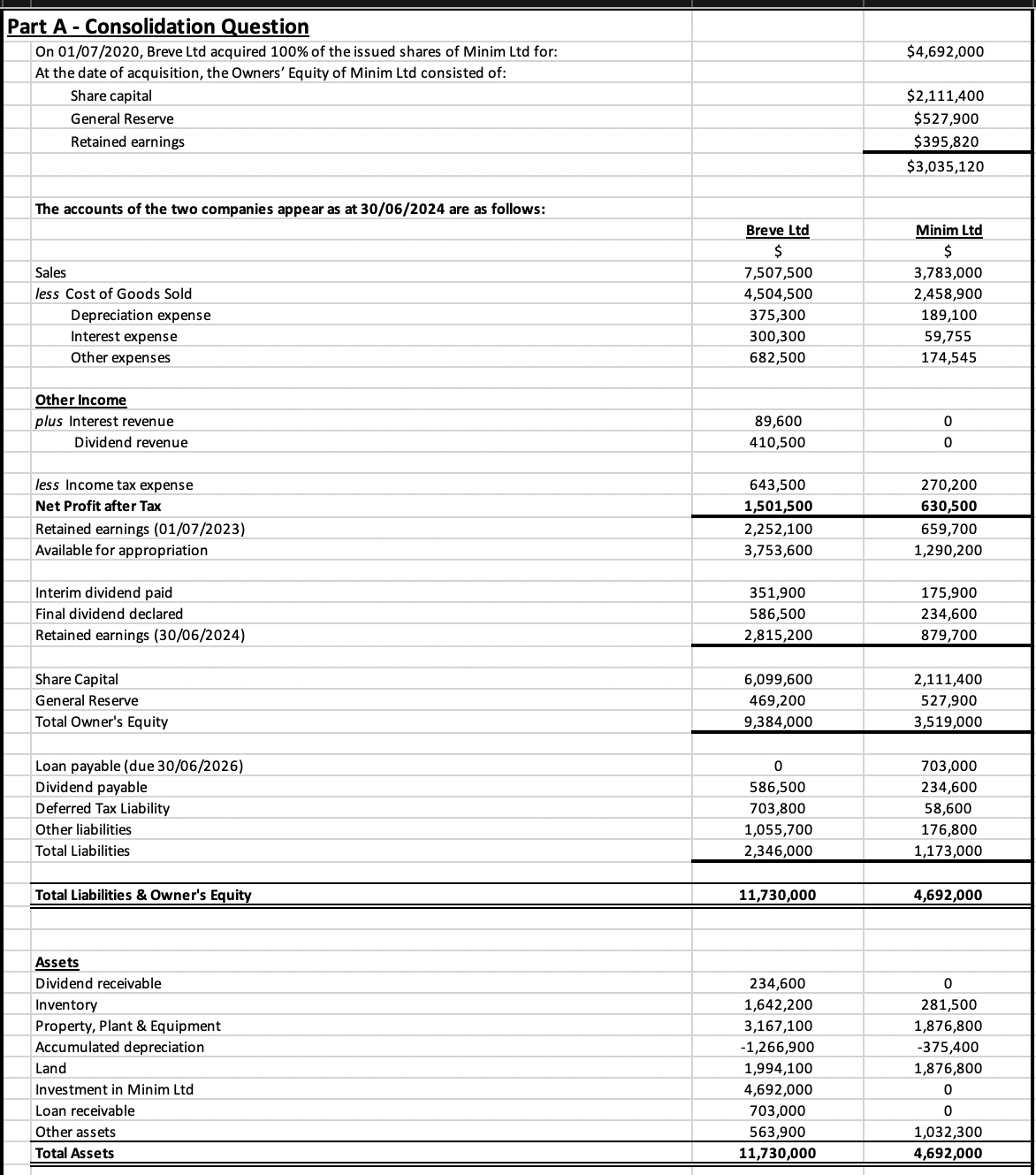

Part A - Consolidation Question On 0 1 / 0 7 / 2 0 2 0 , Breve Ltd acquired 1 0 0 % of

Part A Consolidation Question

On Breve Ltd acquired of the issued shares of Minim Ltd for:

At the date of acquisition, the Owners' Equity of Minim Ltd consisted of:

Share capital

General Reserve

Retained earnings

The accounts of the two companies appear as at are as follows:

Sales

less Cost of Goods Sold

Depreciation expense

Interest expense

Other expenses

Other Income

plus Interest revenue

Dividend revenue

less Income tax expense

Net Profit after Tax

Retained earnings

Available for appropriation

Interim dividend paid

Final dividend declared

Retained earnings

Share Capital

General Reserve

Total Owner's Equity

Loan payable due

Dividend payable

Deferred Tax Liability

Other liabilities

Total Liabilities

Total Liabilities & Owner's Equity

Breve Ltd

S

Assets

Dividend receivable

Inventory

Property, Plant & Equipment

Accumulated depreciation

Land

Investment in Minim Ltd

Loan receivable

Other assets

Total Assets

$

$

$

$

$

Minim Ltd

S

Part A Consolidation Question

On Breve Ltd acquired of the issued shares of Minim Ltd for:

The accounts of the two companies appear as at are as follows:Additional information:

a At date of acquisition, all identifiable net assets of Minim Ltd were recorded at fair value, with the exception of a item of Plant in the books of Minim Ltd

The item of Plant had cost of $ and an accumulated depreciation of $ The management of Breve Ltd believed the item of Plant had a

fair value of $ and a remaining useful life of years.

b The directors apply the impairment test for goodwill annually. As at the cumulative goodwill impairment writedowns for prior years totalled

$ During the current year, the goodwill has further been impaired by another $

c An item of Equipment owned by Minim Ltd was sold to Breve Ltd on for $ The cost of the Equipment was $ and its

accumulated depreciation was $ at the time of trasnfer. Breve Ltd estimated this item had an annual depreciation rate of with no residual

value.

d The opening inventory of Breve Ltd includes unrealised profit of $ on inventory transferred from Minim Ltd during the prior financial year. All of

this inventory was sold by Breve Ltd to parties external to the Group by

e During the financial year ending on Breve Ltd purchased inventory from Minim Ltd for $ This inventory had previously cost

Minim Ltd $ By of this inventory was sold to outsiders by Breve Ltd

f Minim Ltd borrowed a loan from Breve Ltd amounting to $ at the start of the current period. On Minim Ltd paid the annual interest

for the intra group loan at a rate of

e During the current year, Breve Ltd paid Arina Ltd an external party for management fees expense amouning to $

i The tax rate is:

Requirements:

Prepare the acquisition analysis at the date of acquisition.

Record the consolidated journal entries necessary to prepare consolidated accounts for the year ending for the group comprising Breve Ltd

and Minim Ltd

Entering the consolidated journal entries in Part i above to the appropriate debit and credit columns in the Consolidated Worksheet; and

Clearly labelling the references for each of the adjustments in the Consolidated Worksheet.

Part B Discussion Question on Control

Pasta Ltd holds per cent of the voting rights of Spaghetti Ltd Two other shareholdes, Burger King and Big Buns, each hold per cent of the voting

rights of Spaghetti. The remaining voting rights are held by numerous other shareholders, none individually holding more than per cent of the voting

rights. Typically, per cent of eligible votes are cast at the annual general meetings of Spaghetti Ltd A shareholder agreement grants Pasta Ltd the right

to appoint, remove, and set the remuneration of nonexecutive directors of the board of Spaghetti Ltd There are no other arrangements that affect

Spaghetti's decision making.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started