Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part A Doggo Ltd (74 Marks) 1 (4) (4) (2) (10) 3 (3) (4) (3) (3) (8) (5) Calculate the following amounts labelled (A) to

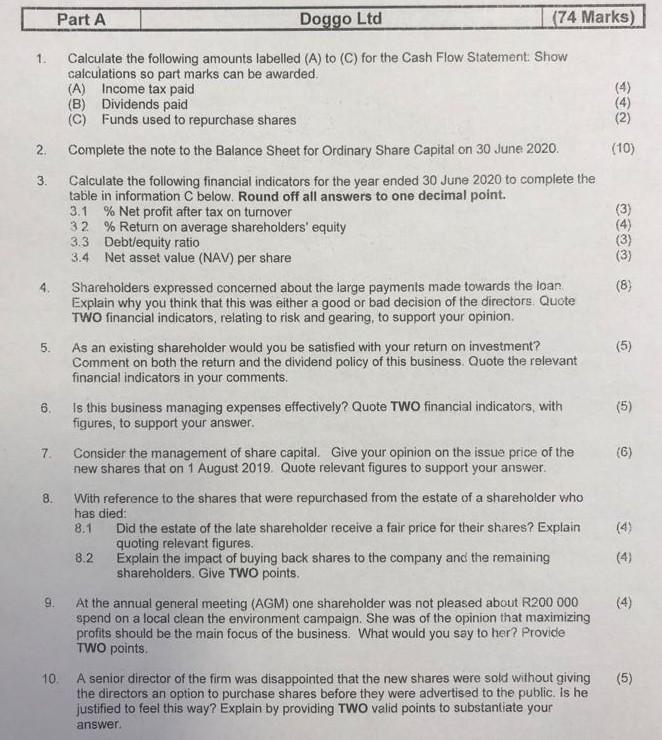

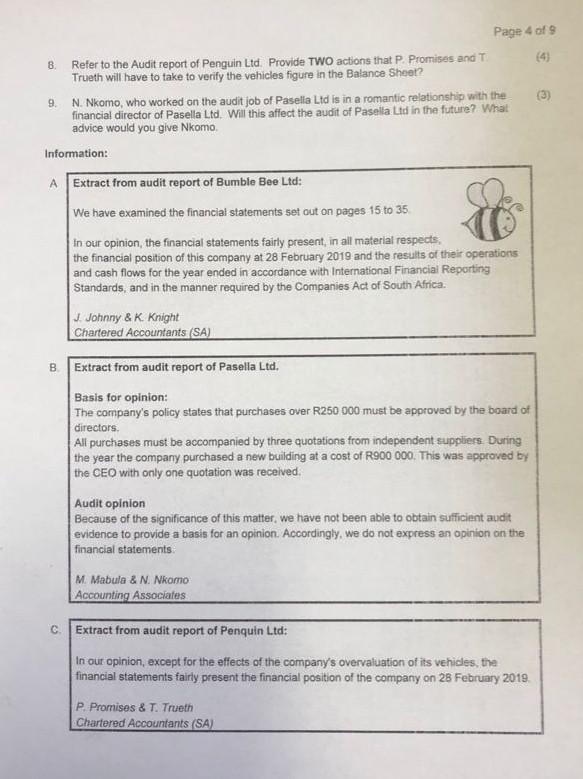

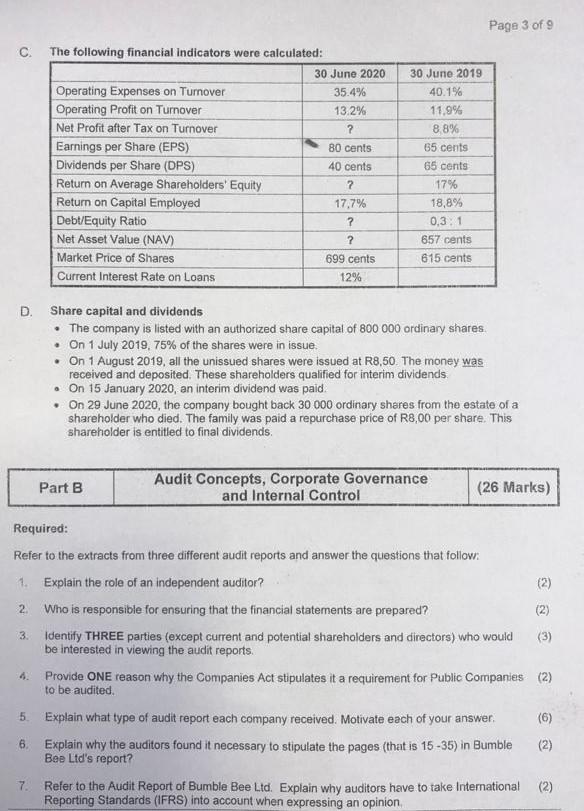

Part A Doggo Ltd (74 Marks) 1 (4) (4) (2) (10) 3 (3) (4) (3) (3) (8) (5) Calculate the following amounts labelled (A) to (C) for the Cash Flow Statement Show calculations so part marks can be awarded. (A) Income tax paid (B) Dividends paid (C) Funds used to repurchase shares 2. Complete the note to the Balance Sheet for Ordinary Share Capital on 30 June 2020. Calculate the following financial indicators for the year ended 30 June 2020 to complete the table in information C below. Round off all answers to one decimal point. 3.1 % Net profit after tax on turnover 32 % Return on average shareholders' equity 3.3 Debt/equity ratio 3.4 Net asset value (NAV) per share Shareholders expressed concerned about the large payments made towards the loan Explain why you think that this was either a good or bad decision of the directors. Quote TWO financial indicators, relating to risk and gearing, to support your opinion, 5. As an existing shareholder would you be satisfied with your return on investment? Comment on both the return and the dividend policy of this business. Quote the relevant financial indicators in your comments. 6 Is this business managing expenses effectively? Quote TWO financial indicators, with figures, to support your answer. Consider the management of share capital. Give your opinion on the issue price of the new shares that on 1 August 2019. Quote relevant figures to support your answer. . With reference to the shares that were repurchased from the estate of a shareholder who has died: 8.1 Did the estate of the late shareholder receive a fair price for their shares? Explain quoting relevant figures. 8.2 Explain the impact of buying back shares to the company and the remaining shareholders. Give TWO points. 9. At the annual general meeting (AGM) one shareholder was not pleased about R200 000 spend on a local clean the environment campaign. She was of the opinion that maximizing profits should be the main focus of the business. What would you say to her? Provide TWO points. 10. A senior director of the firm was disappointed that the new shares were sold without giving the directors an option to purchase shares before they were advertised to the public. Is he justified to feel this way? Explain by providing TWO valid points to substantiate your (5) 7. (6) 8 (4) (5) answer Page 4 of 9 8 Refer to the Audit report of Penguin Ltd. Provide TWO actions that P Promises and T Trueth will have to take to verify the vehicles figure in the Balance Sheet? 9. N. Nkomo, who worked on the audit job of Pasella Ltd is in a romantic relationship with the (3) financial director of Pasella Ltd. Will this affect the audit of Pasella Ltd in the future? What advice would you give Nkomo Information: A Extract from audit report of Bumble Bee Ltd: We have examined the financial statements set out on pages 15 to 35 in our opinion, the financial statements fairly present, in all material respects. the financial position of this company at 28 February 2019 and the results of their operations and cash flows for the year ended in accordance with International Financial Reporting Standards, and in the manner required by the Companies Act of South Africa. J. Johnny & K Knight Chartered Accountants (SA) B Extract from audit report of Pasella Ltd. Basis for opinion: The company's policy states that purchases over R250 000 must be approved by the board of directors All purchases must be accompanied by three quotations from independent suppliers. During the year the company purchased a new building at a cost of R900 000. This was approved by the CEO with only one