Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PART A For each of the following brief scenarios, assume that you are the CPA reporting on the company's financial statements. Using the following

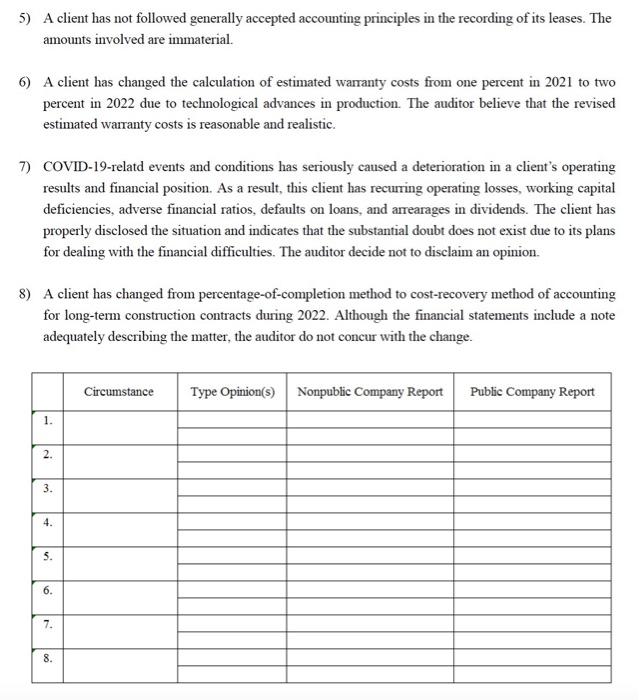

PART A For each of the following brief scenarios, assume that you are the CPA reporting on the company's financial statements. Using the following form included with this problem, describe the reporting circumstances involved, the type or types of opinion possible in the circumstance, and whether a section should be added to the audit report or whether a paragraph should be added to an existing section. Note that while other report changes may be required, this only addresses the issue of a possible additional section or paragraph being added. Because more than one report may be possible in several of the circumstances, a second "type of opinion" and "report alteration" row is added for each circumstance. For example, if the problem doesn't tell you whether a misstatement pervasively misstates the financial statements or doesn't list a characteristics that indicates pervasiveness, two reports may be possible. In most cases, you will not need to use the second row. Do not read more into the circumstance than what is presented, and only reply "emphasis-of-matter" in auditor discretionary circumstances such as those suggested in the textbook. Unless stated otherwise, assume that the information presented is material to the financial statements. For the report modification reply for both nonpublic and public audit reports. 1) A client issues financial statements that purport to present its financial position and results of operations but omits the statement of cash flows. 2) A client introduces a new computerized accounts receivable system resulted in numerous errors in accounts receivable. As of the date of the auditor's report, the Board of Directors is still in the process of rectifying the system deficiencies and correcting the errors. The auditor is unable to confirm or verify by alterative audit procedures the accounts receivable included in the statement of financial position at the reporting date 3) An auditor concludes that a client has no security for an amount of $2,000,000 due from a debtor which has ceased trading. Although no security has been obtained and no cash has been received on this debt, this client includes this debt in debtors shown on the balance sheet without making a full provision for impairment of $2,000,000. As a result, the client's profit before taxation for the year and net assets are not reduced by that amount. While an auditor considers this a material omission. he does not believe that it pervasively affects the financial statements. 4) A client is the defendant in litigation, the outcome of which is highly uncertain. If the case is settled in favor of the plaintiff, the client will be require to pay a substantial amount of cash that might require the sale of certain assets. The litigation and the possible effects have been properly disclosed in the notes to the financial statements. Auditor wishes to include discussion of this matter in the audit report.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started