Answered step by step

Verified Expert Solution

Question

1 Approved Answer

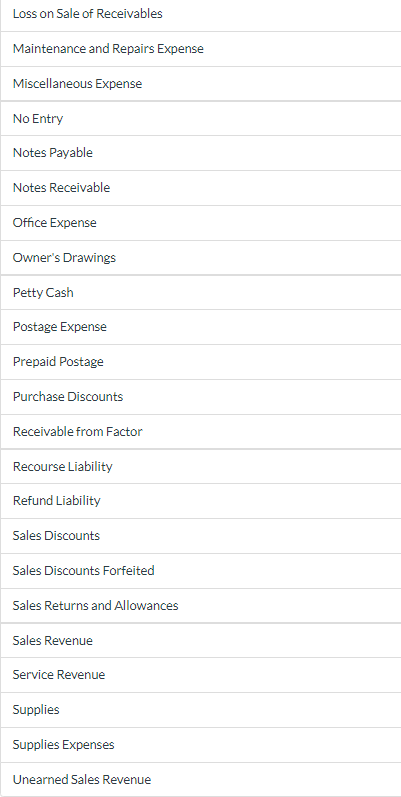

Part A is done and added for reference :) Part B please On June 3, Blue Company sold to Chester Company merchandise having a sale

Part A is done and added for reference :) Part B please

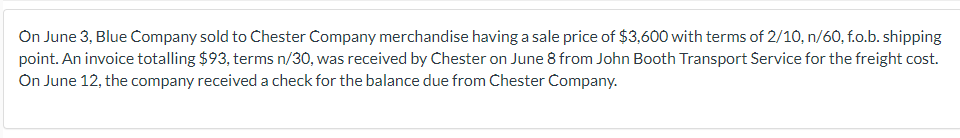

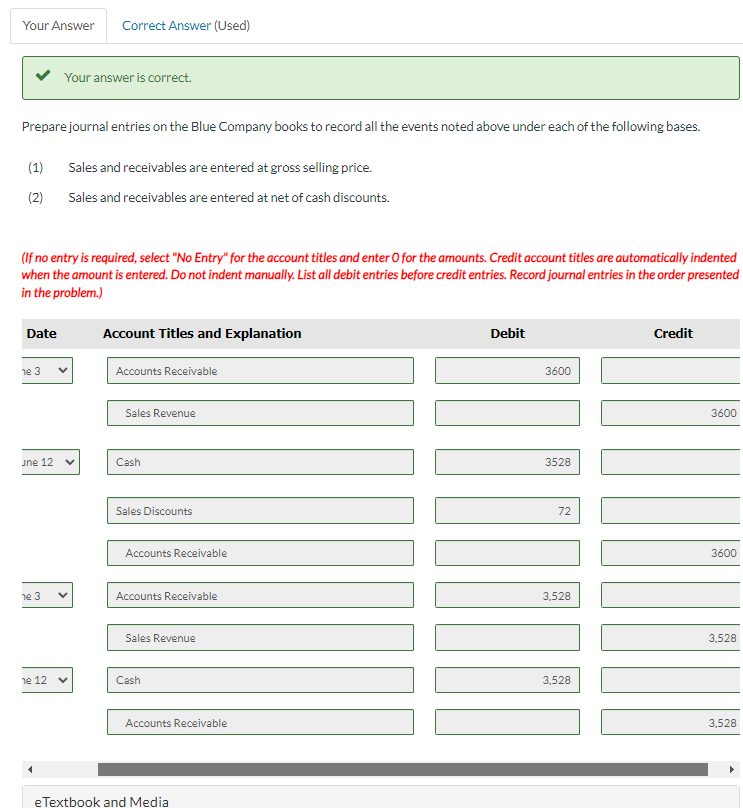

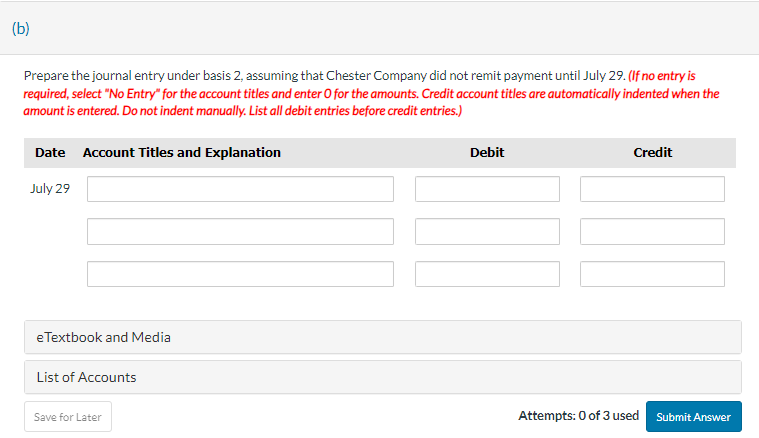

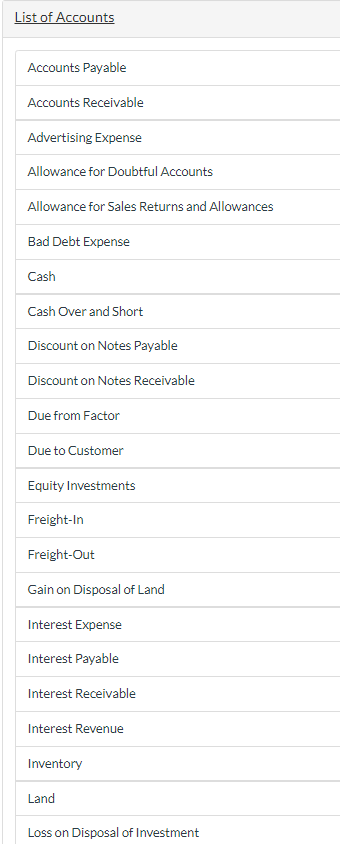

On June 3, Blue Company sold to Chester Company merchandise having a sale price of $3,600 with terms of 2/10,n/60, f.o.b. shipping point. An invoice totalling $93, terms n/30, was received by Chester on June 8 from John Booth Transport Service for the freight cost. On June 12 , the company received a check for the balance due from Chester Company. List of Accounts Accounts Payable Accounts Receivable Advertising Expense Allowance for Doubtful Accounts Allowance for Sales Returns and Allowances Bad Debt Expense Cash Cash Over and Short Discount on Notes Payable Discount on Notes Receivable Due from Factor Due to Customer Equity Investments Freight-In Freight-Out Gain on Disposal of Land Interest Expense Interest Payable Interest Receivable Interest Revenue Inventory Land Loss on Disposal of Investment Prepare the journal entry under basis 2 , assuming that Chester Company did not remit payment until July 29. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) eTextbook and Media List of Accounts Attempts: 0 of 3 used Loss on Sale of Receivables Maintenance and Repairs Expense Miscellaneous Expense No Entry Notes Payable Notes Receivable Office Expense Owner's Drawings Petty Cash Postage Expense Prepaid Postage Purchase Discounts Receivable from Factor Recourse Liability Refund Liability Sales Discounts Sales Discounts Forfeited Sales Returns and Allowances Sales Revenue Service Revenue Supplies Supplies Expenses Unearned Sales Revenue Prepare journal entries on the Blue Company books to record all the events noted above under each of the following bases. (1) Sales and receivables are entered at gross selling price. (2) Sales and receivables are entered at net of cash discounts. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. Record journal entries in the order presente in the problem.)