quotation was received. Audit opinion Because of the significance of this matter, we have not been able to obtain sufficient audit evidence to provide a basis for an opinion. Accordingly, we do not express an opinion on the financial statements M. Mabula & N. Nkomo Accounting Associates C Extract from audit report of Penguin Ltd: In our opinion, except for the effects of the company's overvaluation of its vehides, the financial statements fairly present the financial position of the company on 28 February 2019 P. Promises & T. Trueth Chartered Accountants (SA) Page 3 of 9 C The following financial indicators were calculated: 30 June 2020 Operating Expenses on Turnover 35.4% Operating Profit on Turnover 13.2% Net Profit after Tax on Turnover ? Earnings per Share (EPS) 80 cents Dividends per Share (DPS) 40 cents Return on Average Shareholders' Equity 2 Return on Capital Employed 17.7% Debt/Equity Ratio ? Net Asset Value (NAV) ? Market Price of Shares 699 cents Current Interest Rate on Loans 12% 30 June 2019 40.1% 11.9% 8.8% 65 cents 65 cents 17% 18,8% 0.3.1 657 cents 615 cents D Share capital and dividends The company is listed with an authorized share capital of 800 000 ordinary shares On 1 July 2019, 75% of the shares were in issue. On 1 August 2019, all the unissued shares were issued at R8,50. The money was received and deposited. These shareholders qualified for interim dividends. . On 15 January 2020, an interim dividend was paid . On 29 June 2020, the company bought back 30 000 ordinary shares from the estate of a shareholder who died. The family was paid a repurchase price of R8,00 per share. This shareholder is entitled to final dividends. Part B Audit Concepts, Corporate Governance and Internal Control (26 Marks) 2 3 Required: Refer to the extracts from three different audit reports and answer the questions that follow 1. Explain the role of an independent auditor? (2) Who is responsible for ensuring that the financial statements are prepared? (2) Identify THREE parties (except current and potential shareholders and directors) who would (3) be interested in viewing the audit reports, Provide ONE reason why the Companies Act stipulates it a requirement for Public Companies (2) to be audited 5. Explain what type of audit report each company received. Motivate each of your answer. (6) Explain why the auditors found it necessary to stipulate the pages (that is 15 -35) in Bumble (2) Bee Ltd's report? Refer to the Audit Report of Bumble Bee Ltd. Explain why auditors have to take International (2) Reporting Standards (IFRS) into account when expressing an opinion 6. 7 Page 2 of 9 Information: A Figures extracted from the Financial Statements on 30 June 2020 30 June 2020 Sales 7 500 000 Depreciation 150 000 Operating Profit 950 000 Interest Expense 112 500 Net Profit before Income Tax 978 000 Income Tax 244 500 Net Profit after Income Tax 733 500 1 July 2019 8 600 000 120 000 785 000 125 500 770 000 192 500 577 500 Shareholders' Equity Ordinary Share Capital Retained Income 5 841 500 ? ? 4 098 000 3 900 000 198 000 ? 548 150 Loan from Zero Bank 2 251 800 140 000 76 200 13 300 22 300 Current Assets Trading Stock Trade and Other Receivables SARS Income Tax Cash and Cash Equivalents B7 200 132 300 Current Liabilities Trade and Other Payables SARS: Income Tax Shareholders for Dividends 167 500 60 000 0 107 500 244 750 93 500 22 500 128 750 B Cash Flow Statement for the year ended 30 June 2020 Cash Effects of Operating Activities Cash Generated from Operations Interest Paid Income Tax Paid Dividends Paid (112 500) (A) (B) Cash Effects of Investing Activities Fixed Assets Purchased Fixed Assets Sold For Cash Fixed Deposit (612 500) (878 500) B6 000 180 000 Cash Effects of Financing Activities Proceeds of Shares Issued Repurchase of Shares Decrease in Long-term Loans Cash Surplus/Deficit For The Year Cash And Cash Equivalents (1 July 2019) Cash