On June 3, Blue Company sold to Chester Company merchandise having a sale price of $3,600 with terms of 2/10,n/60, f.o.b. shipping point. An invoice totalling $93, terms n/30, was received by Chester on June 8 from John Booth Transport Service for the freight cost. On June 12 , the company received a check for the balance due from Chester Company. List of Accounts Accounts Payable Accounts Receivable Advertising Expense Allowance for Doubtful Accounts Allowance for Sales Returns and Allowances Bad Debt Expense Cash Cash Over and Short Discount on Notes Payable Discount on Notes Receivable Due from Factor Due to Customer Equity Investments Freight-In Freight-Out Gain on Disposal of Land Interest Expense Interest Payable Interest Receivable Interest Revenue Inventory Land Loss on Disposal of Investment Prepare the journal entry under basis 2 , assuming that Chester Company did not remit payment until July 29. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) eTextbook and Media List of Accounts Attempts: 0 of 3 used Loss on Sale of Receivables Maintenance and Repairs Expense Miscellaneous Expense No Entry Notes Payable Notes Receivable Office Expense Owner's Drawings Petty Cash Postage Expense Prepaid Postage Purchase Discounts Receivable from Factor Recourse Liability Refund Liability Sales Discounts Sales Discounts Forfeited Sales Returns and Allowances Sales Revenue Service Revenue Supplies Supplies Expenses Unearned Sales Revenue Prepare journal entries on the Blue Company books to record all the events noted above under each of the following bases. (1) Sales and receivables are entered at gross selling price. (2) Sales and receivables are entered at net of cash discounts. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. Record journal entries in the order presente in the problem.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started