And Cash Equivalents (30 June 2020) ? (C) (255 000) (36 400) 58 700 22 300 Condo12 Accounting Tem 2 CASS Project - 20 Part A Doggo Ltd (74 Marks) 1 (4) (4) (2) (10) 3 (3) (4) (3) (3) (8) (5) Calculate the following amounts labelled (A) to (C) for the Cash Flow Statement Show calculations so part marks can be awarded. (A) Income tax paid (B) Dividends paid (C) Funds used to repurchase shares 2. Complete the note to the Balance Sheet for Ordinary Share Capital on 30 June 2020. Calculate the following financial indicators for the year ended 30 June 2020 to complete the table in information C below. Round off all answers to one decimal point. 3.1 % Net profit after tax on turnover 32 % Return on average shareholders' equity 3.3 Debt/equity ratio 3.4 Net asset value (NAV) per share Shareholders expressed concerned about the large payments made towards the loan Explain why you think that this was either a good or bad decision of the directors. Quote TWO financial indicators, relating to risk and gearing, to support your opinion, 5. As an existing shareholder would you be satisfied with your return on investment? Comment on both the return and the dividend policy of this business. Quote the relevant financial indicators in your comments. 6 Is this business managing expenses effectively? Quote TWO financial indicators, with figures, to support your answer. Consider the management of share capital. Give your opinion on the issue price of the new shares that on 1 August 2019. Quote relevant figures to support your answer. . With reference to the shares that were repurchased from the estate of a shareholder who has died: 8.1 Did the estate of the late shareholder receive a fair price for their shares? Explain quoting relevant figures. 8.2 Explain the impact of buying back shares to the company and the remaining shareholders. Give TWO points. 9. At the annual general meeting (AGM) one shareholder was not pleased about R200 000 spend on a local clean the environment campaign. She was of the opinion that maximizing profits should be the main focus of the business. What would you say to her? Provide TWO points. 10. A senior director of the firm was disappointed that the new shares were sold without giving the directors an option to purchase shares before they were advertised to the public. Is he justified to feel this way? Explain by providing TWO valid points to substantiate your (5) 7. (6) 8 (4) (5) answer Page 4 of 9 8 Refer to the Audit report of Penguin Ltd. Provide TWO actions that P Promises and T Trueth will have to take to verify the vehicles figure in the Balance Sheet? 9. N. Nkomo, who worked on the audit job of Pasella Ltd is in a romantic relationship with the (3) financial director of Pasella Ltd. Will this affect the audit of Pasella Ltd in the future? What advice would you give Nkomo Information: A Extract from audit report of Bumble Bee Ltd: We have examined the financial statements set out on pages 15 to 35 in our opinion, the financial statements fairly present, in all material respects. the financial position of this company at 28 February 2019 and the results of their operations and cash flows for the year ended in accordance with International Financial Reporting Standards, and in the manner required by the Companies Act of South Africa. J. Johnny & K Knight Chartered Accountants (SA) B Extract from audit report of Pasella Ltd. Basis for opinion: The company's policy states that purchases over R250 000 must be approved by the board of directors All purchases must be accompanied by three quotations from independent suppliers. During the year the company purchased a new building at a cost of R900 000. This was approved by the CEO with only one quotation was received. Audit opinion Because of the significance of this matter, we have not been able to obtain sufficient audit evidence to provide a basis for an opinion. Accordingly, we do not express an opinion on the financial statements M. Mabula & N. Nkomo Accounting Associates C Extract from audit report of Penguin Ltd: In our opinion, except for the effects of the company's overvaluation of its vehides, the financial statements fairly present the financial position of the company on 28 February 2019 P. Promises & T. Trueth Chartered Accountants (SA) Page 3 of 9 C The following financial indicators were calculated: 30 June 2020 Operating Expenses on Turnover 35.4% Operating Profit on Turnover 13.2% Net Profit after Tax on Turnover ? Earnings per Share (EPS) 80 cents Dividends per Share (DPS) 40 cents Return on Average Shareholders' Equity 2 Return on Capital Employed 17.7% Debt/Equity Ratio ? Net Asset Value (NAV) ? Market Price of Shares 699 cents Current Interest Rate on Loans 12% 30 June 2019 40.1% 11.9% 8.8% 65 cents 65 cents 17% 18,8% 0.3.1 657 cents 615 cents D Share capital and dividends The company is listed with an authorized share capital of 800 000 ordinary shares On 1 July 2019, 75% of the shares were in issue. On 1 August 2019, all the unissued shares were issued at R8,50. The money was received and deposited. These shareholders qualified for interim dividends. . On 15 January 2020, an interim dividend was paid . On 29 June 2020, the company bought back 30 000 ordinary shares from the estate of a shareholder who died. The family was paid a repurchase price of R8,00 per share. This shareholder is entitled to final dividends. Part B Audit Concepts, Corporate Governance and Internal Control (26 Marks) 2 3 Required: Refer to the extracts from three different audit reports and answer the questions that follow 1. Explain the role of an independent auditor? (2) Who is responsible for ensuring that the financial statements are prepared? (2) Identify THREE parties (except current and potential shareholders and directors) who would (3) be interested in viewing the audit reports, Provide ONE reason why the Companies Act stipulates it a requirement for Public Companies (2) to be audited 5. Explain what type of audit report each company received. Motivate each of your answer. (6) Explain why the auditors found it necessary to stipulate the pages (that is 15 -35) in Bumble (2) Bee Ltd's report? Refer to the Audit Report of Bumble Bee Ltd. Explain why auditors have to take International (2) Reporting Standards (IFRS) into account when expressing an opinion 6. 7 Page 2 of 9 Information: A Figures extracted from the Financial Statements on 30 June 2020 30 June 2020 Sales 7 500 000 Depreciation 150 000 Operating Profit 950 000 Interest Expense 112 500 Net Profit before Income Tax 978 000 Income Tax 244 500 Net Profit after Income Tax 733 500 1 July 2019 8 600 000 120 000 785 000 125 500 770 000 192 500 577 500 Shareholders' Equity Ordinary Share Capital Retained Income 5 841 500 ? ? 4 098 000 3 900 000 198 000 ? 548 150 Loan from Zero Bank 2 251 800 140 000 76 200 13 300 22 300 Current Assets Trading Stock Trade and Other Receivables SARS Income Tax Cash and Cash Equivalents B7 200 132 300 Current Liabilities Trade and Other Payables SARS: Income Tax Shareholders for Dividends 167 500 60 000 0 107 500 244 750 93 500 22 500 128 750 B Cash Flow Statement for the year ended 30 June 2020 Cash Effects of Operating Activities Cash Generated from Operations Interest Paid Income Tax Paid Dividends Paid (112 500) (A) (B) Cash Effects of Investing Activities Fixed Assets Purchased Fixed Assets Sold For Cash Fixed Deposit (612 500) (878 500) B6 000 180 000 Cash Effects of Financing Activities Proceeds of Shares Issued Repurchase of Shares Decrease in Long-term Loans Cash Surplus/Deficit For The Year Cash And Cash Equivalents (1 July 2019) Cash And Cash Equivalents (30 June 2020) ? (C) (255 000) (36 400) 58 700 22 300 Condo12 Accounting Tem 2 CASS Project - 20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started